A line of credit (LOC) is a flexible borrowing option that allows individuals or businesses to access funds up to a predetermined limit. Unlike traditional loans, LOCs provide the ability to borrow and repay funds repeatedly within the approved credit limit. This financial tool has gained popularity due to its versatility and potential cost-effectiveness. However, like any financial product, it comes with its own set of advantages and disadvantages that borrowers should carefully consider.

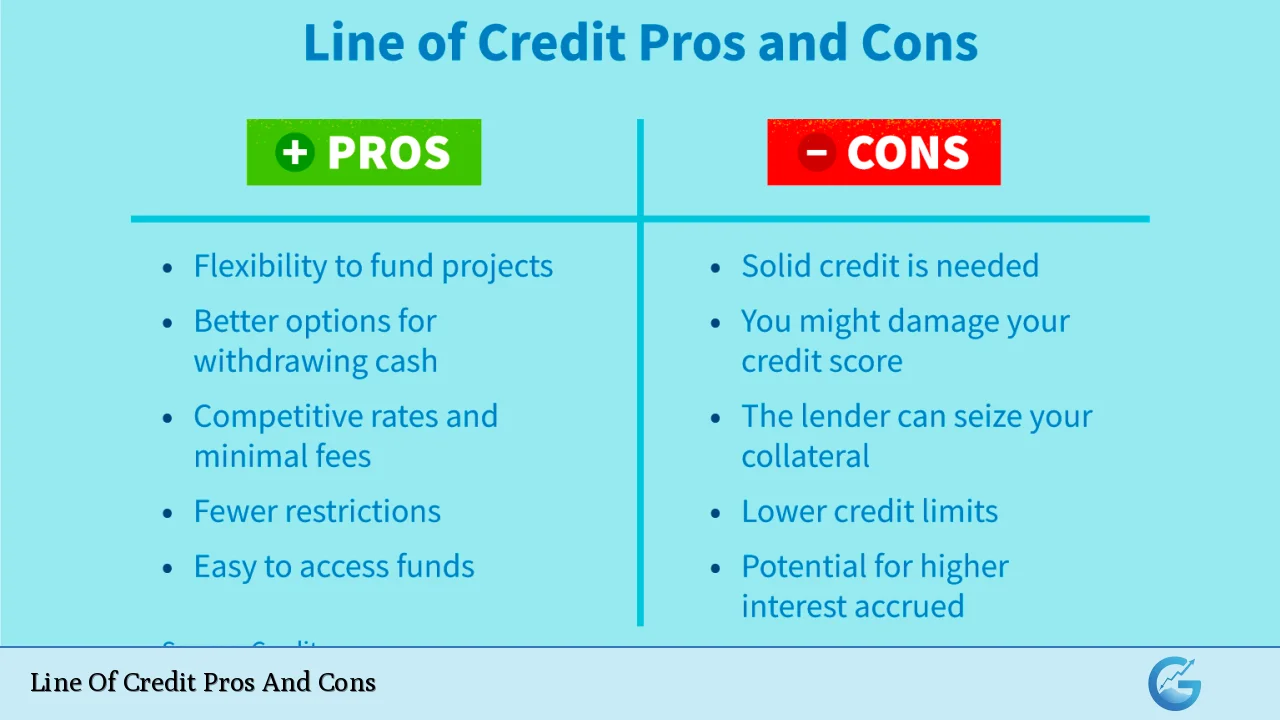

| Pros | Cons |

|---|---|

| Flexible access to funds | Potential for overspending |

| Lower interest rates than credit cards | Variable interest rates |

| Pay interest only on borrowed amount | Collateral may be required |

| Revolving credit facility | Fees and maintenance costs |

| Potential for credit score improvement | Risk of debt accumulation |

| Useful for managing cash flow | Stricter qualification requirements |

Advantages of a Line of Credit

Flexible Access to Funds

One of the primary benefits of a line of credit is its flexibility. Unlike traditional loans that provide a lump sum, a LOC allows borrowers to access funds as needed, up to the approved limit. This flexibility is particularly advantageous for:

- Business owners managing seasonal cash flow fluctuations

- Individuals facing unexpected expenses or emergencies

- Investors looking to capitalize on time-sensitive opportunities

The ability to draw funds at will without reapplying for a loan each time makes LOCs an efficient financial tool for those with varying or unpredictable financial needs.

Lower Interest Rates Than Credit Cards

Lines of credit typically offer more favorable interest rates compared to credit cards. This advantage makes LOCs an attractive option for:

- Consolidating high-interest credit card debt

- Financing large purchases or projects

- Managing ongoing expenses with lower borrowing costs

For example, while credit cards might charge annual percentage rates (APRs) of 15% to 25% or higher, LOCs often feature rates closer to those of personal loans, which can be significantly lower, especially for borrowers with good credit scores.

Pay Interest Only on Borrowed Amount

Unlike traditional loans where interest accrues on the entire principal from day one, with a line of credit, interest is charged only on the amount actually borrowed. This feature offers several benefits:

- Cost-effective borrowing for fluctuating needs

- Reduced overall interest expenses

- Greater control over borrowing costs

This pay-as-you-go interest structure can result in substantial savings for borrowers who don’t need to use their entire credit limit or who can repay borrowed funds quickly.

Revolving Credit Facility

The revolving nature of a line of credit means that as the borrower repays the borrowed amount, the available credit is replenished. This feature provides:

- Ongoing access to funds without reapplying

- Flexibility to borrow and repay as needed

- A safety net for future financial needs

This revolving structure is particularly beneficial for businesses with cyclical revenue patterns or individuals managing variable income streams.

Potential for Credit Score Improvement

Responsible use of a line of credit can positively impact a borrower’s credit score. Factors that can contribute to credit score improvement include:

- Timely payments

- Maintaining a low credit utilization ratio

- Demonstrating the ability to manage revolving credit

By consistently making payments on time and keeping the balance well below the credit limit, borrowers can potentially see an increase in their credit scores over time.

Useful for Managing Cash Flow

Lines of credit excel as tools for managing cash flow, offering benefits such as:

- Bridging gaps between accounts receivable and payable

- Covering short-term operational expenses

- Smoothing out irregular income patterns

For businesses, this can mean the difference between seizing growth opportunities and struggling with day-to-day operations. For individuals, it can provide a buffer against income volatility or unexpected expenses.

Disadvantages of a Line of Credit

Potential for Overspending

The ease of access to funds through a line of credit can lead to overspending, especially for those who lack financial discipline. Risks include:

- Accumulating more debt than initially intended

- Using the LOC for non-essential purchases

- Developing a reliance on credit for everyday expenses

Without proper budgeting and self-control, borrowers may find themselves in a cycle of debt that’s difficult to break.

Variable Interest Rates

Many lines of credit come with variable interest rates, which can introduce uncertainty into borrowing costs. Implications of variable rates include:

- Potential for increased monthly payments if rates rise

- Difficulty in long-term financial planning

- Exposure to market fluctuations and economic changes

While variable rates may start lower than fixed-rate options, they can increase over time, potentially leading to higher overall borrowing costs.

Collateral May Be Required

Depending on the type of line of credit and the lender’s requirements, collateral may be necessary to secure the LOC. This can present several challenges:

- Risk of asset loss if unable to repay the borrowed amount

- Limited access for those without sufficient collateral

- Potential for over-leveraging personal or business assets

Home equity lines of credit (HELOCs), for example, use the borrower’s home as collateral, putting the property at risk if the borrower defaults on payments.

Fees and Maintenance Costs

Lines of credit often come with various fees and costs that can add to the overall expense of borrowing. Common fees include:

- Annual maintenance fees

- Transaction fees for each draw

- Inactivity fees if the line isn’t used

- Setup or origination fees

These additional costs can significantly impact the total cost of borrowing, especially for those who don’t frequently use their line of credit.

Risk of Debt Accumulation

The revolving nature of a line of credit, while beneficial in many ways, can also lead to a continuous cycle of debt. Risks include:

- Constantly carrying a balance without making progress on repayment

- Temptation to repeatedly borrow up to the credit limit

- Difficulty in tracking total debt accumulation over time

Without a structured repayment plan, borrowers may find themselves in a position where they’re only able to make minimum payments, prolonging the debt and increasing the total interest paid.

Stricter Qualification Requirements

Obtaining a line of credit often involves more stringent qualification criteria compared to other forms of credit. Challenges may include:

- Higher credit score requirements

- Extensive documentation of income and assets

- Longer approval processes

These strict requirements can make LOCs less accessible to those with limited credit history or lower credit scores, potentially forcing them to seek higher-cost alternatives.

Closing Thoughts

Lines of credit offer a powerful financial tool for both individuals and businesses, providing flexibility and potential cost savings compared to other forms of credit. The ability to access funds as needed, coupled with typically lower interest rates than credit cards, makes LOCs attractive for managing cash flow, financing projects, or preparing for unexpected expenses.

However, the advantages of lines of credit come with significant responsibilities and potential pitfalls. The ease of access to funds can lead to overspending and debt accumulation if not managed carefully. Variable interest rates introduce an element of uncertainty, and the requirement for collateral in some cases puts valuable assets at risk.

Ultimately, the decision to use a line of credit should be based on a thorough understanding of one’s financial situation, discipline, and long-term financial goals. For those who can responsibly manage revolving credit, a LOC can provide valuable financial flexibility and peace of mind. However, it’s crucial to approach this financial tool with caution, always being mindful of the potential risks and committed to maintaining control over borrowing habits.

As with any financial product, prospective borrowers should carefully review the terms and conditions, compare offers from multiple lenders, and consider consulting with a financial advisor before committing to a line of credit. By doing so, individuals and businesses can make informed decisions that align with their financial objectives and risk tolerance, maximizing the benefits while minimizing the potential drawbacks of this versatile financial instrument.

Frequently Asked Questions About Line Of Credit Pros And Cons

- How does a line of credit differ from a traditional loan?

A line of credit provides flexible access to funds up to a set limit, allowing borrowers to draw and repay as needed. Traditional loans offer a lump sum with fixed repayment terms. - Can a line of credit help improve my credit score?

Yes, responsible use of a line of credit, including timely payments and maintaining a low balance relative to the credit limit, can positively impact your credit score over time. - What types of collateral are typically required for secured lines of credit?

Common forms of collateral include real estate (for HELOCs), vehicles, investment accounts, or business assets. The type of collateral depends on the specific line of credit and lender requirements. - Are there any tax benefits to using a line of credit?

In some cases, interest paid on a line of credit used for business purposes or home improvements (with a HELOC) may be tax-deductible. Consult a tax professional for specific advice. - How do lenders determine the credit limit for a line of credit?

Lenders consider factors such as credit score, income, existing debts, and collateral value (for secured lines) to determine the credit limit. Higher creditworthiness typically results in higher limits. - Can a lender reduce or cancel my line of credit?

Yes, lenders reserve the right to reduce credit limits or cancel lines of credit, especially if the borrower’s financial situation deteriorates or they violate the terms of the agreement. - What happens if I can’t make payments on my line of credit?

Missed payments can result in late fees, increased interest rates, negative credit report impacts, and potential legal action. For secured lines, failure to pay may lead to loss of collateral. - How does a business line of credit differ from a personal line of credit?

Business lines of credit often have higher limits and may offer more favorable terms but typically require business financial documentation and may have stricter qualification criteria than personal lines.