Life Insurance Retirement Plans (LIRPs) have gained popularity as an alternative retirement savings strategy, particularly among high-income earners. These plans combine the benefits of life insurance with the potential for tax-free income during retirement. However, as with any financial product, they come with their own set of advantages and disadvantages. This article will explore the pros and cons of LIRPs in detail, helping potential investors make informed decisions.

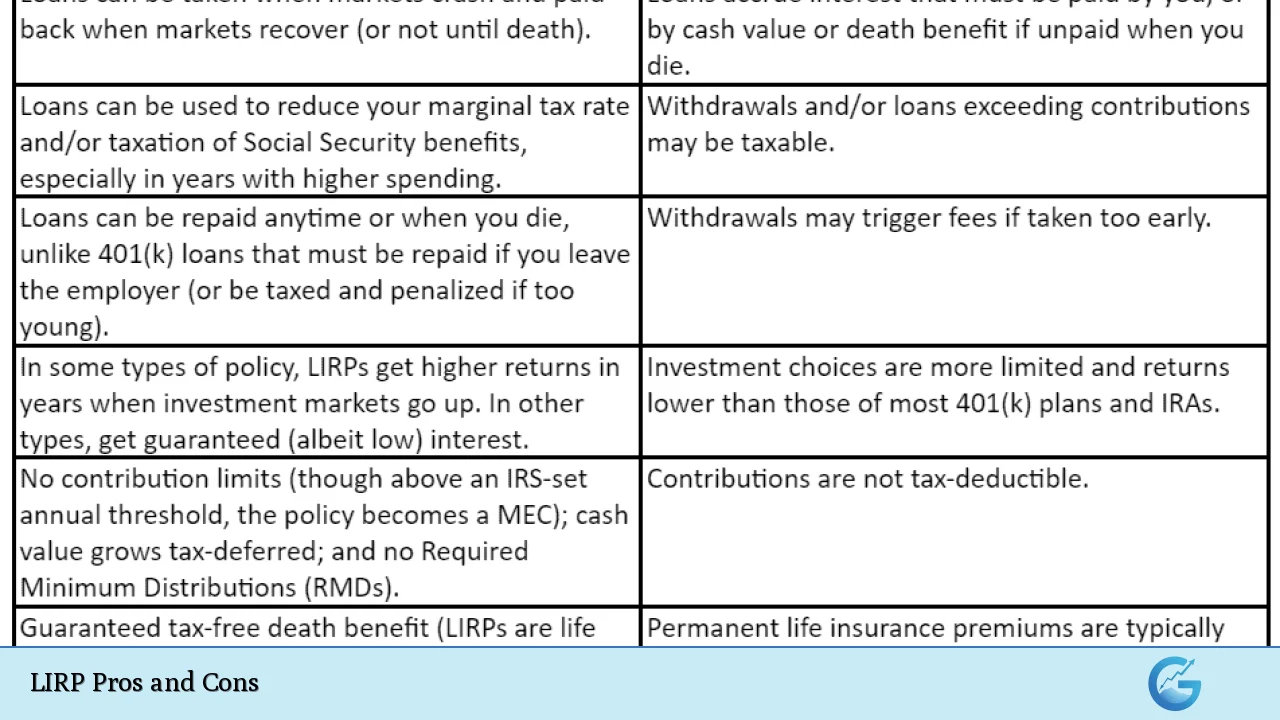

| Pros | Cons |

|---|---|

| Tax-free retirement income | Complexity and need for proper structuring |

| No contribution limits | High fees and costs |

| Protection against market downturns | Long-term commitment required |

| Flexible access to funds | Capped returns on investments |

| Death benefit for beneficiaries | Potential for becoming a Modified Endowment Contract (MEC) |

| Tax-deferred growth of cash value | Non-deductible contributions |

| Protection from creditors | Limited investment choices in some policies |

| Accessible funds without age restrictions | Slow early cash value growth |

Tax-Free Retirement Income

One of the most significant advantages of LIRPs is the ability to withdraw funds tax-free during retirement. Unlike traditional retirement accounts such as IRAs or 401(k)s, where withdrawals are subject to income tax, LIRPs allow policyholders to access their cash value without incurring tax liabilities. This feature can greatly enhance an individual’s financial situation in retirement, providing a steady stream of income without the burden of taxes.

No Contribution Limits

LIRPs do not impose annual contribution limits like other retirement accounts. This flexibility is particularly beneficial for high-income earners who have maxed out their contributions to traditional retirement plans. By allowing higher contributions, LIRPs enable individuals to accumulate significant cash value over time, enhancing their financial security in retirement.

Protection Against Market Downturns

LIRPs often provide a safeguard against market volatility. Many policies offer a guaranteed minimum interest rate or floor, ensuring that the policyholder’s principal is protected from market losses. This feature makes LIRPs an attractive option for those seeking stability in their retirement savings, particularly during economic downturns.

Flexible Access to Funds

Policyholders can access the cash value of their LIRP before retirement without facing penalties typically associated with early withdrawals from traditional retirement accounts. This flexibility allows individuals to tap into their savings for emergencies or unexpected expenses without incurring additional costs.

Death Benefit for Beneficiaries

In addition to serving as a retirement tool, LIRPs provide a death benefit to beneficiaries. This aspect adds a layer of financial security for families, ensuring that loved ones are taken care of in the event of the policyholder’s untimely death. The death benefit is typically paid out tax-free, providing significant financial relief during difficult times.

Tax-Deferred Growth of Cash Value

The cash value component of a LIRP grows on a tax-deferred basis. This means that policyholders do not pay taxes on the growth until they withdraw funds from the policy. This feature allows for more substantial accumulation over time, as the money can grow without being diminished by taxes each year.

Protection from Creditors

LIRPs can offer protection from creditors in case of lawsuits or bankruptcy. This aspect is particularly important for high-net-worth individuals who may be at risk of legal actions. By placing funds in a LIRP, individuals can safeguard their assets from potential claims.

Accessible Funds Without Age Restrictions

Unlike traditional retirement accounts that impose age restrictions on withdrawals, LIRPs allow policyholders to access their cash value at any time. This accessibility can be crucial for those who may need funds unexpectedly or wish to supplement their income before reaching retirement age.

Complexity and Need for Proper Structuring

Despite their benefits, LIRPs can be complex financial instruments requiring careful planning and structuring to maximize their advantages. Missteps in policy design can lead to underperformance or unintended tax consequences. It is essential for individuals considering a LIRP to work closely with knowledgeable financial advisors who understand these products’ intricacies.

High Fees and Costs

LIRPs often come with various fees, including premium costs, administrative charges, and agent commissions. These expenses can eat into the overall returns on investment, making it crucial for potential investors to understand all associated costs before committing to a policy.

Long-Term Commitment Required

To fully realize the benefits of a LIRP, a long-term commitment is necessary. Early withdrawals or terminating the policy prematurely can undermine the tax-free income goal that many investors seek. Individuals must be prepared for this long-term investment horizon when considering a LIRP as part of their financial strategy.

Capped Returns on Investments

Some LIRPs may impose caps on the returns that policyholders can earn, particularly those linked to indexed policies. While this feature protects against losses during market downturns, it may also limit growth potential compared to direct investments in higher-yielding assets like stocks or mutual funds.

Potential for Becoming a Modified Endowment Contract (MEC)

If a LIRP is overfunded according to IRS guidelines, it may be classified as a Modified Endowment Contract (MEC). This classification alters the tax treatment of withdrawals and loans taken against the policy’s cash value, potentially leading to unfavorable tax consequences that negate some benefits typically associated with LIRPs.

Non-Deductible Contributions

Contributions made to a LIRP are generally not tax-deductible. This contrasts with traditional retirement accounts where contributions may reduce taxable income in the year they are made. Individuals should consider this factor when evaluating whether a LIRP aligns with their overall financial strategy.

Limited Investment Choices in Some Policies

While some LIRPs offer diverse investment options within their cash value component, others may have limited choices available. Policyholders should carefully review these options before selecting a plan to ensure it aligns with their investment goals and risk tolerance.

Slow Early Cash Value Growth

In the initial years of a LIRP, cash value growth may be slow due to high upfront costs associated with establishing the policy. Investors must be patient as they wait for their cash value to accumulate meaningfully over time.

In conclusion, Life Insurance Retirement Plans (LIRPs) present both compelling advantages and notable drawbacks that potential investors must weigh carefully. While they offer unique benefits such as tax-free income and protection against market downturns, they also come with complexities and costs that require thorough understanding and planning. Ultimately, whether a LIRP is suitable will depend on individual financial circumstances and long-term goals.

Frequently Asked Questions About LIRP

- What is a Life Insurance Retirement Plan (LIRP)?

A Life Insurance Retirement Plan (LIRP) combines life insurance coverage with an investment component that allows individuals to accumulate cash value while also providing a death benefit. - Who should consider investing in a LIRP?

LIRPs are particularly beneficial for high-income earners who have maxed out other retirement savings options and seek additional tax-efficient savings vehicles. - What are the primary benefits of a LIRP?

The main benefits include tax-free withdrawals during retirement, no contribution limits, protection against market downturns, and flexible access to funds. - Are there any risks associated with LIRPs?

Yes, risks include complexity requiring proper structuring, high fees that can diminish returns, and potential caps on investment growth. - Can I access my funds before retirement?

Yes, you can access your cash value at any time without penalties typically associated with early withdrawals from traditional accounts. - What happens if I overfund my LIRP?

If overfunded according to IRS guidelines, your policy may become classified as a Modified Endowment Contract (MEC), leading to less favorable tax treatment. - How does a LIRP compare to traditional retirement accounts?

LIRPs offer unique benefits such as tax-free income and no contribution limits but lack some tax advantages found in IRAs or 401(k)s. - Is professional advice recommended when considering a LIRP?

Yes, working with knowledgeable financial advisors is crucial due to the complexity involved in properly structuring these plans.