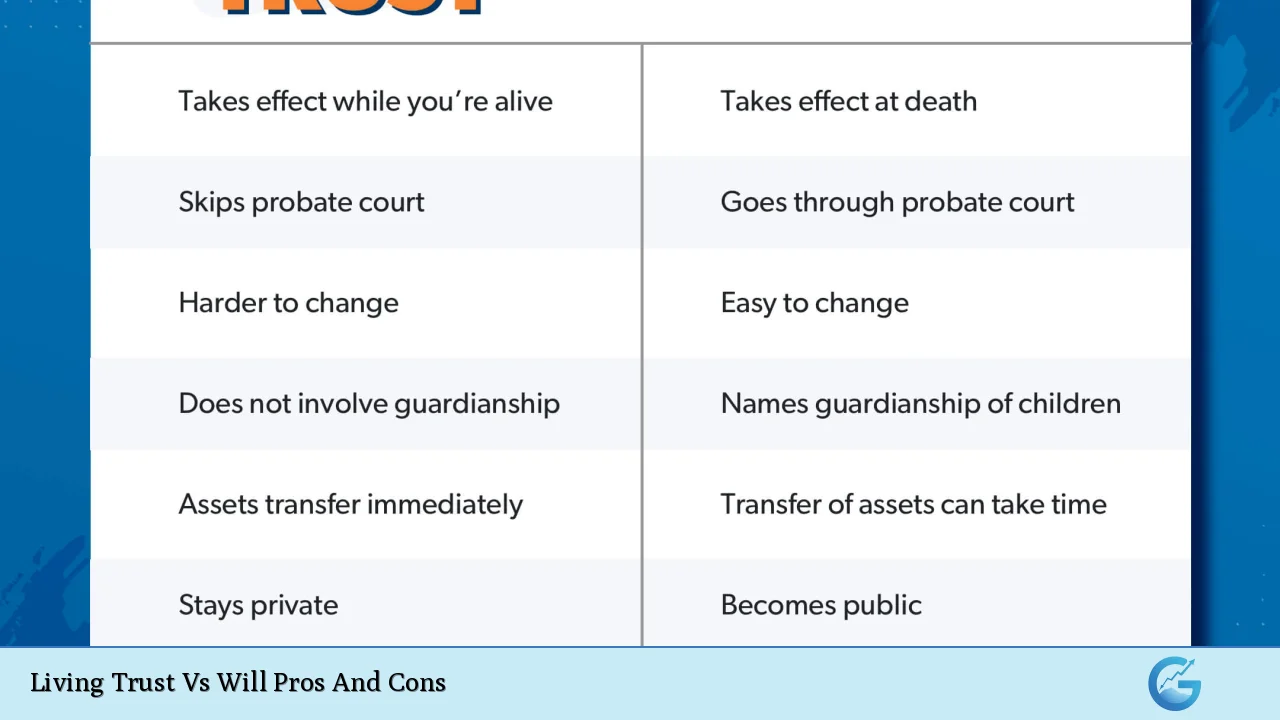

Estate planning is a crucial aspect of financial management that ensures your assets are distributed according to your wishes after your passing. Two popular tools for estate planning are living trusts and wills. Each has its own set of advantages and disadvantages, and understanding these can help you make an informed decision about which option best suits your needs.

| Pros | Cons |

|---|---|

| Avoids probate | Higher initial cost |

| Provides privacy | More complex to set up |

| Offers flexibility and control | Requires ongoing management |

| Enables incapacity planning | Limited creditor protection |

| Allows for seamless asset management | Potential for oversight in funding |

| Can reduce estate taxes | May not cover all assets |

| Facilitates smooth asset transfer | Doesn’t name guardians for minor children |

| Provides protection for out-of-state property | Requires retitling of assets |

Advantages of a Living Trust

Probate Avoidance

One of the most significant benefits of a living trust is its ability to bypass the probate process. Probate is the legal procedure through which a deceased person’s estate is settled under court supervision. This process can be time-consuming, expensive, and public. Assets held in a living trust can be distributed to beneficiaries without going through probate, which offers several advantages:

- Faster distribution of assets to beneficiaries

- Reduced legal fees and court costs

- Avoidance of potential delays associated with probate

- Minimized risk of disputes among beneficiaries

For individuals with complex estates or assets in multiple states, probate avoidance can be particularly beneficial, as it eliminates the need for ancillary probate proceedings in different jurisdictions.

Enhanced Privacy Protection

Unlike wills, which become public records during probate, living trusts offer a higher degree of privacy. The terms of a living trust, including asset details and beneficiary information, remain confidential even after the grantor’s death. This privacy can be especially valuable for:

- High-net-worth individuals seeking to maintain discretion about their wealth

- Those concerned about potential challenges to their estate plan

- Families wishing to keep their financial affairs private

In an era where financial privacy is increasingly valued, the confidentiality offered by a living trust can be a significant advantage over a will.

Flexibility and Control

Living trusts provide grantors with a high degree of flexibility and control over their assets. Key aspects of this advantage include:

- Ability to modify or revoke the trust during the grantor’s lifetime

- Option to specify detailed distribution instructions for beneficiaries

- Potential to include spendthrift provisions to protect beneficiaries from creditors

- Flexibility to adapt the trust to changing circumstances or family dynamics

This level of control allows for more nuanced estate planning, particularly for those with complex family situations or specific wishes for asset distribution.

Incapacity Planning

A well-structured living trust can serve as an effective tool for incapacity planning. By naming a successor trustee, the grantor ensures that:

- Trust assets can be managed seamlessly if the grantor becomes incapacitated

- The need for court-appointed guardianship or conservatorship is avoided

- Financial affairs continue to be handled according to the grantor’s wishes

This feature of living trusts can provide peace of mind and financial stability for individuals and their families in the event of unexpected health issues or cognitive decline.

Seamless Asset Management

Living trusts facilitate smooth and continuous asset management, both during the grantor’s lifetime and after their passing. Benefits include:

- Uninterrupted investment management and financial decision-making

- Ability to consolidate assets under a single entity for easier administration

- Streamlined process for adding or removing assets from the trust

This seamless management can be particularly advantageous for individuals with diverse investment portfolios or business interests.

Potential Tax Benefits

While living trusts themselves do not provide direct tax advantages, they can be structured to minimize estate taxes for married couples. Through the use of AB trusts or other advanced trust structures, couples can:

- Maximize their estate tax exemptions

- Potentially reduce the overall tax burden on their combined estates

- Ensure that assets are distributed tax-efficiently to beneficiaries

It’s important to note that tax laws are complex and subject to change, so consulting with a tax professional is crucial when considering the tax implications of a living trust.

Smooth Asset Transfer

Living trusts enable a smooth and efficient transfer of assets to beneficiaries upon the grantor’s death. This advantage is characterized by:

- Immediate access to trust assets for beneficiaries

- Reduced likelihood of legal challenges compared to will contests

- Ability to structure phased distributions based on beneficiary age or other criteria

The efficiency of asset transfer through a living trust can be particularly beneficial in ensuring financial stability for dependents or in cases where business continuity is a concern.

Protection for Out-of-State Property

For individuals owning property in multiple states, a living trust can simplify estate administration by:

- Avoiding the need for ancillary probate proceedings in different jurisdictions

- Consolidating out-of-state property under a single trust entity

- Streamlining the management and eventual distribution of geographically diverse assets

This advantage can result in significant time and cost savings for estates with multi-state property holdings.

Disadvantages of a Living Trust

Higher Initial Cost

One of the primary drawbacks of establishing a living trust is the upfront cost. Compared to creating a simple will, setting up a living trust typically involves:

- Higher legal fees for drafting complex trust documents

- Costs associated with transferring assets into the trust

- Potential fees for professional advice on trust structure and funding

While these initial costs can be substantial, it’s important to weigh them against the potential long-term savings in probate fees and estate administration expenses.

Complexity in Setup and Maintenance

Creating and maintaining a living trust requires more effort and attention to detail than a will. This complexity is evident in:

- The need for careful drafting of trust documents to ensure legal validity

- The process of transferring assets into the trust (known as “funding” the trust)

- Ongoing record-keeping and potential tax filings for the trust

For some individuals, this level of complexity may be daunting or may require ongoing professional assistance, adding to the overall cost of trust administration.

Ongoing Management Requirements

Unlike a will, which becomes operative only upon death, a living trust requires active management throughout the grantor’s lifetime. This ongoing responsibility includes:

- Regular review and potential updates to the trust document

- Continuous monitoring of trust assets and investments

- Ensuring that newly acquired assets are properly titled in the trust’s name

The time and effort required for ongoing trust management can be significant, particularly for individuals with large or complex estates.

Limited Creditor Protection

While living trusts offer many benefits, they provide limited protection against creditors’ claims. Key limitations include:

- Assets in a revocable living trust remain accessible to the grantor’s creditors

- Trust assets may be considered in determining eligibility for certain government benefits

- After the grantor’s death, trust assets may still be subject to claims against the estate

For individuals seeking robust asset protection, other estate planning tools or irrevocable trusts may be more appropriate.

Potential for Oversight in Funding

One of the most common pitfalls in using a living trust is the failure to properly fund the trust. This can occur when:

- Assets are not correctly retitled in the name of the trust

- New acquisitions are not added to the trust

- Certain assets, such as retirement accounts, are inadvertently left out of the trust

Failure to fully fund a living trust can result in partial probate, negating one of the primary advantages of creating the trust in the first place.

May Not Cover All Assets

While living trusts can encompass a wide range of assets, certain types of property may not be suitable for inclusion in a trust. Examples include:

- Retirement accounts with designated beneficiaries

- Life insurance policies

- Certain types of jointly owned property

As a result, a comprehensive estate plan may still require additional documents, such as a will, to address assets not held in the trust.

Inability to Name Guardians for Minor Children

Unlike a will, a living trust cannot be used to name guardians for minor children. This means that:

- Parents must still create a will to designate guardians

- The estate plan may require multiple documents to address all aspects of asset distribution and child care

For families with minor children, this limitation necessitates a more comprehensive approach to estate planning.

Requirement for Retitling Assets

Transferring assets into a living trust requires retitling those assets in the name of the trust. This process can be:

- Time-consuming, especially for individuals with numerous assets

- Potentially complex, particularly for certain types of property or accounts

- Ongoing, as new assets are acquired or existing assets change

The retitling process is crucial for the effectiveness of the trust but can be a significant administrative burden for the grantor.

In conclusion, the decision between a living trust and a will depends on individual circumstances, including the complexity of the estate, privacy concerns, and long-term financial goals. While living trusts offer significant advantages in terms of probate avoidance, privacy, and control, they also come with higher costs and ongoing management responsibilities. Careful consideration of these pros and cons, ideally with the guidance of a qualified estate planning professional, is essential to making the right choice for your estate planning needs.

Frequently Asked Questions About Living Trust Vs Will Pros And Cons

- Can a living trust completely eliminate the need for probate?

While a properly funded living trust can avoid probate for assets held within the trust, it may not eliminate probate entirely. Assets outside the trust may still require probate, and a pour-over will is often used to catch any overlooked assets. - Is a living trust always better than a will for estate planning?

Not necessarily. The choice depends on individual circumstances such as estate size, complexity, privacy concerns, and personal preferences. For simpler estates or those primarily concerned with naming guardians for minor children, a will may be sufficient. - How does a living trust affect my control over my assets during my lifetime?

With a revocable living trust, you maintain full control over your assets as the trustee. You can buy, sell, or transfer assets as you see fit, and you can modify or revoke the trust at any time during your lifetime. - Are there any tax advantages to creating a living trust?

A basic revocable living trust doesn’t provide direct tax benefits. However, certain types of trusts, such as AB trusts for married couples, can be structured to minimize estate taxes. Consult with a tax professional for specific advice. - How much does it cost to set up a living trust compared to a will?

Generally, setting up a living trust is more expensive than creating a will. Costs can vary widely depending on the complexity of the estate and local legal fees, but a living trust may cost several thousand dollars to establish, while a simple will might cost a few hundred dollars. - Can creditors access assets in a living trust?

For a revocable living trust, creditors can generally access the assets during the grantor’s lifetime. After the grantor’s death, the trust assets may still be subject to creditors’ claims against the estate, depending on state laws and the trust’s structure. - How often should a living trust be updated?

It’s advisable to review your living trust every few years or after significant life events such as marriages, divorces, births, deaths, or substantial changes in assets. Regular reviews ensure the trust remains aligned with your current wishes and circumstances. - Can a living trust protect assets from Medicaid spend-down requirements?

A revocable living trust typically does not protect assets from Medicaid spend-down requirements. For Medicaid planning purposes, specialized irrevocable trusts may be more appropriate, but these come with their own set of pros and cons and should be discussed with an elder law attorney.