Limited Liability Companies (LLCs) have become increasingly popular among entrepreneurs and investors in the finance, crypto, forex, and money markets. This business structure offers a unique blend of features from both corporations and partnerships, providing flexibility and protection that can be particularly advantageous in these dynamic sectors. However, like any business entity, LLCs come with their own set of advantages and disadvantages that must be carefully considered before formation.

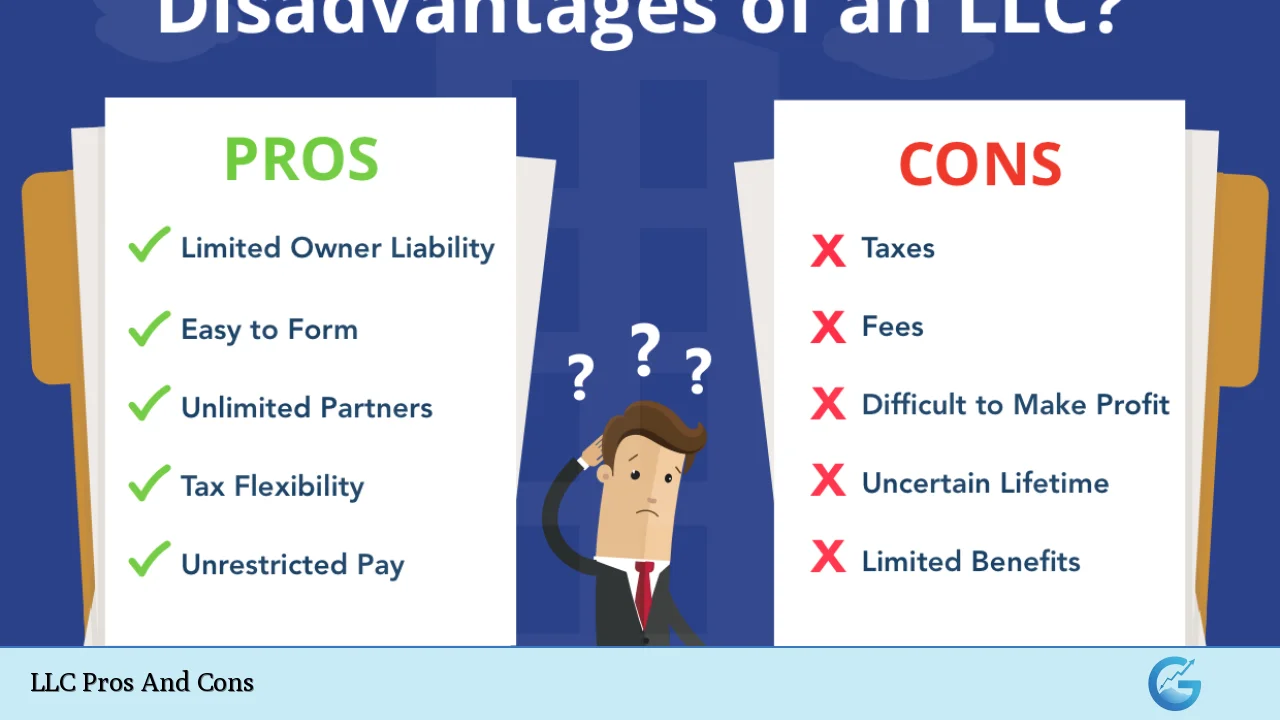

| Pros | Cons |

|---|---|

| Limited Liability Protection | Self-Employment Taxes |

| Pass-Through Taxation | Complexity in Formation |

| Flexible Management Structure | Limited Investment Options |

| Credibility Enhancement | State-Specific Regulations |

| Perpetual Existence | Potential Member Conflicts |

| Asset Protection | Ongoing Compliance Costs |

Advantages of Forming an LLC

Limited Liability Protection

The cornerstone benefit of an LLC is the personal asset protection it provides to its members.

This protection is particularly crucial in high-risk sectors like forex trading and cryptocurrency investments, where market volatility can lead to significant financial exposure.

- Shields personal assets from business debts and liabilities

- Protects against lawsuits targeting the business

- Reduces personal financial risk in volatile markets

For instance, if an LLC engaged in forex trading incurs substantial losses due to unexpected currency fluctuations, the members’ personal assets—such as homes, vehicles, and savings accounts—are typically protected from creditors seeking to recover those losses.

Pass-Through Taxation

LLCs offer a favorable tax structure that can be especially beneficial for those operating in the financial markets.

- Avoids double taxation common in C-corporations

- Allows profits and losses to flow directly to members’ personal tax returns

- Provides flexibility in choosing tax classification (partnership, S-corporation, or C-corporation)

This tax advantage can be particularly impactful for crypto traders and forex investors, as it allows for more efficient tax planning and potentially lower overall tax burdens. For example, losses from cryptocurrency trading can be used to offset other income on personal tax returns, subject to certain limitations.

Flexible Management Structure

The adaptable management structure of an LLC is well-suited to the fast-paced nature of financial and crypto markets.

- Can be member-managed or manager-managed

- Allows for customized operating agreements tailored to specific business needs

- Facilitates quick decision-making processes crucial in volatile markets

This flexibility enables LLCs to adapt swiftly to market changes, whether it’s adjusting trading strategies in the forex market or pivoting to new blockchain technologies in the crypto space.

Credibility Enhancement

Operating as an LLC can significantly boost a business’s credibility in the eyes of partners, clients, and financial institutions.

- Demonstrates commitment and professionalism

- May improve access to business banking services and credit lines

- Enhances trust with potential investors and trading partners

In the often-skeptical world of cryptocurrency and forex trading, the added legitimacy of an LLC structure can be a valuable asset, potentially opening doors to partnerships and opportunities that might be closed to sole proprietorships.

Perpetual Existence

The concept of perpetual existence provides stability and continuity, which can be particularly valuable in long-term investment strategies.

- Business can continue regardless of ownership changes

- Facilitates smoother transitions in case of member exits or deaths

- Allows for long-term planning and strategy implementation

This feature is especially beneficial for crypto mining operations or algorithmic trading firms that require consistent, uninterrupted operations to maintain profitability.

Asset Protection

Beyond personal liability protection, LLCs offer robust asset protection mechanisms that can be crucial in high-stakes financial markets.

- Protects business assets from personal creditors of members

- Allows for the creation of series LLCs in some states, further compartmentalizing risk

- Provides a legal framework for protecting intellectual property, such as proprietary trading algorithms

For instance, a forex trading LLC could protect its trading capital and proprietary strategies from personal creditors of its members, ensuring the continuity of operations even if individual members face financial difficulties.

Disadvantages of Forming an LLC

Self-Employment Taxes

While pass-through taxation offers benefits, it also comes with potential drawbacks, particularly regarding self-employment taxes.

- Members may be subject to self-employment taxes on their share of profits

- Can result in higher overall tax burden compared to corporation structures

- Requires careful tax planning and potential quarterly estimated tax payments

This aspect can be particularly impactful for successful crypto traders or forex investors who generate significant profits, as they may face higher tax rates compared to traditional employment income.

Complexity in Formation

Despite being simpler than corporations, forming an LLC still involves complexities that can be challenging, especially for those new to business ownership.

- Requires filing articles of organization with the state

- Necessitates creation of a comprehensive operating agreement

- May involve additional paperwork for multi-member LLCs or those operating in multiple states

The intricacies of formation can be particularly daunting for individuals transitioning from personal trading accounts to a formal business structure in the crypto or forex markets.

Limited Investment Options

LLCs face certain limitations when it comes to raising capital, which can be a significant drawback in the fast-moving world of financial markets and cryptocurrency.

- Cannot issue stock like corporations, limiting options for equity financing

- May face challenges in attracting venture capital or angel investors

- Potential difficulties in implementing employee stock option plans

These limitations can be particularly problematic for crypto startups or innovative forex trading firms looking to scale quickly through external investment.

State-Specific Regulations

The regulatory landscape for LLCs can vary significantly from state to state, adding layers of complexity for businesses operating across multiple jurisdictions.

- Different formation requirements and ongoing compliance obligations by state

- Potential need for foreign LLC registration when operating outside the home state

- Varying tax treatments and reporting requirements across states

This regulatory patchwork can be especially challenging for crypto and forex businesses that often operate without regard to state boundaries, potentially necessitating complex compliance strategies.

Potential Member Conflicts

The flexible nature of LLC management can sometimes lead to disputes among members, particularly in high-stress environments like financial trading.

- Disagreements over profit distribution and reinvestment strategies

- Conflicts regarding management decisions and business direction

- Potential for deadlocks in decision-making processes

These internal conflicts can be particularly detrimental in the fast-paced worlds of cryptocurrency and forex trading, where quick, unified decision-making is often crucial for success.

Ongoing Compliance Costs

Maintaining an LLC involves ongoing expenses and administrative duties that can be burdensome, especially for smaller operations.

- Annual report filings and associated fees

- Potential requirement for registered agent services

- Costs associated with maintaining separate business bank accounts and records

For traders and investors accustomed to operating personal accounts, these additional compliance requirements and costs can represent a significant shift in operational approach.

In conclusion, while LLCs offer numerous advantages that align well with the needs of businesses operating in finance, crypto, forex, and money markets, they also come with notable drawbacks.

The decision to form an LLC should be made after careful consideration of these pros and cons, ideally in consultation with legal and financial professionals who understand the unique challenges of these dynamic sectors.

By weighing the benefits of liability protection and tax flexibility against the complexities of formation and ongoing compliance, entrepreneurs and investors can make informed decisions about whether an LLC is the right structure for their financial market endeavors.

Frequently Asked Questions About LLC Pros And Cons

- How does an LLC protect personal assets in high-risk trading environments?

An LLC creates a legal separation between personal and business assets. This means that if the LLC incurs losses or faces lawsuits from trading activities, the members’ personal assets are generally protected from creditors or legal claims against the business. - Can an LLC structure help optimize tax outcomes for cryptocurrency traders?

Yes, an LLC can offer tax advantages for crypto traders. The pass-through taxation allows for direct reporting of profits and losses on personal tax returns, potentially enabling more efficient tax planning and the ability to offset gains with losses from other income sources. - Are there any specific advantages of using an LLC for forex trading?

LLCs can be particularly beneficial for forex trading due to their flexibility in management and potential tax benefits. They also provide a level of credibility that can be helpful when dealing with brokers and financial institutions, potentially leading to better trading terms or access to institutional-grade platforms. - How does the formation of an LLC impact day-to-day trading operations?

Forming an LLC requires separating personal and business finances, which can lead to more structured record-keeping and potentially better risk management. It may also necessitate changes in how trading accounts are set up and managed, as they would need to be in the LLC’s name rather than personal accounts. - Can an LLC structure help attract investors to a crypto or forex trading business?

While LLCs have limitations in issuing stock, they can still be attractive to certain investors. The limited liability protection and potential tax benefits can appeal to partners or angel investors. However, venture capitalists and institutional investors often prefer C-corporation structures for larger investments. - What are the main compliance challenges for an LLC operating in multiple states for trading purposes?

LLCs operating across state lines may need to register as foreign LLCs in each state where they conduct business. This can involve additional filing requirements, fees, and potentially different tax obligations in each state, adding complexity to compliance and reporting processes. - How does an LLC structure affect the ability to use leverage or margin in trading activities?

An LLC structure doesn’t inherently affect the ability to use leverage or margin, but it can provide a more formal framework for managing these high-risk activities. Some brokers may offer different terms or higher leverage limits to business entities compared to individual traders. - What are the key considerations when choosing between an LLC and a corporation for a fintech startup in the crypto space?

Key considerations include the desired tax treatment, plans for future fundraising, management structure preferences, and compliance requirements. LLCs offer more flexibility and potentially favorable tax treatment, while corporations might be better suited for businesses planning to raise significant venture capital or go public in the future.