Max Funded Indexed Universal Life (IUL) insurance is a sophisticated financial product that combines life insurance coverage with a cash value component linked to stock market index performance. This strategy involves funding an IUL policy to the maximum extent allowed by IRS guidelines without triggering Modified Endowment Contract (MEC) status. By optimizing premium payments, policyholders aim to accelerate cash value growth while maintaining the tax advantages associated with life insurance policies.

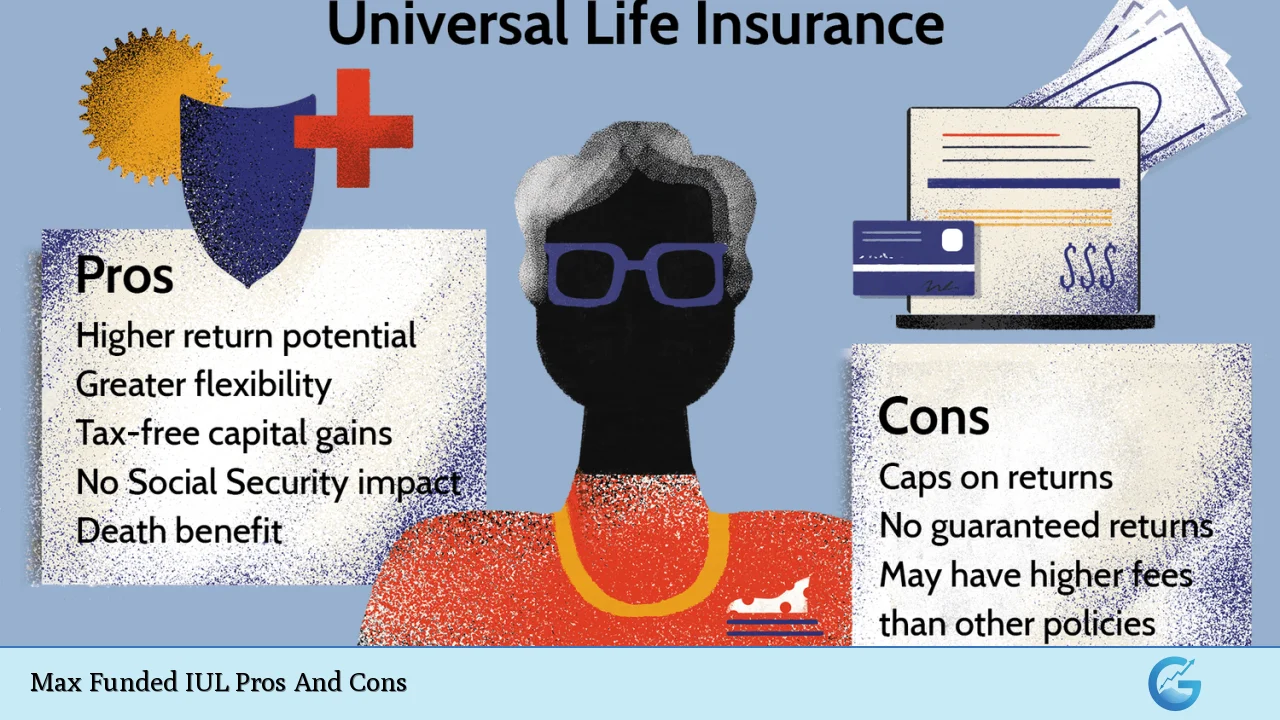

| Pros | Cons |

|---|---|

| Tax-advantaged growth potential | Complex product structure |

| Downside protection | Capped returns |

| Flexible premium payments | High fees and costs |

| Access to cash value | Policy lapse risk |

| Death benefit for beneficiaries | Potential for underperformance |

| Creditor protection (in some states) | Requires active management |

Tax-Advantaged Growth Potential

One of the most significant advantages of a Max Funded IUL is its potential for tax-advantaged growth. The cash value within the policy grows on a tax-deferred basis, meaning that policyholders do not pay taxes on the gains as long as the money remains within the policy. This tax treatment can lead to substantial long-term growth, especially for high-income individuals in higher tax brackets.

- Tax-deferred growth allows for compound interest to work more effectively

- Potential for tax-free loans against the policy’s cash value

- Opportunity for tax-free withdrawals up to the policy basis

It’s crucial to understand that while the growth is tax-deferred, improper management of the policy can lead to unexpected tax consequences.

Policyholders must be careful not to trigger a taxable event by allowing the policy to lapse or by taking excessive withdrawals that cause the policy to become a Modified Endowment Contract (MEC).

Complex Product Structure

The complexity of Max Funded IULs is a significant drawback that can make it challenging for many individuals to fully understand and manage their policies effectively. These products involve intricate mechanisms for crediting interest, adjusting death benefits, and managing policy expenses.

- Multiple moving parts, including index crediting methods, caps, and participation rates

- Difficulty in comparing different IUL products due to varying features and terminology

- Potential for misunderstanding the true costs and risks associated with the policy

The complexity of Max Funded IULs necessitates ongoing education and potentially professional guidance to ensure optimal policy performance.

Policyholders who do not fully grasp the nuances of their IUL may make suboptimal decisions regarding premium payments, loans, or withdrawals, which could negatively impact the policy’s long-term viability.

Downside Protection

A key feature of Max Funded IULs is the downside protection they offer against market volatility. Unlike direct investments in the stock market, IULs typically provide a guaranteed minimum interest rate or “floor,” often set at 0% or 1%. This means that even in years when the linked index performs poorly, the policyholder’s cash value is protected from losses.

- Preservation of principal during market downturns

- Reduced overall portfolio volatility

- Peace of mind for risk-averse investors

The downside protection feature can be particularly valuable during periods of economic uncertainty or when nearing retirement age.

It allows policyholders to participate in market gains to some extent while shielding their accumulated cash value from the full brunt of market corrections.

Capped Returns

While downside protection is a significant benefit, it comes at the cost of capped returns. IUL policies typically limit the maximum interest that can be credited to the cash value account, regardless of how well the underlying index performs. This cap, often ranging from 8% to 14%, can significantly dampen returns during strong market years.

- Potential for underperformance compared to direct market investments

- Caps may be adjusted by the insurer over time, potentially lowering future growth

- Complexity in understanding how caps interact with other policy features

Policyholders must carefully consider whether the trade-off between downside protection and capped upside aligns with their long-term financial goals.

In bull markets, Max Funded IULs may significantly underperform compared to traditional investment vehicles like mutual funds or ETFs.

Flexible Premium Payments

Max Funded IULs offer a degree of flexibility in premium payments that is not typically available with traditional whole life insurance policies. This flexibility can be advantageous for individuals with variable income or those who want to adjust their financial commitments over time.

- Ability to increase or decrease premium payments within certain limits

- Option to skip payments if sufficient cash value has accumulated

- Potential to make additional payments to further boost cash value growth

While premium flexibility can be beneficial, it’s important to note that consistently underfunding the policy can lead to increased costs and potential lapse.

Policyholders should strive to maintain the planned premium schedule to ensure the policy performs as intended.

High Fees and Costs

One of the most significant drawbacks of Max Funded IULs is the high fees and costs associated with these policies. These expenses can eat into the policy’s cash value and reduce overall returns, especially in the early years of the policy.

- Cost of insurance charges that typically increase as the insured ages

- Administrative fees and policy maintenance charges

- Surrender charges that can be substantial if the policy is terminated early

The impact of fees on policy performance can be substantial and may not be immediately apparent to policyholders.

It’s crucial to carefully review the policy illustration and understand how these costs affect the long-term growth of the cash value.

Access to Cash Value

Max Funded IULs provide policyholders with the ability to access their cash value through loans or withdrawals. This feature can offer financial flexibility and serve as a source of tax-advantaged income in retirement.

- Policy loans can be taken without triggering immediate taxation

- Withdrawals up to the policy basis can be taken tax-free

- Potential for creating a “private banking” system for personal or business use

While access to cash value can be beneficial, it’s crucial to manage withdrawals and loans carefully to avoid negatively impacting the policy’s performance or triggering unexpected tax consequences.

Excessive loans or withdrawals can lead to policy lapse if not properly managed.

Policy Lapse Risk

One of the most significant risks associated with Max Funded IULs is the potential for policy lapse. If the cash value becomes insufficient to cover the ongoing costs of insurance and policy fees, the policy may terminate, potentially resulting in significant financial loss and tax consequences.

- Market underperformance can erode cash value faster than anticipated

- Increasing costs of insurance as the insured ages can accelerate cash value depletion

- Excessive loans or withdrawals can strain the policy’s ability to sustain itself

Policyholders must remain vigilant and be prepared to adjust premium payments or reduce death benefits to prevent policy lapse, especially during periods of poor market performance.

Regular policy reviews and proactive management are essential to maintain the long-term viability of a Max Funded IUL.

Death Benefit for Beneficiaries

While the focus of Max Funded IULs is often on cash value accumulation, it’s important to remember that these policies also provide a death benefit to beneficiaries. This can be a valuable component of an overall estate planning strategy.

- Tax-free death benefit payout to beneficiaries

- Potential for increasing death benefit over time as cash value grows

- Option to adjust death benefit to balance between protection and cash value growth

The death benefit can provide financial security for loved ones and may be structured to help mitigate estate tax concerns for high-net-worth individuals.

However, policyholders should regularly review whether the death benefit aligns with their current needs and adjust accordingly.

In conclusion, Max Funded IULs offer a unique combination of life insurance protection and potential for tax-advantaged cash value growth. While they can be powerful financial tools when properly structured and managed, they come with significant complexities and risks that require careful consideration. Prospective policyholders should thoroughly evaluate their financial objectives, risk tolerance, and long-term commitment before pursuing a Max Funded IUL strategy. Consultation with qualified financial professionals who have expertise in these products is highly recommended to ensure that a Max Funded IUL aligns with an individual’s overall financial plan and goals.

Frequently Asked Questions About Max Funded IUL Pros And Cons

- What is the main difference between a Max Funded IUL and a traditional IUL?

A Max Funded IUL is designed to maximize cash value growth by contributing the highest allowable premiums without triggering MEC status. Traditional IULs may have a greater focus on death benefit protection with lower premium payments. - How does the tax treatment of a Max Funded IUL compare to other investment vehicles?

Max Funded IULs offer tax-deferred growth and potential tax-free access to cash value through loans. This can be advantageous compared to taxable investment accounts, but they lack the upfront tax benefits of qualified retirement plans like 401(k)s. - Can I lose money in a Max Funded IUL?

While the cash value is protected from market losses, you can lose money due to high fees, especially in the early years of the policy. Policy lapse can also result in significant financial loss and potential tax consequences. - How often should I review my Max Funded IUL policy?

It’s recommended to review your policy annually, or more frequently during times of market volatility or significant life changes. Regular reviews help ensure the policy remains aligned with your financial goals and performs as intended. - Are there alternatives to Max Funded IULs for tax-advantaged growth?

Yes, alternatives include Roth IRAs, traditional IRAs, 401(k)s, and other retirement accounts. Each has its own set of rules, contribution limits, and tax implications that should be carefully compared to Max Funded IULs. - How does the creditor protection feature of Max Funded IULs work?

In some states, the cash value of life insurance policies, including IULs, may be protected from creditors. However, the level of protection varies by state and may have limitations, so it’s important to consult with a legal professional for specific guidance. - What happens if I can’t afford to continue funding my Max Funded IUL at the maximum level?

If you reduce premium payments, the policy may not perform as originally projected. You may need to adjust the death benefit or be prepared for slower cash value growth. In some cases, additional premiums may be required to keep the policy in force. - How do changes in interest rates affect a Max Funded IUL?

Interest rate changes can impact the policy’s performance. Lower interest rates may result in lower caps or participation rates, potentially reducing the policy’s growth potential. Conversely, rising rates could lead to more favorable crediting terms.