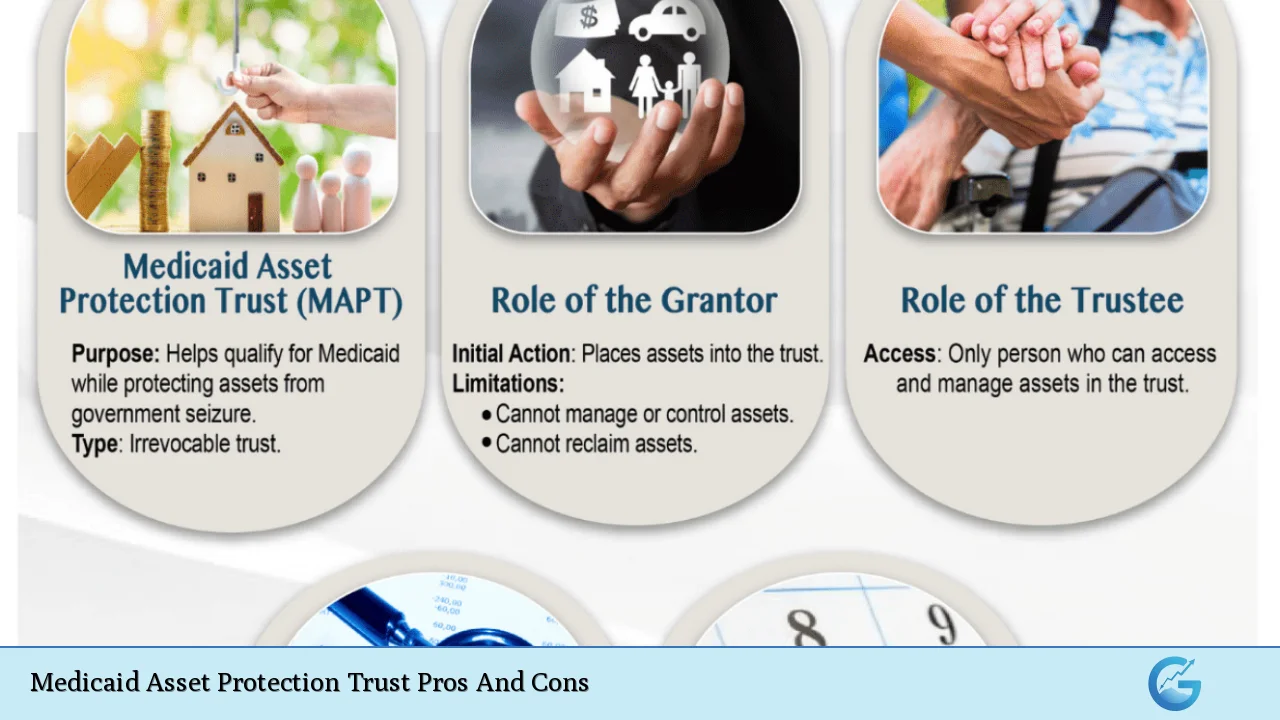

Medicaid Asset Protection Trusts (MAPTs) are specialized irrevocable trusts designed to help individuals protect their assets while qualifying for Medicaid benefits. As healthcare costs, particularly for long-term care, continue to rise, many people seek ways to preserve their wealth against the potential depletion caused by these expenses. MAPTs allow individuals to transfer ownership of their assets to a trust, thereby excluding them from Medicaid’s asset calculations. However, while MAPTs can provide significant advantages, they also come with notable disadvantages that require careful consideration.

| Pros | Cons |

|---|---|

| Protects assets from Medicaid estate recovery | Loss of control over assets |

| Helps qualify for Medicaid without depleting personal assets | Complexity and cost of setting up the trust |

| Potential tax benefits | Five-year look-back period for asset transfers |

| Income generated by the trust can still be accessed | Restrictions on distributions may limit access to funds |

| Protection from creditors and lawsuits | Potential impact on eligibility for other benefits |

| Allows for estate planning and beneficiary designations | Not suitable for everyone; requires careful planning |

| Preserves wealth for future generations | May not cover all long-term care costs |

Protects Assets from Medicaid Estate Recovery

One of the primary advantages of a Medicaid Asset Protection Trust is its ability to protect assets from Medicaid estate recovery claims. When an individual receives Medicaid benefits, the state may seek reimbursement from their estate after their death. By placing assets in a MAPT, those assets are not considered part of the estate, thus preventing the state from claiming them to recover costs associated with long-term care.

- Assets remain intact for heirs: This protection ensures that family members can inherit the preserved assets rather than having them depleted by healthcare costs.

- Peace of mind: Knowing that your legacy is protected can provide significant emotional relief during challenging times.

Helps Qualify for Medicaid Without Depleting Personal Assets

MAPTs are designed specifically to help individuals qualify for Medicaid without having to spend down their personal assets. This is particularly important given the high costs associated with long-term care facilities.

- Financial security: This strategy allows individuals to maintain a level of financial security while still accessing necessary medical care.

- Avoiding financial hardship: By protecting assets, families can avoid the financial strain that often accompanies long-term care needs.

Potential Tax Benefits

Establishing a MAPT can also offer potential tax advantages. Since the assets are no longer owned by the individual but rather held in trust, they may not be subject to estate taxes upon death.

- Estate tax reduction: For high-net-worth individuals, this can lead to significant savings.

- Capital gains tax protection: Depending on how the trust is structured, it may also help mitigate capital gains taxes when assets are sold.

Income Generated by the Trust Can Still Be Accessed

While transferring assets into a MAPT means relinquishing ownership, beneficiaries can still benefit from income generated by those assets.

- Access to income: The trustee can distribute income generated from investments within the trust, providing financial support without jeopardizing Medicaid eligibility.

- Flexibility in usage: This income can be used for various expenses, enhancing the quality of life for beneficiaries.

Protection from Creditors and Lawsuits

Assets held in a MAPT are generally protected from creditors and lawsuits. This feature adds an additional layer of security for individuals concerned about potential legal claims against their personal wealth.

- Safeguarding wealth: This protection is particularly valuable for business owners or professionals who may face liability risks.

- Long-term security: It ensures that personal assets remain intact despite unforeseen legal challenges.

Allows for Estate Planning and Beneficiary Designations

MAPTs serve as effective tools for estate planning. Individuals can designate beneficiaries and outline how they want their assets distributed after their death.

- Control over asset distribution: This allows individuals to have a say in how their wealth is passed on.

- Customizable arrangements: Trusts can be tailored to meet specific family needs and circumstances.

Preserves Wealth for Future Generations

By using a MAPT, individuals can ensure that their wealth is preserved not only for themselves but also for future generations.

- Generational wealth transfer: This strategy supports the goal of leaving a financial legacy for children or grandchildren.

- Long-term financial planning: It encourages proactive planning regarding family finances and inheritance.

Loss of Control Over Assets

One of the most significant disadvantages of establishing a MAPT is the irrevocable loss of control over the transferred assets. Once placed in trust, these assets cannot be reclaimed or managed directly by the grantor.

- Inflexibility in financial decisions: This restriction can pose challenges if financial circumstances change unexpectedly.

- Dependence on trustee decisions: Beneficiaries must rely on trustees to manage and distribute trust assets according to established terms.

Complexity and Cost of Setting Up the Trust

Setting up a MAPT involves legal complexities and associated costs. The process requires careful drafting and adherence to specific regulations governing trusts and Medicaid eligibility.

- Legal fees: Establishment costs can range significantly based on jurisdiction and complexity, often requiring several thousand dollars.

- Time-consuming process: Navigating the legal landscape can be daunting without professional assistance.

Five-Year Look-Back Period for Asset Transfers

Medicaid imposes a five-year look-back period during which any asset transfers made to a MAPT may affect eligibility. If an individual applies for Medicaid within five years of transferring assets into a trust, they could face penalties or delays in receiving benefits.

- Planning ahead is crucial: Individuals must plan well in advance to avoid penalties when applying for Medicaid.

- Risk of delayed coverage: Those who fail to comply with look-back regulations may have to spend down their resources before qualifying for assistance.

Restrictions on Distributions May Limit Access to Funds

While income generated by the trust may be accessible, distributions from the principal often come with restrictions. This limitation may hinder beneficiaries’ ability to access funds when needed most.

- Financial strain during emergencies: In times of unexpected financial need, beneficiaries may find themselves unable to tap into necessary resources.

- Limited flexibility in spending: The restrictions placed on distributions can create frustration among beneficiaries who require immediate access to funds.

Potential Impact on Eligibility for Other Benefits

Transferring assets into a MAPT might affect eligibility for other government benefits beyond Medicaid. It’s essential to consider how these changes could impact overall financial health.

- Complicated benefit landscape: Individuals must navigate multiple programs and regulations when managing their finances.

- Risk of losing other assistance programs: In some cases, asset transfers could disqualify individuals from receiving other forms of aid or support.

Not Suitable for Everyone; Requires Careful Planning

MAPTs are not universally appropriate; they require careful consideration based on individual circumstances. Consulting with an experienced estate planning attorney is crucial before proceeding with this strategy.

- Personalized assessment needed: Each individual’s financial situation is unique and should be evaluated on its own merits.

- Long-term commitment required: Establishing a MAPT involves significant commitment regarding asset management and distribution plans.

May Not Cover All Long-Term Care Costs

While MAPTs provide essential protections against certain costs associated with long-term care, they do not necessarily cover all expenses incurred during such care.

- Additional funding may be necessary: Families should prepare for potential out-of-pocket expenses that might arise even with a MAPT in place.

- Relying solely on Medicaid could limit options: Not all facilities accept Medicaid payments, which could restrict choices regarding care quality or location.

In conclusion, while Medicaid Asset Protection Trusts offer substantial advantages in protecting wealth and ensuring access to necessary healthcare services without depleting personal resources, they also come with significant drawbacks that must be carefully weighed. Understanding both sides of this financial tool is crucial for anyone considering it as part of their long-term care planning strategy.

Frequently Asked Questions About Medicaid Asset Protection Trust Pros And Cons

- What is a Medicaid Asset Protection Trust?

A Medicaid Asset Protection Trust (MAPT) is an irrevocable trust designed to protect an individual’s assets while qualifying them for Medicaid benefits. - What are the main advantages of a MAPT?

The primary advantages include asset protection from Medicaid recovery claims, qualification for Medicaid without depleting personal resources, and potential tax benefits. - What are some disadvantages associated with MAPTs?

The main disadvantages include loss of control over transferred assets, complex setup processes, and restrictions on accessing funds. - How does the five-year look-back period affect MAPTs?

The five-year look-back period means any asset transfers made within five years before applying for Medicaid could result in penalties or delayed eligibility. - Can I still access income generated from my MAPT?

Yes, beneficiaries can typically access income generated by the trust; however, principal distributions may come with restrictions. - Are there tax benefits associated with establishing a MAPT?

Yes, establishing a MAPT may provide tax advantages such as reducing estate taxes since transferred assets are no longer part of your taxable estate. - Is a MAPT suitable for everyone?

No, establishing a MAPT requires careful consideration based on individual circumstances; consulting an estate planning attorney is recommended. - What happens if I need long-term care before five years have passed?

If you require long-term care within five years after transferring assets into a MAPT, you may face penalties that affect your eligibility for Medicaid benefits.