The Massachusetts Housing Partnership (MHP) ONE Mortgage program is a unique initiative designed to make homeownership more accessible and affordable for first-time homebuyers in Massachusetts. This innovative mortgage product combines features that address common barriers to homeownership, particularly for low- and moderate-income families. As with any financial product, it’s crucial to understand both its advantages and potential drawbacks before making a decision.

| Pros | Cons |

|---|---|

| Low down payment requirement | Limited to first-time homebuyers |

| No private mortgage insurance (PMI) | Income and asset limits |

| Discounted fixed interest rate | Restricted to Massachusetts properties |

| Interest rate subsidy for eligible buyers | Potential for subsidy repayment |

| Flexible credit requirements | Limited lender participation |

| Post-purchase support | Property type restrictions |

Advantages of MHP ONE Mortgage

Low Down Payment Requirement

The ONE Mortgage program offers an exceptionally low down payment option, making homeownership more attainable for many first-time buyers. Here are the key points:

- Minimum down payment of just 3% for single-family homes, condominiums, and two-family properties

- 5% down payment required for three-family properties

- Down payment assistance programs can be used to meet the requirement

- Allows for gifted funds from family members to be used towards the down payment

This low entry barrier significantly reduces the upfront costs associated with purchasing a home, which is often one of the biggest hurdles for first-time buyers, especially in high-cost markets like Massachusetts.

No Private Mortgage Insurance (PMI)

One of the most substantial cost-saving features of the ONE Mortgage is the absence of private mortgage insurance (PMI). This benefit cannot be overstated:

- Typical conventional loans require PMI for down payments less than 20%

- PMI can cost hundreds of dollars per month

- Elimination of PMI results in lower monthly payments

- Increases affordability and purchasing power for buyers

The absence of PMI can save homeowners thousands of dollars over the life of their loan, making the ONE Mortgage an attractive option for those looking to maximize their budget and minimize long-term costs.

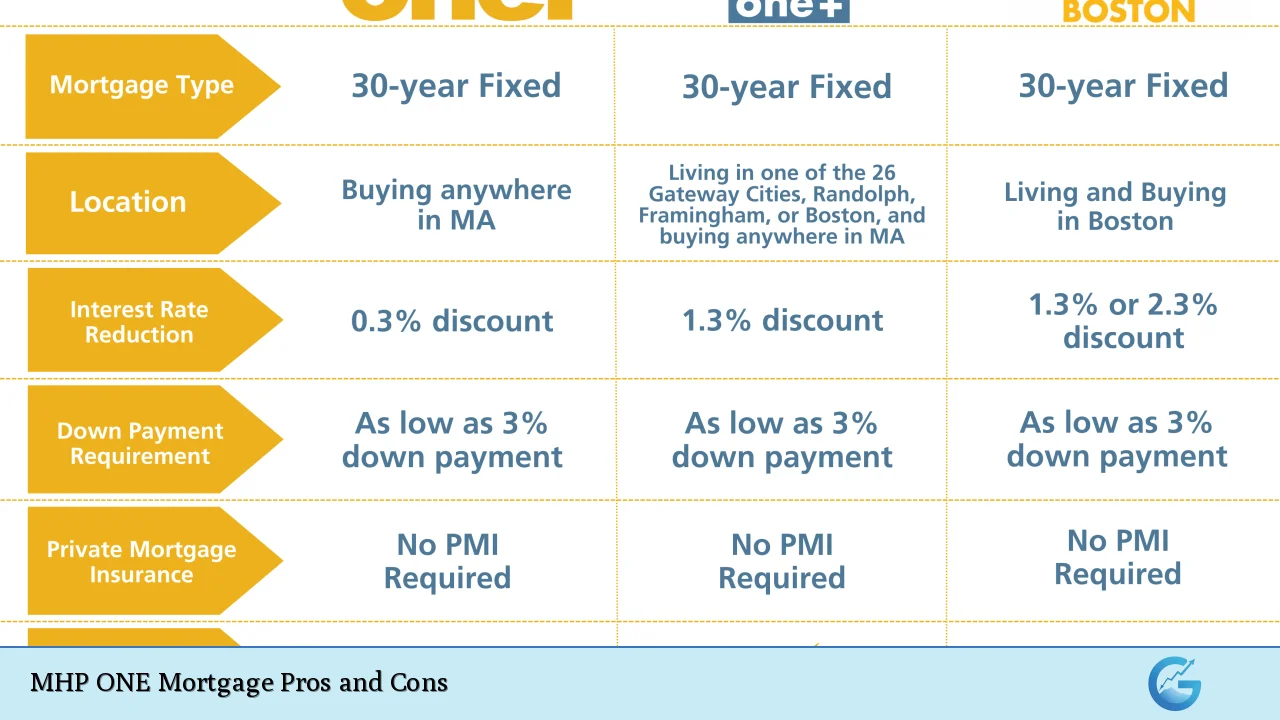

Discounted Fixed Interest Rate

The ONE Mortgage program offers a competitive, discounted interest rate that remains fixed for the entire 30-year term of the loan. This feature provides several benefits:

- Interest rates are typically 30 basis points below the Freddie Mac Weekly Primary Mortgage Market Survey rate

- Fixed rate provides stability and predictability in monthly payments

- Protection against future interest rate increases

- Easier budgeting and financial planning for homeowners

The combination of a discounted rate and the fixed nature of the loan offers significant long-term savings and financial security for borrowers.

Interest Rate Subsidy for Eligible Buyers

For qualified buyers with incomes at or below 80% of the area median income, the ONE Mortgage offers an additional interest rate subsidy. This unique feature provides:

- Reduction of the effective interest rate by up to 2 percentage points

- Gradual phase-out of the subsidy over the first seven years of the loan

- Lower monthly payments during the critical early years of homeownership

- Increased affordability for lower-income buyers

This subsidy can make a substantial difference in the early years of homeownership when many buyers are still adjusting to the financial responsibilities of owning a home.

Flexible Credit Requirements

The ONE Mortgage program demonstrates flexibility in its credit requirements, making it accessible to a broader range of borrowers:

- Minimum credit score of 640 for single-family homes and condominiums

- Minimum credit score of 660 for two- and three-family properties

- Allowances for borrowers with limited credit history

- Options for using non-traditional credit sources to qualify

This flexibility can be particularly beneficial for younger buyers, recent immigrants, or others who may not have extensive credit histories but are otherwise financially responsible.

Post-Purchase Support

The ONE Mortgage program goes beyond just helping buyers purchase a home; it also provides valuable post-purchase support. This includes:

- Free post-purchase education through the HomeSafe program

- Counseling services to help new homeowners navigate challenges

- Resources for maintaining and managing their new property

- Support in case of financial difficulties or job loss

This ongoing support can be crucial for first-time homeowners who may face unexpected challenges or need guidance in their new role as property owners.

Disadvantages of MHP ONE Mortgage

Limited to First-Time Homebuyers

One of the primary limitations of the ONE Mortgage program is its restriction to first-time homebuyers:

- Defined as those who have not owned a home in the last three years

- Excludes current homeowners looking to refinance or purchase a new property

- May not be suitable for those who have previously owned a home but are re-entering the market

This restriction, while beneficial for focusing resources on new entrants to the housing market, does limit the program’s reach and applicability to a broader range of potential homebuyers.

Income and Asset Limits

The ONE Mortgage program imposes income and asset limits on applicants, which can be a significant drawback for some potential buyers:

- Income limits vary by community and household size

- Asset limit of $75,000 in total household assets (excluding retirement and college savings accounts)

- May disqualify some buyers who exceed these limits but still struggle with housing affordability

These limits, while designed to target the program to those most in need, can create a cliff effect where slightly higher-earning households are excluded from the benefits.

Restricted to Massachusetts Properties

The ONE Mortgage program is exclusively available for properties within Massachusetts:

- Not applicable for those looking to purchase in other states

- Limits options for buyers considering properties in neighboring states

- May not be suitable for those whose job or life circumstances require flexibility in location

This geographical restriction, while beneficial for Massachusetts residents, does limit the program’s utility for those with broader housing search parameters.

Potential for Subsidy Repayment

While the interest rate subsidy is a significant benefit, it comes with a potential drawback:

- Subsidy may need to be repaid upon sale or transfer of the property

- Can impact the net proceeds from a home sale

- May complicate refinancing decisions

- Potential financial obligation that persists throughout ownership

Borrowers need to carefully consider this aspect, especially if they anticipate selling or refinancing in the short to medium term.

Limited Lender Participation

The ONE Mortgage program is not universally available through all lenders:

- Only offered through participating lenders approved by MHP

- May limit options for comparing rates and terms across a wide range of lenders

- Potential for less competitive pricing due to reduced competition

- Could necessitate switching from a preferred lender or bank

This limitation in lender choice could potentially result in less favorable terms or reduced convenience for some borrowers.

Property Type Restrictions

The ONE Mortgage program has specific requirements regarding property types:

- Limited to 1-3 family properties and condominiums

- Excludes multi-family properties with more than three units

- May not be suitable for those looking to invest in larger residential properties

- Could limit options in certain urban areas where larger multi-family properties are common

These restrictions, while designed to focus on primary residences, may not align with the goals of all potential homebuyers, particularly those interested in larger investment properties.

In conclusion, the MHP ONE Mortgage program offers significant advantages for first-time homebuyers in Massachusetts, particularly those with moderate incomes. Its combination of low down payment requirements, absence of PMI, discounted interest rates, and additional subsidies can make homeownership more accessible and affordable. However, potential applicants must carefully consider the program’s limitations, including eligibility restrictions, geographical constraints, and potential repayment obligations. As with any major financial decision, prospective homebuyers should thoroughly research their options, consult with financial advisors, and carefully weigh the pros and cons in the context of their individual circumstances and long-term financial goals.

Frequently Asked Questions About MHP ONE Mortgage Pros and Cons

- Who is eligible for the MHP ONE Mortgage program?

The program is available to first-time homebuyers in Massachusetts who meet income and asset limits. Applicants must complete a homebuyer education course and plan to use the property as their primary residence. - How does the interest rate subsidy work?

Eligible buyers with incomes at or below 80% AMI can receive a subsidy that reduces their effective interest rate by up to 2 percentage points. This subsidy is phased out over the first seven years of the loan. - Can I use down payment assistance with the ONE Mortgage?

Yes, the program allows the use of down payment assistance programs and gifted funds from family members to meet the minimum down payment requirement. - What happens if I want to sell my home purchased with a ONE Mortgage?

If you sell or transfer the property, you may be required to repay the interest subsidy you received. The loan must also be paid off or refinanced at this time. - Are there any restrictions on the type of property I can buy?

The ONE Mortgage program is limited to 1-3 family properties and condominiums in Massachusetts that will serve as the buyer’s primary residence. - How does the absence of PMI benefit me?

Not having to pay PMI can save you hundreds of dollars each month, lowering your overall monthly mortgage payment and potentially increasing your buying power. - What kind of post-purchase support does the program offer?

The program provides free post-purchase education and counseling through the HomeSafe program, offering resources and support for new homeowners. - Can I refinance a ONE Mortgage loan in the future?

Refinancing is possible, but it would require paying off the original ONE Mortgage loan and potentially repaying any subsidy received. Carefully consider the terms and long-term implications before refinancing.