Money Market Deposit Accounts (MMDAs) are a popular financial product that combines features of both checking and savings accounts. They typically offer higher interest rates than traditional savings accounts while providing easy access to funds. Understanding the advantages and disadvantages of MMDAs is crucial for anyone considering this type of investment, especially for those involved in finance, crypto, forex, and money markets. This article will explore the pros and cons of Money Market Deposit Accounts in detail, helping you make an informed decision.

| Pros | Cons |

|---|---|

| Higher interest rates compared to traditional savings accounts | Minimum balance requirements can be high |

| Access to funds through checks and debit cards | Limited number of transactions per month |

| FDIC or NCUA insurance protects deposits up to $250,000 | Monthly maintenance fees may apply |

| Flexible access to funds, ideal for emergencies | Interest rates may be variable and decrease over time |

| Potential for higher yields with larger deposits | Not as liquid as checking accounts for frequent transactions |

| Combination of savings and checking account features | May offer lower returns compared to other investment options |

| Easy online management and transfers between accounts | Withdrawal limits may lead to fees if exceeded |

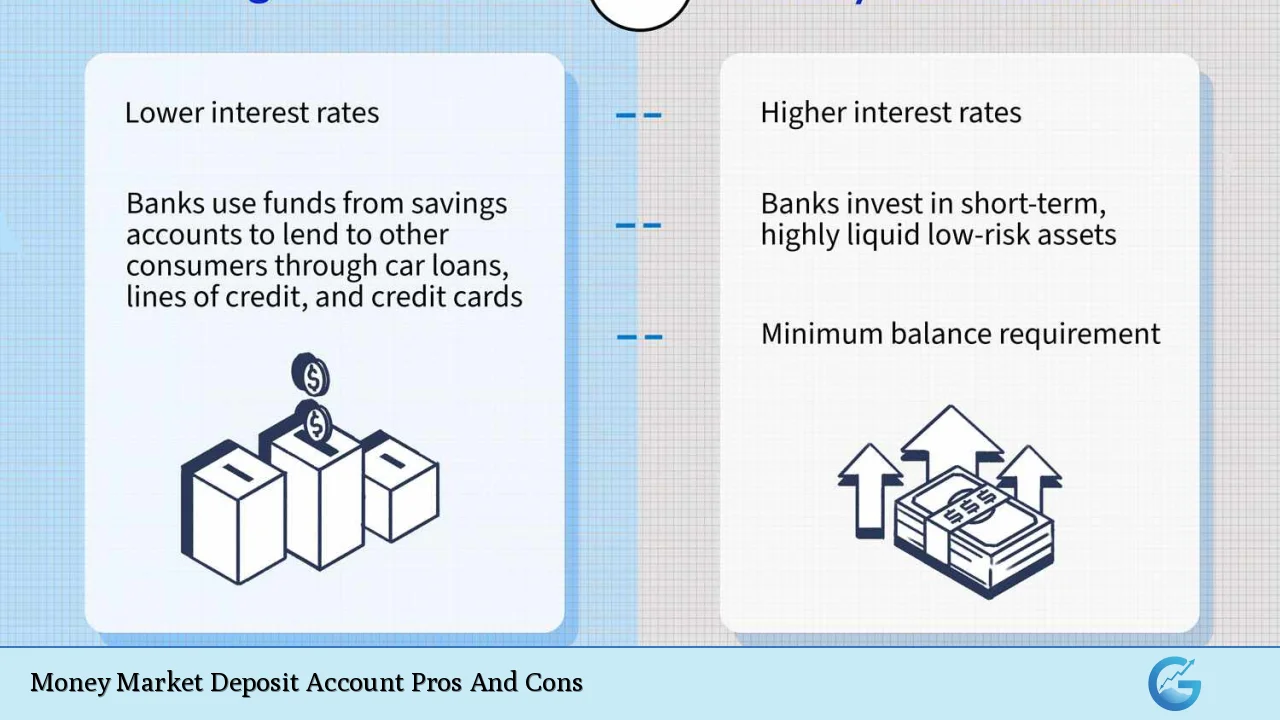

Higher Interest Rates Compared to Traditional Savings Accounts

One of the most significant advantages of Money Market Deposit Accounts is their ability to offer higher interest rates than traditional savings accounts.

- MMDAs often provide competitive annual percentage yields (APYs), making them an attractive option for savers looking to grow their money.

- The interest rates on MMDAs can be influenced by broader economic factors, such as changes in the Federal Reserve’s benchmark interest rate.

- For example, a $10,000 deposit in an MMDA with a 1% APY would yield $100 in interest over a year, significantly more than what a traditional savings account would offer.

Access to Funds Through Checks and Debit Cards

MMDAs provide account holders with convenient access to their funds, which is a notable benefit.

- Many money market accounts come with check-writing privileges and debit cards, allowing users to manage their finances easily.

- This feature provides flexibility for making payments or withdrawals without needing to transfer funds to a checking account first.

- For instance, if unexpected expenses arise, such as car repairs or medical bills, account holders can write a check directly from their MMDA.

FDIC or NCUA Insurance Protects Deposits Up to $250,000

Another key advantage of MMDAs is the federal insurance they carry.

- Deposits in MMDAs at banks are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor per bank.

- For accounts held at credit unions, the National Credit Union Administration (NCUA) provides similar insurance coverage.

- This insurance ensures that your deposits are protected even in the unlikely event of a bank failure, giving savers peace of mind regarding their funds’ safety.

Flexible Access to Funds, Ideal for Emergencies

MMDAs are designed with flexibility in mind, making them suitable for various financial needs.

- Unlike certificates of deposit (CDs), which require funds to be locked away for a specific term, MMDAs allow for easier access to cash when needed.

- This feature makes them ideal for individuals who want to save while retaining the ability to access their money quickly in case of emergencies.

- The combination of higher interest rates and flexible access positions MMDAs as an effective savings tool.

Potential for Higher Yields with Larger Deposits

The structure of MMDAs often rewards larger deposits with higher interest rates.

- Many financial institutions offer tiered interest rates that increase as your account balance grows.

- This means that individuals who can deposit larger sums may benefit significantly from higher yields compared to those with smaller balances.

- For example, depositing $50,000 might yield a higher APY than depositing only $10,000, maximizing your earnings potential over time.

Combination of Savings and Checking Account Features

MMDAs uniquely blend features from both savings and checking accounts.

- This hybrid nature allows users not only to earn interest but also to conduct transactions like writing checks or using debit cards without transferring funds elsewhere.

- The convenience of having both functionalities in one account simplifies personal finance management.

- As such, MMDAs can serve as effective tools for managing both short-term liquidity needs and long-term savings goals.

Easy Online Management and Transfers Between Accounts

In today’s digital age, managing finances online has become essential for many individuals.

- Most financial institutions offer robust online banking platforms that allow easy management of money market accounts.

- Users can monitor balances, transfer funds between accounts, and even set up automatic transfers or bill payments with ease.

- This level of accessibility enhances user experience and encourages regular engagement with one’s finances.

Minimum Balance Requirements Can Be High

Despite their many advantages, MMDAs often come with significant drawbacks that potential account holders should consider.

- One major disadvantage is the high minimum balance requirement that many banks impose.

- To open an MMDA or maintain its benefits—such as earning the highest interest rate—account holders may need to keep substantial amounts deposited.

- This requirement can be prohibitive for some savers who may not have large sums available at all times.

Limited Number of Transactions Per Month

Another limitation associated with MMDAs is the restriction on monthly transactions.

- Although recent changes have relaxed some transaction limits imposed by federal regulations, most banks still limit the number of withdrawals or transfers you can make each month.

- Typically, this limit is set at six transactions per statement cycle for electronic transfers or checks; exceeding this limit may incur fees or result in account conversion to a standard checking account.

- For individuals who require frequent access to their funds, this limitation could pose challenges.

Monthly Maintenance Fees May Apply

Many financial institutions charge monthly maintenance fees on MMDAs that can diminish overall returns.

- These fees vary by institution but can be avoided by meeting certain criteria—such as maintaining a minimum balance or setting up direct deposits.

- However, if you fail to meet these conditions consistently, these fees can erode any interest earned over time.

- Even small monthly fees can add up significantly over the course of a year and impact your overall savings strategy negatively.

Interest Rates May Be Variable and Decrease Over Time

While MMDAs typically start with attractive interest rates, these rates are often variable and subject to change based on market conditions or bank policies.

- If economic conditions worsen or the Federal Reserve lowers its benchmark rates again, the interest rates on MMDAs may decrease accordingly.

- This variability means that while you might enjoy high yields initially, there is no guarantee that those rates will remain competitive over time.

- Savers must stay vigilant about monitoring their account’s performance relative to other savings options available in the market.

Not as Liquid as Checking Accounts for Frequent Transactions

While MMDAs provide better liquidity than CDs or other long-term investments, they are still less liquid than standard checking accounts when it comes to frequent transactions.

- Individuals who need immediate access without restrictions might find checking accounts more suitable due to their unlimited transaction capabilities.

- If your financial needs require regular withdrawals or payments without incurring fees or penalties, relying solely on an MMDA could be limiting.

May Offer Lower Returns Compared To Other Investment Options

Finally, while MMDAs provide competitive interest rates compared to traditional savings accounts, they may not yield returns comparable to other investment vehicles like stocks or mutual funds over time.

- For investors seeking growth through higher-risk options such as equities or real estate investments, MMDAs might seem conservative and less rewarding.

- Therefore, it’s essential for potential account holders to weigh their risk tolerance against their financial goals when considering where to allocate their assets effectively.

In conclusion, Money Market Deposit Accounts present several advantages such as higher interest rates than traditional savings accounts, convenient access through checks and debit cards, and federal insurance protection. However, they also come with disadvantages including high minimum balance requirements and transaction limits that could hinder frequent access. By understanding both sides of this financial product thoroughly—alongside your personal financial goals—you can make informed decisions about whether an MMDA aligns well with your overall investment strategy.

Frequently Asked Questions About Money Market Deposit Accounts

- What is a Money Market Deposit Account?

A Money Market Deposit Account is a type of deposit account offered by banks and credit unions that combines features of savings and checking accounts. - Are Money Market Deposit Accounts insured?

Yes, deposits in Money Market Deposit Accounts are insured by the FDIC (for banks) or NCUA (for credit unions) up to $250,000 per depositor. - Can I write checks from my Money Market Deposit Account?

Many Money Market Deposit Accounts allow check-writing privileges along with debit card access. - What are the typical transaction limits on Money Market Deposit Accounts?

Most banks limit transactions from MMDA accounts to six per month for electronic transfers or checks. - Do I need a minimum balance in my Money Market Deposit Account?

Yes, many banks require maintaining a minimum balance; failing which may incur monthly maintenance fees. - How do interest rates work on Money Market Deposit Accounts?

The interest rates on MMDAs are usually variable; they can change based on economic conditions. - What happens if I exceed my monthly transaction limit?

If you exceed your transaction limit regularly, your bank may convert your MMDA into a standard checking account. - Are there any fees associated with Money Market Deposit Accounts?

Yes, some banks charge monthly maintenance fees which could apply unless certain conditions are met.