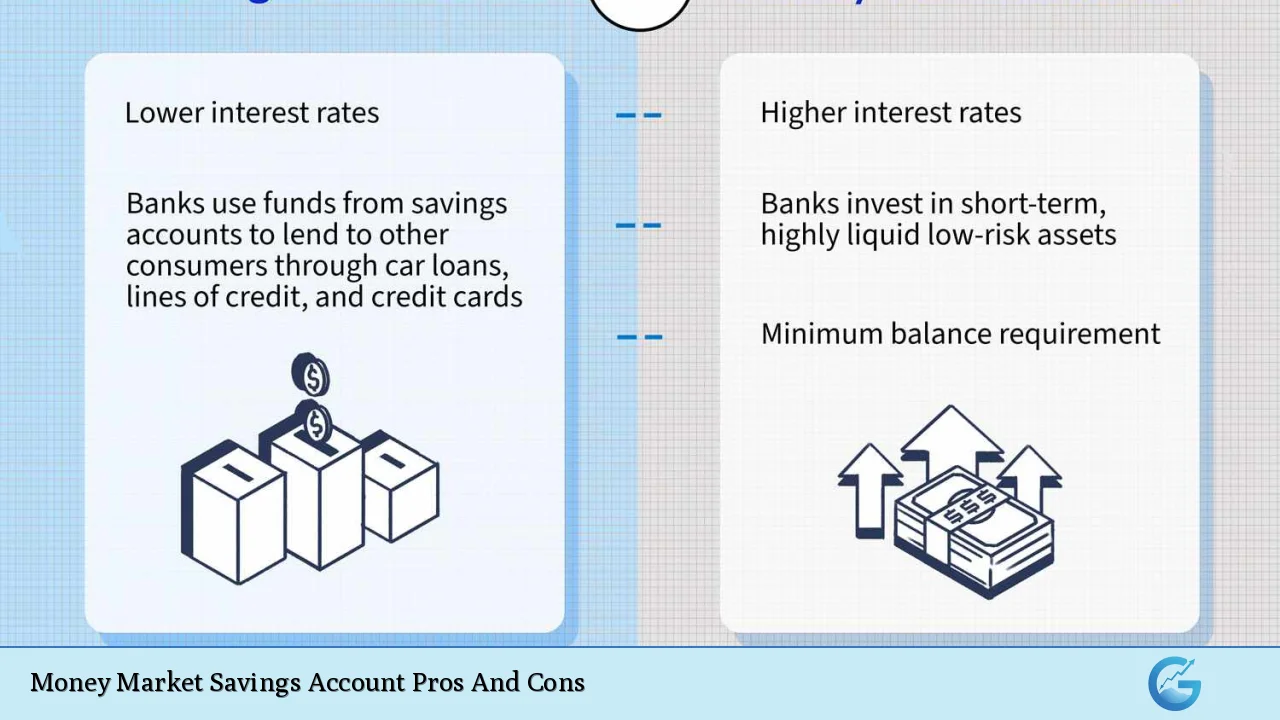

Money Market Savings Accounts (MMSAs) are a popular choice for individuals looking to save money while earning interest. They combine features of both savings and checking accounts, providing a unique blend of benefits that can appeal to various financial needs. With the potential for higher interest rates than traditional savings accounts and the flexibility to access funds, these accounts have gained traction among consumers. However, like any financial product, they come with their own set of advantages and disadvantages that potential investors should consider carefully.

| Pros | Cons |

|---|---|

| Higher interest rates compared to regular savings accounts | May require a higher minimum balance |

| FDIC insurance protection up to $250,000 | Limited number of monthly transactions |

| Easy access to funds through checks and debit cards | Potential monthly maintenance fees |

| Flexibility in deposits and withdrawals | Interest rates may vary and can be lower than other investment options |

| Combines features of checking and savings accounts | Not ideal for frequent transactions or bill payments |

Higher Interest Rates Compared to Regular Savings Accounts

One of the most significant advantages of Money Market Savings Accounts is the potential for higher interest rates.

- Competitive APYs: Many MMSAs offer annual percentage yields (APYs) that are significantly higher than those found in traditional savings accounts. This can help your savings grow faster over time.

- Variable Rates: While rates can fluctuate, they often remain competitive, especially when compared to standard savings options.

- Promotional Offers: Some banks may provide promotional rates for new customers or for maintaining higher balances, further enhancing the appeal of these accounts.

FDIC Insurance Protection Up to $250,000

Another critical benefit of MMSAs is the security they offer.

- Federal Insurance: Funds in Money Market Accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per institution. This provides peace of mind knowing that your money is protected against bank failures.

- Credit Union Coverage: If held at a credit union, similar protections are provided by the National Credit Union Administration (NCUA), ensuring that your deposits are safe.

Easy Access to Funds Through Checks and Debit Cards

MMSAs offer greater accessibility compared to traditional savings accounts.

- Withdrawal Methods: Account holders typically have access to their funds via checks, debit cards, and electronic transfers. This flexibility allows for easier management of finances.

- Convenient Transactions: Many institutions allow online banking features, enabling customers to monitor their accounts and perform transactions from anywhere.

Flexibility in Deposits and Withdrawals

MMSAs provide a level of flexibility that can be beneficial for savers.

- Unlimited Deposits: You can make deposits at any time without restrictions, allowing you to grow your savings as needed.

- Withdrawal Limitations: Although there may be limits on withdrawals (often up to six per month), the ability to access funds relatively easily remains a strong point of these accounts.

Combines Features of Checking and Savings Accounts

MMSAs serve as a hybrid between checking and savings accounts.

- Check-Writing Privileges: Many Money Market Accounts allow account holders to write checks, which is not typically permitted with standard savings accounts.

- Debit Card Access: The inclusion of debit cards makes it easy to use funds directly from the account without needing to transfer money first.

May Require a Higher Minimum Balance

Despite their advantages, MMSAs often come with higher minimum balance requirements than traditional savings accounts.

- Initial Deposit Requirements: To open an account, banks may require a substantial initial deposit, which could be a barrier for some savers.

- Ongoing Balance Maintenance: To avoid monthly fees or earn higher interest rates, account holders may need to maintain a specific balance. This could limit access to funds if not managed carefully.

Limited Number of Monthly Transactions

While MMSAs offer some transaction capabilities, they are not as flexible as checking accounts regarding withdrawals.

- Transaction Limits: Federal regulations previously limited certain types of withdrawals from money market accounts; while this restriction has been lifted, many financial institutions still impose their limits on how many transactions can occur each month.

- Not Ideal for Frequent Use: For individuals who need regular access to funds or frequently pay bills, an MMA might not be the best option due to these limitations.

Potential Monthly Maintenance Fees

Many banks impose fees on Money Market Accounts that can diminish overall returns.

- Monthly Fees: Some institutions charge monthly maintenance fees unless specific balance thresholds are met. These fees can erode interest earnings over time if not avoided.

- Fee Structures Vary: It’s essential for consumers to understand each bank’s fee structure before opening an account since policies differ widely among institutions.

Interest Rates May Vary and Can Be Lower Than Other Investment Options

While MMSAs offer competitive rates compared to traditional savings options, they may not always match other investment vehicles.

- Rate Fluctuations: Interest rates on MMAs can change based on economic conditions or bank policies. This variability means that what starts as a competitive rate may decrease over time.

- Comparative Returns: For those seeking higher returns on investments, alternatives such as stocks or mutual funds may provide better growth potential than what is typically available through MMAs.

Not Ideal for Frequent Transactions or Bill Payments

Due to their structure and limitations, MMSAs are not designed for everyday transactional use like checking accounts.

- Transaction Restrictions: With limits on how many transactions can occur each month, using an MMA for regular bill payments may not be practical.

- Better Alternatives Available: For individuals who need frequent access to cash or wish to manage regular payments easily, traditional checking accounts might be more suitable than MMAs.

In conclusion, Money Market Savings Accounts present a mix of attractive features and potential drawbacks. They can serve as an excellent tool for those looking to earn higher interest while maintaining some liquidity with their cash. However, understanding the associated costs and limitations is crucial before deciding if an MMA is the right choice for your financial strategy.

Frequently Asked Questions About Money Market Savings Accounts

- What is a Money Market Savings Account?

A Money Market Savings Account is a type of deposit account that typically offers higher interest rates than standard savings accounts while allowing limited check-writing privileges. - Are Money Market Accounts FDIC insured?

Yes, funds in Money Market Accounts are insured by the FDIC up to $250,000 per depositor per institution. - What are the typical fees associated with Money Market Accounts?

Fees may include monthly maintenance charges if balance requirements are not met and fees for exceeding transaction limits. - Can I write checks from my Money Market Account?

Yes, many Money Market Accounts allow check-writing privileges similar to checking accounts. - How many transactions can I make from my Money Market Account each month?

While federal restrictions have been lifted on transaction limits, many banks still impose their limits—often around six withdrawals or transfers per month. - Is there a minimum balance requirement for these accounts?

Most Money Market Accounts require maintaining a minimum balance either to avoid fees or earn higher interest rates. - Can I use my Money Market Account like a checking account?

No; while you can access funds through checks and debit cards, MMAs are generally not suitable for frequent transactions like bill payments. - What should I consider before opening a Money Market Account?

You should evaluate factors such as minimum balance requirements, potential fees, interest rates offered by different banks, and your intended use of the account.

This comprehensive overview highlights both the strengths and weaknesses associated with Money Market Savings Accounts. By weighing these factors carefully against personal financial goals and needs, individuals can make informed decisions about whether this type of account aligns with their investment strategies.