In the complex world of mortgage financing, potential homebuyers often face a critical decision: whether to work with a mortgage broker or go directly through a bank. Each option presents unique advantages and disadvantages that can significantly impact the mortgage process, loan terms, and ultimately, the financial health of the borrower. This article will explore the pros and cons of using a mortgage broker versus a bank, providing insights to help you make an informed decision tailored to your financial situation.

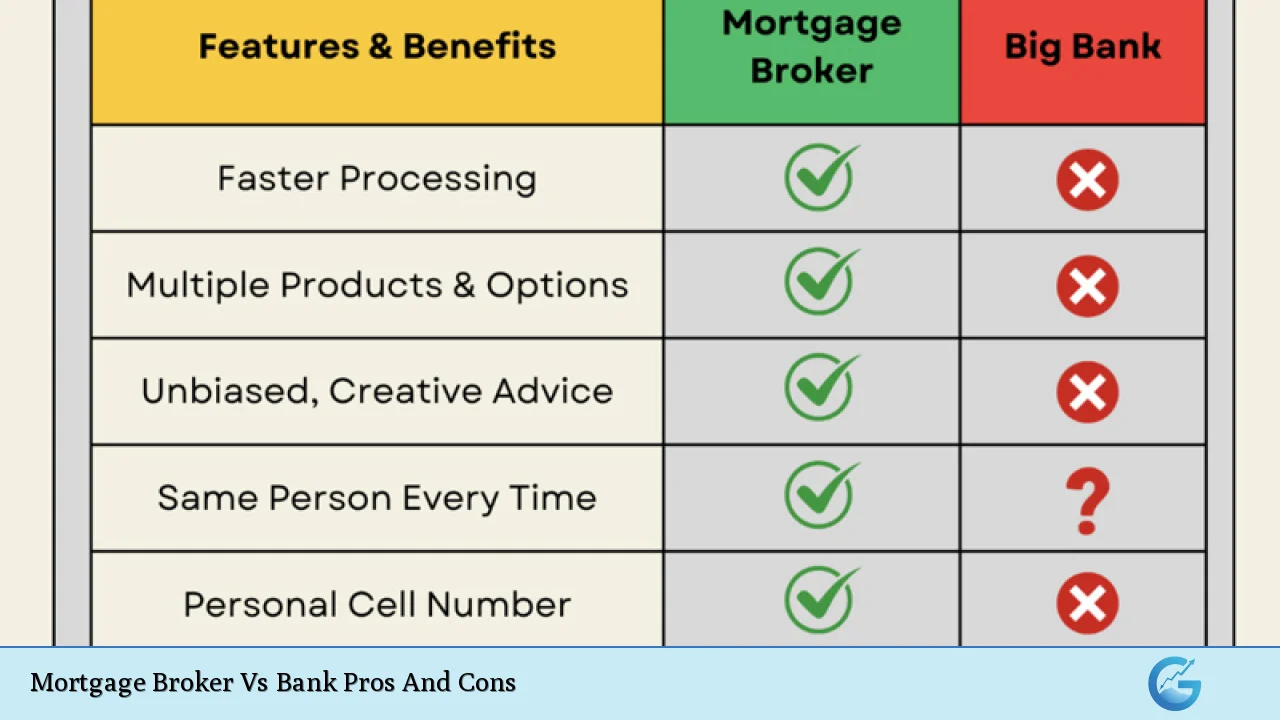

| Pros | Cons |

|---|---|

| Access to multiple lenders and products | Potential fees for broker services |

| Personalized advice tailored to individual needs | Longer process due to intermediary involvement |

| Expertise in navigating complex financial situations | Variability in broker experience and qualifications |

| Time-saving through streamlined processes | Possible bias towards lenders offering higher commissions |

| Ability to negotiate better rates and terms | Less control over the application process |

| Support in understanding mortgage jargon and documentation | Not all brokers have equal access to lenders or products |

| No upfront costs as brokers are typically paid by lenders | Limited product range from banks may not suit all borrowers |

| Can assist with refinancing and future mortgage needs | Potentially less personalized service from bank loan officers |

Access to Multiple Lenders and Products

One of the most significant advantages of using a mortgage broker is their ability to connect you with a wide array of lenders. Brokers have access to numerous financial institutions, which allows them to present various loan products that may suit your specific needs.

- Broader Options: Mortgage brokers can shop around for the best rates and terms from multiple lenders.

- Specialized Products: They may have access to niche products not available through traditional banks, which can be especially beneficial for unique financial situations.

However, banks typically offer only their own mortgage products, which can limit your options.

Personalized Advice Tailored to Individual Needs

Mortgage brokers excel in providing personalized service. They assess your financial situation comprehensively and guide you toward suitable mortgage options based on your circumstances.

- Tailored Solutions: Brokers can offer customized advice that aligns with your long-term financial goals.

- Expert Guidance: They help navigate complex scenarios, such as self-employment or poor credit histories.

In contrast, bank loan officers often work within a more rigid framework, focusing solely on their institution’s offerings.

Expertise in Navigating Complex Financial Situations

For borrowers with unique circumstances—such as those who are self-employed or have non-traditional income sources—mortgage brokers can provide invaluable assistance.

- Understanding Nuances: Brokers are familiar with various lenders’ criteria and can help position your application favorably.

- Problem-Solving Skills: They can identify potential issues in your application before submission, saving time and effort.

Banks may lack the flexibility needed to accommodate such situations effectively.

Time-Saving Through Streamlined Processes

The mortgage application process can be lengthy and convoluted. Mortgage brokers often streamline this process by handling much of the legwork involved.

- Efficiency: Brokers manage paperwork and communication with lenders, reducing the burden on you.

- Faster Approvals: Their expertise can expedite approvals compared to navigating the process alone or through a bank.

However, involving a broker may add an extra layer of complexity, potentially elongating the timeline if not managed well.

Ability to Negotiate Better Rates and Terms

Brokers leverage their relationships with multiple lenders to negotiate favorable terms on your behalf.

- Competitive Rates: They often secure lower interest rates or reduced fees than you might obtain directly from a bank.

- Better Terms: Brokers can negotiate aspects like loan duration or repayment schedules based on your needs.

Conversely, banks may not offer as much flexibility in negotiations since they adhere strictly to their policies.

Support in Understanding Mortgage Jargon and Documentation

The mortgage process is laden with industry-specific terminology that can be daunting for first-time buyers. A mortgage broker acts as an educator throughout this journey.

- Clarification of Terms: They explain complex concepts in simple language, ensuring you understand every aspect of your loan.

- Documentation Assistance: Brokers help gather necessary documents and ensure everything is in order before submission.

While bank representatives can also provide explanations, they may not offer the same level of personalized support.

No Upfront Costs as Brokers Are Typically Paid by Lenders

A significant advantage of working with a mortgage broker is that their services are often free for borrowers. Brokers are typically compensated by lenders upon closing the loan.

- Cost-Effective: You receive expert assistance without incurring direct costs.

- Value Addition: The potential savings from better rates often outweigh any indirect costs associated with using a broker.

In contrast, banks might charge fees for certain services or require upfront payments for processing applications.

Potential Fees for Broker Services

Despite many brokers not charging upfront fees, some may impose charges depending on their payment structure or the complexity of your situation.

- Transparency Issues: It’s crucial to understand how a broker is compensated before engaging their services.

- Hidden Costs: Some brokers might favor lenders who pay higher commissions, potentially impacting their impartiality.

Banks generally have more transparent fee structures but may still impose costs that could affect your overall borrowing expenses.

Longer Process Due to Intermediary Involvement

While brokers can save time by managing many aspects of the application process, involving an intermediary can also introduce delays.

- Additional Steps: Communication between you, the broker, and various lenders may slow down decision-making.

- Complexity: If not managed well, this could lead to misunderstandings or miscommunications that extend timelines unnecessarily.

Directly working with a bank might streamline certain processes but could limit options available to you as a borrower.

Variability in Broker Experience and Qualifications

Not all mortgage brokers are created equal; their experience levels and qualifications can vary significantly.

- Due Diligence Required: It’s essential to research potential brokers thoroughly before making a choice.

- Impact on Outcomes: An inexperienced broker could lead to unfavorable loan terms or missed opportunities for better deals.

Conversely, bank loan officers typically undergo standardized training within their institutions but may lack exposure to diverse lending options available through brokers.

Possible Bias Towards Lenders Offering Higher Commissions

While many brokers aim to find the best deal for their clients, there is always the risk of bias based on commission structures.

- Commission Influence: Some brokers might prioritize loans from lenders who offer higher commissions over those that best suit your needs.

- Transparency Matters: Always inquire about how your broker is compensated before proceeding with any agreements.

Banks do not operate under this commission structure but may still prioritize certain products over others based on internal policies.

Less Control Over the Application Process

When working with a broker, you relinquish some control over how your application is handled.

- Intermediary Dynamics: You depend on the broker’s efficiency and effectiveness in managing communications with lenders.

- Potential Delays: If issues arise during processing, it may take longer to resolve them compared to dealing directly with a bank representative who has immediate access to decision-makers.

However, many borrowers appreciate this support system as it alleviates some stress associated with navigating complex mortgage processes alone.

Limited Product Range from Banks May Not Suit All Borrowers

While banks offer straightforward processes and familiarity for existing customers, they often provide fewer product options than brokers.

- Narrow Focus: Banks typically only present their own products which might not align well with every borrower’s needs.

- Less Competitive Rates: The limited competition within one institution could result in higher costs over time compared to what a broker could secure through multiple lenders.

Mortgage brokers excel at providing diverse options tailored specifically for each borrower’s unique circumstances.

Potentially Less Personalized Service from Bank Loan Officers

Bank loan officers may handle numerous clients simultaneously due to their institutional roles.

- Standardized Approach: This could lead to less personalized service compared to what dedicated mortgage brokers provide.

- Limited Time for Clients: Officers might not have sufficient time to address all questions thoroughly or provide detailed guidance throughout the process.

In contrast, brokers often prioritize customer service due to their reliance on referrals and client satisfaction for business growth.

In conclusion, choosing between a mortgage broker and a bank involves weighing several factors based on personal circumstances. If you seek personalized service tailored specifically for unique financial situations or access to diverse lending options, working with a mortgage broker may be advantageous. Conversely, if you prefer straightforward processes backed by established relationships or already have favorable terms with your bank, going directly through them could be more beneficial. Ultimately, understanding these pros and cons will empower you in making an informed decision that aligns with your financial goals.

Frequently Asked Questions About Mortgage Broker Vs Bank Pros And Cons

- What is the primary difference between a mortgage broker and a bank?

A mortgage broker connects borrowers with various lenders offering different products while banks only provide loans from their own offerings. - Are there any fees associated with using a mortgage broker?

Some brokers charge fees depending on their payment structure; however, many are compensated by lenders upon closing. - Can I get better rates using a mortgage broker?

Brokers often secure competitive rates by comparing offers from multiple lenders rather than being limited to one institution. - Is it faster to get a mortgage through a bank?

Banks may offer quicker processing times due to direct communication; however, brokers streamline applications across multiple lenders. - Do banks provide personalized service?

Banks tend towards standardized service due to handling numerous clients; brokers typically offer more tailored support. - Can I negotiate better terms through a broker?

Brokers have negotiation power across various lenders which may lead to better interest rates or terms than those offered directly by banks. - What should I consider when choosing between them?

Your choice should depend on personal circumstances such as credit history complexity level preference for personalized guidance versus straightforward processes. - How do I find a reliable mortgage broker?

Research potential brokers’ credentials reviews ask about their lender access experience before making decisions.