Mortgage insurance in case of death, often referred to as mortgage life insurance, is a specialized type of insurance designed to pay off a borrower’s mortgage in the event of their death. This financial product is particularly relevant for homeowners who want to ensure that their loved ones can retain their home without the burden of mortgage payments after their passing. While it offers certain benefits, it also comes with significant drawbacks. This article explores the advantages and disadvantages of mortgage insurance in case of death, providing a comprehensive overview for those considering this option.

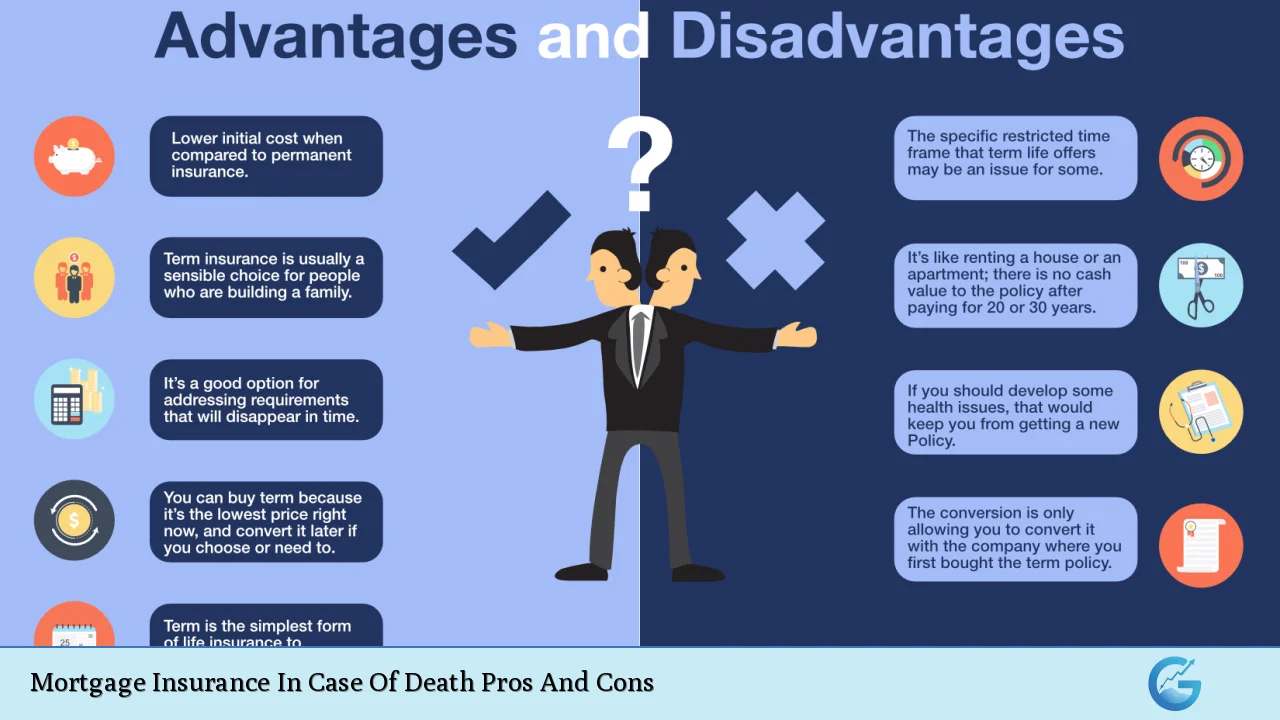

| Pros | Cons |

|---|---|

| Provides financial security for dependents by paying off the mortgage. | The death benefit goes directly to the lender, not to beneficiaries. |

| No medical exam required for approval. | Premiums can be high relative to coverage received. |

| Peace of mind knowing that homeownership is protected. | Coverage decreases as the mortgage balance decreases. |

| Can help maintain family stability during a difficult time. | Limited use of funds; cannot cover other debts or expenses. |

| Guaranteed acceptance regardless of health status. | Policy may expire if the mortgage is paid off before death. |

Provides Financial Security for Dependents by Paying Off the Mortgage

One of the primary advantages of mortgage insurance in case of death is its ability to provide financial security for dependents.

- Home Retention: The policy ensures that, in the event of the borrower’s death, the outstanding mortgage balance will be paid off, allowing family members to retain ownership of their home without worrying about monthly payments.

- Stability During Grief: This financial cushion can help families maintain stability during a challenging emotional period, allowing them to focus on grieving rather than financial distress.

The Death Benefit Goes Directly to the Lender, Not to Beneficiaries

A significant downside of mortgage insurance is that its death benefit is paid directly to the lender.

- No Financial Flexibility: Unlike traditional life insurance policies where beneficiaries receive funds that can be used at their discretion, mortgage insurance limits the payout strictly to settling the mortgage debt.

- Potential Burden on Family: This structure may leave surviving family members without additional funds needed for other expenses such as funeral costs or daily living expenses.

No Medical Exam Required for Approval

Mortgage insurance typically offers guaranteed acceptance without requiring a medical examination.

- Accessibility: This feature makes it an attractive option for individuals with pre-existing health conditions who might struggle to qualify for traditional life insurance.

- Simplicity: The straightforward application process can be appealing for those seeking quick coverage without extensive underwriting requirements.

Premiums Can Be High Relative to Coverage Received

While mortgage insurance provides essential coverage, its cost can be a drawback.

- Higher Costs: Premiums may be significantly higher compared to traditional life insurance policies offering similar coverage amounts. This is particularly true since many policies do not require medical exams, which can lead to increased risk for insurers.

- Value Consideration: Homeowners must weigh whether the cost justifies the limited benefit, especially if they could obtain more comprehensive coverage through other means.

Peace of Mind Knowing That Homeownership Is Protected

Mortgage insurance offers peace of mind by ensuring that one’s home remains secure even in unforeseen circumstances.

- Emotional Security: Knowing that your loved ones will not face losing their home due to unpaid mortgage debts can alleviate stress and anxiety about future uncertainties.

- Long-Term Planning: Homeowners can feel more confident in their long-term financial planning when they have this safety net in place.

Coverage Decreases as the Mortgage Balance Decreases

As borrowers make payments on their mortgages, the amount owed decreases, which affects the coverage provided by mortgage insurance.

- Decreasing Benefits: Many policies are structured as decreasing term insurance, meaning that while premiums remain constant, the payout amount diminishes over time alongside the mortgage balance.

- Potential Insufficiency: This arrangement could lead to scenarios where the remaining coverage is inadequate compared to other financial obligations or unexpected expenses that arise after death.

Can Help Maintain Family Stability During a Difficult Time

Mortgage insurance serves as a stabilizing force during times of loss.

- Home Stability: By ensuring that the mortgage is paid off, families can continue living in their home without facing immediate financial upheaval, allowing them time to adjust and plan their next steps.

- Support During Transition: This financial support can also assist families in transitioning through grief without the added pressure of housing instability.

Limited Use of Funds; Cannot Cover Other Debts or Expenses

The restrictive nature of mortgage insurance payouts poses challenges for beneficiaries.

- Narrow Application: Since funds are earmarked solely for paying off the mortgage, families may find themselves struggling with other debts or expenses that arise after a loved one’s passing.

- Financial Strain: This limitation can create additional stress if survivors need funds for funeral costs or other living expenses that are not covered by this policy.

Guaranteed Acceptance Regardless of Health Status

The guarantee of acceptance is a notable feature of mortgage insurance policies.

- Inclusivity: Individuals who may have been denied traditional life insurance due to health issues can still secure coverage through mortgage insurance, making it an essential option for many homeowners.

- Peace of Mind: This assurance allows individuals to protect their family’s future without worrying about health-related disqualifications.

Policy May Expire If the Mortgage Is Paid Off Before Death

Another critical disadvantage is that these policies are tied directly to the duration and amount of the mortgage itself.

- Loss of Coverage: If borrowers pay off their mortgage early or refinance without maintaining their policy, they may lose out on potential benefits they have been paying premiums for over time.

- No Return on Investment: Unlike traditional life insurance where beneficiaries receive a payout regardless of when death occurs during coverage, mortgage insurance may provide no return if the borrower outlives their policy’s usefulness.

In conclusion, while mortgage insurance in case of death provides essential benefits such as securing homeownership and offering peace of mind during difficult times, it also presents significant drawbacks like limited payout flexibility and potentially high costs. Homeowners must carefully consider these factors when deciding whether this type of insurance aligns with their long-term financial goals and family needs.

Frequently Asked Questions About Mortgage Insurance In Case Of Death

- What happens if I die before my mortgage is paid off?

Mortgage insurance will pay off your remaining balance directly to your lender, ensuring your family retains ownership of your home. - Can I use mortgage insurance payouts for anything other than my mortgage?

No, payouts from mortgage insurance are strictly allocated to pay off your outstanding mortgage balance and cannot be used for other expenses. - Is there a medical exam required for mortgage insurance?

No, most mortgage insurance policies offer guaranteed acceptance without requiring a medical exam. - What are some alternatives to mortgage insurance?

Alternatives include traditional life insurance policies which provide more flexibility with payouts and potentially lower premiums. - Does my premium change over time?

The premium typically remains constant; however, the death benefit decreases as you pay down your mortgage balance. - If I refinance my home, do I need new mortgage insurance?

Yes, if you change lenders or refinance your loan, you will likely need to obtain new coverage as existing policies do not transfer automatically. - Can I cancel my mortgage insurance policy?

Yes, you can cancel your policy at any time; however, consider whether you have alternative coverage in place before doing so. - Is it worth getting mortgage protection insurance?

This depends on individual circumstances; evaluate your financial situation and consider whether this type of coverage meets your specific needs compared to other options available.

This comprehensive examination should aid homeowners in making informed decisions regarding whether or not they should invest in mortgage insurance in case of death.