Mortgage loan modification is a process that allows homeowners to change the terms of their existing mortgage to make payments more manageable. This can include altering the interest rate, extending the repayment period, or even reducing the principal balance. For many homeowners facing financial difficulties, loan modification can be a lifeline that helps avoid foreclosure. However, it is essential to weigh the pros and cons before proceeding with this option.

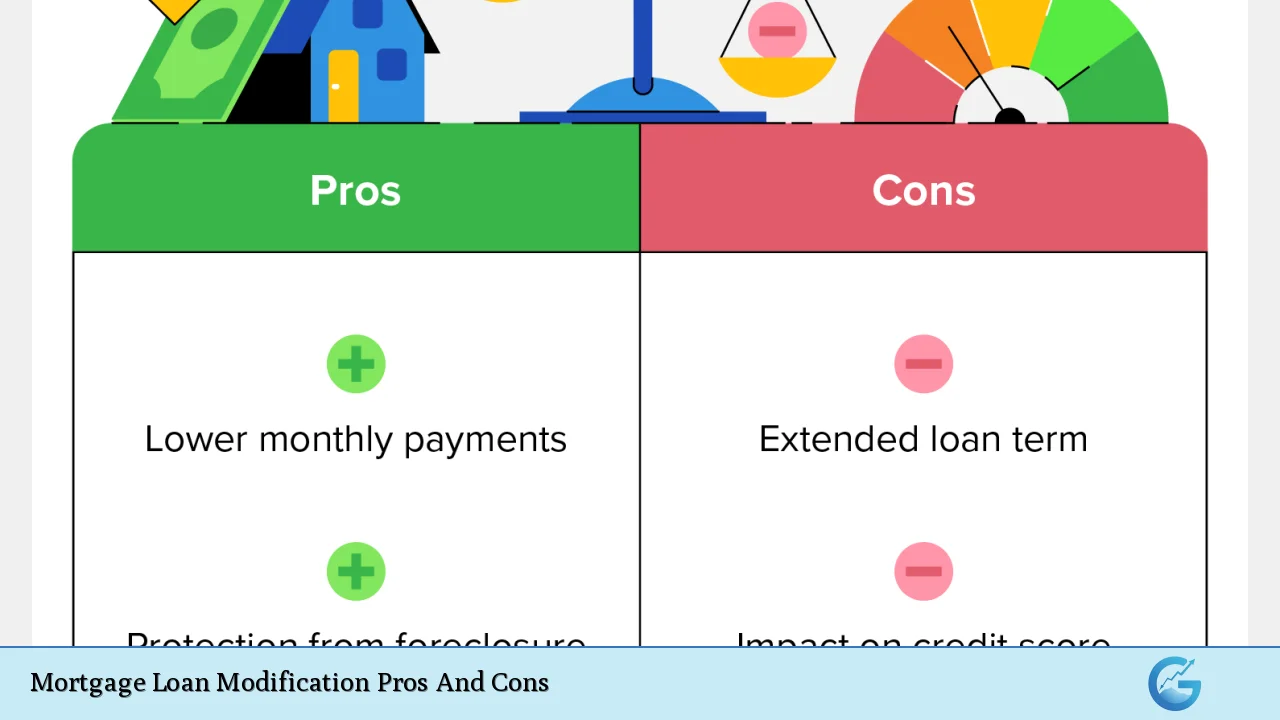

| Pros | Cons |

|---|---|

| Lower monthly payments | Potential negative impact on credit score |

| Avoid foreclosure | Must demonstrate financial hardship |

| No closing costs involved | Lengthened loan term may lead to more interest paid |

| Faster process compared to refinancing | Negotiation process can be cumbersome and lengthy |

| Possibility of principal forbearance | Not all lenders offer modifications, and terms vary widely |

Lower Monthly Payments

One of the most significant advantages of a mortgage loan modification is the potential for lower monthly payments.

- Interest Rate Reduction: Lenders may agree to lower your interest rate, which directly decreases your monthly payment.

- Extended Loan Term: By extending the repayment period, you can spread out your payments over a longer time frame, making each payment smaller and more manageable.

- Principal Reduction: In some cases, lenders may forgive a portion of the principal balance, further reducing monthly obligations.

This financial relief can be crucial for homeowners struggling to meet their current payment schedules.

Avoid Foreclosure

Another critical benefit of loan modification is its ability to help homeowners avoid foreclosure.

- Immediate Relief: Modifying your mortgage can provide immediate relief from financial stress and prevent the loss of your home due to missed payments.

- Long-Term Security: By securing new terms that are more affordable, homeowners can stabilize their financial situation and maintain ownership of their property.

This aspect is particularly important in times of economic downturn or personal hardship, where maintaining homeownership can significantly impact overall well-being.

No Closing Costs Involved

Unlike refinancing, which often comes with substantial closing costs, mortgage loan modifications typically do not incur these additional fees.

- Cost-Effective Solution: This makes modifications a more cost-effective solution for homeowners who are already facing financial difficulties.

- Preservation of Equity: By avoiding closing costs, borrowers can preserve more equity in their homes, which is especially beneficial if property values rise in the future.

This feature makes loan modifications an attractive option for those looking to adjust their mortgage terms without incurring further debt.

Faster Process Compared to Refinancing

The modification process is generally quicker than refinancing because it involves adjusting existing terms rather than applying for a new loan.

- Streamlined Approval: Homeowners may find that lenders are more willing to negotiate terms when they are already familiar with the borrower’s history.

- Less Documentation Required: While some documentation is still necessary, it is often less extensive than what is required for refinancing applications.

This speed can be crucial for those in imminent danger of foreclosure who need immediate assistance.

Possibility of Principal Forbearance

Some lenders may offer principal forbearance as part of a loan modification agreement.

- Temporary Relief on Principal Payments: This means that part of the principal may be deferred or forgiven temporarily, allowing homeowners to focus on making lower monthly payments without the burden of full principal repayment.

- Improved Cash Flow: This arrangement can significantly improve cash flow during tough financial times, providing much-needed breathing room.

However, it’s important to understand that this option may not be available with all lenders or all types of loans.

Potential Negative Impact on Credit Score

While a loan modification can provide relief, it may also negatively affect your credit score.

- Reporting Practices Vary: Depending on how lenders report modifications to credit bureaus, there could be a decrease in your credit score if you have missed payments leading up to the modification request.

- Long-Term Effects: Although less severe than foreclosure or bankruptcy, any negative mark on your credit report can impact future borrowing ability and interest rates for years to come.

Homeowners should consider this potential drawback when deciding whether to pursue a modification.

Must Demonstrate Financial Hardship

To qualify for a mortgage loan modification, borrowers must typically demonstrate financial hardship.

- Documentation Requirements: This often involves providing detailed documentation regarding income loss or increased expenses due to circumstances like job loss or medical emergencies.

- Limited Access for Some Borrowers: Homeowners who do not have verifiable hardship may find it challenging to secure a modification, leaving them with fewer options during difficult times.

This requirement can create barriers for some individuals seeking relief from their mortgage obligations.

Lengthened Loan Term May Lead to More Interest Paid

While extending the loan term can lower monthly payments, it may also result in paying more interest over time.

- Increased Total Cost: A longer repayment period means that while individual payments are lower, the total amount paid over the life of the loan could increase significantly due to accumulated interest.

- Longer Debt Obligation: Homeowners may find themselves in debt for many additional years compared to their original mortgage terms, which can be daunting and financially burdensome in the long run.

Understanding this trade-off is essential when considering a loan modification as a solution to financial difficulties.

Negotiation Process Can Be Cumbersome and Lengthy

The process of negotiating a loan modification can be time-consuming and complex.

- Lender Discretion: Not all lenders are willing or able to modify loans. Each lender has different policies and procedures that may complicate negotiations.

- Trial Periods Required: Many modifications require borrowers to undergo trial periods where they must make modified payments before permanent changes are implemented. This process can add additional stress and uncertainty during an already challenging time.

Patience and persistence are crucial as homeowners navigate this potentially frustrating process with their lenders.

Not All Lenders Offer Modifications; Terms Vary Widely

Finally, it’s essential to recognize that not all lenders provide mortgage modifications or offer them under similar terms.

- Limited Options: Homeowners with certain types of loans (e.g., private loans) may find fewer options available compared to those with government-backed loans (e.g., FHA or VA loans).

- Variability in Terms: The specific terms offered during a modification process can vary widely from lender to lender. Some might offer favorable conditions while others might impose stricter requirements or less favorable terms.

This inconsistency necessitates careful research and consideration before pursuing a modification agreement with any lender.

In conclusion, mortgage loan modifications present both significant advantages and notable disadvantages. They provide an opportunity for struggling homeowners to adjust their mortgage terms in ways that can alleviate financial pressure and help avoid foreclosure. However, potential impacts on credit scores, extended debt obligations, and variability in lender policies must be carefully considered.

For individuals facing financial hardships related to their mortgages, understanding these pros and cons is essential in making informed decisions about their housing future.

Frequently Asked Questions About Mortgage Loan Modification

- What is a mortgage loan modification?

A mortgage loan modification is a permanent change made to one or more terms of an existing mortgage agreement aimed at making payments more manageable. - How does a loan modification differ from refinancing?

A loan modification changes the existing mortgage terms without creating a new loan; refinancing replaces an old mortgage with a new one. - Who qualifies for a mortgage loan modification?

Typically, borrowers who demonstrate financial hardship and have missed payments or are at risk of missing payments qualify for modifications. - Will my credit score be affected by a loan modification?

Yes, modifying your mortgage might negatively impact your credit score depending on how lenders report missed payments prior to the modification. - Are there any costs associated with obtaining a loan modification?

No closing costs are typically involved; however, some lenders might charge fees related to processing the modification. - How long does it take to get approved for a loan modification?

The approval process can take anywhere from one month up to six months depending on lender procedures and requirements. - Can I still refinance after getting my mortgage modified?

Yes, but some lenders require you to wait several months after receiving a modification before you can refinance. - What happens if my application for modification is denied?

If denied, you may appeal within 14 days or explore other options such as deferment programs or seeking assistance from housing counselors.