Mortgages are a cornerstone of the modern financial system, enabling individuals to purchase homes without needing the full purchase price upfront. While they offer numerous benefits, mortgages also come with significant responsibilities and risks. This article explores the advantages and disadvantages of mortgages to help you make an informed decision about whether this financial tool aligns with your goals.

| Pros | Cons |

|---|---|

| Access to homeownership | Long-term financial commitment |

| Building equity | Risk of foreclosure |

| Potential tax benefits | Interest costs over time |

| Lower monthly costs compared to renting | Fluctuating property values (risk of negative equity) |

| Credit score improvement through responsible payments | Lack of liquidity and flexibility |

| Diverse loan options for different needs | Complexity in understanding terms and conditions |

Advantages of Mortgages

Access to Homeownership

- Mortgages make it possible for individuals to buy homes without saving the entire purchase price upfront.

- They allow people to spread payments over decades, making homeownership more accessible.

- Owning a home provides stability and freedom compared to renting.

Building Equity

- As you repay your mortgage, you build equity in your home, which can increase your net worth.

- Equity can serve as a financial resource through tools like home equity loans or lines of credit.

- Over time, owning a property outright can provide long-term financial security.

Potential Tax Benefits

- In the U.S., mortgage interest payments on loans up to $750,000 may be tax-deductible.

- Property taxes may also be deductible, depending on your filing status and local laws.

- These benefits can reduce the overall cost of borrowing.

Lower Monthly Costs Compared to Renting

- In many markets, monthly mortgage payments are lower than rent for comparable properties.

- Fixed-rate mortgages provide stability by locking in payments for the loan term.

Credit Score Improvement

- Successfully managing a mortgage demonstrates financial responsibility.

- Regular on-time payments can improve your credit score, opening doors to better loan terms.

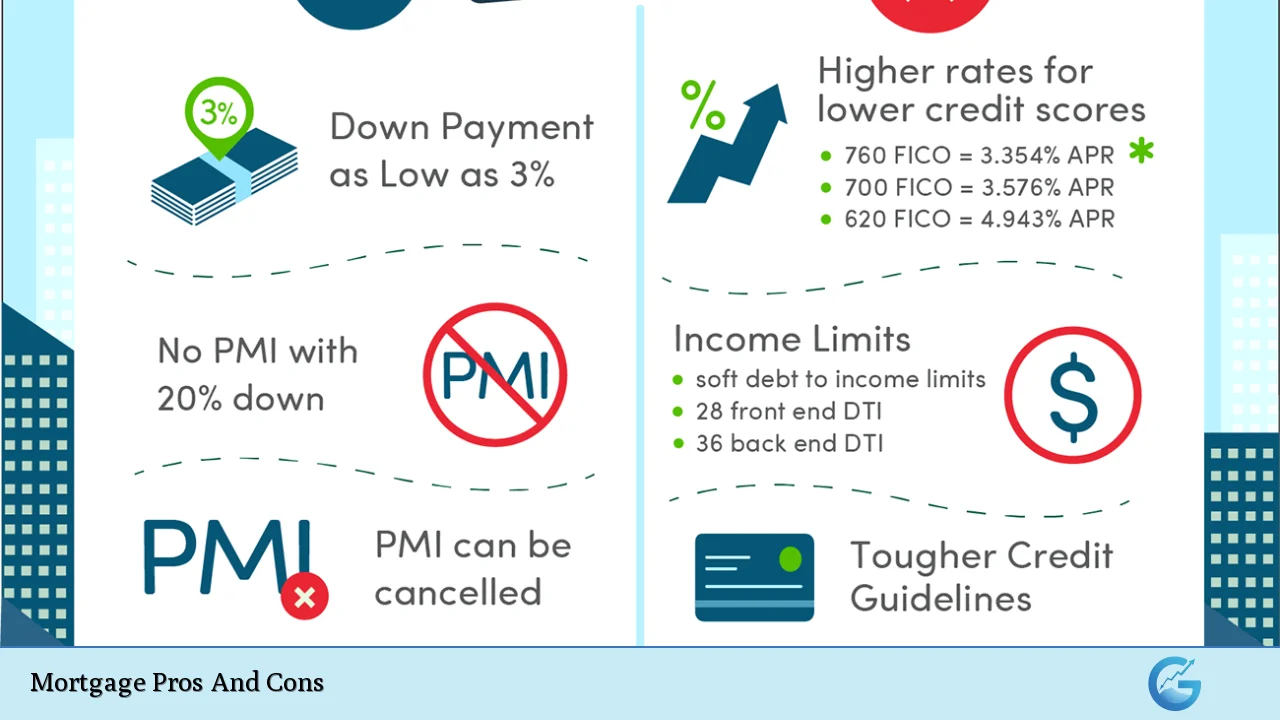

Diverse Loan Options

- Mortgages come in various forms, including fixed-rate, adjustable-rate, and government-backed loans.

- Borrowers can choose terms that align with their financial goals and risk tolerance.

Disadvantages of Mortgages

Long-Term Financial Commitment

- Mortgages typically last 15 to 30 years, tying up a significant portion of income.

- This long-term obligation limits financial flexibility.

Risk of Foreclosure

- Failure to make payments can lead to foreclosure, resulting in the loss of your home.

- Foreclosure damages credit scores and creates long-term financial challenges.

Interest Costs Over Time

- Even with low interest rates, the total cost of borrowing over decades can be substantial.

- For example, a $300,000 mortgage at 4% interest over 30 years results in nearly $215,000 in interest payments.

Fluctuating Property Values

- Real estate markets are unpredictable; property values may decline, leading to negative equity.

- Negative equity occurs when the outstanding loan exceeds the home’s market value.

Lack of Liquidity and Flexibility

- Home equity is not easily accessible without selling or taking out additional loans.

- Selling a mortgaged property involves settling the remaining balance, which can complicate transactions.

Complexity in Terms and Conditions

- Understanding mortgage terms requires careful attention to details like interest rates, fees, and penalties.

- Borrowers must navigate complex processes involving appraisals, inspections, and legal documentation.

Frequently Asked Questions About [keyword]

- What is a mortgage?

A mortgage is a loan used to purchase real estate. The borrower agrees to repay the lender over time with interest. - How does building equity work?

Equity increases as you pay down your mortgage principal or if your property’s value appreciates. - Are all mortgages tax-deductible?

No. Tax deductions depend on factors like loan size and whether you itemize deductions. - What happens if I miss payments?

Missed payments can lead to late fees, credit score damage, or foreclosure. - Is renting better than buying?

This depends on factors like your financial situation, market conditions, and long-term goals. - Can I refinance my mortgage?

Yes. Refinancing allows you to adjust terms or rates but involves additional costs. - What is negative equity?

Negative equity occurs when your home’s market value is less than the remaining mortgage balance. - How do I choose the right mortgage?

Consider factors like interest rates, loan terms, fees, and your financial stability when selecting a mortgage.

Conclusion

Mortgages are powerful tools for achieving homeownership but come with significant responsibilities. Understanding both their benefits and drawbacks is essential for making informed decisions. By carefully evaluating your financial situation and long-term goals, you can determine whether a mortgage aligns with your needs. Always consult with professionals for personalized advice tailored to your circumstances.