The Michigan State Housing Development Authority (MSHDA) offers a variety of loan programs designed to assist residents in achieving homeownership, particularly targeting low- to moderate-income individuals and families. MSHDA loans primarily provide down payment assistance, making it easier for first-time homebuyers to afford homes in Michigan. These programs are crucial in addressing the financial barriers that many face when trying to enter the housing market. However, like any financial product, MSHDA loans come with their own set of advantages and disadvantages that potential borrowers should carefully consider.

| Pros | Cons |

|---|---|

| Provides up to $10,000 in down payment assistance | Assistance must be repaid upon sale or refinancing of the home |

| 0% interest on down payment assistance | Eligibility requirements can be strict, including income limits and credit scores |

| Can be combined with various loan types (FHA, VA, USDA) | Limited to homes priced under $224,500 statewide |

| Helps bridge the financial gap for homebuyers | Requires completion of a homebuyer education course |

| Statewide availability enhances accessibility | May involve additional paperwork and processing time |

| Lower monthly mortgage payments due to competitive interest rates | Down payment assistance is considered a second mortgage lien on the property |

| Encourages stability in Michigan’s housing market | Potential for limited options in high-demand areas due to price caps |

Provides Up to $10,000 in Down Payment Assistance

One of the most significant advantages of MSHDA loans is the provision of up to $10,000 in down payment assistance. This financial support is critical for first-time homebuyers who often struggle to accumulate enough savings for a down payment. By reducing the upfront costs associated with purchasing a home, MSHDA loans enable more individuals and families to enter the housing market.

- Financial relief: The assistance can cover down payments and closing costs.

- Accessibility: This program is available statewide, ensuring that many Michiganders can benefit.

0% Interest on Down Payment Assistance

The down payment assistance provided by MSHDA comes with a 0% interest rate. This means that while borrowers must repay the amount received, they do not incur any interest charges during the repayment period.

- Cost-effective: Borrowers save money compared to traditional loans with interest.

- Deferred repayment: Payments are only required when the home is sold or refinanced.

Can Be Combined with Various Loan Types

MSHDA loans offer flexibility as they can be combined with other loan types such as FHA, VA, or USDA loans. This allows borrowers to take advantage of different benefits associated with each loan type while still receiving MSHDA’s financial assistance.

- Broader options: Borrowers can choose the loan type that best fits their financial situation.

- Enhanced affordability: Combining loans can lead to lower overall mortgage payments.

Helps Bridge the Financial Gap for Homebuyers

By providing financial assistance for down payments and closing costs, MSHDA loans help bridge the gap between what buyers can afford and what is needed to purchase a home. This support is especially vital in a competitive housing market where prices are rising.

- Increased purchasing power: Buyers can afford homes they might not have been able to purchase otherwise.

- Encouragement for first-time buyers: More individuals are likely to consider homeownership.

Statewide Availability Enhances Accessibility

MSHDA’s programs are available throughout Michigan, making them accessible to a wide range of potential homebuyers. This statewide reach ensures that residents in both urban and rural areas can benefit from these financial resources.

- Equitable access: Residents across different regions have equal opportunities for assistance.

- Community growth: Increased homeownership can lead to stronger communities.

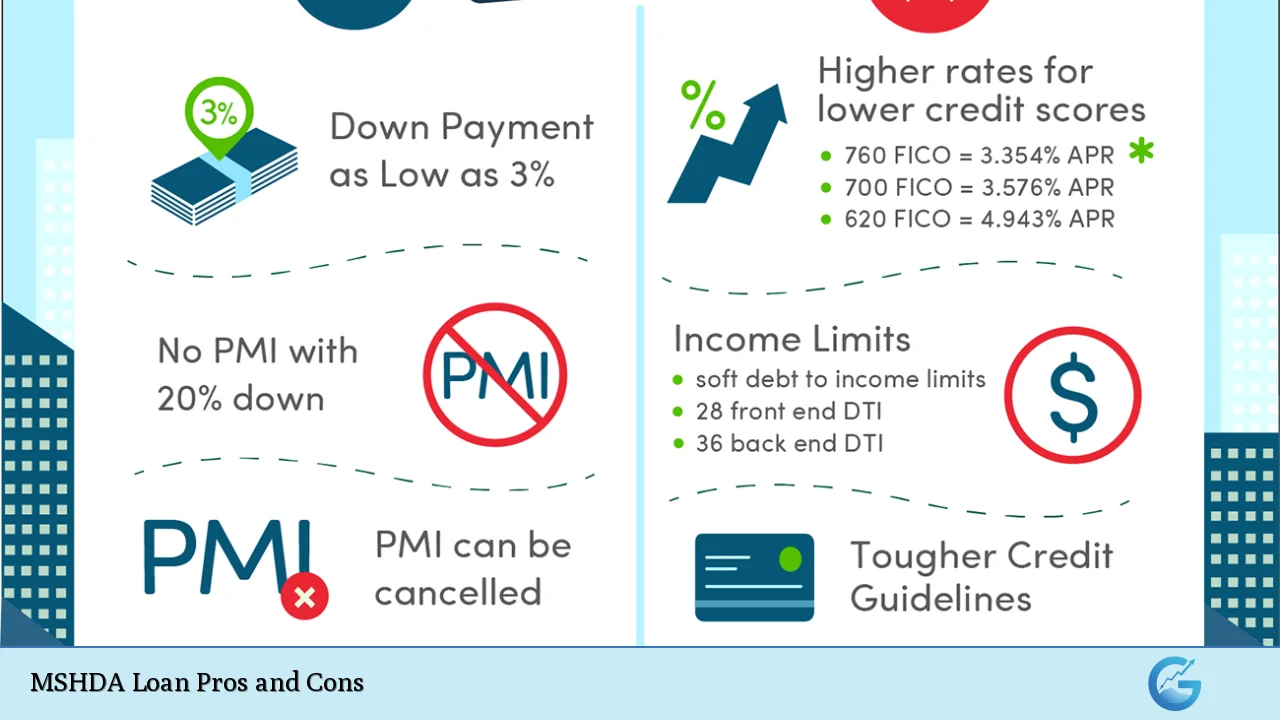

Lower Monthly Mortgage Payments Due to Competitive Interest Rates

MSHDA loans typically offer competitive interest rates compared to conventional mortgages. Lower interest rates mean lower monthly payments, making it easier for borrowers to manage their finances.

- Affordability: Lower payments contribute to overall financial stability.

- Long-term savings: Over time, reduced interest rates can lead to significant savings.

Assistance Must Be Repaid Upon Sale or Refinancing of the Home

While MSHDA loans provide valuable financial support, one of their primary disadvantages is that the assistance must be repaid when the homeowner sells or refinances their property. This requirement can create challenges for some borrowers who may not have anticipated this obligation.

- Financial planning necessary: Homeowners need to plan for future repayments.

- Potential burden during resale: If property values do not appreciate as expected, repaying the assistance could be challenging.

Eligibility Requirements Can Be Strict

To qualify for MSHDA loans, applicants must meet specific eligibility criteria, including income limits and minimum credit scores. These requirements can sometimes exclude potential borrowers who would otherwise benefit from the program.

- Income restrictions: Income limits vary based on family size and location.

- Credit score requirements: A minimum score (usually around 640) is necessary for approval.

Limited to Homes Priced Under $224,500 Statewide

Another drawback of MSHDA loans is that they are limited to homes priced under $224,500 statewide. In high-demand areas where housing prices exceed this cap, potential buyers may find themselves unable to utilize MSHDA assistance effectively.

- Market limitations: Buyers may need to compromise on location or property features.

- Potential exclusion from desirable neighborhoods: Some areas may simply be out of reach financially.

Requires Completion of a Homebuyer Education Course

Borrowers are required to complete a homebuyer education course as part of the application process for MSHDA loans. While this requirement is designed to equip buyers with essential knowledge about homeownership, it may also add an extra step in securing financing.

- Educational benefits: The course provides valuable information about budgeting and maintaining a home.

- Time commitment: Completing the course may delay the buying process for some individuals.

May Involve Additional Paperwork and Processing Time

Applying for an MSHDA loan typically involves more paperwork than conventional mortgage applications. The additional documentation required can lead to longer processing times, which may frustrate some buyers eager to close on their new homes quickly.

- Increased complexity: The application process may feel overwhelming for some.

- Delays in closing: Extended processing times could hinder timely transactions.

Down Payment Assistance Is Considered a Second Mortgage Lien on the Property

The down payment assistance provided by MSHDA is classified as a second mortgage lien on the property. This classification means that it will be recorded against the property title, which could complicate future refinancing or selling efforts.

- Impact on equity: Homeowners must consider how this lien affects their overall equity position.

- Repayment obligations upon selling or refinancing: Future transactions could become more complex due to this lien.

Potential for Limited Options in High-Demand Areas Due to Price Caps

In regions where housing demand is high and prices are rising rapidly, potential buyers may find themselves limited by the price cap imposed by MSHDA loans. This limitation could restrict access to desirable neighborhoods or properties that meet their needs.

- Market dynamics: Buyers may need to adjust expectations regarding location or property type.

- Increased competition among buyers: Limited options could drive up competition in lower-priced markets.

In conclusion, while MSHDA loans provide significant advantages such as down payment assistance and competitive interest rates aimed at facilitating homeownership in Michigan, they also come with disadvantages that prospective borrowers must weigh carefully. Understanding both sides will enable individuals considering these loans to make informed decisions about their financial futures.

Frequently Asked Questions About MSHDA Loans

- What types of properties qualify for MSHDA loans?

MSHDA loans can be used for various properties including single-family homes, condos, and certain manufactured homes built after June 14, 1976. - Are there income limits for obtaining an MSHDA loan?

Yes, income limits apply based on family size and location; these limits vary throughout Michigan. - How long do I have before I need to repay my down payment assistance?

The repayment of down payment assistance is required when you sell your home or refinance your mortgage. - Is there any interest charged on the down payment assistance?

No, there is no interest charged on the down payment assistance; it is offered at 0% interest. - Do I need a minimum credit score?

A minimum credit score of 640 is typically required; however, some programs may require higher scores. - Can I use MSHDA loans if I am not a first-time buyer?

You can use MSHDA loans if you have not owned a home in the past three years or if you are purchasing in a targeted area. - What happens if I sell my house before paying back my down payment assistance?

If you sell your house before repaying your down payment assistance, you will need to repay it from the proceeds of your sale. - How do I apply for an MSHDA loan?

You apply through an approved lender who participates in MSHDA’s programs; you will also need supporting documentation.