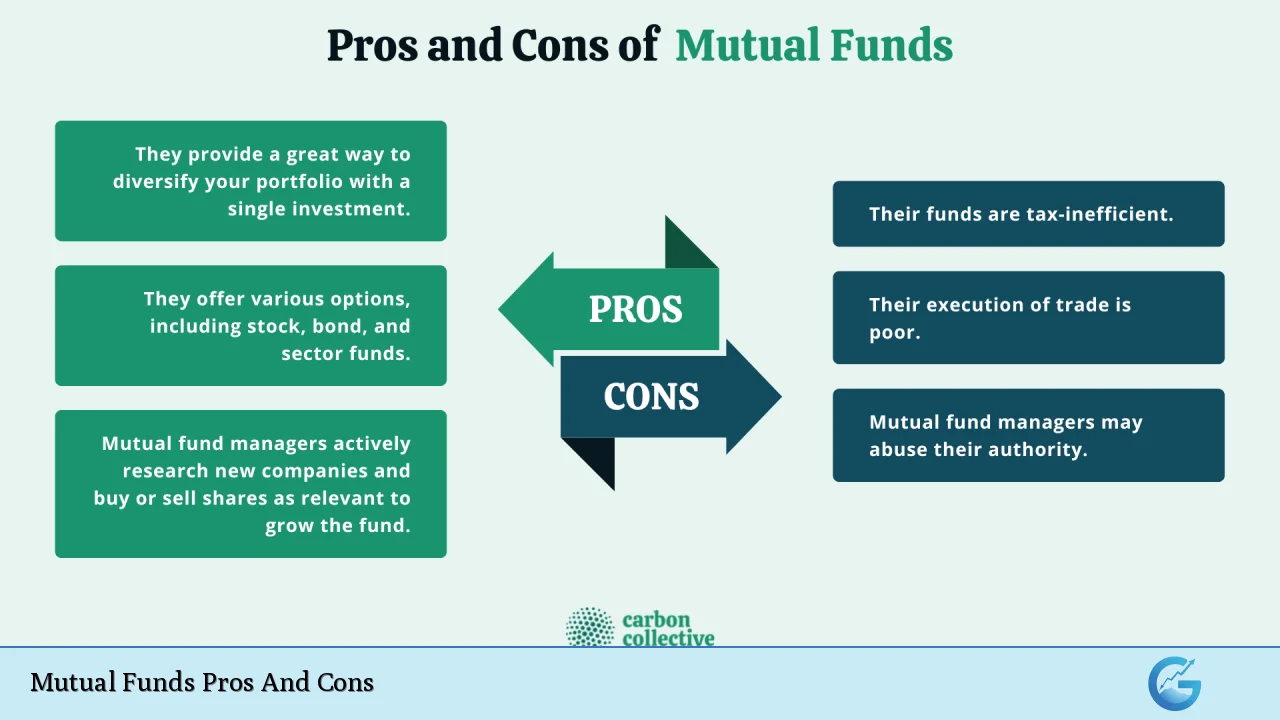

Mutual funds have become a cornerstone of modern investing, offering a way for individuals to access diversified portfolios managed by professionals. These investment vehicles pool money from multiple investors to purchase a variety of securities, including stocks, bonds, and other assets. As with any investment strategy, mutual funds come with their own set of advantages and disadvantages that investors should carefully consider before allocating their capital.

| Pros | Cons |

|---|---|

| Professional Management | Management Fees and Expenses |

| Diversification | Lack of Control |

| Liquidity | Potential for Underperformance |

| Accessibility | Tax Inefficiency |

| Economies of Scale | Over-diversification Risk |

| Regulatory Oversight | Cash Drag |

| Reinvestment Options | Style Drift |

| Variety of Investment Strategies | Complexity in Selection |

Advantages of Mutual Funds

Professional Management

One of the primary benefits of mutual funds is access to professional money management.

Fund managers and their teams dedicate their time and expertise to researching, selecting, and monitoring investments. This is particularly valuable for investors who lack the time, knowledge, or inclination to manage their own portfolios actively.

- Experienced professionals make investment decisions

- Continuous market analysis and portfolio adjustments

- Access to sophisticated research tools and resources

For instance, a large-cap equity fund manager might employ a team of analysts to conduct in-depth research on Fortune 500 companies, using financial models and industry expertise that individual investors typically cannot replicate.

Diversification

Mutual funds offer instant diversification, which is crucial for risk management. By investing in a broad range of securities, mutual funds can help mitigate the impact of poor performance in any single investment.

- Spread risk across multiple securities and sectors

- Potential to invest across different asset classes

- Geographic diversification, including international markets

A balanced fund, for example, might hold a mix of domestic and international stocks, government and corporate bonds, and even a small allocation to commodities or real estate investment trusts (REITs).

Liquidity

Most mutual funds offer high liquidity, allowing investors to buy or sell shares on any business day at the current net asset value (NAV).

This is particularly advantageous compared to less liquid investments like real estate or certain types of bonds.

- Easy to buy and sell shares

- Daily pricing and trading

- Ability to quickly adjust investment strategy

However, it’s important to note that some specialty funds, such as those investing in illiquid assets, may have restrictions on redemptions.

Accessibility

Mutual funds make it possible for investors with limited capital to access diversified portfolios. Many funds have low minimum investment requirements, sometimes as little as $100 or less for automatic investment plans.

- Low initial investment requirements

- Fractional share ownership

- Automatic investment plans available

This accessibility allows even small investors to participate in markets and investment strategies that might otherwise be out of reach.

Economies of Scale

By pooling resources from many investors, mutual funds can achieve economies of scale, potentially reducing transaction costs and providing access to investments that might be prohibitively expensive for individual investors.

- Lower trading costs due to bulk transactions

- Access to institutional share classes with lower fees

- Ability to negotiate better terms with service providers

For example, a large mutual fund might be able to purchase bonds in million-dollar lots, often at better prices than smaller investors could obtain.

Regulatory Oversight

Mutual funds are subject to strict regulatory oversight, providing a level of investor protection.

In the United States, the Securities and Exchange Commission (SEC) regulates mutual funds, requiring regular reporting and adherence to specific operating standards.

- Mandatory disclosure of fund holdings and performance

- Regular audits and compliance checks

- Standardized reporting of fees and expenses

This regulatory framework helps ensure transparency and can provide investors with confidence in the integrity of their investments.

Reinvestment Options

Many mutual funds offer automatic dividend reinvestment programs, allowing investors to compound their returns over time without manual intervention.

- Automatic reinvestment of dividends and capital gains

- Dollar-cost averaging through regular investments

- Potential for long-term wealth accumulation

This feature can be particularly beneficial for long-term investors looking to grow their wealth over extended periods.

Variety of Investment Strategies

The mutual fund industry offers a wide array of investment strategies to suit different investor goals, risk tolerances, and market outlooks.

- Equity funds (growth, value, income, sector-specific)

- Bond funds (government, corporate, high-yield)

- Balanced and target-date funds

- Specialty funds (real estate, commodities, alternatives)

This variety allows investors to construct portfolios tailored to their specific needs and market views.

Disadvantages of Mutual Funds

Management Fees and Expenses

One of the most significant drawbacks of mutual funds is the cost associated with professional management and fund operations.

These fees can eat into returns, especially in low-yield environments.

- Annual expense ratios can range from 0.1% to over 2%

- Potential sales loads (front-end or back-end fees)

- Transaction costs within the fund

For example, an actively managed equity fund with an expense ratio of 1.5% would need to outperform its benchmark by at least that amount just to break even with a low-cost index fund.

Lack of Control

When investing in mutual funds, investors cede control over specific investment decisions to the fund manager. This can be frustrating for those who want more say in their portfolio composition.

- No ability to select individual securities

- Limited control over the timing of buy and sell decisions

- Potential for holdings that conflict with personal values or preferences

An investor in a broad market index fund, for instance, might find themselves indirectly invested in companies or industries they would prefer to avoid.

Potential for Underperformance

Despite professional management, many actively managed mutual funds fail to outperform their benchmark indices over extended periods.

This underperformance can be due to various factors, including high fees, poor investment decisions, or simply the difficulty of consistently beating the market.

- Historical data shows many active funds underperform

- Manager skill is difficult to predict or sustain

- Market efficiency makes outperformance challenging

According to S&P Dow Jones Indices, over the 15-year period ending December 2020, 75% of large-cap active funds underperformed the S&P 500 index.

Tax Inefficiency

Mutual funds can be less tax-efficient than other investment vehicles, particularly for investors in taxable accounts. This is due to the structure of mutual funds and how they distribute capital gains.

- Mandatory distribution of capital gains

- Limited control over the timing of taxable events

- Potential tax liability even in years of negative performance

For instance, a fund might be forced to sell long-held positions to meet redemptions, triggering capital gains distributions that are taxable to all shareholders, even those who have recently invested.

Over-diversification Risk

While diversification is generally beneficial, there is a point at which additional diversification provides diminishing returns and may even hinder performance.

- Potential dilution of high-conviction investments

- Difficulty in significantly outperforming broad market indices

- Increased complexity in understanding fund holdings

A fund holding hundreds of stocks, for example, may find it challenging to meaningfully outperform the market, as its performance will likely closely mirror that of the overall market.

Cash Drag

Mutual funds typically maintain a cash position to meet redemption requests and take advantage of investment opportunities. However, this cash allocation can act as a drag on performance during rising markets.

- Cash holdings may underperform in bull markets

- Difficulty in staying fully invested

- Potential for missed opportunities

A fund with a 5% cash position, for instance, would lag a fully invested portfolio by 0.5% in a year when the market rises 10%, all else being equal.

Style Drift

Over time, some mutual funds may deviate from their stated investment objectives or style, a phenomenon known as style drift. This can occur due to changes in market conditions, manager preferences, or attempts to boost short-term performance.

- Potential misalignment with investor expectations

- Difficulty in maintaining consistent asset allocation

- Risk of unintended portfolio overlap

For example, a small-cap fund manager might start investing in larger companies as the fund’s assets grow, potentially altering the risk-return profile that investors initially sought.

Complexity in Selection

The sheer number of mutual funds available can make the selection process overwhelming for many investors.

With thousands of funds to choose from, identifying the most suitable options requires significant research and due diligence.

- Difficulty in comparing funds across different categories

- Potential for analysis paralysis

- Risk of choosing funds based on past performance alone

The proliferation of niche and specialty funds further complicates the selection process, as investors must evaluate not only fund performance but also the underlying investment thesis and market outlook.

In conclusion, mutual funds offer a range of benefits that make them attractive to many investors, including professional management, diversification, and accessibility. However, they also come with potential drawbacks such as fees, lack of control, and tax inefficiencies. Investors should carefully weigh these pros and cons in the context of their financial goals, risk tolerance, and overall investment strategy. By understanding both the advantages and disadvantages of mutual funds, investors can make more informed decisions about whether and how to incorporate these investment vehicles into their portfolios.

Frequently Asked Questions About Mutual Funds Pros And Cons

- Are mutual funds suitable for beginner investors?

Yes, mutual funds can be excellent for beginners due to their professional management and diversification. They offer an easy way to start investing with relatively small amounts of money. - How do mutual fund fees impact returns?

Fees directly reduce returns. For example, if a fund earns 7% but charges a 1% fee, the net return to investors is 6%. Over time, even small differences in fees can significantly impact long-term performance. - Can mutual funds protect against market downturns?

While diversification in mutual funds can help mitigate some risk, they cannot completely protect against market downturns. Certain types of funds, like balanced or bond funds, may offer more stability during market volatility. - How often can I buy or sell mutual fund shares?

Most mutual funds allow daily transactions. However, some funds may have restrictions or fees for frequent trading to discourage short-term speculation. - Are index funds better than actively managed mutual funds?

It depends on individual goals and market conditions. Index funds generally have lower fees and have often outperformed many active funds over long periods. However, some active funds may outperform in certain market conditions or sectors. - How are mutual funds taxed?

In taxable accounts, investors pay taxes on distributions of dividends and capital gains. In tax-advantaged accounts like IRAs, taxes are deferred or eliminated, depending on the account type. - Can I lose all my money in a mutual fund?

While it’s extremely rare to lose all your money in a mutual fund due to diversification, you can lose a significant portion if the market or the fund’s strategy performs poorly. Always consider your risk tolerance when investing. - How do I choose the right mutual fund for my portfolio?

Consider your investment goals, risk tolerance, time horizon, and the fund’s performance history, fees, and investment strategy. It’s often helpful to consult with a financial advisor for personalized guidance.