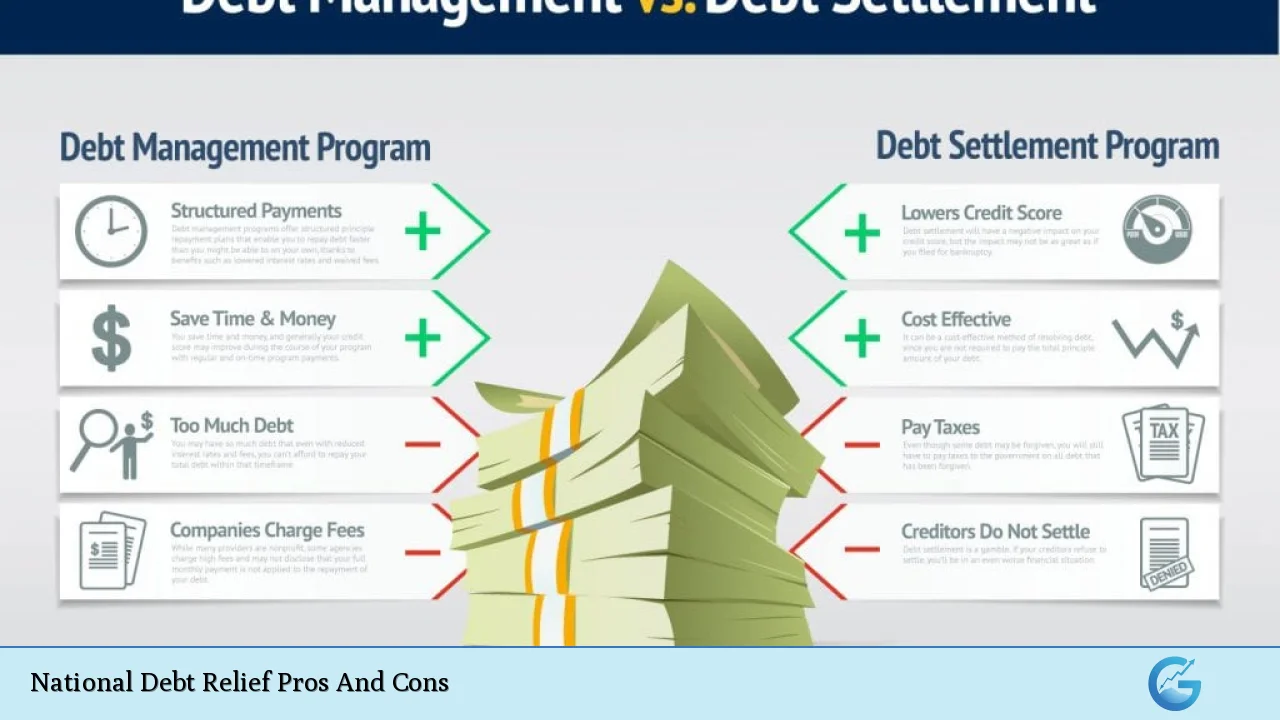

National Debt Relief is a prominent debt settlement company that offers services to help individuals struggling with overwhelming unsecured debt. As with any financial decision, it’s crucial to weigh the advantages and disadvantages before committing to a debt relief program. This comprehensive analysis will explore the pros and cons of National Debt Relief, providing valuable insights for those considering this option to manage their financial obligations.

| Pros | Cons |

|---|---|

| Potential for significant debt reduction | Negative impact on credit score |

| Single monthly payment | High fees (up to 25% of enrolled debt) |

| No upfront fees | Not all debts are eligible |

| Professional negotiation with creditors | Risk of creditor lawsuits |

| Faster debt resolution than minimum payments | Potential tax implications on forgiven debt |

| Avoid bankruptcy | No guarantee of successful settlements |

| Free initial consultation | Long program duration (24-48 months) |

| A+ BBB rating and accreditations | Not available in all states |

Advantages of National Debt Relief

Potential for Significant Debt Reduction

National Debt Relief claims to help clients reduce their debt by up to 50% of the original amount owed. This substantial reduction can provide much-needed financial relief for individuals struggling with high-interest credit card debt or other unsecured loans. The company’s experienced negotiators work directly with creditors to secure lower payoff amounts, potentially saving clients thousands of dollars.

- Possibility of settling debts for less than the full amount owed

- Skilled negotiators with established relationships with creditors

- Potential for substantial savings compared to paying off debts in full

Single Monthly Payment

One of the most appealing aspects of National Debt Relief’s program is the simplification of debt repayment through a single monthly deposit. This approach can help clients better manage their finances by:

- Consolidating multiple debt payments into one

- Reducing the stress of juggling various due dates and creditors

- Potentially lowering the overall monthly payment amount

No Upfront Fees

National Debt Relief adheres to the Federal Trade Commission’s Telemarketing Sales Rule, which prohibits debt relief companies from charging upfront fees. This policy ensures that:

- Clients only pay fees after debts are successfully settled

- There’s no financial risk to enroll in the program

- The company is incentivized to achieve positive results for clients

Professional Negotiation with Creditors

National Debt Relief employs experienced debt arbitrators who are accredited through the International Association of Professional Debt Arbitrators (IAPDA). This expertise can be invaluable when dealing with creditors, as these professionals:

- Understand the intricacies of debt negotiation

- Have established relationships with many creditors

- Can often secure better settlements than individuals negotiating on their own

Faster Debt Resolution Than Minimum Payments

For many individuals struggling with high-interest debt, making minimum payments can lead to a debt cycle that lasts for years or even decades. National Debt Relief’s program aims to resolve debts more quickly:

- Typical program duration of 24-48 months

- Potential to become debt-free in a fraction of the time compared to minimum payments

- Opportunity to start rebuilding credit sooner

Avoid Bankruptcy

Debt settlement through National Debt Relief can serve as an alternative to bankruptcy for many individuals. While both options have negative impacts on credit, debt settlement generally:

- Has a less severe and shorter-lasting impact on credit scores

- Allows for more control over which debts are settled

- Doesn’t require court involvement or public records

Free Initial Consultation

National Debt Relief offers a no-obligation, free consultation to potential clients. This service provides:

- An opportunity to discuss financial situations without commitment

- Professional advice on whether debt settlement is appropriate

- Exploration of alternative debt relief options if settlement isn’t suitable

A+ BBB Rating and Accreditations

National Debt Relief’s A+ rating with the Better Business Bureau and various accreditations lend credibility to their services. These credentials indicate:

- A track record of resolving customer complaints

- Adherence to industry best practices

- Commitment to ethical business conduct

Disadvantages of National Debt Relief

Negative Impact on Credit Score

Enrolling in a debt settlement program with National Debt Relief will likely cause a significant drop in your credit score. This occurs because:

- Clients are advised to stop making payments to creditors

- Accounts become delinquent and may be charged off

- Settled debts are reported on credit reports for seven years

High Fees

While National Debt Relief doesn’t charge upfront fees, their services come at a cost:

- Fees typically range from 15% to 25% of the enrolled debt

- Additional costs may include monthly maintenance fees

- The total cost can significantly reduce the overall savings from debt settlement

Not All Debts Are Eligible

National Debt Relief’s program is limited to certain types of unsecured debt:

- Credit cards, personal loans, and medical bills are typically eligible

- Secured debts like mortgages and auto loans are not included

- Some types of federal student loans may not qualify

Risk of Creditor Lawsuits

When clients stop making payments as part of the debt settlement process, there’s a risk that creditors may pursue legal action. This can lead to:

- Potential lawsuits from creditors seeking payment

- Additional stress and potential legal fees

- Complications in the debt settlement process

Potential Tax Implications on Forgiven Debt

The IRS generally considers forgiven debt as taxable income. This means:

- Clients may owe taxes on the amount of debt that is forgiven

- The tax burden could be substantial, depending on the amount settled

- Additional financial planning may be necessary to account for potential tax liabilities

No Guarantee of Successful Settlements

While National Debt Relief has a track record of successful negotiations, there’s no guarantee that all debts will be settled. This uncertainty means:

- Some creditors may refuse to negotiate or settle

- The process may take longer than anticipated

- Clients may end up with less savings than initially projected

Long Program Duration

The debt settlement process through National Debt Relief typically takes 24-48 months to complete. This extended timeline:

- Requires long-term commitment from clients

- May prolong the negative impact on credit scores

- Could delay other financial goals or plans

Not Available in All States

National Debt Relief’s services are not available nationwide. Residents of certain states, including:

- Oregon

- Vermont

- West Virginia

- Wisconsin

are unable to enroll in the program, limiting its accessibility to some individuals who might benefit from debt settlement services.

In conclusion, National Debt Relief offers a potential solution for individuals struggling with significant unsecured debt. While the program can provide substantial debt reduction and a path to financial recovery, it comes with serious considerations, including credit score impact and high fees. Potential clients should carefully weigh these pros and cons, consider alternative debt relief options, and possibly consult with a financial advisor before committing to a debt settlement program.

Frequently Asked Questions About National Debt Relief Pros And Cons

- How much can I expect to save with National Debt Relief?

National Debt Relief claims potential savings of up to 50% of enrolled debt before fees. However, actual savings vary based on individual circumstances and successful negotiations with creditors. - Will using National Debt Relief affect my credit score?

Yes, enrolling in National Debt Relief’s program will likely cause a significant drop in your credit score. This is due to the cessation of payments to creditors and the reporting of settled debts. - How long does the National Debt Relief program typically take?

The program usually takes between 24 to 48 months to complete. The duration depends on factors such as the amount of debt enrolled and how quickly you can save for settlements. - Are there any upfront fees with National Debt Relief?

No, National Debt Relief does not charge upfront fees. Their fees are only collected after a debt has been successfully settled with a creditor. - What types of debt can be enrolled in National Debt Relief’s program?

National Debt Relief primarily works with unsecured debts such as credit cards, personal loans, and medical bills. Secured debts like mortgages and auto loans are not eligible. - Is there a minimum debt amount required to enroll with National Debt Relief?

Yes, National Debt Relief typically requires a minimum of $7,500 in qualifying unsecured debt to enroll in their program. - Can National Debt Relief guarantee that all my debts will be settled?

No, National Debt Relief cannot guarantee that all debts will be successfully settled. Outcomes depend on negotiations with individual creditors and other factors. - Are there tax consequences to settling debt through National Debt Relief?

Potentially, yes. The IRS generally considers forgiven debt as taxable income. Clients may need to report the forgiven amount on their tax returns and could owe taxes on it.