NerdWallet is a popular personal finance platform that provides users with tools and resources to make informed financial decisions. Founded in 2009, it has grown to become a leading source for comparing financial products, managing personal finances, and obtaining financial advice. With a user-friendly interface and a wealth of information, NerdWallet caters to a diverse audience interested in finance, including investors in crypto, forex, and money markets. However, like any service, it has its strengths and weaknesses. This article will explore the pros and cons of using NerdWallet in detail.

| Pros | Cons |

|---|---|

| Comprehensive financial product comparisons | Potential bias due to affiliate marketing |

| Free credit score monitoring | Limited budgeting features |

| User-friendly interface | Inconsistent account balance updates |

| Extensive educational resources | No direct customer support via phone |

| Personalized financial recommendations | Ads may overwhelm some users |

| Free net worth and cash flow tracking tools | Premium features may incur costs |

| Access to expert advice through forums | Quality of advice can vary significantly |

| Mobile app for on-the-go management | Limited functionality compared to the website |

Comprehensive Financial Product Comparisons

NerdWallet excels in providing detailed comparisons of various financial products such as credit cards, loans, insurance policies, and investment accounts.

- Wide Range of Options: Users can filter results based on their specific needs, such as rewards programs or interest rates.

- User Reviews: The platform includes user-generated reviews that provide insights into real-world experiences with different products.

- Educational Content: Each product comparison is often accompanied by articles explaining the benefits and drawbacks of each option.

This extensive comparison capability helps users make informed decisions tailored to their financial situations.

Potential Bias Due to Affiliate Marketing

While NerdWallet offers valuable comparisons and information, it is important to recognize that the platform generates revenue through affiliate marketing.

- Sponsored Listings: Some products may be highlighted more prominently because they offer higher commissions to NerdWallet.

- Transparency Issues: Users might question the objectivity of the recommendations if they are not aware of the affiliate relationships.

- Consumer Caution: It is advisable for users to cross-reference recommendations with other sources to ensure they are getting unbiased information.

Free Credit Score Monitoring

One of the standout features of NerdWallet is its free credit score monitoring service.

- Real-Time Updates: Users can check their credit scores regularly without incurring any fees.

- Credit Report Insights: The platform offers insights into factors affecting credit scores, helping users understand how to improve them.

- Alerts for Changes: Users receive alerts for significant changes in their credit reports, which can help prevent identity theft.

This feature is particularly beneficial for individuals looking to improve their credit health without incurring additional costs.

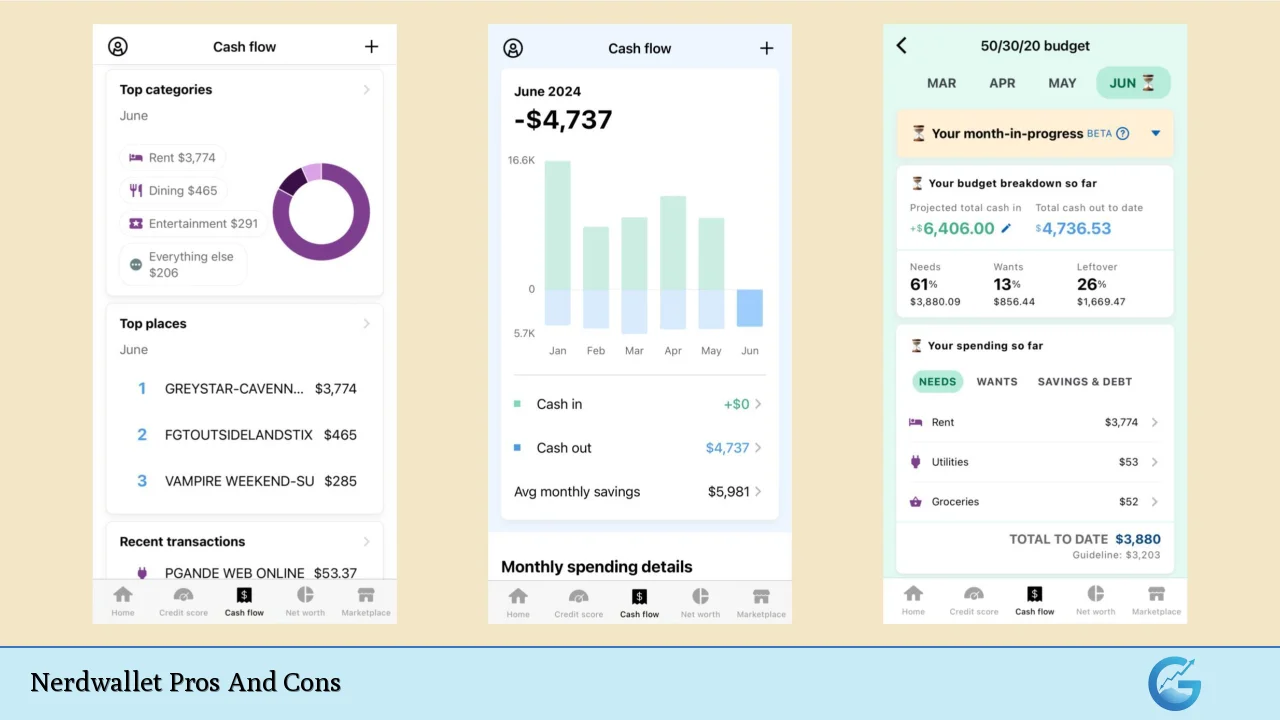

Limited Budgeting Features

Despite its strengths, NerdWallet has limitations when it comes to budgeting tools.

- Basic Tracking Only: While it offers cash flow tracking, users seeking comprehensive budgeting tools may find the options lacking.

- No Custom Categories: Users cannot create custom categories for expenses, which can limit personalized budgeting strategies.

- Integration Issues: Some users have reported difficulties syncing all accounts for real-time updates on their budgets.

For those who prioritize detailed budgeting capabilities, alternatives may be more suitable.

User-Friendly Interface

NerdWallet’s website and mobile app are designed with user experience in mind.

- Intuitive Navigation: The layout is straightforward, allowing users to easily access various tools and resources.

- Visual Data Representation: Financial data is presented visually, making it easier for users to understand their financial situations at a glance.

- Quick Access to Information: Users can quickly find information on specific topics or products without extensive searching.

This focus on usability makes it accessible for individuals who may not be financially savvy but want to manage their finances effectively.

Inconsistent Account Balance Updates

A notable drawback reported by some users is the inconsistency in account balance updates within the app.

- Delayed Refreshes: Some accounts may take days or even weeks to refresh, leading to outdated information being displayed.

- User Frustration: This issue can frustrate users who rely on real-time data for tracking spending and managing finances effectively.

- Impact on Decision Making: Delayed updates can hinder timely financial decisions based on current balances and transactions.

Users should be aware of this limitation when relying on NerdWallet for account management.

Extensive Educational Resources

NerdWallet provides an abundance of educational content aimed at improving financial literacy among its users.

- Articles and Guides: The platform features a vast library of articles covering various topics such as investing, retirement planning, and tax strategies.

- Interactive Tools: Users have access to calculators that help them estimate loan payments or retirement savings needs.

- Expert Insights: The site often includes expert opinions and analyses that can enhance understanding of complex financial concepts.

These resources are invaluable for users looking to expand their knowledge and make informed financial choices.

No Direct Customer Support via Phone

One significant drawback of using NerdWallet is the lack of direct customer support options via phone.

- Limited Support Channels: Users can contact support through email or forums but may find response times slow or inadequate for urgent issues.

- Self-Service Model: The reliance on self-service resources means that users must often troubleshoot problems independently without immediate assistance.

- Frustration with Complex Issues: For more complicated inquiries, the absence of direct support can lead to user frustration and dissatisfaction with the service.

This limitation may deter some potential users who prefer robust customer support options when dealing with financial matters.

Personalized Financial Recommendations

NerdWallet offers personalized recommendations based on user profiles and preferences.

- Tailored Suggestions: By analyzing user data, NerdWallet provides customized product recommendations that align with individual financial goals.

- Enhanced User Experience: This personalization enhances user engagement by making the experience relevant and targeted rather than generic.

- Regular Updates: As user circumstances change (e.g., income levels or credit scores), recommendations are updated accordingly to reflect those changes.

These personalized features help users find products that best suit their financial needs without extensive searching.

Ads May Overwhelm Some Users

While advertisements fund many free services online, some users find NerdWallet’s ad placements overwhelming.

- Frequent Promotions: The presence of numerous ads can distract from the primary content and tools available on the site.

- User Experience Impact: An overabundance of ads may detract from the overall user experience, making navigation feel cluttered or commercialized.

- Ad Relevance Concerns: Some ads might not align with user interests or needs, leading to frustration when navigating through content.

Users should be prepared for a commercial environment while using NerdWallet’s services.

Free Net Worth and Cash Flow Tracking Tools

NerdWallet provides free tools that allow users to track their net worth and cash flow effectively.

- Comprehensive Overview: These tools give users a clear picture of their financial health by consolidating assets and liabilities into one view.

- Easy Tracking Mechanism: Users can input data manually or sync accounts for automatic updates regarding cash flow changes over time.

- Visual Progress Tracking: Graphs and charts illustrate changes in net worth over time, helping users visualize their progress toward financial goals.

These features empower users by providing them with essential insights into their overall financial status without incurring additional costs.

Premium Features May Incur Costs

While many services are free on NerdWallet, some premium features come at a cost.

- Subscription Models Available: Certain advanced tools or personalized services may require a subscription fee or one-time payment.

- Cost-Benefit Analysis Required: Users need to evaluate whether these premium features provide sufficient value relative to their costs before committing financially.

- Potential Hidden Fees: Users should be cautious about any potential hidden fees associated with premium features or services offered through partnerships with third parties.

Being aware of these costs ensures that users can make informed decisions about which features are worth investing in based on their individual needs.

Access to Expert Advice Through Forums

NerdWallet hosts forums where users can engage with experts in finance-related discussions.

- Diverse Perspectives Available: Users can gain insights from various experts who provide answers to questions on personal finance topics ranging from investing strategies to debt management.

- Community Engagement Opportunities: The forums also foster community interaction among users seeking similar advice or sharing experiences related to personal finance challenges.

- Quality Control Concerns: However, as previously mentioned, the quality of advice varies significantly; not all responses come from qualified professionals which could lead some users astray if they follow poor advice blindly.

This feature allows for knowledge sharing but requires careful consideration regarding whose advice is followed closely.

Mobile App for On-the-Go Management

The availability of a mobile app enhances accessibility for users looking to manage finances while on the go.

- Convenient Features Offered: The app allows quick access to essential functions such as checking credit scores or tracking cash flow without needing a computer.

- Limited Functionality Compared To Website Version: While useful for basic tasks like monitoring accounts or viewing product offers; some advanced functionalities available on the website may not be present in the app version (e.g., certain calculators).

- Regular Updates Improve User Experience Over Time: Continuous improvements based on user feedback help enhance performance over time but still require awareness about limitations compared against full desktop capabilities.

The mobile app serves as an excellent companion tool but should not replace comprehensive desktop usage when deeper analysis is needed.

In conclusion, while NerdWallet offers numerous advantages such as comprehensive product comparisons, free credit monitoring services, extensive educational resources tailored towards improving financial literacy among its audience; it also presents several disadvantages including potential biases due affiliate marketing practices impacting objectivity along with limitations regarding budgeting capabilities & direct customer support options available when needed most urgently by consumers seeking assistance navigating complex issues surrounding personal finances today!

Frequently Asked Questions About Nerdwallet Pros And Cons

- What are the main benefits of using NerdWallet?

NerdWallet provides comprehensive comparisons of financial products, free credit score monitoring, personalized recommendations based on user profiles, extensive educational resources about personal finance topics. - Are there any downsides associated with using NerdWallet?

The potential bias due affiliate marketing practices affecting objectivity; limited budgeting features compared other platforms; inconsistent account balance updates; lack direct customer support via phone. - Is NerdWallet suitable for beginners?

Yes! Its user-friendly interface & educational content make it accessible even if someone lacks prior knowledge about managing finances effectively. - How does NerdWallet generate revenue?

Nerdwallet earns money primarily through affiliate marketing by promoting certain financial products & earning commissions from banks/financial institutions when customers sign up via their platform. - Can I trust the advice provided on Nerdwallet?

While many articles offer sound advice written by knowledgeable professionals; consumers should validate information against multiple sources before acting upon recommendations given varying quality across responses found within forums. - Does using Nerdwallet cost anything?

The majority of services offered are free; however certain premium features may incur costs depending upon what specific functionality one opts into utilizing. - How frequently does Nerdwallet update its content?

Nerdwallet regularly updates its articles & product comparisons ensuring they remain relevant amidst changing market conditions impacting consumer choices. - Is there a mobile app available?

Yes! There’s both an iOS & Android app allowing easy access while managing finances away from home; though some functionalities differ from what’s available online.