In the rapidly evolving landscape of financial services, online lending has emerged as a significant disruptor, challenging traditional banking models and offering new avenues for borrowers to access funds. This digital revolution in lending has brought both opportunities and challenges, reshaping how individuals and businesses approach borrowing. As we delve into the intricacies of online lending, it’s crucial to understand its multifaceted nature and the implications it holds for borrowers and the broader financial ecosystem.

Online lending platforms, also known as peer-to-peer (P2P) lenders or marketplace lenders, leverage technology to connect borrowers directly with lenders or investors. This model bypasses traditional financial intermediaries, potentially offering more efficient and accessible lending solutions. However, like any financial innovation, it comes with its own set of advantages and disadvantages that warrant careful consideration.

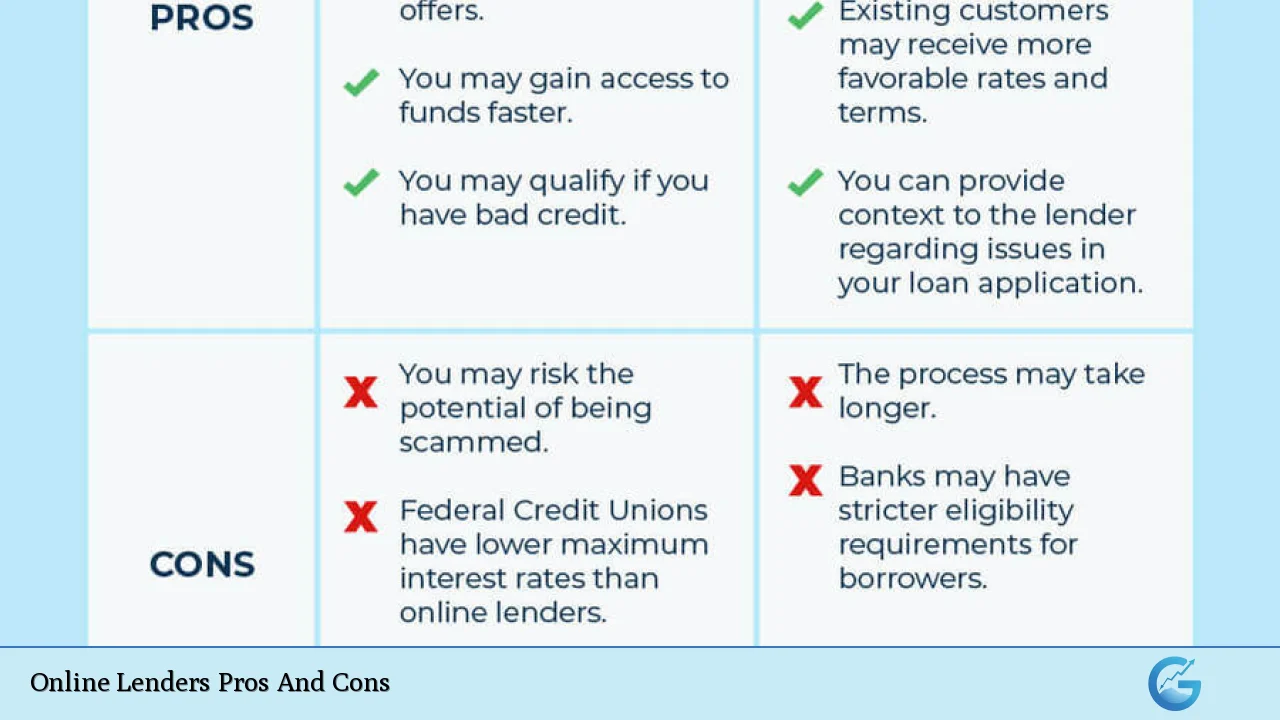

Let’s begin by summarizing the key pros and cons of online lenders:

| Pros | Cons |

|---|---|

| Faster application and approval process | Potentially higher interest rates |

| Increased accessibility and convenience | Security and privacy concerns |

| More flexible lending criteria | Limited personal interaction |

| Competitive rates for prime borrowers | Risk of predatory lending practices |

| Diverse loan products | Potential for overborrowing |

| Transparency in terms and fees | Regulatory uncertainties |

| Automated decision-making | Limited building of banking relationships |

Now, let’s explore each of these aspects in greater detail to provide a comprehensive understanding of online lenders’ advantages and disadvantages.

Advantages of Online Lenders

Faster Application and Approval Process

Online lenders have revolutionized the loan application process, significantly reducing the time from application to funding. Traditional banks often require extensive paperwork and can take weeks to process a loan application. In contrast, online lenders leverage advanced algorithms and automated systems to streamline the process.

Key benefits include:

- Applications can often be completed in minutes

- Many online lenders offer instant pre-approval

- Funds can be disbursed within 24-48 hours in some cases

This speed is particularly beneficial for businesses facing cash flow issues or individuals dealing with unexpected expenses. The quick turnaround can be a lifeline in time-sensitive situations where traditional bank loans might be too slow to meet urgent financial needs.

Increased Accessibility and Convenience

Online lenders have democratized access to credit, making loans available to a broader range of borrowers. This increased accessibility is particularly impactful for:

- Individuals in rural areas with limited access to physical bank branches

- Small business owners who may not meet traditional bank lending criteria

- Borrowers with non-traditional income sources or credit histories

The convenience factor cannot be overstated – borrowers can apply for loans 24/7 from the comfort of their homes or offices, eliminating the need for in-person visits to bank branches. This accessibility aligns well with the digital-first preferences of many modern consumers and businesses.

More Flexible Lending Criteria

Traditional banks often have rigid lending criteria, which can exclude many potential borrowers. Online lenders, on the other hand, tend to take a more holistic approach to assessing creditworthiness. They may consider factors such as:

- Alternative data points (e.g., utility bill payments, rental history)

- Business performance metrics beyond credit scores

- Educational background and employment history

This flexibility can open doors for borrowers who might not fit the conventional mold but are still creditworthy. It’s particularly beneficial for:

- Startups and young businesses without extensive credit histories

- Gig economy workers and freelancers with variable income

- Individuals rebuilding their credit after past financial difficulties

Competitive Rates for Prime Borrowers

While online lenders are often associated with higher interest rates, this isn’t universally true. For prime borrowers with excellent credit scores, online lenders can offer highly competitive rates. This is due to:

- Lower overhead costs compared to traditional banks

- Use of sophisticated risk assessment models

- Intense competition in the online lending space

Some online lenders specialize in offering premium products to high-credit-score borrowers, potentially beating the rates offered by traditional banks. This competition benefits consumers by driving down costs and improving loan terms across the board.

Diverse Loan Products

Online lenders have shown remarkable innovation in developing diverse loan products tailored to specific needs. This diversity includes:

- Short-term business loans

- Invoice financing

- Lines of credit with flexible draw periods

- Specialized loans for equipment or inventory purchases

- Personal loans for debt consolidation or major purchases

This variety allows borrowers to find products that closely match their specific financial needs, rather than trying to fit into the more limited options typically offered by traditional banks.

Transparency in Terms and Fees

Many online lenders pride themselves on offering clear, upfront information about loan terms, interest rates, and fees. This transparency is often manifested through:

- Easy-to-understand loan comparison tools

- Clear disclosure of APRs and all associated fees

- Detailed explanations of loan terms and repayment schedules

This level of transparency helps borrowers make more informed decisions and reduces the risk of unexpected costs or hidden fees. It’s a stark contrast to the sometimes opaque pricing structures of traditional financial products.

Automated Decision-Making

The use of artificial intelligence and machine learning in loan underwriting processes has enabled online lenders to make faster, more consistent lending decisions. Benefits of this automation include:

- Reduced potential for human bias in lending decisions

- Ability to process and analyze vast amounts of data quickly

- Continuous improvement of risk assessment models

While automation raises some concerns (which we’ll address in the disadvantages section), it has undeniably contributed to the efficiency and scalability of online lending platforms.

Disadvantages of Online Lenders

Potentially Higher Interest Rates

While online lenders can offer competitive rates to prime borrowers, they often charge higher interest rates compared to traditional banks, especially for borrowers with less-than-perfect credit. Reasons for this include:

- Higher risk tolerance, leading to lending to borrowers traditional banks might reject

- The need to offset potential losses from a higher-risk borrower pool

- Lack of the same level of federal insurance and backing as traditional banks

It’s crucial for borrowers to carefully compare rates and understand the total cost of borrowing, as the convenience of online loans can sometimes come at a premium.

Security and Privacy Concerns

The digital nature of online lending platforms introduces unique security and privacy risks:

- Potential for data breaches and identity theft

- Concerns about the sharing and selling of personal financial information

- Risk of phishing scams and fraudulent lending websites

While reputable online lenders invest heavily in security measures, the digital landscape is inherently vulnerable to cyber threats. Borrowers must be vigilant and ensure they’re dealing with legitimate, secure platforms.

Limited Personal Interaction

The lack of face-to-face interaction in online lending can be a significant drawback for some borrowers. This limitation manifests in several ways:

- Difficulty in getting personalized advice or explanations of complex loan terms

- Challenges in negotiating loan terms or seeking flexibility in repayment

- Absence of relationship-building that can be beneficial for future financial needs

For borrowers who value personal relationships with their financial institutions or need more hands-on guidance, the impersonal nature of online lending can be a significant disadvantage.

Risk of Predatory Lending Practices

The online lending space, particularly in the short-term and payday loan segments, has been known to harbor predatory lenders. These unethical practices can include:

- Extremely high interest rates and fees

- Lack of transparency about loan terms

- Aggressive collection practices

While regulations are evolving to address these issues, borrowers must remain cautious and thoroughly research lenders before committing to a loan.

Potential for Overborrowing

The ease and speed of obtaining loans online can lead to irresponsible borrowing behaviors:

- Taking out multiple loans from different lenders simultaneously

- Borrowing more than one can realistically afford to repay

- Using high-interest loans for non-essential purchases

The convenience of online lending, while beneficial in many ways, can also make it easier for individuals to fall into debt traps if not approached with caution and financial discipline.

Regulatory Uncertainties

The online lending industry operates in a rapidly evolving regulatory landscape:

- Varying regulations across different states and countries

- Ongoing debates about appropriate oversight and consumer protection measures

- Potential for sudden regulatory changes that could impact loan terms or availability

This regulatory flux can create uncertainties for both lenders and borrowers, potentially affecting the stability and consistency of online lending products.

Limited Building of Banking Relationships

By bypassing traditional banks, online borrowers may miss out on building long-term relationships with financial institutions. This can have implications for:

- Future loan applications or financial products

- Access to personalized financial advice and services

- Potential preferential treatment or rates for long-term customers

While online lending offers many advantages, the transactional nature of these platforms may not provide the same long-term benefits that can come from a established relationship with a traditional bank.

In conclusion, online lenders have undeniably transformed the lending landscape, offering unprecedented access to credit and innovative financial products. However, this convenience and accessibility come with their own set of challenges and risks. As the industry continues to evolve, it’s crucial for borrowers to approach online lending with a balanced perspective, carefully weighing the pros and cons against their individual financial situations and needs.

Ultimately, the decision to use an online lender should be made after thorough research, careful consideration of alternatives, and a clear understanding of one’s financial capabilities and goals. As with any financial decision, informed choice and responsible borrowing are key to leveraging the benefits of online lending while mitigating its potential drawbacks.

Frequently Asked Questions About Online Lenders Pros And Cons

- Are online lenders safe to use?

Reputable online lenders are generally safe, but it’s crucial to verify their credentials and read reviews. Always ensure the website is secure (https://) and check for licensing information before sharing personal data. - How do interest rates from online lenders compare to traditional banks?

Interest rates can vary widely among online lenders. For prime borrowers, rates can be competitive with or lower than traditional banks, while subprime borrowers may face higher rates. - Can I get an online loan with bad credit?

Many online lenders cater to borrowers with less-than-perfect credit, but interest rates may be higher. Some lenders use alternative data to assess creditworthiness beyond traditional credit scores. - How quickly can I receive funds from an online lender?

Funding times vary, but many online lenders can approve loans within hours and disburse funds within 1-3 business days. Some offer same-day funding for certain loan products. - Are there any hidden fees with online loans?

Reputable online lenders typically disclose all fees upfront. However, it’s essential to read the loan agreement carefully and ask about any charges you don’t understand before accepting the loan. - Can online lenders offer the same loan amounts as traditional banks?

Loan amounts vary by lender. While some online lenders specialize in smaller loans, others offer amounts comparable to or exceeding those of traditional banks, especially for business loans. - How do online lenders verify my information?

Online lenders typically use a combination of automated data verification, credit checks, and sometimes manual review. They may request additional documentation for larger loans or to verify specific information. - What happens if I can’t repay my online loan?

Consequences for non-payment can include late fees, negative credit reporting, and potential legal action. Many online lenders offer hardship programs or flexible repayment options for borrowers facing financial difficulties.