Oscar Health Insurance is a relatively new player in the health insurance market, aiming to provide affordable and user-friendly healthcare options primarily through technology. Founded in 2012, Oscar has positioned itself as a tech-driven health insurance provider that focuses on simplifying the healthcare experience for its members. With its innovative approach, Oscar offers various plans under the Affordable Care Act (ACA), including individual, family, and Medicare Advantage plans. However, as with any health insurance option, there are both advantages and disadvantages to consider.

| Pros | Cons |

|---|---|

| Innovative technology and user-friendly mobile app | Limited coverage area and availability in only 18 states |

| Access to free virtual primary care and telemedicine services | High premiums compared to competitors |

| Personalized care teams for support and guidance | Poor customer service ratings and high complaint volume |

| Rewards program for healthy activities (e.g., step tracking) | No dental or vision coverage for adults |

| Clear plan structures with Simple Plans for easier understanding | High deductibles for many plans, making them less suitable for those needing frequent care |

| Coverage of essential health benefits as mandated by the ACA | Limited provider networks may restrict access to preferred doctors |

| Offers Health Savings Account (HSA)-compatible plans | Mixed reviews regarding claim processing and reimbursement speed |

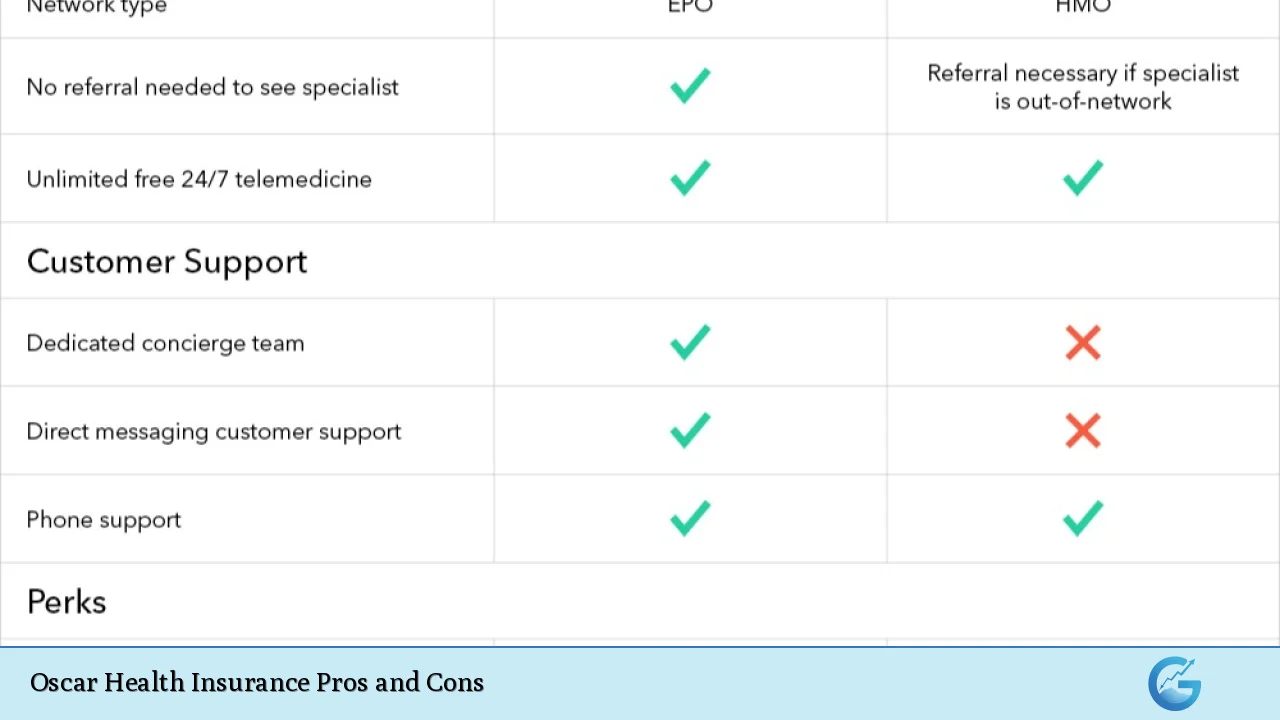

| Includes preventive care services at no cost before meeting the deductible | Some plans may have limited specialist access without referrals or higher costs |

Innovative Technology and User-Friendly Mobile App

Oscar Health Insurance stands out due to its emphasis on technology. The company has developed a user-friendly mobile app that allows members to access various services easily.

- Telemedicine Services: Members can consult with doctors virtually without incurring additional costs, which is particularly beneficial during times when in-person visits may be challenging.

- Health Tracking: The app syncs with health tracking devices like Fitbit or Apple Health, enabling users to monitor their health metrics.

- Care Teams: Each member is assigned a personalized care team that includes a care guide and registered nurse, providing tailored support.

Limited Coverage Area

Despite its innovative offerings, Oscar is limited in terms of geographical reach.

- Availability: Oscar operates in only 18 states, which may not be sufficient for individuals seeking nationwide coverage options.

- Network Limitations: Members must use providers within Oscar’s network for coverage, which can be restrictive if preferred doctors are not included.

Access to Free Virtual Primary Care

Oscar provides free virtual primary care visits, which can significantly reduce healthcare costs for members who require regular check-ups or consultations.

- Convenience: This service allows patients to receive timely medical advice without the need for physical appointments.

- Immediate Access: Members can connect with healthcare professionals quickly, improving overall access to care.

High Premiums Compared to Competitors

One of the notable downsides of Oscar Health Insurance is its pricing structure.

- Cost Analysis: Many users report that Oscar’s premiums are higher than those of competing insurers, which can be a barrier for budget-conscious consumers.

- Value Assessment: While the technology and services offered are appealing, potential customers should weigh these benefits against the higher costs involved.

Poor Customer Service Ratings

Customer service has been a significant concern among Oscar members.

- Complaint Volume: Reports indicate that Oscar receives more complaints compared to other insurers of similar size, raising questions about customer satisfaction.

- Claim Processing Issues: Members have expressed frustration over delays in claim processing and difficulties in reaching customer support representatives.

Rewards Program for Healthy Activities

Oscar incentivizes healthy behavior through a rewards program that encourages physical activity.

- Step Tracking Rewards: Members can earn up to $240 annually by tracking their steps through compatible health apps, promoting an active lifestyle.

- Engagement: This program aims to engage members actively in their health management while providing financial incentives.

No Dental or Vision Coverage for Adults

While Oscar offers some pediatric plans that include dental and vision coverage, adult plans lack these essential benefits.

- Coverage Gaps: Adults seeking comprehensive health insurance that includes dental and vision may need to look elsewhere or purchase separate policies.

Clear Plan Structures with Simple Plans

Oscar’s plan structures are designed to be straightforward, particularly with their “Simple Plans.”

- Understanding Costs: Simple Plans have a single deductible that matches the out-of-pocket maximum, making it easier for members to understand their financial responsibilities.

- Predictability: This clarity helps members anticipate their healthcare expenses more accurately than traditional plans with multiple tiers of cost-sharing.

High Deductibles Making Plans Less Suitable for Frequent Care

Many of Oscar’s plans come with high deductibles that could deter individuals who require regular medical attention from enrolling.

- Financial Burden: Those who frequently visit doctors or require ongoing treatments may find themselves paying substantial out-of-pocket costs before their insurance kicks in.

- Suitability Assessment: Prospective members should evaluate their healthcare needs carefully against the deductible levels offered by Oscar’s plans.

Coverage of Essential Health Benefits

Oscar complies with ACA regulations by covering essential health benefits such as preventive care, hospitalizations, mental health services, and more.

- Comprehensive Coverage: Members can expect coverage for a wide range of medical services necessary for maintaining overall health.

- Preventive Services at No Cost: Preventive care is available without cost-sharing before meeting deductibles, promoting proactive health management among members.

Limited Provider Networks May Restrict Access

Oscar employs a curated network strategy that focuses on quality over quantity but may limit member choices.

- In-Network Requirements: Members must use providers within the network except in emergencies; this can lead to higher costs if they seek out-of-network care.

- Provider Availability Concerns: Some users have reported issues with outdated provider lists or difficulties finding available specialists within the network.

Mixed Reviews Regarding Claim Processing

Members have expressed mixed feelings about how claims are handled by Oscar Health Insurance.

- Processing Delays: Some users report lengthy delays in claim processing times, which can lead to frustration during critical healthcare moments.

- Reimbursement Challenges: Difficulties in obtaining timely reimbursements can add stress for those relying on their insurance coverage during medical events.

Closing Paragraph

In summary, Oscar Health Insurance offers a blend of innovative technology and personalized healthcare support aimed at simplifying the insurance experience. However, potential customers must weigh these benefits against significant drawbacks such as high premiums, limited provider networks, and customer service challenges. While Oscar may appeal to tech-savvy individuals seeking easy access to virtual care and wellness incentives, those requiring comprehensive coverage—including dental and vision—might find better options elsewhere. As always, it’s crucial for consumers to assess their unique healthcare needs and financial situations before selecting an insurance provider.

Frequently Asked Questions About Oscar Health Insurance

- What types of plans does Oscar offer?

Oscar provides individual and family plans under the ACA as well as Medicare Advantage plans. They offer various plan types categorized into Simple Plans and Classic Plans. - Are there any rewards programs available?

Yes, Oscar has a rewards program where members can earn cash incentives by tracking healthy activities like step counts through compatible apps. - Is dental or vision coverage included?

No, adult plans do not include dental or vision coverage unless specified under pediatric plans. - How does telemedicine work with Oscar?

Members have access to free virtual primary care visits through the mobile app or website without additional costs. - What are the customer service ratings like?

Customer service ratings are generally poor; many users report dissatisfaction with response times and claim processing. - Can I see out-of-network providers?

No, except in emergencies; members must use providers within Oscar’s network unless they want to incur higher costs. - What states does Oscar operate in?

Oscar currently operates in 18 states across the U.S., limiting its availability compared to other insurers. - Are there high deductibles associated with Oscar’s plans?

Yes, many of Oscar’s plans feature high deductibles which may not be suitable for individuals needing frequent medical care.