The Pennsylvania 529 College and Career Savings Program is designed to help families save for future educational expenses. This program offers two types of plans: the Guaranteed Savings Plan (GSP) and the Investment Plan (IP). Each plan has unique features that cater to different financial needs and goals. Understanding the advantages and disadvantages of the PA 529 plan is crucial for families considering this option for saving for education. This article will explore the pros and cons in detail, providing insights that can help you make informed decisions about your educational savings strategy.

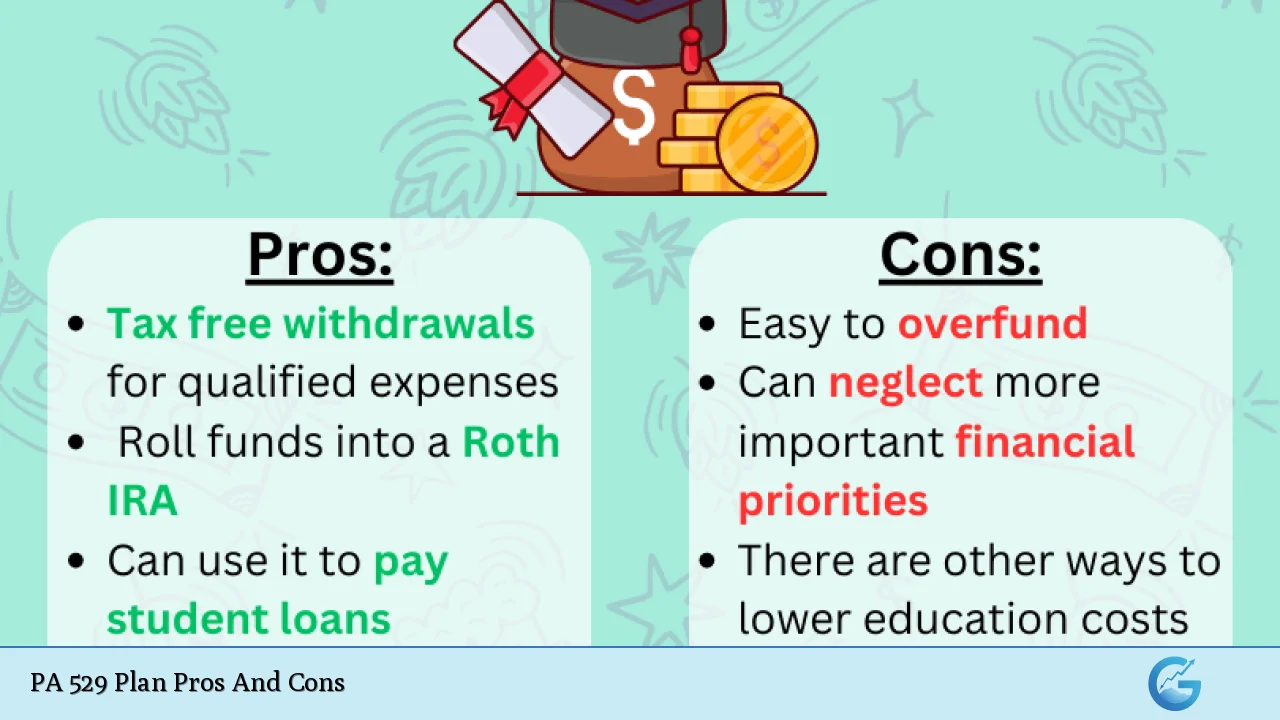

| Pros | Cons |

|---|---|

| High contribution limits | Funds must be used for educational purposes only |

| Tax benefits at both federal and state levels | Limited investment options |

| Flexibility in usage for various educational expenses | Potential penalties for non-qualified withdrawals |

| Low maintenance fees and easy account management | Impact on financial aid eligibility |

| Protection from creditors in Pennsylvania | Fees can vary significantly between plans |

| State income tax deductions for contributions | Restrictions on changing investment options once selected |

| SAGE Scholars Tuition Rewards program offering discounts at private colleges | Complex rules regarding rollovers and beneficiary changes |

High Contribution Limits

One of the most significant advantages of the PA 529 plan is its high contribution limits.

- Annual Contribution: Individuals can contribute up to $18,000 per beneficiary per year, while married couples can contribute up to $36,000 if both spouses have sufficient income.

- Lifetime Contribution: The total contribution limit can exceed $300,000 depending on the plan, allowing families to save substantially over time without worrying about hitting a cap too early.

This flexibility enables families to save aggressively for their children’s education without facing immediate restrictions.

Tax Benefits at Both Federal and State Levels

The PA 529 plan offers substantial tax advantages that can enhance your savings.

- State Tax Deduction: Contributions to a PA 529 plan are deductible from Pennsylvania state income taxes, which can significantly reduce your taxable income.

- Tax-Free Growth: Earnings in a PA 529 plan grow federal and state tax-free as long as they are used for qualified educational expenses.

These tax benefits make the PA 529 plan an attractive option compared to other savings vehicles.

Flexibility in Usage for Various Educational Expenses

Another appealing aspect of the PA 529 plan is its flexibility regarding what expenses can be covered.

- Qualified Expenses: Funds can be used not only for college tuition but also for K-12 education, vocational training, and certain apprenticeship programs.

- Wide Range of Institutions: The funds can be applied to any accredited institution nationwide, including some foreign schools, thus providing broad access to educational opportunities.

This versatility allows families to tailor their savings strategy according to their specific educational goals.

Low Maintenance Fees and Easy Account Management

The PA 529 plan is designed with user-friendliness in mind.

- No Minimum Deposit: There is no minimum deposit required to open an account, making it accessible for families at all income levels.

- Low Fees: The plans are generally low-maintenance with minimal fees compared to other investment accounts, which helps maximize savings over time.

These features simplify the process of managing an education savings account.

Protection from Creditors in Pennsylvania

Assets held in a PA 529 plan are protected from creditors under Pennsylvania law.

- Estate Planning Benefits: This protection can be particularly beneficial in estate planning scenarios, ensuring that funds designated for education remain intact even if the account holder faces financial difficulties.

This unique feature adds an additional layer of security for families saving for education.

State Income Tax Deductions for Contributions

Pennsylvania residents benefit from state tax deductions on contributions made to a PA 529 plan.

- Contribution Limits: As mentioned earlier, individuals can deduct contributions up to $18,000 annually per beneficiary from their state taxable income.

- Joint Filers: For married couples filing jointly, this deduction can double, allowing significant tax relief while saving for education.

These deductions provide immediate financial benefits that enhance the overall value of participating in a PA 529 plan.

SAGE Scholars Tuition Rewards Program Offering Discounts at Private Colleges

The PA 529 plan includes access to the SAGE Scholars Tuition Rewards program, which provides discounts at over 400 private colleges across the country.

- Tuition Discounts: Families can earn tuition discounts that can significantly reduce college costs when attending participating institutions.

- Incentive to Save: This program encourages families to save more by offering tangible rewards for their contributions.

This added benefit makes the PA 529 plan even more appealing for those considering private education options.

Funds Must Be Used for Educational Purposes Only

While there are many advantages to the PA 529 plan, one significant drawback is that funds must be used exclusively for qualified educational expenses.

- Non-Qualified Withdrawals: If funds are withdrawn for non-qualified expenses, they will incur taxes on earnings plus a 10% penalty.

This restriction limits flexibility compared to other savings accounts where funds can be accessed without penalties or taxes.

Limited Investment Options

The investment choices within a PA 529 plan can be quite limited compared to other investment vehicles.

- Predefined Portfolios: Many plans offer only a selection of predefined portfolios rather than allowing account holders to choose individual investments.

- Higher Costs: Some plans may include high-cost investment options that could diminish overall returns compared to lower-cost alternatives available elsewhere.

For experienced investors seeking diverse options, this limitation may be a significant disadvantage.

Potential Penalties for Non-Qualified Withdrawals

As previously mentioned, withdrawing funds from a PA 529 account for non-qualified expenses results in penalties.

- Strict Rules: The rules governing withdrawals are strict; therefore, it’s essential to keep track of how funds are used.

- Impact on Savings Goals: Accidental misuse of funds could lead to unexpected tax liabilities and penalties that undermine your savings efforts.

Understanding these rules is crucial before committing significant resources to a PA 529 plan.

Impact on Financial Aid Eligibility

Another consideration when evaluating the PA 529 plan is its impact on financial aid eligibility.

- Asset Consideration: Assets held in a parent-owned 529 account are considered parental assets when calculating financial aid eligibility.

- Reduced Aid: This means that having a substantial amount saved in a 529 account could reduce the amount of financial aid available by approximately 5.64% of the account’s value.

Families should carefully consider how their savings strategy may affect potential financial aid opportunities when planning for college expenses.

Fees Can Vary Significantly Between Plans

While many aspects of the PA 529 plan are beneficial, fees associated with different plans may vary significantly.

- Comparative Costs: Some plans may charge higher fees than others based on investment choices or administrative costs.

- Long-Term Impact: Over time, these fees can erode savings potential if not managed carefully. It’s essential to review fee structures before selecting a specific plan.

Understanding these costs will help families choose the most cost-effective option available within the PA 529 framework.

Restrictions on Changing Investment Options Once Selected

Once you select an investment option within your PA 529 plan, changing it may not be straightforward.

- Limited Changes Allowed: Typically, you can only change your investment options once per calendar year or upon changing beneficiaries.

- Investment Strategy Lock-In: This restriction may limit your ability to respond dynamically to market conditions or personal financial situations as they evolve over time.

Families should weigh this limitation against their investment strategies when considering enrollment in a PA 529 plan.

In conclusion, while the Pennsylvania 529 College and Career Savings Program offers numerous advantages such as high contribution limits, tax benefits, and flexibility regarding educational expenses, it also presents challenges like restrictions on fund usage and limited investment options. Families considering this savings vehicle should carefully evaluate these pros and cons in light of their unique financial circumstances and educational goals. Ultimately, understanding both sides will empower you to make informed decisions about funding your child’s education effectively.

Frequently Asked Questions About PA 529 Plan Pros And Cons

- What are the main benefits of a PA 529 plan?

The main benefits include high contribution limits, tax-free growth on earnings when used for qualified expenses, and state tax deductions on contributions. - Are there any penalties associated with withdrawing funds?

Yes, withdrawing funds for non-qualified expenses incurs taxes on earnings plus a 10% penalty. - Can I use my PA 529 funds at any school?

You can use funds at any accredited institution nationwide and some foreign schools. - How does having a PA 529 affect financial aid?

A parent-owned PA 529 account counts as an asset when calculating financial aid eligibility, potentially reducing available aid. - What types of expenses can I cover with my PA 529?

You can cover tuition, fees, room and board, books, K-12 expenses, vocational training costs, and certain apprenticeship programs. - Are there limits on changing investments within my account?

You typically can only change investments once per calendar year or upon changing beneficiaries. - What happens if I don’t use all my contributions?

If unused contributions remain after education needs are met, you may face taxes and penalties unless transferred or rolled over properly. - Do I have any control over my investments?

The level of control varies; some plans offer predefined portfolios with limited customization options.