Parent PLUS Loans are federal loans offered to parents of dependent undergraduate students to help finance their child’s education. These loans can be a valuable tool for families struggling to cover the full cost of college, but they also come with significant responsibilities and potential drawbacks. Let’s explore the advantages and disadvantages of Parent PLUS Loans in detail.

| Pros | Cons |

|---|---|

| Fixed interest rates | Higher interest rates than other federal loans |

| No annual or aggregate borrowing limits | Parent bears full responsibility for repayment |

| Less stringent credit requirements | Origination fees |

| Flexible repayment options | Impact on parent’s credit and debt-to-income ratio |

| Potential tax deductions on interest | Limited income-driven repayment options |

| Deferment and forbearance options | No grace period |

| Eligibility for loan forgiveness programs | Potential to overborrow |

Advantages of Parent PLUS Loans

Fixed Interest Rates

Parent PLUS Loans offer the security of fixed interest rates, which remain constant throughout the life of the loan. This feature provides borrowers with predictability in their repayment obligations, making it easier to budget and plan for the long term. For the 2024-2025 academic year, the fixed interest rate for Parent PLUS Loans is 9.08%. While this rate is higher than those for other federal student loans, it may still be competitive compared to some private loan options, especially for borrowers with less-than-stellar credit.

Benefits of fixed interest rates include:

- Protection against market fluctuations

- Consistent monthly payments

- Easier long-term financial planning

No Annual or Aggregate Borrowing Limits

Unlike other federal student loans, Parent PLUS Loans allow borrowing up to the full cost of attendance minus any other financial aid received. This feature can be particularly beneficial for families facing significant funding gaps after exhausting other financial aid options. The ability to borrow the full amount needed can help ensure that students can attend their chosen institution without financial constraints.

Advantages of no borrowing limits:

- Flexibility to cover all educational expenses

- Reduced need for multiple loan sources

- Potential to avoid higher-interest private loans

Less Stringent Credit Requirements

Parent PLUS Loans have more lenient credit requirements compared to many private student loan options. While a credit check is required, the standards for approval are generally less strict than those for private loans. Parents with an adverse credit history may still qualify by obtaining an endorser or demonstrating extenuating circumstances.

Benefits of easier credit approval:

- Increased accessibility for parents with less-than-perfect credit

- Potential alternative to cosigning private loans

- Opportunity to build or rebuild credit through responsible repayment

Flexible Repayment Options

Parent PLUS Loans offer various repayment plans to suit different financial situations. Borrowers can choose from options such as:

- Standard Repayment Plan (10 years)

- Graduated Repayment Plan (10 years with increasing payments)

- Extended Repayment Plan (up to 25 years)

- Income-Contingent Repayment (ICR) Plan (if consolidated into a Direct Consolidation Loan)

This flexibility allows parents to adjust their repayment strategy as their financial circumstances change over time.

Potential Tax Deductions on Interest

Interest paid on Parent PLUS Loans may be tax-deductible, providing a potential financial benefit to borrowers. As of 2024, parents may be able to deduct up to $2,500 in student loan interest annually, subject to income limitations. This deduction can help reduce the overall cost of borrowing and provide some tax relief for families managing educational debt.

Benefits of tax-deductible interest:

- Potential reduction in taxable income

- Lower overall cost of borrowing

- Additional financial incentive for timely repayment

Deferment and Forbearance Options

Parent PLUS Loans offer deferment and forbearance options, which can provide temporary relief from payments during periods of financial hardship. Deferment allows borrowers to postpone payments without accruing interest in certain situations, such as when the student returns to school at least half-time. Forbearance can temporarily reduce or suspend payments, although interest continues to accrue.

Advantages of deferment and forbearance:

- Temporary relief during financial difficulties

- Flexibility to manage unexpected life events

- Reduced risk of default

Eligibility for Loan Forgiveness Programs

While more limited than other federal student loans, Parent PLUS Loans may be eligible for certain loan forgiveness programs. By consolidating Parent PLUS Loans into a Direct Consolidation Loan, borrowers may become eligible for Public Service Loan Forgiveness (PSLF) or Income-Contingent Repayment (ICR) forgiveness after 25 years of qualifying payments. This potential for forgiveness can provide a long-term financial benefit for parents working in public service or facing extended repayment periods.

Disadvantages of Parent PLUS Loans

Higher Interest Rates Than Other Federal Loans

Parent PLUS Loans typically carry higher interest rates compared to other federal student loans offered directly to students. For the 2024-2025 academic year, the 9.08% fixed rate for Parent PLUS Loans is significantly higher than the 5.50% rate for undergraduate Direct Subsidized and Unsubsidized Loans. This higher rate translates to increased overall borrowing costs and potentially larger monthly payments.

Drawbacks of higher interest rates:

- Greater long-term cost of borrowing

- Larger portion of payments going toward interest

- Potential for slower principal reduction

Parent Bears Full Responsibility for Repayment

Unlike student loans, where the student is responsible for repayment, Parent PLUS Loans place the full repayment obligation on the parent borrower. This responsibility can create significant financial stress for parents, particularly those nearing retirement or managing other financial obligations. The burden of repayment may impact parents’ ability to save for retirement, manage other debts, or maintain their desired lifestyle.

Risks of parent responsibility:

- Potential strain on retirement savings

- Impact on parents’ financial flexibility

- Possible tension in parent-child relationships regarding repayment

Origination Fees

Parent PLUS Loans come with substantial origination fees, which are deducted from the loan amount before disbursement. For loans first disbursed on or after October 1, 2024, and before October 1, 2025, the origination fee is 4.228% of the loan amount. This fee increases the overall cost of borrowing and reduces the actual amount received for educational expenses.

Disadvantages of origination fees:

- Increased total cost of borrowing

- Reduced funds available for immediate educational expenses

- Need to borrow more to cover the same costs

Impact on Parent’s Credit and Debt-to-Income Ratio

Taking on a Parent PLUS Loan can significantly affect a parent’s credit profile and debt-to-income ratio. The loan appears on the parent’s credit report and is factored into their overall debt load, potentially impacting their ability to qualify for other loans or credit in the future. This increased debt burden may affect parents’ financial flexibility and options for years to come.

Potential credit and debt impacts:

- Reduced borrowing capacity for other needs

- Possible difficulty qualifying for mortgages or refinancing

- Long-term effect on parents’ financial health

Limited Income-Driven Repayment Options

While Parent PLUS Loans offer some flexibility in repayment, they have more limited access to income-driven repayment plans compared to other federal student loans. To become eligible for Income-Contingent Repayment (ICR), the only income-driven plan available, Parent PLUS Loans must first be consolidated into a Direct Consolidation Loan. This limitation can make it more challenging for parents to manage payments based on their income and family size.

Drawbacks of limited income-driven options:

- Potentially higher monthly payments

- Less flexibility for parents with variable or limited incomes

- Increased risk of financial strain during economic downturns

No Grace Period

Unlike many student loans that offer a grace period after graduation, Parent PLUS Loans enter repayment as soon as the loan is fully disbursed. This immediate repayment requirement can create financial pressure for families, especially if they were not prepared to begin making payments while the student is still in school. The lack of a grace period necessitates careful financial planning to ensure timely repayment from the outset.

Challenges of no grace period:

- Immediate financial obligation after disbursement

- Potential overlap with other educational expenses

- Less time for financial adjustment after borrowing

Potential to Overborrow

The ability to borrow up to the full cost of attendance, while beneficial in some cases, also presents a risk of overborrowing. Parents may be tempted to take on more debt than they can realistically manage, especially when factoring in the higher interest rates and fees associated with Parent PLUS Loans. This potential for excessive borrowing can lead to long-term financial strain and difficulty in repayment.

Risks of overborrowing:

- Long-term financial burden for parents

- Potential for default if repayment becomes unmanageable

- Impact on parents’ retirement planning and overall financial health

In conclusion, Parent PLUS Loans offer a valuable option for families seeking to finance their child’s education, providing access to federal loan benefits and potentially filling funding gaps. However, the higher costs, parent responsibility, and potential long-term financial impacts necessitate careful consideration and planning. Families should thoroughly evaluate their financial situation, explore all available aid options, and consider the long-term implications before deciding to take on a Parent PLUS Loan.

Frequently Asked Questions About Parent Plus Loan Pros And Cons

- Can Parent PLUS Loans be transferred to the student after graduation?

No, Parent PLUS Loans cannot be transferred to the student. The parent borrower remains legally responsible for repayment throughout the life of the loan. - Are there any alternatives to Parent PLUS Loans with potentially lower interest rates?

Yes, private student loans may offer lower rates for borrowers with excellent credit. However, they typically lack the federal benefits and protections of PLUS Loans. - Can parents deduct Parent PLUS Loan payments from their taxes?

While loan payments themselves are not deductible, parents may be able to deduct up to $2,500 of interest paid annually, subject to income limitations. - What happens to Parent PLUS Loans if the parent borrower dies or becomes disabled?

In these cases, the loan may be discharged. The death of the student may also result in loan discharge for the parent borrower. - Can Parent PLUS Loans be refinanced?

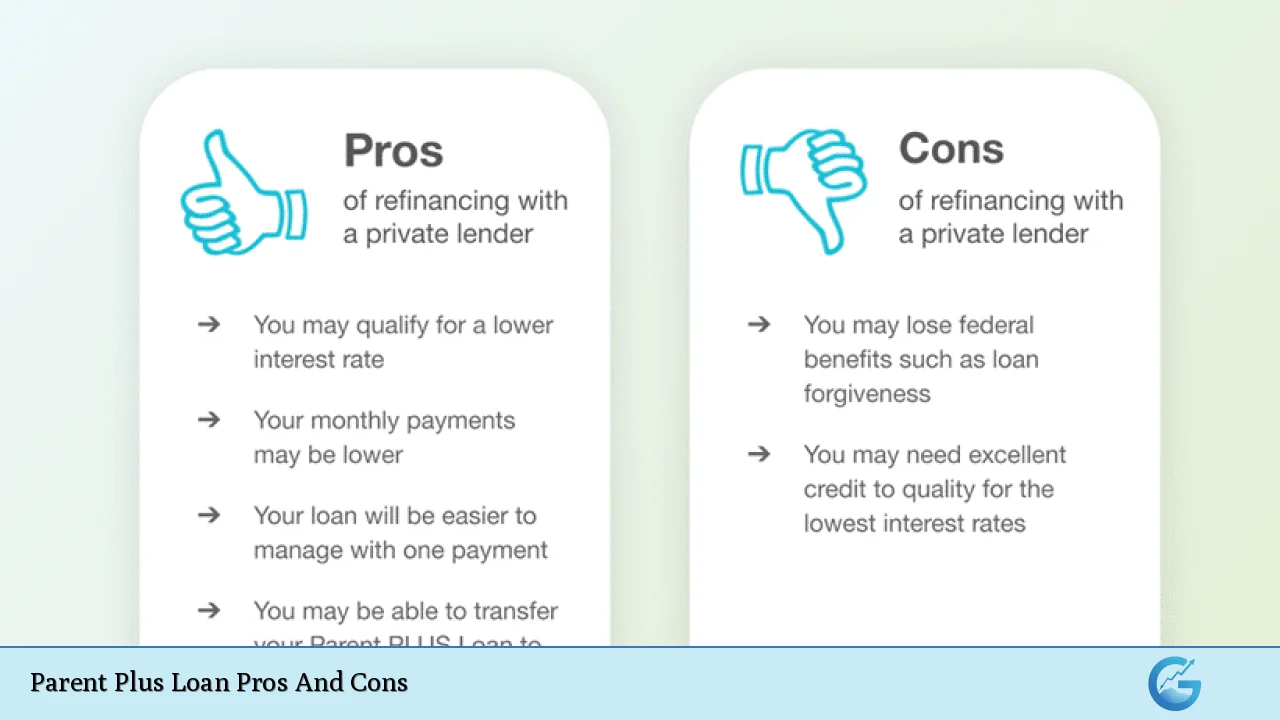

Yes, Parent PLUS Loans can be refinanced through private lenders, potentially lowering interest rates. However, this forfeits federal loan benefits and protections. - Are there any income limits for Parent PLUS Loan eligibility?

No, there are no income limits for Parent PLUS Loans. Eligibility is primarily based on credit history rather than income. - Can both parents take out separate Parent PLUS Loans for the same student?

Yes, both parents can take out separate PLUS Loans, but the combined amount cannot exceed the cost of attendance minus other financial aid received. - Is it possible to get a Parent PLUS Loan with bad credit?

Parents with adverse credit history may still qualify by obtaining an endorser or demonstrating extenuating circumstances that led to the adverse credit.