PayPal has revolutionized online payments since its inception in 1998. As a pioneer in digital financial services, it has grown to become one of the most widely used payment platforms globally. However, like any financial tool, PayPal comes with its own set of advantages and disadvantages. This comprehensive analysis will delve into the pros and cons of using PayPal, particularly for individuals and businesses involved in finance, cryptocurrency, forex, and money markets.

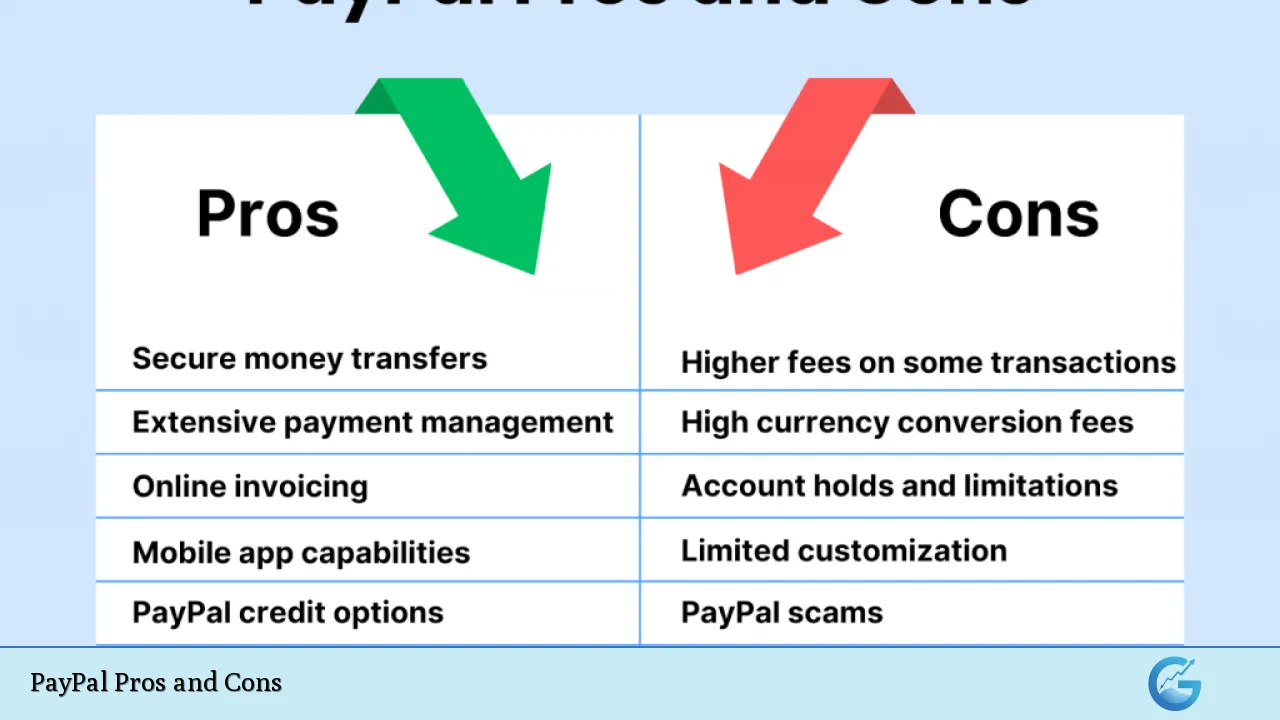

| Pros | Cons |

|---|---|

| User-friendly interface | Transaction fees can be high |

| Wide global acceptance | Account freezes and limitations |

| Buyer and seller protection | Currency conversion fees |

| Multiple currency support | Limited cryptocurrency options |

| Integration with e-commerce platforms | Potential for chargebacks |

| Mobile app functionality | Customer service issues |

| Quick and easy transfers | Not ideal for large business transactions |

| Offers credit and debit card options | Privacy concerns |

Advantages of Using PayPal

User-Friendly Interface

PayPal’s intuitive design makes it accessible to users of all technical backgrounds. This ease of use is particularly beneficial for:

- Quick account setup

- Straightforward navigation

- Simple payment processes

- Easy-to-understand transaction history

The platform’s user-friendliness extends to its mobile app, allowing users to manage their finances on the go with minimal friction.

Wide Global Acceptance

PayPal’s extensive reach is a significant advantage for international transactions. Benefits include:

- Accepted in over 200 countries

- Supports 25 currencies

- Facilitates cross-border transactions

- Reduces the need for multiple payment processors

This global acceptance is particularly valuable for forex traders and international investors who frequently deal with multi-currency transactions.

Buyer and Seller Protection

PayPal offers robust protection for both parties in a transaction:

- Buyer Protection covers eligible purchases if items are not received or significantly different from described

- Seller Protection shields against fraudulent chargebacks and reversals

- Dispute resolution services

These protections are crucial for maintaining trust in online transactions, especially in volatile markets like cryptocurrency trading.

Multiple Currency Support

For those involved in forex or international investments, PayPal’s multi-currency support is invaluable:

- Hold balances in different currencies

- Convert between currencies within the platform

- Receive payments in various currencies

This feature allows for more flexible financial management and can help mitigate some currency exchange risks.

Integration with E-commerce Platforms

PayPal’s seamless integration with numerous e-commerce platforms offers several advantages:

- Easy setup with popular platforms like Shopify, WooCommerce, and Magento

- Customizable payment buttons for websites

- API access for developers to create custom integrations

This integration capability is particularly beneficial for businesses operating in the digital space, including those in fintech and cryptocurrency sectors.

Mobile App Functionality

The PayPal mobile app extends the platform’s utility:

- Send and receive money on the go

- Track expenses and transactions in real-time

- Mobile check deposits

- NFC payments at physical stores

The app’s functionality is especially useful for traders and investors who need to monitor and manage their finances while away from their desks.

Quick and Easy Transfers

PayPal facilitates rapid money movements:

- Instant transfers between PayPal accounts

- Fast bank transfers (often within 1-3 business days)

- Option for immediate transfers to linked debit cards (for a fee)

This speed is crucial in fast-moving financial markets where timing can significantly impact investment outcomes.

Offers Credit and Debit Card Options

PayPal’s financial product offerings extend beyond basic payment processing:

- PayPal Credit for financing purchases

- PayPal Cashback Mastercard for earning rewards

- PayPal Prepaid Mastercard for those without traditional bank accounts

These options provide additional flexibility for managing finances and can be particularly useful for small businesses or individual investors.

Disadvantages of Using PayPal

Transaction Fees Can Be High

While PayPal offers many free services, its fee structure can be costly:

- Standard transaction fees range from 2.9% + $0.30 for domestic transactions

- Higher fees for international transactions

- Additional fees for instant transfers and certain business transactions

These fees can significantly eat into profits, especially for high-volume traders or businesses operating on thin margins.

Account Freezes and Limitations

PayPal has been known to freeze accounts or place limitations, which can be problematic:

- Sudden account freezes can disrupt business operations

- Funds may be held for extended periods

- Limited recourse for users facing account restrictions

This risk is particularly concerning for businesses that rely heavily on PayPal for their cash flow.

Currency Conversion Fees

For those dealing in multiple currencies, PayPal’s conversion fees can be a drawback:

- Currency conversion fee of 3-4% above the base exchange rate

- Lack of transparency in exchange rates offered

- Potentially unfavorable rates compared to specialized forex services

These fees can significantly impact the profitability of international transactions and investments.

Limited Cryptocurrency Options

While PayPal has entered the cryptocurrency space, its offerings are still limited:

- Only a few major cryptocurrencies supported (Bitcoin, Ethereum, Litecoin, Bitcoin Cash)

- Cannot transfer crypto to external wallets

- Limited functionality compared to dedicated crypto exchanges

This limitation may be frustrating for serious cryptocurrency traders and investors who require more advanced features.

Potential for Chargebacks

The risk of chargebacks can be a significant concern, especially for sellers:

- Buyers can dispute transactions up to 180 days after purchase

- Chargeback process can be time-consuming and costly for sellers

- Higher risk in certain industries (e.g., digital goods, high-value items)

This risk can be particularly problematic for businesses dealing in non-tangible assets or services.

Customer Service Issues

PayPal’s customer service has been a point of criticism:

- Limited direct contact options

- Long response times for complex issues

- Automated systems that may not adequately address unique problems

For users dealing with time-sensitive financial matters, these service issues can be particularly frustrating and potentially costly.

Not Ideal for Large Business Transactions

PayPal may not be the best choice for large-scale business operations:

- Transaction limits may be too low for high-value deals

- Lack of specialized features for complex business needs

- Higher fees compared to traditional merchant accounts for large volumes

Businesses operating in finance or dealing with large transactions may find PayPal’s limitations restrictive.

Privacy Concerns

Some users have expressed concerns about PayPal’s data practices:

- Collection and use of personal and financial data

- Sharing of information with third parties

- Potential for data breaches

In an era of increasing digital privacy concerns, these issues may be particularly worrying for those dealing with sensitive financial information.

Conclusion

PayPal offers a mix of convenience and functionality that has made it a popular choice for online transactions. Its user-friendly interface, wide acceptance, and diverse features make it an attractive option for many individuals and businesses. However, the platform’s fees, account stability issues, and limitations in certain areas like cryptocurrency trading can be significant drawbacks.

For those involved in finance, crypto, forex, and money markets, PayPal can be a useful tool, particularly for smaller transactions and everyday use. However, it should be considered as part of a broader financial strategy rather than a one-size-fits-all solution. As with any financial service, it’s crucial to weigh the pros and cons in the context of your specific needs and risk tolerance.

Ultimately, while PayPal has revolutionized online payments, users should be aware of its limitations and consider alternative options for specialized financial activities, especially those involving large sums or requiring advanced features not offered by the platform.

Frequently Asked Questions About PayPal Pros and Cons

- Is PayPal safe for online transactions?

PayPal is generally considered safe due to its encryption technology and buyer/seller protection policies. However, users should still exercise caution and follow best practices for online security. - Can I use PayPal for forex trading?

While PayPal supports multiple currencies, it’s not specifically designed for forex trading. The platform’s currency conversion fees and exchange rates may not be competitive for frequent traders. - How does PayPal compare to traditional bank transfers for international payments?

PayPal often offers faster transfer times and easier setup than traditional bank transfers. However, bank transfers may be more cost-effective for large amounts due to PayPal’s percentage-based fees. - Are there any alternatives to PayPal for cryptocurrency transactions?

Yes, there are several alternatives like Coinbase, Binance, and Kraken that offer more extensive cryptocurrency services. These platforms typically provide a wider range of cryptocurrencies and more advanced trading features. - How quickly can I access funds received through PayPal?

Funds are usually available immediately in your PayPal balance. Transferring to a bank account typically takes 1-3 business days, while instant transfers to eligible debit cards are available for a fee. - Does PayPal offer any benefits for high-volume merchants?

PayPal offers volume-based discounts for eligible merchants. However, businesses with very high transaction volumes might find better rates with traditional merchant accounts. - Can PayPal be integrated with accounting software for business use?

Yes, PayPal integrates with various accounting software like QuickBooks and Xero, making it easier for businesses to manage their finances and reconcile transactions. - How does PayPal handle disputes and fraud prevention?

PayPal uses advanced fraud detection systems and offers a resolution center for disputes. While this protects users, it can sometimes lead to account limitations or holds on funds during investigations.