Pensions are a crucial component of retirement planning, offering individuals a means to secure financial stability in their later years. As defined-benefit plans, pensions provide guaranteed income based on factors such as salary history and years of service. While they offer numerous advantages, they also come with significant drawbacks. This article explores the pros and cons of pension plans, helping individuals understand their implications in the context of finance, including investments in crypto, forex, and other money markets.

| Pros | Cons |

|---|---|

| Guaranteed income for life | Lack of control over investments |

| No employee contributions required | Strict withdrawal rules |

| Predictable retirement benefits | Potential for reduced benefits if employer faces financial issues |

| Inflation protection in some plans | Limited flexibility in accessing funds |

| Death benefits for beneficiaries | Long vesting periods in some cases |

| Employer bears investment risk | Potential tax implications upon withdrawal |

Guaranteed Income for Life

One of the most significant advantages of pension plans is the guaranteed income for life. This feature provides retirees with a steady stream of income that can help cover living expenses without the worry of market fluctuations.

- Financial Security: Knowing that a specific amount will be received monthly can alleviate anxiety about outliving savings.

- Budgeting Ease: Predictable income allows for better financial planning and budgeting throughout retirement.

Lack of Control Over Investments

A notable disadvantage of pension plans is that employees typically have no control over how their funds are invested.

- Investment Decisions: The employer or a designated fund manager makes all investment decisions, which may not align with an employee’s personal investment philosophy or risk tolerance.

- Performance Risks: If the chosen investments underperform, employees cannot adjust their portfolios to mitigate losses.

No Employee Contributions Required

Pension plans often do not require employees to make contributions, which can be seen as a significant advantage.

- Increased Disposable Income: Without mandatory contributions, employees can allocate more of their salary towards immediate needs or other investments.

- Employer Funding: Employers typically shoulder the financial responsibility for funding the pension plan, which can be beneficial for employees.

Strict Withdrawal Rules

While pensions offer guaranteed income, they also come with strict withdrawal rules that can limit access to funds.

- Age Restrictions: Employees usually cannot access pension funds until reaching a certain age, often 65.

- Job Changes: If an employee leaves their job before retirement age, they may face restrictions on transferring or withdrawing pension benefits.

Predictable Retirement Benefits

Pensions provide predictable retirement benefits based on a formula that considers salary and years of service.

- Clear Expectations: Employees can estimate their retirement income based on their employment history.

- Financial Planning: This predictability aids in long-term financial planning and reduces uncertainty regarding future income.

Potential for Reduced Benefits if Employer Faces Financial Issues

A significant risk associated with pensions is the potential for reduced benefits if the employer experiences financial difficulties.

- Bankruptcy Risks: If a company goes bankrupt, the pension benefits may be reduced or lost entirely. Although protections exist through government agencies like the Pension Benefit Guaranty Corporation (PBGC), they may not cover all promised benefits.

- Employer Responsibility: The burden of maintaining the pension fund lies solely with the employer, leaving employees vulnerable to corporate financial health.

Inflation Protection in Some Plans

Certain pension plans offer inflation protection, ensuring that benefits maintain purchasing power over time.

- Cost-of-Living Adjustments (COLAs): Some pensions include provisions for annual increases tied to inflation rates.

- Long-Term Stability: This feature helps retirees manage rising costs associated with living expenses throughout retirement.

Limited Flexibility in Accessing Funds

Pensions generally offer limited flexibility regarding how and when funds can be accessed.

- Fixed Payment Structures: Retirees receive set payments at predetermined intervals without options for lump-sum withdrawals or variable payment amounts.

- Transfer Limitations: Unlike 401(k) plans, pensions are not easily transferable between jobs or accounts.

Death Benefits for Beneficiaries

Many pension plans provide death benefits that can be passed on to beneficiaries, adding an extra layer of security.

- Survivor Benefits: In many cases, if a retiree passes away before their spouse or other designated beneficiaries, those individuals may receive a portion of the pension benefits.

- Financial Security for Loved Ones: This feature can provide peace of mind knowing that loved ones will have some financial support after one’s passing.

Long Vesting Periods in Some Cases

Some pension plans require lengthy vesting periods before employees become entitled to full benefits.

- Commitment Required: Employees may need to work several years—often five to ten—before they earn any pension benefits.

- Job Mobility Issues: This requirement can discourage employees from changing jobs or pursuing new opportunities if they fear losing accrued benefits.

Employer Bears Investment Risk

In contrast to defined contribution plans like 401(k)s, pensions place the investment risk on the employer rather than the employee.

- Reduced Personal Risk: Employees do not need to worry about market downturns affecting their retirement income directly.

- Stability in Income: Since employers manage investment strategies, retirees benefit from professional management without personal involvement.

Potential Tax Implications Upon Withdrawal

While pensions provide tax-deferred growth during accumulation phases, there are potential tax implications when withdrawing funds during retirement.

- Ordinary Income Tax Rates: Pension withdrawals are typically taxed as ordinary income, which could lead to higher tax liabilities depending on overall income levels during retirement.

- Planning Considerations: Retirees must consider tax implications when planning withdrawals to minimize tax burdens effectively.

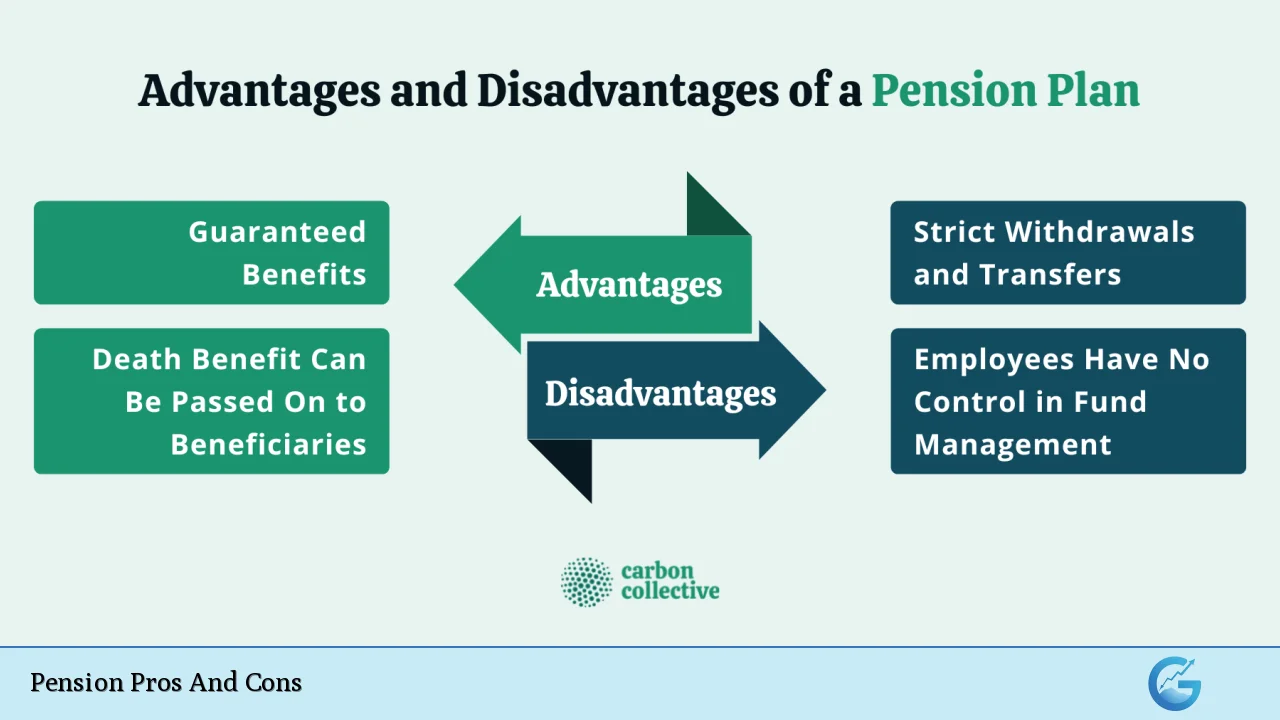

In conclusion, understanding the pros and cons of pension plans is essential for making informed decisions about retirement savings. While pensions offer guaranteed income and financial security during retirement, they also present challenges such as lack of control over investments and potential risks associated with employer solvency.

Individuals should weigh these factors carefully against their personal financial situations and retirement goals. As part of a comprehensive retirement strategy that may include other investment vehicles such as 401(k)s or IRAs, pensions can play a vital role in achieving long-term financial stability and peace of mind during retirement years.

Frequently Asked Questions About Pension Pros And Cons

- What is a pension plan?

A pension plan is a retirement savings plan funded by an employer that provides guaranteed monthly payments to retirees based on salary and years of service. - What are the main advantages of having a pension?

The main advantages include guaranteed lifetime income, no required employee contributions, predictable benefits, and potential death benefits for beneficiaries. - What are common disadvantages associated with pensions?

Disadvantages include lack of control over investments, strict withdrawal rules, potential reductions due to employer bankruptcy risks, and long vesting periods. - How does inflation affect pensions?

Some pensions offer inflation protection through cost-of-living adjustments (COLAs), helping maintain purchasing power over time. - Can I transfer my pension if I change jobs?

Pensions are generally not transferable like 401(k) accounts; however, you may leave your funds until retirement age. - What happens to my pension if my employer goes bankrupt?

If your employer goes bankrupt, your benefits may be reduced; however, some protections exist through government agencies like PBGC. - Are there tax implications when withdrawing from a pension?

Yes, withdrawals from pensions are taxed as ordinary income, which could affect your overall tax liability during retirement. - How does a pension compare to other retirement savings options?

Pensions typically offer guaranteed income but less flexibility compared to defined contribution plans like 401(k)s.