Permanent life insurance is a type of life insurance policy that provides coverage for the insured’s entire lifetime, as long as premiums are paid. Unlike term life insurance, which only covers a specific period, permanent life insurance combines a death benefit with a cash value component that grows over time. This dual nature makes it an attractive option for individuals seeking long-term financial security and investment opportunities. However, it is essential to weigh the advantages and disadvantages before making a decision.

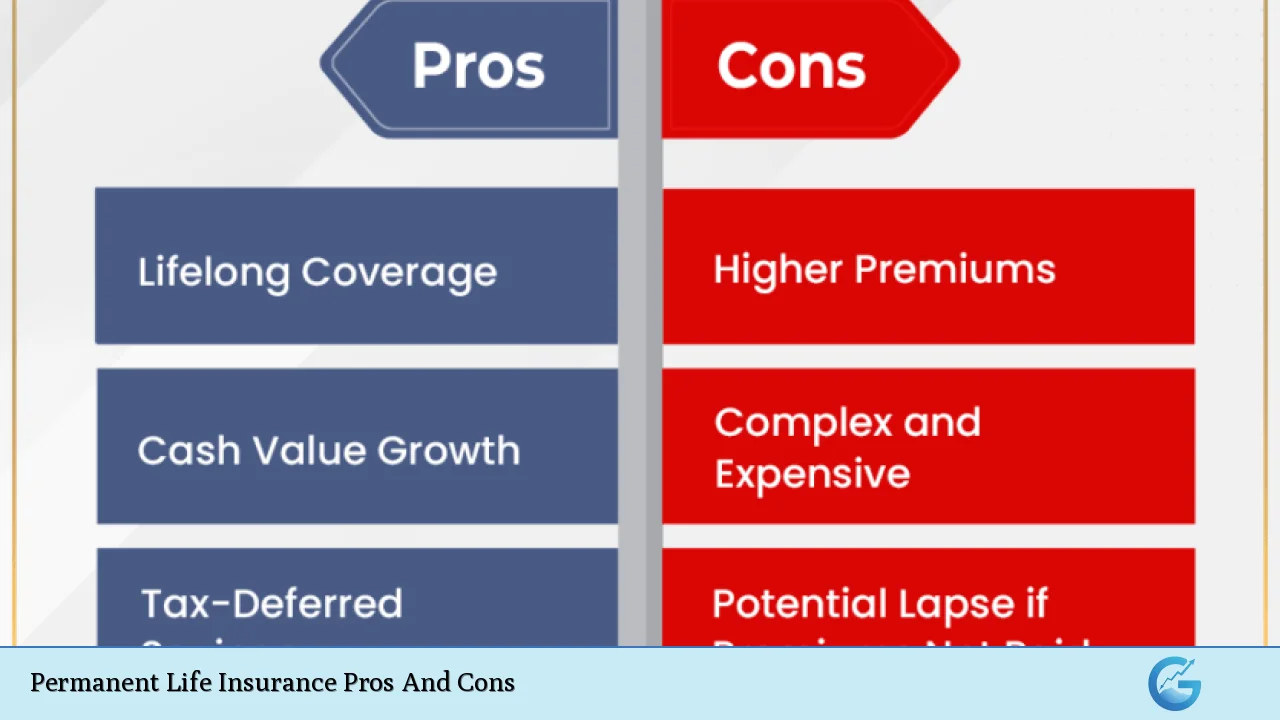

| Pros | Cons |

|---|---|

| Lifelong coverage ensures beneficiaries receive a death benefit. | Higher premiums compared to term life insurance. |

| Cash value accumulates over time, providing a savings component. | Complexity in understanding policy terms and conditions. |

| Tax-deferred growth on cash value. | Potential for policy lapse if premiums are not maintained. |

| Ability to borrow against cash value without credit checks. | Loans against the policy reduce the death benefit. |

| Fixed premiums provide predictability in budgeting. | Limited investment options compared to other investment vehicles. |

Lifelong Coverage

One of the most significant advantages of permanent life insurance is its lifelong coverage. As long as the policyholder continues to pay their premiums, the policy remains in force, ensuring that beneficiaries will receive a death benefit regardless of when the insured passes away. This feature is particularly beneficial for individuals who want to provide financial security for their loved ones throughout their lives.

- Security for Dependents: Permanent life insurance is ideal for those with lifelong dependents, such as children or spouses who may rely on them financially.

- Estate Planning: It can be an essential tool in estate planning, helping to cover estate taxes and ensuring that heirs receive the intended inheritance.

Cash Value Accumulation

Permanent life insurance policies include a cash value component that grows over time. This cash value can be accessed during the policyholder’s lifetime, providing a source of funds for various needs.

- Savings Component: The cash value accumulates at a guaranteed rate, offering a safe place to save money.

- Flexibility: Policyholders can borrow against this cash value for emergencies or significant expenses without undergoing credit checks.

Tax Advantages

The cash value in permanent life insurance grows tax-deferred, meaning policyholders do not have to pay taxes on the gains as long as they remain within the policy. This feature provides an additional layer of financial benefit.

- Tax-Free Death Benefit: The death benefit paid to beneficiaries is generally tax-free, making it an attractive option for wealth transfer.

- Tax-Free Loans: Loans taken against the cash value are also tax-free, provided the policy remains active.

Fixed Premiums

Permanent life insurance typically features fixed premiums that do not increase with age or health changes. This predictability can make budgeting easier for policyholders.

- Budgeting: Knowing that premiums will remain constant allows individuals to plan their finances more effectively.

- Long-Term Commitment: Fixed premiums can be advantageous for those looking to maintain coverage over many years without unexpected cost increases.

Higher Premiums

Despite its numerous advantages, one of the most significant drawbacks of permanent life insurance is its higher premiums compared to term life insurance.

- Cost Considerations: The initial costs can be significantly higher—often five to fifteen times more than term policies—making it less accessible for younger individuals or those on tight budgets.

- Affordability Issues: As financial situations change, some individuals may find it challenging to maintain these higher premium payments over time.

Complexity

Permanent life insurance policies can be more complex than term policies, often involving intricate terms and conditions that may confuse potential buyers.

- Understanding Terms: The various features and options available can lead to misunderstandings about how the policy works.

- Need for Guidance: Individuals may require professional advice or extensive research to fully comprehend their options and obligations under a permanent policy.

Risk of Policy Lapse

If premium payments are missed or become unaffordable, there is a risk that the policy could lapse.

- Loss of Coverage: A lapsed policy means losing coverage and any benefits associated with it, which can leave beneficiaries unprotected.

- Reinstatement Challenges: Reinstating a lapsed policy may involve additional costs and could require medical underwriting, potentially leading to higher premiums if health has declined.

Loans Against Cash Value

While borrowing against the cash value of a permanent life insurance policy offers flexibility, it also comes with risks.

- Reduced Death Benefit: Any loans taken out will reduce the death benefit payable to beneficiaries if not repaid.

- Interest Charges: Borrowed amounts accrue interest, which can complicate repayment and further reduce the overall benefits of the policy.

Limited Investment Options

Although permanent life insurance includes a cash value component, it often provides limited investment flexibility compared to other investment vehicles like mutual funds or retirement accounts.

- Investment Growth Potential: The growth rate on cash value may be lower than what could be achieved through other investments, which could limit overall financial growth potential.

- Market Exposure: Some policies offer variable components that allow investment in stocks or bonds; however, these options come with market risks that may not align with all investors’ risk tolerance levels.

In conclusion, permanent life insurance presents both significant advantages and notable disadvantages. It provides lifelong coverage, cash value accumulation, tax benefits, and predictable premiums. However, potential buyers must carefully consider higher costs, complexity, risks of lapsing policies, and limited investment flexibility.

Ultimately, individuals interested in permanent life insurance should assess their financial goals and consult with financial advisors to determine if this type of coverage aligns with their long-term objectives and needs.

Frequently Asked Questions About Permanent Life Insurance

- What is permanent life insurance?

Permanent life insurance is a type of life insurance that provides coverage for your entire lifetime as long as premiums are paid. It includes both a death benefit and a cash value component that grows over time. - How does cash value work in permanent life insurance?

The cash value accumulates over time based on premium payments and interest credited by the insurer. Policyholders can borrow against this cash value or withdraw funds during their lifetime. - Are premiums fixed in permanent life insurance?

Yes, most permanent life insurance policies have fixed premiums that do not increase with age or health changes, providing predictability in budgeting. - What happens if I miss premium payments?

If you miss premium payments and do not catch up within the grace period, your policy may lapse, resulting in loss of coverage and benefits. - Can I access my cash value without penalties?

You can access your cash value through loans or withdrawals; however, loans accrue interest and reduce your death benefit if not repaid. - Is the death benefit from permanent life insurance taxable?

Generally, the death benefit paid out to beneficiaries is tax-free under federal law. - How does permanent life insurance compare to term life insurance?

Permanent life insurance offers lifelong coverage and builds cash value but comes with higher premiums compared to term life insurance, which only provides coverage for a specified period at lower costs. - Who should consider purchasing permanent life insurance?

Individuals seeking lifelong protection for dependents or those interested in using life insurance as part of their estate planning strategy may find permanent life insurance beneficial.