Personal loans have become a popular financial product for individuals seeking quick access to funds without the need for collateral. These loans can be utilized for a variety of purposes, including debt consolidation, home improvements, and unexpected expenses. However, like any financial tool, personal loans come with their own set of advantages and disadvantages that potential borrowers should carefully consider. This article explores the pros and cons of personal loans in detail, providing insights to help you make informed financial decisions.

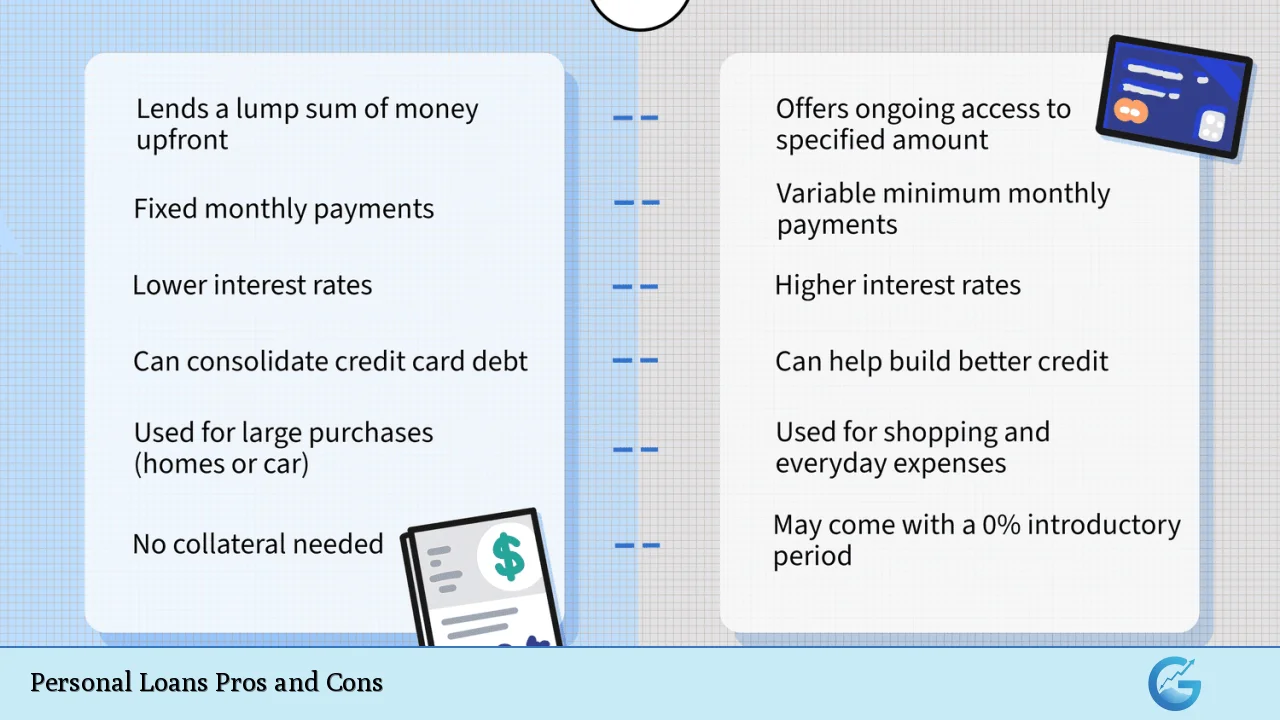

| Pros | Cons |

|---|---|

| Flexibility in usage | Potential high interest rates |

| Quick access to funds | Fees and penalties may apply |

| Fixed repayment terms | Impact on credit score if mismanaged |

| No collateral required | Risk of accumulating more debt |

| Can improve credit score if used wisely | May lead to financial strain if not budgeted properly |

Flexibility in Usage

One of the most significant advantages of personal loans is their flexibility. Borrowers can use the funds for a wide range of purposes, including:

- Debt consolidation: Combining multiple debts into a single loan can simplify payments and potentially lower interest rates.

- Home improvements: Personal loans can finance renovations or repairs, increasing property value.

- Medical expenses: They provide immediate funds for unexpected medical bills.

- Major purchases: Whether it’s a wedding or a vacation, personal loans can help cover significant expenses.

This versatility makes personal loans an attractive option for many individuals looking to manage their finances more effectively.

Quick Access to Funds

Personal loans are known for their rapid approval processes. Many lenders offer online applications that can lead to funding within a day or two. This speed is particularly beneficial in emergencies when immediate cash is needed.

- Same-day funding: Some lenders can deposit funds into your account on the same day you apply if you meet their criteria.

- Streamlined application process: The ease of applying online has made personal loans more accessible than ever.

This quick access to funds allows borrowers to address urgent financial needs without lengthy delays commonly associated with other types of loans.

Fixed Repayment Terms

Another advantage of personal loans is the predictability they offer. Most personal loans come with fixed interest rates and fixed monthly payments, which means borrowers know exactly how much they need to pay each month for the duration of the loan.

- Budgeting ease: Fixed payments help individuals plan their budgets effectively without worrying about fluctuating interest rates.

- Longer repayment terms: Many lenders offer terms ranging from one to seven years, allowing borrowers to choose a repayment schedule that fits their financial situation.

This structure can provide peace of mind as it reduces the uncertainty associated with variable-rate loans or credit cards.

No Collateral Required

Most personal loans are unsecured, meaning they do not require collateral such as a home or car. This feature makes them accessible to a broader audience since borrowers do not risk losing valuable assets if they cannot repay the loan.

- Lower risk: Without collateral requirements, borrowers can take out loans without putting their property on the line.

This aspect is particularly appealing for those who may not have significant assets but need financial assistance.

Can Improve Credit Score If Used Wisely

When managed correctly, personal loans can positively impact your credit score. By consolidating high-interest debt into a single loan and making timely payments, borrowers can improve their credit utilization ratio and payment history.

- Building credit history: Regular on-time payments demonstrate responsible borrowing behavior, which can enhance creditworthiness over time.

However, it is essential to approach this benefit with caution; irresponsible use can lead to negative consequences instead.

Potential High Interest Rates

Despite their many advantages, personal loans often come with higher interest rates compared to secured loans or mortgages. Borrowers with lower credit scores may face even steeper rates.

- Cost implications: Higher interest rates mean that borrowing costs can accumulate quickly, leading to more significant overall debt if not managed properly.

This factor makes it crucial for potential borrowers to shop around for the best rates and terms before committing to a loan.

Fees and Penalties May Apply

Many lenders charge fees associated with personal loans, including origination fees, late payment fees, and prepayment penalties. These costs can add up and significantly impact the total amount repaid over time.

- Understanding total costs: It’s essential to read the fine print and understand all potential fees before taking out a loan.

Being aware of these additional costs helps borrowers make informed decisions about whether a personal loan is truly affordable in their specific situation.

Impact on Credit Score If Mismanaged

While personal loans can improve credit scores when used responsibly, they can also have detrimental effects if mismanaged. Missing payments or defaulting on a loan can severely damage your credit rating.

- Credit score risks: A lower credit score may affect future borrowing capabilities and lead to higher interest rates on other forms of credit.

Borrowers must assess their ability to repay before taking out a loan to avoid these negative repercussions.

Risk of Accumulating More Debt

The accessibility of personal loans can sometimes lead individuals into a cycle of debt. Borrowers might be tempted to take out multiple loans or fail to address underlying financial issues that led them to borrow in the first place.

- Financial discipline required: It’s crucial for borrowers to have a solid plan for repayment and avoid using new loans as a means to cover existing debts without making lifestyle changes.

This behavior can exacerbate financial problems rather than solve them, leading to increased stress and potential bankruptcy in severe cases.

May Lead to Financial Strain If Not Budgeted Properly

Taking on additional debt through a personal loan requires careful budgeting. If borrowers do not account for monthly payments within their overall financial plan, they may find themselves struggling to meet other obligations.

- Importance of budgeting: Creating a detailed budget that includes all income sources and expenses will help ensure that loan repayments are manageable alongside other financial responsibilities.

Failing to budget properly could lead to missed payments and further financial difficulties down the line.

In conclusion, personal loans offer various benefits such as flexibility in usage, quick access to funds, fixed repayment terms, no collateral requirements, and potential credit score improvements when managed wisely. However, they also come with drawbacks like high-interest rates, fees, potential negative impacts on credit scores if mismanaged, risks of accumulating more debt, and possible financial strain if not budgeted properly.

Before deciding on a personal loan, it’s essential for borrowers to evaluate their financial situation carefully and consider whether this type of financing aligns with their long-term goals. By understanding both the strengths and weaknesses of personal loans, individuals can make informed choices that best suit their needs in today’s complex financial landscape.

Frequently Asked Questions About Personal Loans

- What are personal loans used for?

Personal loans can be used for various purposes such as consolidating debt, financing home improvements, covering medical expenses, or making large purchases. - How quickly can I get a personal loan?

Many lenders offer fast approval processes that allow you to receive funds within one business day or even on the same day. - Do I need good credit to qualify for a personal loan?

While having good credit improves your chances of approval and lower interest rates, some lenders offer options for those with less-than-perfect credit. - What is the typical repayment term for personal loans?

Repayment terms generally range from one year (12 months) up to seven years (84 months), depending on the lender. - Are there any fees associated with personal loans?

Yes, many lenders charge origination fees or late payment penalties; it’s important to read all terms carefully before applying. - Can I pay off my personal loan early?

Most lenders allow early repayment without penalties; however, some may charge fees for paying off your loan ahead of schedule. - How does taking out a personal loan affect my credit score?

If managed well with timely payments, it can improve your score; however, missed payments or defaults will negatively impact it. - Is it better to use a personal loan or credit card?

This depends on individual circumstances; generally, personal loans have lower interest rates compared to credit cards but lack ongoing access like revolving credit.