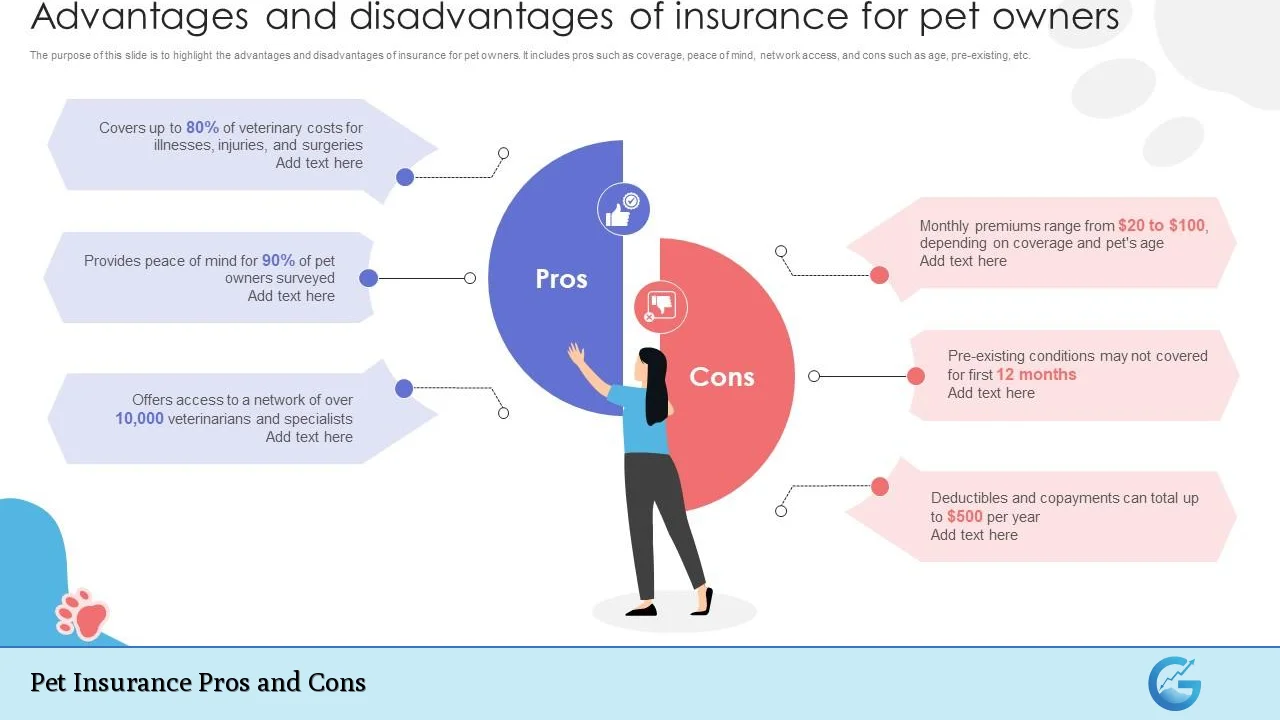

Pet insurance has become an increasingly popular option for pet owners seeking financial protection against unexpected veterinary expenses. As the costs of veterinary care continue to rise, many pet owners are considering whether investing in pet insurance is a wise decision. This article delves into the advantages and disadvantages of pet insurance, providing a comprehensive overview to help potential policyholders make informed choices.

| Pros | Cons |

|---|---|

| Financial protection against high veterinary bills | Monthly premiums can add up over time |

| Peace of mind for pet owners | Claims process can be cumbersome |

| Access to a wider range of treatment options | Exclusions for pre-existing conditions |

| Flexible coverage options available | Coverage may decrease as pets age |

| Encourages preventive care and regular check-ups | Not all policies cover routine care |

| Can help manage unexpected emergencies | Potential for premium increases over time |

| Offers various types of plans to suit different needs | You may pay more in premiums than you claim back |

| Can provide coverage for hereditary conditions | Limited availability for older pets or certain breeds |

Financial Protection Against High Veterinary Bills

One of the primary advantages of pet insurance is its ability to provide financial protection against unexpected veterinary expenses.

- Emergency treatments: Pet insurance can cover significant portions of emergency treatments, surgeries, or chronic illness management, alleviating the financial burden on pet owners.

- Costly procedures: Many pet owners face bills that can exceed thousands of dollars for surgeries or advanced medical care. Insurance can help mitigate these costs.

Peace of Mind for Pet Owners

Having pet insurance offers peace of mind, allowing pet owners to focus on their pets’ health without worrying excessively about costs.

- Avoiding difficult decisions: Insurance helps prevent situations where owners must choose between their pet’s health and their financial situation.

- Emotional relief: Knowing that you have coverage can reduce stress during emergencies, enabling you to make decisions based on your pet’s needs rather than financial constraints.

Access to a Wider Range of Treatment Options

Pet insurance can expand the range of treatment options available to pet owners.

- More comprehensive care: With insurance, owners may feel more comfortable opting for advanced treatments that they might otherwise avoid due to cost.

- Encourages proactive care: Pet insurance can encourage regular check-ups and preventive care, leading to better overall health outcomes for pets.

Flexible Coverage Options Available

Pet insurance policies come with various coverage options tailored to different needs and budgets.

- Customizable plans: Owners can select from accident-only plans, comprehensive illness coverage, or wellness plans that include routine care.

- Adaptable to specific needs: This flexibility allows pet owners to choose a plan that best fits their lifestyle and financial situation.

Encourages Preventive Care and Regular Check-Ups

Pet insurance often promotes regular veterinary visits and preventive care measures.

- Routine check-ups covered: Some policies include coverage for vaccinations, flea control, and other preventive measures.

- Long-term health benefits: Regular visits can lead to early detection of health issues, which can save money and improve the quality of life for pets.

Can Help Manage Unexpected Emergencies

Emergencies are unpredictable, and having pet insurance can provide a safety net during such times.

- Financial buffer: In cases where pets experience sudden illnesses or accidents, insurance can help manage unexpected expenses.

- Access to urgent care: Pet owners are more likely to seek immediate care when they know they have financial backing through their insurance policy.

Potential Drawbacks of Pet Insurance

While there are many benefits to pet insurance, there are also several drawbacks that potential policyholders should consider.

Monthly Premiums Can Add Up Over Time

One significant disadvantage is the ongoing cost associated with monthly premiums.

- Long-term expense: Depending on the plan and the pet’s age or breed, monthly premiums can range significantly but may become a substantial expense over time.

- Cost vs. benefit analysis: For some healthy pets, the cost of premiums may exceed the benefits received from claims.

Claims Process Can Be Cumbersome

The claims process for pet insurance is not always straightforward and can be frustrating for some owners.

- Out-of-pocket payments required: Most policies require owners to pay veterinary bills upfront before filing claims for reimbursement.

- Complex paperwork: The need to submit claims personally may involve navigating complex paperwork and waiting periods for reimbursement.

Exclusions for Pre-existing Conditions

Pre-existing conditions are often excluded from coverage, which can limit the effectiveness of a policy.

- Understanding exclusions: Many policies do not cover conditions that existed before the policy was purchased, which can leave some pets unprotected.

- Potential gaps in coverage: Owners should thoroughly review policy details to understand what is excluded before purchasing insurance.

Coverage May Decrease as Pets Age

As pets grow older, their insurance coverage may change in ways that could be disadvantageous.

- Increased premiums with age: Premiums typically rise as pets age, which can make continued coverage financially burdensome.

- Reduced benefits: Some policies may reduce coverage percentages as pets age or introduce new exclusions that were not present when the policy was first taken out.

Not All Policies Cover Routine Care

While some policies offer wellness plans that include routine care, many do not cover these essential services.

- Additional costs for routine visits: Owners may still need to pay out-of-pocket for vaccinations and preventive treatments if their policy does not include them.

- Budgeting challenges: This limitation means that even with insurance, routine veterinary costs must still be factored into overall budgeting.

Potential for Premium Increases Over Time

Another concern is that premiums may increase significantly over time, especially after claims are made.

- Annual premium hikes: Many insurers raise premiums annually based on factors like age or previous claims history.

- Financial planning issues: Sudden increases in premiums can complicate budgeting and lead some owners to reconsider their coverage options.

You May Pay More in Premiums Than You Claim Back

For some pet owners, particularly those with healthy pets, there is a risk that they will pay more in premiums than they ever claim back from their insurance provider.

- Cost-benefit ratio considerations: If a pet remains healthy throughout its life, the total amount paid in premiums could far exceed any potential reimbursement received.

- Self-insurance alternative: Some owners might find it more cost-effective to set aside funds each month for potential veterinary expenses instead of paying monthly premiums.

Limited Availability for Older Pets or Certain Breeds

Finding suitable coverage for older pets or specific breeds can be challenging due to restrictions imposed by insurers.

- Age restrictions on policies: Many insurers impose age limits on new policies or only offer limited accident-only coverage for older animals.

- Breed-specific limitations: Certain breeds may face higher premiums or exclusions due to predisposed health conditions associated with those breeds.

In conclusion, deciding whether to invest in pet insurance requires careful consideration of both its pros and cons. While it offers significant advantages such as financial protection against high veterinary bills and peace of mind during emergencies, it also comes with drawbacks like rising premiums and potential exclusions. Each pet owner’s situation is unique; thus, evaluating personal circumstances alongside these factors is crucial before making a decision about obtaining pet insurance.

Frequently Asked Questions About Pet Insurance

- What types of coverage does pet insurance offer?

Pet insurance typically offers accident-only plans, illness plans covering various conditions, and wellness plans that include routine care. - Is pet insurance worth it?

This depends on your financial situation and your pet’s health; it provides peace of mind but may not always result in savings. - Can I use any veterinarian with my pet insurance?

Most pet insurance plans allow you to use any licensed veterinarian without network restrictions. - What happens if my pet has a pre-existing condition?

Most policies do not cover pre-existing conditions; it’s vital to understand your plan’s specifics before purchasing. - How do I file a claim with my pet insurance?

You typically need to pay your vet upfront and then submit a claim form along with receipts for reimbursement. - Will my premium increase as my pet ages?

Yes, most insurers raise premiums as pets get older due to increased health risks. - Are there any limitations on what procedures are covered?

Certain procedures may be excluded based on the policy; it’s essential to read the fine print regarding coverage limitations. - When is the best time to get pet insurance?

The best time is when your pet is young and healthy; this minimizes the risk of pre-existing conditions affecting your coverage.