Obtaining a Forex license in Poland is a crucial step for brokers and financial institutions looking to operate in the Polish market. This comprehensive guide will explore the intricacies of acquiring a Forex license in Poland, including regulatory requirements, application processes, and key considerations for both local and international entities.

| Aspect | Details | Implications |

|---|---|---|

| Regulatory Authority | Polish Financial Supervision Authority (KNF) | Oversees licensing and regulation of Forex brokers |

| Minimum Capital Requirement | €125,000 – €730,000 (depending on services offered) | Ensures financial stability and protects investors |

| Processing Time | 3-6 months (average) | Requires thorough preparation and patience |

Regulatory Framework and Requirements

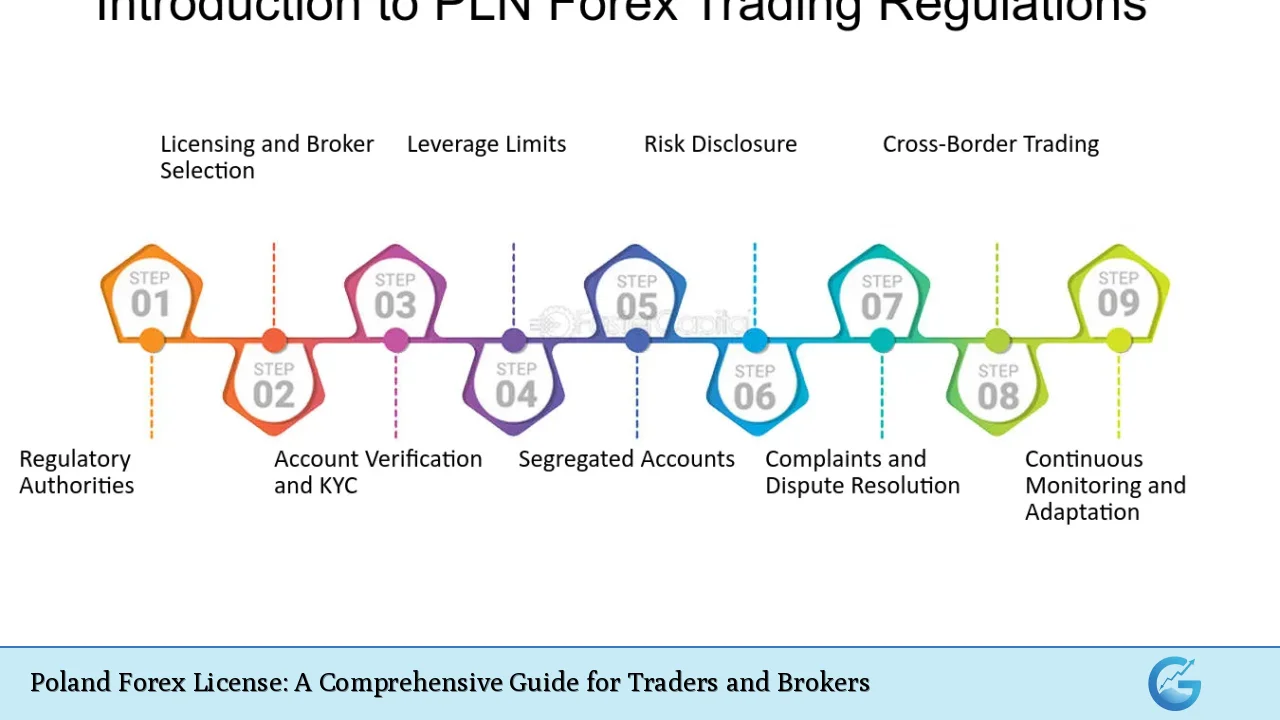

The Polish Financial Supervision Authority (KNF) is the primary regulatory body overseeing Forex trading activities in Poland. As a member of the European Union, Poland adheres to the Markets in Financial Instruments Directive II (MiFID II), which sets harmonized standards for financial services across the EU.

Key requirements for obtaining a Forex license in Poland:

- Legal entity establishment in Poland (typically as a limited liability company or joint-stock company)

- Minimum capital requirements (varying based on the scope of services)

- Qualified management team with relevant experience

- Robust risk management and compliance systems

- Detailed business plan and operational procedures

- Anti-Money Laundering (AML) and Know Your Customer (KYC) policies

User experiences suggest that while the process is thorough, it is manageable with proper preparation and guidance. Many brokers recommend engaging legal experts familiar with Polish financial regulations to navigate the complexities of the application process.

Application Process and Documentation

The application process for a Poland Forex license involves several steps and requires meticulous preparation of documentation.

Essential documents for the application:

- Articles of Association

- Proof of capital

- Detailed business plan

- CVs and criminal record checks for key personnel

- AML and compliance policies

- IT systems and security protocols

Technical aspects of the application often include demonstrating the robustness of trading platforms and risk management systems. Brokers who have successfully obtained licenses emphasize the importance of transparency and thoroughness in all submitted documents.

Recommendations from industry experts include:

- Start the preparation process early, as gathering all required documents can be time-consuming

- Ensure all translations are certified if documents are not in Polish

- Be prepared for additional information requests from the KNF during the review process

Operational Considerations and Ongoing Compliance

Once licensed, Forex brokers in Poland must adhere to strict operational standards and ongoing compliance requirements.

Key operational considerations include:

- Maintaining adequate capital ratios

- Regular reporting to the KNF

- Continuous monitoring of trading activities

- Updating policies and procedures in line with regulatory changes

User experiences highlight the importance of robust compliance systems and regular staff training to ensure adherence to regulatory requirements. Many brokers invest in advanced technology solutions to automate compliance processes and minimize human error.

Recommendations for maintaining compliance:

- Implement a dedicated compliance team or officer

- Conduct regular internal audits

- Stay informed about regulatory updates and industry best practices

Market Opportunities and Challenges

The Polish Forex market presents both opportunities and challenges for licensed brokers. With a growing economy and increasing interest in financial markets, Poland offers a promising landscape for Forex trading.

Market opportunities:

- Large and growing retail investor base

- Increasing financial literacy among Polish citizens

- Strategic location for accessing Eastern European markets

However, brokers must also navigate challenges such as:

- Intense competition from both local and international brokers

- Evolving regulatory landscape, including potential changes in EU-wide regulations

- Need for localized marketing and customer support

User experiences suggest that success in the Polish market often depends on offering competitive spreads, robust educational resources, and excellent customer service. Many brokers have found success by tailoring their offerings to the specific needs and preferences of Polish traders.

Cross-Border Considerations

For international brokers looking to enter the Polish market, there are additional considerations regarding cross-border operations.

Key points for international brokers:

- Passporting rights for EU-licensed brokers

- Compliance with both Polish and home country regulations

- Cultural and language considerations in marketing and customer support

Brokers with experience in multiple jurisdictions emphasize the importance of understanding local market dynamics and regulatory nuances. Many recommend partnering with local experts or establishing a dedicated Polish team to ensure smooth operations.

In conclusion, obtaining a Forex license in Poland requires careful planning, substantial resources, and a commitment to ongoing compliance. While the process can be complex, the potential rewards of operating in the Polish market make it an attractive proposition for many brokers. By understanding the regulatory landscape, preparing thoroughly for the application process, and maintaining high operational standards, brokers can position themselves for success in this dynamic market.

FAQs

- How long does it take to obtain a Forex license in Poland?

The process typically takes 3-6 months, depending on the completeness of the application and responsiveness to KNF inquiries. - Can foreign entities apply for a Polish Forex license?

Yes, foreign entities can apply but must establish a legal presence in Poland. - What is the minimum capital requirement for a Forex broker in Poland?

The minimum capital ranges from €125,000 to €730,000, depending on the scope of services offered. - Are there any restrictions on leverage for Forex trading in Poland?

Yes, Poland follows EU regulations limiting retail client leverage to 1:30 for major currency pairs. - Can EU-licensed brokers operate in Poland without a local license?

EU-licensed brokers can passport their services to Poland but must still notify the KNF and comply with local regulations.