Prepaid funeral plans are arrangements made in advance to cover the costs of funeral services. These plans allow individuals to pay for their funerals ahead of time, either as a lump sum or through installments, ensuring that their wishes are honored and that financial burdens are alleviated for their loved ones. The growing interest in financial planning has led many to consider prepaid funeral plans as a viable option for end-of-life expenses. However, as with any financial product, there are both advantages and disadvantages to consider.

| Pros | Cons |

|---|---|

| Locks in current prices, protecting against inflation. | Not all funeral costs may be covered by the plan. |

| Provides peace of mind for both the individual and their family. | Plans may not be transferable if you move or choose a different provider. |

| Allows for personalization of funeral arrangements. | Funds are tied up and may not be accessible for other expenses. |

| Can ease the emotional burden on loved ones during a difficult time. | Potential for overpayment if inflation rates exceed investment growth. |

| Regulated by authorities, ensuring consumer protection. | Risk of provider insolvency could jeopardize the plan’s benefits. |

Locks in Current Prices

One of the most significant advantages of prepaid funeral plans is that they allow individuals to lock in current prices for funeral services. This is particularly beneficial in an environment where inflation is rising, as it protects families from future increases in funeral costs.

- Protection Against Inflation: By prepaying, individuals can ensure that their loved ones will not face unexpected financial burdens due to rising prices at the time of death.

- Cost Predictability: Families can budget more effectively when they know the costs associated with the funeral will not change.

Provides Peace of Mind

Prepaid funeral plans offer substantial peace of mind to both individuals and their families. Knowing that arrangements are made can alleviate stress during an already difficult time.

- Reduced Stress for Loved Ones: Families often struggle with decision-making during periods of grief. A prepaid plan simplifies this process by clearly outlining wishes and covering costs.

- Confidence in Arrangements: Individuals can rest assured that their preferences regarding their final send-off will be honored.

Allows for Personalization

These plans provide an opportunity for individuals to personalize their funeral arrangements according to their wishes.

- Choice of Services: Individuals can select specific services, such as burial or cremation, and choose details like caskets or urns.

- Tailored Experience: Personalizing a plan ensures that the service reflects the individual’s life and values, which can be comforting for family members.

Eases Emotional Burden

By taking care of funeral arrangements in advance, prepaid funeral plans can significantly ease the emotional burden on families.

- Less Decision-Making Pressure: With arrangements made ahead of time, families can focus on grieving rather than planning a funeral amidst their sorrow.

- Financial Relief: Knowing that funds are set aside for funeral expenses allows families to avoid financial strain during a challenging emotional period.

Regulated by Authorities

In many regions, including the United States, prepaid funeral plans are regulated by financial authorities. This regulation adds a layer of security for consumers.

- Consumer Protection: Regulatory oversight helps ensure that providers adhere to specific standards and practices.

- Dispute Resolution: If issues arise with a prepaid plan, consumers have access to dispute resolution mechanisms through regulatory bodies.

Not All Funeral Costs Covered

Despite their advantages, one notable disadvantage is that prepaid funeral plans do not always cover all associated costs.

- Additional Expenses May Arise: Certain aspects like memorial services or additional fees may not be included in the plan.

- Need for Clear Communication: It’s vital for individuals to understand what is covered and communicate this information clearly to family members.

Limited Transferability

Most prepaid funeral plans are tied to specific providers or locations, which can pose challenges if circumstances change.

- Difficulty in Transferring Plans: If an individual moves or wishes to change providers, transferring a prepaid plan can be complicated and may not always be possible.

- Potential Loss of Benefits: Families might face difficulties accessing benefits if the original provider is no longer available.

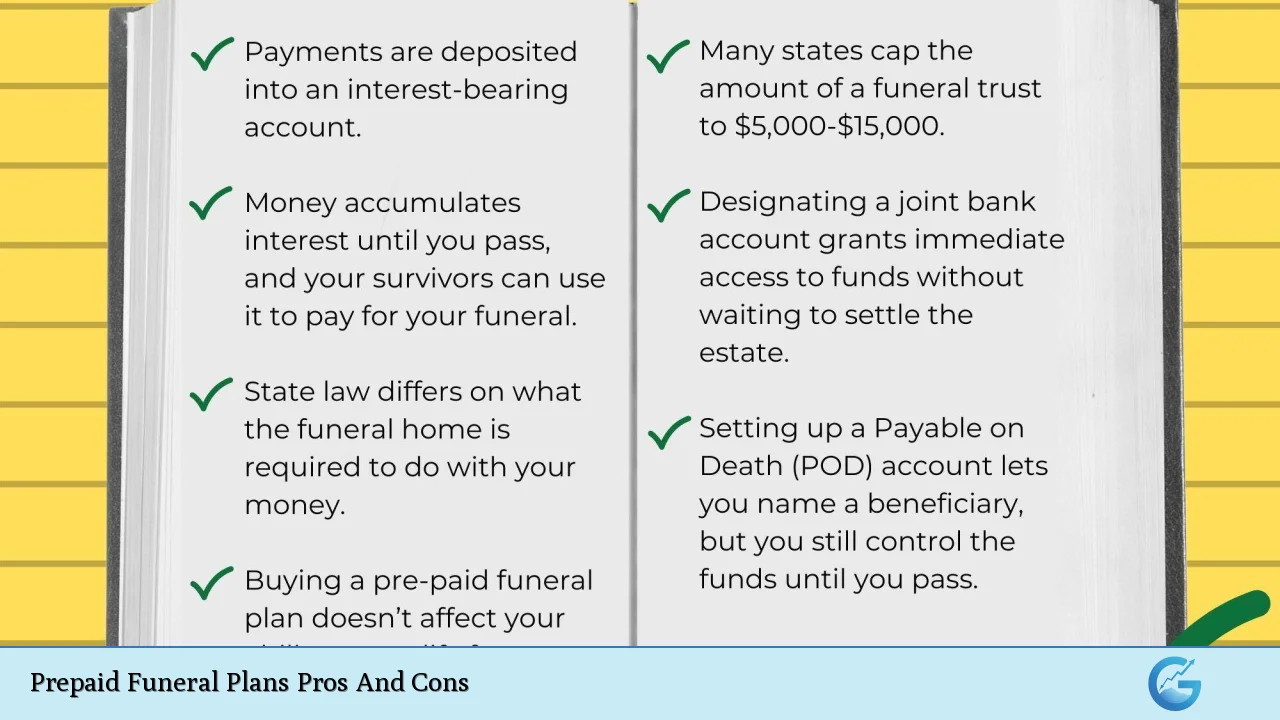

Funds Are Tied Up

When funds are placed into a prepaid funeral plan, they become inaccessible until needed for funeral expenses.

- Liquidity Issues: Individuals must consider whether they are comfortable tying up funds that could otherwise be used for immediate needs or investments.

- Opportunity Cost: Money invested in a prepaid plan cannot be used elsewhere, which could limit financial flexibility.

Potential for Overpayment

There is also the risk that individuals may end up overpaying for their prepaid plans if inflation rates do not align with investment growth.

- Interest Rate Concerns: If interest rates on the funds invested in the plan are lower than inflation rates, individuals could pay more than necessary over time.

- Assessing Value: It’s crucial to evaluate whether locking in prices now is more beneficial than investing elsewhere that might yield higher returns.

Risk of Provider Insolvency

Lastly, there is an inherent risk associated with relying on a third-party provider to fulfill future obligations.

- Provider Bankruptcy Risks: If a funeral home goes out of business before providing services, families may find themselves without recourse for recovering funds.

- Importance of Research: It’s essential to choose reputable providers with strong financial stability and good reviews from consumers.

In conclusion, prepaid funeral plans offer several advantages such as locking in current prices, providing peace of mind, allowing personalization of arrangements, easing emotional burdens on families, and being regulated by authorities. However, potential drawbacks include incomplete coverage of all costs, limited transferability between providers, tied-up funds that could affect liquidity, potential overpayment risks due to inflation discrepancies, and concerns about provider insolvency.

Understanding these factors is crucial when considering whether a prepaid funeral plan aligns with your financial strategy and personal wishes.

Frequently Asked Questions About Prepaid Funeral Plans

- What is a prepaid funeral plan?

A prepaid funeral plan allows individuals to pay in advance for their funeral services and specify their preferences regarding arrangements. - Are prepaid funeral plans regulated?

Yes, many regions have regulatory bodies overseeing prepaid funeral plans to ensure consumer protection and fair practices. - Can I transfer my prepaid funeral plan?

This depends on the provider; many plans are not transferable if you move or wish to switch providers. - What happens if my chosen provider goes out of business?

If your provider becomes insolvent, you may lose your benefits unless there are protections in place through regulatory agencies. - Do all costs get covered by a prepaid plan?

No, not all expenses may be included; it’s important to understand what your specific plan covers. - Can I personalize my prepaid funeral arrangements?

Yes, most plans allow you to specify details such as burial or cremation preferences and other service elements. - Is it possible to get a refund if I change my mind?

This varies by provider; some offer partial refunds while others may charge cancellation fees. - How do I choose a reputable provider?

Research providers thoroughly by checking reviews, regulatory compliance status, and financial stability before making a decision.