Primerica, Inc. is a notable player in the financial services industry, primarily known for its term life insurance products. Founded in 1977 and operating under a multi-level marketing (MLM) model, Primerica aims to provide financial education and services to middle-income families. The company has garnered attention for its unique approach to selling insurance and investment products, which has led to a mix of praise and criticism. This article will explore the pros and cons of Primerica, providing a comprehensive overview for potential clients and those interested in financial services.

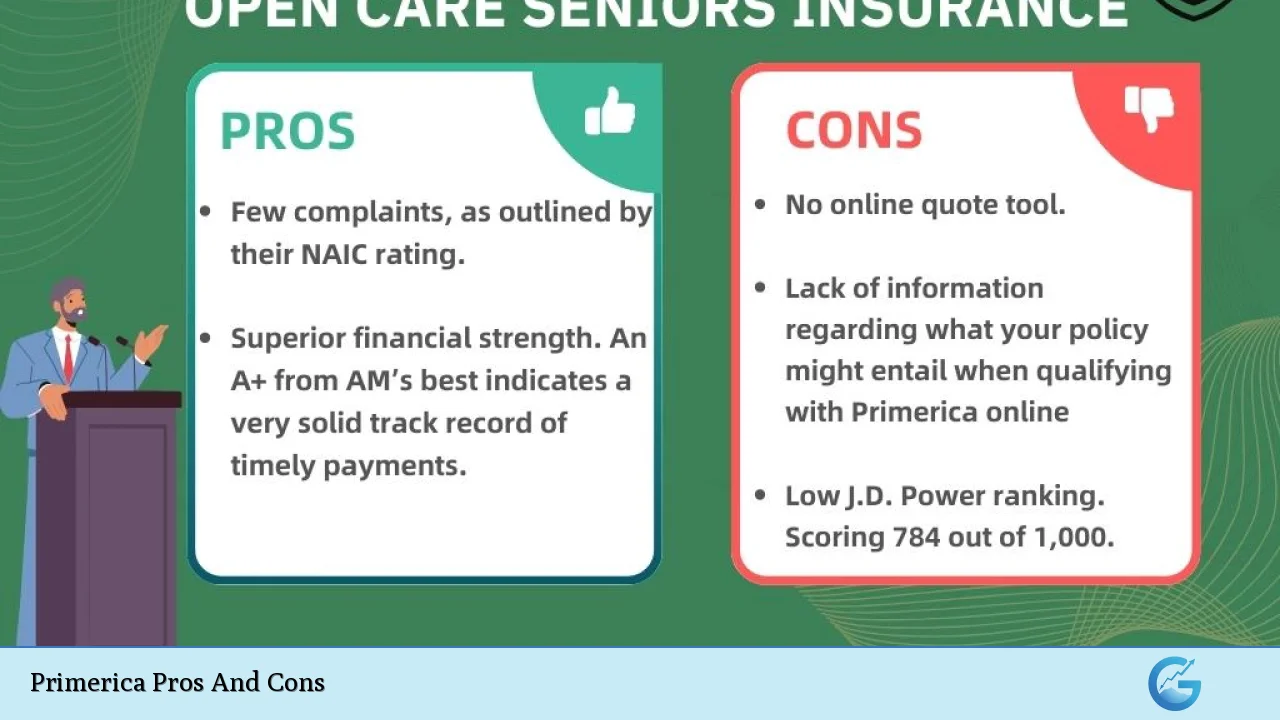

| Pros | Cons |

|---|---|

| Strong financial stability with an A+ rating from AM Best. | High premiums compared to competitors. |

| No medical exam required for certain policies. | Limited product offerings (only term life insurance). |

| Focus on financial education for clients. | Multi-level marketing structure may pressure friends and family. |

| Flexible policy options with renewal until age 95. | Mixed customer satisfaction ratings. |

| Access to a large network of independent agents. | Potential for low commission payouts for agents. |

Strong Financial Stability

Primerica holds an A+ (Superior) rating from AM Best, indicating robust financial strength. This rating reflects the company’s ability to meet its ongoing insurance obligations, which is crucial for clients seeking reliable coverage.

- Financial Security: Clients can feel confident that their policies are backed by a financially stable company.

- Trustworthiness: The strong rating enhances Primerica’s reputation in the insurance market.

No Medical Exam Required

One of the appealing features of Primerica’s term life insurance is the option for no medical exam coverage through its TermNow policy.

- Accessibility: This feature makes it easier for individuals who may have health issues or those who prefer a simpler application process.

- Speedy Approval: Clients can obtain coverage quickly without the delays associated with medical examinations.

Focus on Financial Education

Primerica emphasizes educating its clients about financial management and planning.

- Financial Literacy: The company provides resources that help clients understand their finances better, which is especially beneficial for those new to investing or insurance.

- Empowerment: By equipping clients with knowledge, Primerica aims to empower them to make informed decisions about their financial futures.

Flexible Policy Options

Primerica offers various term life insurance policies that can be renewed up to age 95.

- Customization: Clients can choose from multiple term lengths (10, 15, 20, 25, 30 years) and have options for increasing death benefits.

- Renewal Flexibility: The ability to renew policies without undergoing a medical exam until age 95 provides peace of mind as clients age.

Access to a Large Network of Independent Agents

With a vast network of over 145,000 representatives, Primerica provides extensive access to independent agents who can assist clients in finding suitable products.

- Personalized Service: Clients often receive tailored advice based on their unique financial situations from agents familiar with their needs.

- Widespread Availability: The large network allows Primerica to serve clients across various regions effectively.

High Premiums Compared to Competitors

Despite its advantages, Primerica’s life insurance premiums are often higher than those offered by other companies.

- Cost Considerations: Clients may find that they can obtain similar or better coverage at lower prices from competitors.

- Budget Constraints: Higher premiums might deter potential clients who are price-sensitive or looking for affordable options.

Limited Product Offerings

Primerica primarily focuses on term life insurance and does not offer whole life or universal life policies.

- Lack of Variety: Clients seeking diverse insurance products may need to look elsewhere as Primerica’s offerings are limited.

- Inflexibility in Coverage Types: Those interested in permanent life insurance options will not find them available through Primerica.

Multi-Level Marketing Structure

The MLM model used by Primerica has drawn criticism and may create uncomfortable situations for potential clients.

- Pressure Tactics: Friends or family members who sell Primerica products may pressure others into purchasing policies or joining the business as agents.

- Recruitment Focus: The emphasis on recruiting new agents rather than solely selling products can lead to conflicts of interest among representatives.

Mixed Customer Satisfaction Ratings

Customer satisfaction ratings for Primerica vary significantly across different platforms and studies.

- J.D. Power Rankings: In recent studies, Primerica ranked below the industry average in customer satisfaction, indicating potential service issues.

- Complaint Index: While the National Association of Insurance Commissioners (NAIC) shows fewer complaints than expected for its size, customer experiences can still vary widely.

Potential for Low Commission Payouts

Agents working with Primerica often report lower commission rates compared to traditional insurance sales roles.

- Income Limitations: Many representatives earn modest incomes due to lower commission structures and reliance on recruitment bonuses rather than direct sales commissions.

- Agent Retention Issues: Low earnings may lead some agents to leave the company in search of better opportunities elsewhere.

In conclusion, while Primerica offers several advantages such as strong financial stability, educational resources, and flexible policy options, it also presents notable disadvantages including high premiums, limited product offerings, and potential pressure from its MLM structure. Prospective clients should carefully consider these factors when evaluating whether Primerica aligns with their financial needs and goals.

Frequently Asked Questions About Primerica Pros And Cons

- What types of insurance does Primerica offer?

Primerica primarily offers term life insurance policies with various term lengths but does not provide whole life or universal life options. - Is Primerica financially stable?

Yes, Primerica has an A+ rating from AM Best, indicating strong financial stability and reliability in meeting its obligations. - How does Primerica’s pricing compare to competitors?

Primerica’s premiums are generally higher than those offered by many competitors in the market. - Can I get a policy without a medical exam?

Yes, Primerica offers a no-medical-exam option through its TermNow policy. - What is the recruitment model used by Primerica?

Primerica operates under a multi-level marketing model where representatives earn commissions based on sales and recruitment. - Are there any complaints about Primerica?

The company has received mixed reviews regarding customer satisfaction; however, it has fewer complaints than expected based on its size according to NAIC data. - What educational resources does Primerica provide?

Primerica focuses on educating clients about financial management through various tools and resources aimed at improving financial literacy. - Is it worth joining Primerica as an agent?

This depends on individual circumstances; some agents report low earnings due to commission structures while others appreciate the opportunity to help clients manage their finances.

Overall, individuals considering Primerica should weigh these pros and cons carefully against their personal financial goals and preferences.