The debate over the privatization of Medicare, a vital program for millions of American seniors and individuals with disabilities, has gained significant traction in recent years. As the population ages and healthcare costs rise, discussions about the sustainability of Medicare have intensified. Proponents of privatization argue that it could lead to increased efficiency and choice for beneficiaries, while opponents warn that it may undermine the quality of care and accessibility. This article delves into the pros and cons of privatizing Medicare, providing a comprehensive overview for those interested in finance, healthcare policy, and the broader implications for the economy.

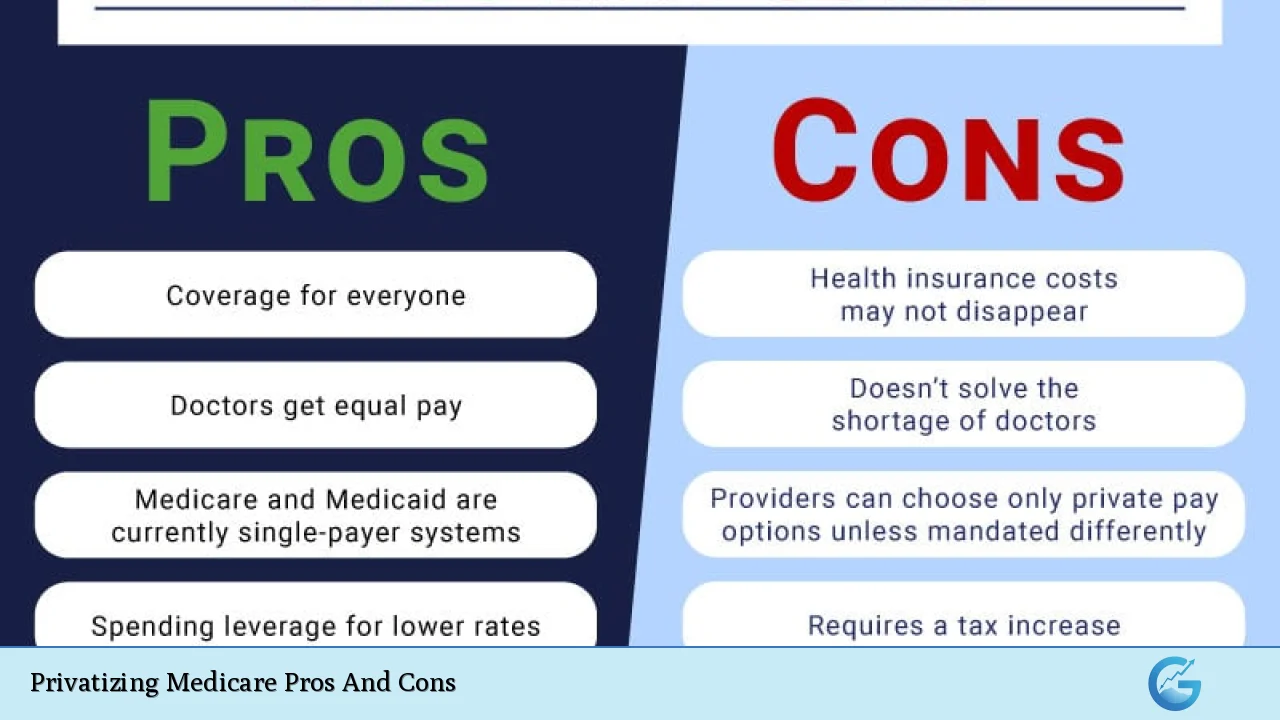

| Pros | Cons |

|---|---|

| Increased choice for beneficiaries | Potential for reduced access to care |

| Cost savings through competition | Higher overall costs to taxpayers |

| Innovation in healthcare delivery | Risk of profit-driven care decisions |

| Streamlined services with integrated care options | Complexity and confusion for patients |

| Potentially better customer service | Disparities in care quality among plans |

Increased Choice for Beneficiaries

One of the primary arguments in favor of privatizing Medicare is that it increases choice for beneficiaries. Under a privatized system, seniors can select from various plans offered by private insurers, allowing them to tailor their healthcare coverage to their specific needs.

- Flexibility: Beneficiaries can choose plans that offer additional services not covered by traditional Medicare, such as vision and dental care.

- Personalization: Seniors can select plans based on their health conditions, preferred doctors, and other personal preferences.

However, while increased choice can be beneficial, it may also lead to confusion among seniors who may struggle to navigate the complexities of multiple plans.

Cost Savings Through Competition

Proponents argue that introducing competition among private insurers could lead to cost savings for both beneficiaries and taxpayers.

- Market Efficiency: Competition may drive down prices as insurers strive to attract more customers.

- Value-Based Care: Private companies might focus on value-based care models that incentivize better health outcomes rather than simply increasing service volume.

Nevertheless, these potential savings are often offset by concerns about higher overall costs associated with privatization.

Innovation in Healthcare Delivery

Privatization advocates suggest that private insurers can foster innovation in healthcare delivery systems.

- New Technologies: Insurers may invest in new technologies and treatment methods that improve patient outcomes.

- Integrated Care Models: Private plans might offer integrated services that streamline patient care across different providers.

However, this innovation comes with risks, particularly if profit motives overshadow patient care considerations.

Streamlined Services with Integrated Care Options

Another advantage of privatizing Medicare is the possibility of streamlined services through integrated care options.

- One-Stop Shopping: Many private plans offer bundled services that include hospital care, outpatient services, and prescription drugs under one plan.

- Coordinated Care: Integrated models can enhance coordination among providers, potentially leading to better health outcomes.

On the flip side, these streamlined services may create barriers for patients who prefer traditional Medicare or who face difficulties understanding their options.

Potentially Better Customer Service

Private insurers often tout superior customer service compared to government-run programs.

- Responsive Support: Insurers may provide more responsive customer service through dedicated support teams.

- User-Friendly Technology: Many private plans utilize advanced technology platforms that simplify claims processing and access to information.

However, disparities in service quality can arise, with some enrollees experiencing significant challenges navigating their benefits.

Potential for Reduced Access to Care

A significant concern regarding privatizing Medicare is the potential reduction in access to necessary medical services.

- Narrow Networks: Many private plans limit their networks of providers, which can restrict seniors’ choices regarding where they receive care.

- Prior Authorization Requirements: Insurers may impose stringent prior authorization processes that delay necessary treatments or procedures.

This limitation on access can lead to adverse health outcomes for vulnerable populations who rely heavily on Medicare services.

Higher Overall Costs to Taxpayers

Despite claims of cost savings through competition, evidence suggests that privatizing Medicare could result in higher overall costs for taxpayers.

- Overpayments to Private Plans: The government often pays private insurers more than it would spend on beneficiaries enrolled in traditional Medicare due to risk-adjusted payments.

- Administrative Costs: The administrative expenses associated with managing multiple private plans can be significantly higher than those incurred by traditional Medicare.

These higher costs ultimately burden taxpayers and raise questions about the financial sustainability of a privatized system.

Risk of Profit-Driven Care Decisions

A major criticism of privatizing Medicare is the risk that profit motives will overshadow patient care considerations.

- Denial of Necessary Services: Private insurers may prioritize profits over patient needs by denying coverage for essential treatments or medications.

- Upcoding Practices: There are concerns about practices such as upcoding, where insurers classify patients as sicker than they are to receive higher reimbursements from the government.

Such practices not only undermine patient trust but also contribute to rising healthcare costs.

Complexity and Confusion for Patients

The introduction of multiple private plans could lead to increased complexity and confusion among beneficiaries trying to navigate their options.

- Diverse Plan Features: Each plan may have different coverage levels, out-of-pocket costs, and provider networks, making it challenging for seniors to make informed choices.

- Potential for Misinformation: With so many options available, there is a heightened risk of misinformation leading beneficiaries astray regarding their coverage choices.

This complexity could deter some seniors from seeking necessary medical care or lead them to choose suboptimal plans.

Disparities in Care Quality Among Plans

As private insurers enter the Medicare market, disparities in care quality can emerge between different plans.

- Variable Coverage Levels: Some plans may offer comprehensive coverage while others provide minimal benefits or impose high out-of-pocket costs.

- Access Issues: Beneficiaries enrolled in lower-quality plans may experience difficulties accessing necessary services or face longer wait times for treatment.

These disparities pose significant risks for low-income seniors or those with chronic health conditions who depend on consistent access to quality healthcare services.

In conclusion, while there are several potential advantages associated with privatizing Medicare—such as increased choice and competition—there are also significant drawbacks that cannot be overlooked. The implications for beneficiaries’ access to care, overall costs to taxpayers, and the quality of healthcare services must be carefully considered. As policymakers continue to debate this critical issue, it is essential to prioritize the needs of seniors and ensure that any changes made serve their best interests rather than simply catering to profit-driven motives within the healthcare industry.

Frequently Asked Questions About Privatizing Medicare

- What is Medicare Advantage?

Medicare Advantage is a type of health insurance plan offered by private companies that provides an alternative way for seniors to receive their Medicare benefits. - How does privatization affect healthcare costs?

Privatization can lead to higher overall costs due to overpayments made by the government to private insurers compared to traditional Medicare. - Will I have fewer choices under privatized Medicare?

While privatization aims to increase choices through multiple plans, many private insurers limit provider networks which can restrict access. - What are the risks associated with private insurance?

The risks include potential denial of necessary services and an emphasis on profit over patient care. - How does privatization impact low-income seniors?

Low-income seniors may face greater challenges accessing quality care if they are enrolled in lower-quality private plans. - Can I still use my current doctor under a privatized system?

Your ability to see your current doctor may depend on whether they are part of your chosen plan’s network. - What should I consider when choosing a plan?

You should evaluate coverage options, out-of-pocket costs, provider networks, and any additional benefits offered. - Is there a risk of losing traditional Medicare?

If trends continue towards increased enrollment in private plans like Medicare Advantage, traditional Medicare could be significantly diminished over time.