Qapital is a personal finance app designed to help users save money and reach their financial goals through automated savings rules and investment options. This innovative platform combines elements of traditional banking with modern technology to create a unique approach to personal finance management. By leveraging behavioral economics and gamification, Qapital aims to make saving money more engaging and accessible for its users.

| Pros | Cons |

|---|---|

| Customizable savings rules | Monthly subscription fees |

| Goal-based savings approach | Low interest rates on savings |

| Automated savings features | Limited customer support options |

| Investment options available | No tax-advantaged retirement accounts |

| Spending account with debit card | Potential for overly complex savings rules |

| Budgeting and spending insights | Limited web access |

| FDIC-insured accounts | Potential delays in fund transfers |

| Couple sharing feature | Not ideal for large investment balances |

Advantages of Qapital

Customizable Savings Rules

One of Qapital’s standout features is its highly customizable savings rules. These rules allow users to automate their savings based on various triggers and conditions, making the process of setting aside money more engaging and personalized. Some notable savings rules include:

- Round-up Rule: Automatically rounds up purchases to the nearest dollar and saves the difference.

- Guilty Pleasure Rule: Saves a predetermined amount when you indulge in a specific activity or purchase.

- Set & Forget Rule: Automatically transfers a fixed amount on a regular schedule.

- If This Then That (IFTTT) Integration: Allows users to create custom savings triggers based on various apps and services.

By offering such a diverse range of savings rules, Qapital empowers users to tailor their savings strategy to their unique lifestyle and preferences, potentially increasing the likelihood of consistent saving habits.

Goal-Based Savings Approach

Qapital’s goal-based savings approach is another significant advantage. Users can create multiple savings goals, each with its own target amount and deadline. This feature helps to:

- Visualize progress towards specific financial objectives

- Motivate users by breaking down larger goals into manageable chunks

- Allocate funds more effectively across various short-term and long-term goals

The ability to set and track multiple goals simultaneously makes Qapital an excellent tool for users who want to save for various purposes, such as emergency funds, vacations, or major purchases.

Automated Savings Features

The automation aspect of Qapital is a key selling point for many users. By setting up rules and goals, users can essentially “set it and forget it” when it comes to saving money. This automated approach offers several benefits:

- Reduces the mental effort required to save consistently

- Helps overcome procrastination and forgetfulness

- Enables users to save small amounts frequently, which can add up over time

- Minimizes the temptation to spend money that’s earmarked for savings

For individuals who struggle with disciplined saving, Qapital’s automated features can be a game-changer in building a robust savings habit.

Investment Options Available

While primarily known for its savings features, Qapital also offers investment options through its Invest feature. This addition allows users to:

- Invest in diversified portfolios of low-cost ETFs

- Choose from various risk levels to match their investment goals

- Automatically invest based on their savings rules

- Benefit from dollar-cost averaging through regular, small investments

The inclusion of investment options makes Qapital a more comprehensive financial tool, enabling users to potentially grow their wealth beyond simple savings.

Spending Account with Debit Card

Qapital’s spending account, which comes with a debit card, adds another layer of functionality to the app. This feature allows users to:

- Access their Qapital funds more easily

- Use the debit card for everyday purchases

- Set up direct deposits to their Qapital account

- Analyze spending patterns more effectively

By offering a spending account, Qapital positions itself as a more complete banking alternative, potentially reducing the need for users to juggle multiple accounts across different institutions.

Budgeting and Spending Insights

The app provides valuable budgeting tools and spending insights, helping users to:

- Track expenses across various categories

- Identify areas where they may be overspending

- Set budget limits for different expense categories

- Receive personalized recommendations for improving financial habits

These features contribute to a more holistic approach to personal finance management, going beyond simple savings to help users understand and optimize their overall financial picture.

FDIC-Insured Accounts

Qapital partners with FDIC-insured banks to hold user funds, providing an important layer of security. This means that:

- User deposits are protected up to $250,000

- Savings and spending accounts have the same level of protection as traditional bank accounts

- Users can have peace of mind knowing their funds are secure

The FDIC insurance coverage is a crucial feature that helps establish Qapital as a trustworthy platform for managing personal finances.

Couple Sharing Feature

Qapital offers a unique couple sharing feature, which allows partners to:

- Set joint savings goals

- Contribute to shared accounts

- Track combined progress towards financial objectives

- Maintain transparency in financial matters

This feature can be particularly beneficial for couples looking to align their financial goals and work together towards shared aspirations.

Disadvantages of Qapital

Monthly Subscription Fees

One of the most significant drawbacks of Qapital is its subscription-based model. Unlike some competitors that offer free basic services, Qapital charges monthly fees for all its plans. This can be a deterrent for:

- Users with small account balances, as the fees may eat into their savings

- Individuals looking for a no-cost savings solution

- Those who prefer traditional, fee-free savings accounts

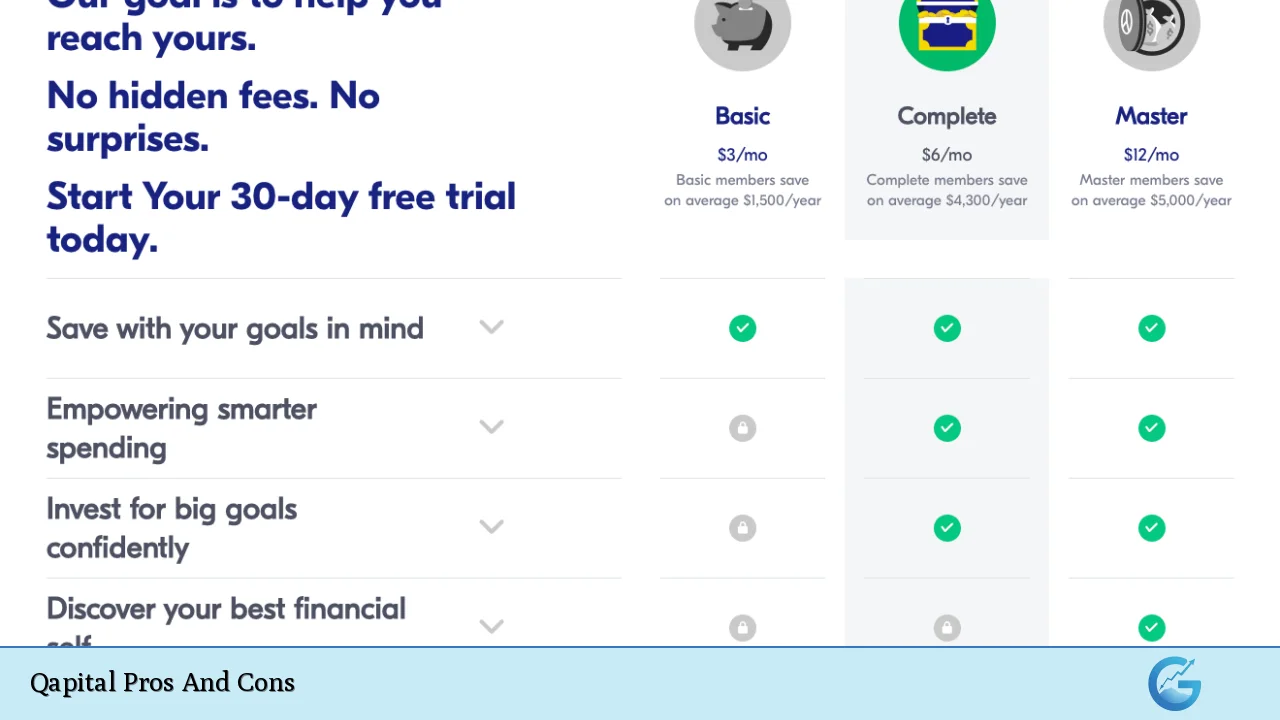

The subscription fees, which range from $3 to $12 per month depending on the plan, can significantly impact the overall value of the service, especially for users with modest savings goals.

Low Interest Rates on Savings

Qapital’s interest rates on savings accounts are notably low compared to high-yield savings accounts offered by many online banks. This disadvantage means:

- Users may miss out on potential earnings from their savings

- The real value of savings may decrease over time due to inflation

- There’s less incentive to keep large balances in Qapital accounts

For users primarily focused on maximizing the return on their savings, Qapital’s low interest rates may be a significant drawback.

Limited Customer Support Options

Qapital’s customer support is somewhat limited compared to traditional banks and some fintech competitors. The main issues include:

- No phone support, which can be frustrating for users with urgent issues

- Reliance on email and in-app messaging for customer service

- Potential delays in response times for complex problems

The lack of immediate, person-to-person support options may be a concern for users who value readily available customer service, especially when dealing with financial matters.

No Tax-Advantaged Retirement Accounts

A notable limitation of Qapital is the absence of tax-advantaged retirement account options such as IRAs or 401(k)s. This means:

- Users can’t use Qapital for long-term retirement savings strategies

- There’s a missed opportunity for tax benefits associated with retirement accounts

- Users may need to maintain separate accounts for retirement savings

For individuals looking for a comprehensive financial platform that includes retirement planning, this omission may be a significant drawback.

Potential for Overly Complex Savings Rules

While the customizable savings rules are a strength of Qapital, they can also be a potential weakness. Some users may find that:

- Setting up multiple, complex rules can be overwhelming

- It’s easy to lose track of how much is being saved across various rules

- Overly aggressive savings rules might lead to unexpected account overdrafts

Users need to carefully manage their rules to ensure they’re saving effectively without compromising their day-to-day financial needs.

Limited Web Access

Qapital is primarily designed as a mobile app, with limited functionality available through web browsers. This can be inconvenient for users who:

- Prefer managing their finances on a desktop computer

- Want to access detailed reports or analytics that may be easier to view on a larger screen

- Need to perform complex account management tasks

The focus on mobile access may limit Qapital’s appeal to users who value the flexibility of both mobile and desktop platforms.

Potential Delays in Fund Transfers

Some users have reported delays in fund transfers between Qapital and external bank accounts. These delays can:

- Cause frustration when trying to access saved funds quickly

- Lead to potential cash flow issues if transfers take longer than expected

- Reduce the overall flexibility of the platform for users who need quick access to their money

While these delays may be infrequent, they represent a potential inconvenience that users should be aware of when considering Qapital.

Not Ideal for Large Investment Balances

While Qapital offers investment options, it may not be the best choice for users with large investment balances or those seeking advanced investment strategies. Limitations include:

- A relatively simple investment approach with pre-set portfolios

- Lack of access to individual stocks or more complex investment products

- Potentially higher fees compared to dedicated investment platforms for larger balances

Users with significant investment needs or those seeking more sophisticated investment options may find Qapital’s offerings too basic for their requirements.

In conclusion, Qapital offers a unique and engaging approach to personal finance management, with its customizable savings rules and goal-based strategy being particularly noteworthy. However, the monthly fees, low interest rates, and limitations in certain areas may make it less suitable for some users. As with any financial tool, potential users should carefully weigh the pros and cons of Qapital against their personal financial goals and preferences before deciding to use the platform.

Frequently Asked Questions About Qapital Pros And Cons

- Is Qapital FDIC insured?

Yes, Qapital partners with FDIC-insured banks to hold user funds, providing protection up to $250,000. - Can I use Qapital for retirement savings?

No, Qapital does not offer tax-advantaged retirement accounts like IRAs or 401(k)s. Users will need to look elsewhere for dedicated retirement savings options. - How does Qapital make money?

Qapital primarily generates revenue through its subscription-based model, charging monthly fees for access to its various features and services. - Are there any free plans available with Qapital?

No, Qapital does not offer a free plan. All users must subscribe to one of the paid plans to access the app’s features. - Can couples use Qapital together?

Yes, Qapital offers a couple sharing feature that allows partners to set joint savings goals and contribute to shared accounts. - How quickly can I access my money in Qapital?

While Qapital aims for quick transfers, some users have reported delays. Generally, transfers between Qapital and external accounts can take 1-3 business days. - Does Qapital offer customer support by phone?

No, Qapital does not provide phone support. Customer service is primarily handled through email and in-app messaging. - Can I invest in individual stocks through Qapital?

No, Qapital’s investment options are limited to pre-set portfolios of ETFs. Users cannot invest in individual stocks through the platform.