Investing in real estate can be a lucrative venture, offering numerous opportunities for wealth accumulation and financial stability. However, like any investment, it comes with its own set of advantages and disadvantages. Understanding these factors is crucial for potential investors, especially those involved in finance, crypto, forex, and money markets. This article will explore the pros and cons of real estate investing in detail, providing insights that can help guide your investment decisions.

| Pros | Cons |

|---|---|

| Steady cash flow from rental income | High initial investment and ongoing costs |

| Potential for property appreciation | Market volatility and economic sensitivity |

| Tax benefits and deductions | Illiquidity of real estate assets |

| Diversification of investment portfolio | Time-consuming management responsibilities |

| Control over investment decisions | Risk of tenant issues and vacancies |

| Hedge against inflation | Potential for negative cash flow during downturns |

| Ability to leverage investments | Long-term commitment required for returns |

| Direct involvement in the property market | Legal and regulatory challenges |

Steady Cash Flow from Rental Income

One of the primary advantages of investing in real estate is the ability to generate a steady stream of income through rental payments. This cash flow can provide financial stability and supplement other income sources.

- Passive Income: Once properties are rented out, they can produce monthly income with relatively little ongoing effort.

- Financial Security: Reliable rental income can help cover mortgage payments and other expenses associated with property ownership.

High Initial Investment and Ongoing Costs

Despite the benefits, real estate requires a significant financial commitment upfront, which can deter many potential investors.

- Down Payments: Purchasing property often requires a substantial down payment, typically ranging from 15% to 25% of the property’s value.

- Ongoing Expenses: Investors must also budget for property taxes, insurance, maintenance costs, and unexpected repairs, which can quickly add up.

Potential for Property Appreciation

Real estate has historically appreciated in value over time, making it an attractive long-term investment option.

- Equity Growth: As property values increase, so does the equity that investors hold in their properties.

- Capital Gains: Selling appreciated properties can yield significant profits if market conditions are favorable.

Market Volatility and Economic Sensitivity

However, the real estate market is not immune to fluctuations. Economic downturns can lead to decreased property values and rental demand.

- Market Risks: Property values can drop due to economic recessions or changes in local market conditions.

- Demand Fluctuations: During economic downturns, finding tenants may become challenging, leading to potential vacancies.

Tax Benefits and Deductions

Real estate investing offers various tax advantages that can enhance overall profitability.

- Deductions: Investors can deduct mortgage interest, property taxes, maintenance expenses, and depreciation from their taxable income.

- Lower Tax Rates on Rental Income: Rental income is often taxed at lower rates compared to ordinary income.

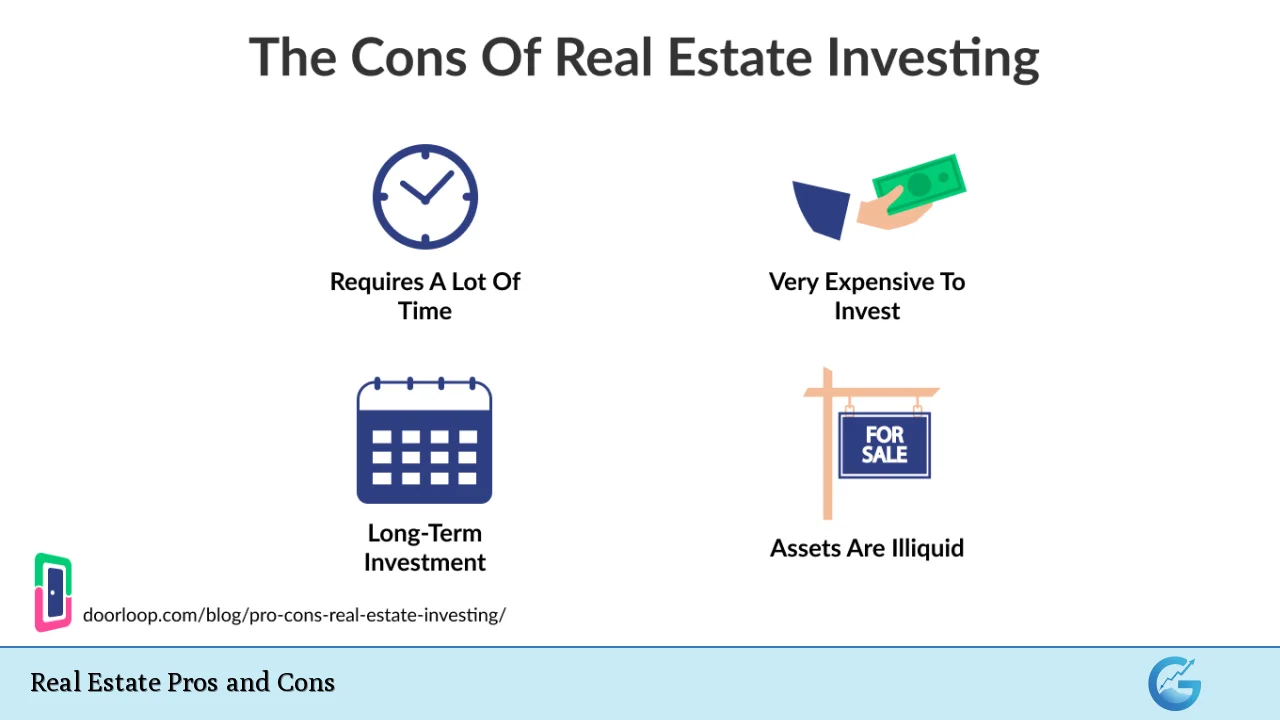

Illiquidity of Real Estate Assets

A significant disadvantage of real estate is its illiquidity compared to other investments like stocks or bonds.

- Selling Challenges: Liquidating a property can take time due to market conditions and the complexities involved in selling real estate.

- Access to Funds: Investors may find it difficult to access their capital quickly when needed since real estate transactions are not instantaneous.

Diversification of Investment Portfolio

Investing in real estate allows individuals to diversify their portfolios beyond traditional stocks and bonds.

- Risk Mitigation: Real estate often behaves differently than other asset classes, providing a hedge against stock market volatility.

- Variety of Options: Investors can choose from various types of properties (residential, commercial) to further diversify their holdings.

Time-consuming Management Responsibilities

Active real estate investing requires considerable time commitment for property management tasks.

- Property Management: Investors must handle tenant relations, maintenance issues, and legal compliance unless they hire a property management company.

- Market Research: Continuous analysis of market trends is necessary to make informed investment decisions.

Control Over Investment Decisions

Owning real estate provides investors with direct control over their assets unlike some other investment vehicles.

- Decision-making Power: Investors can set rental rates, choose tenants, and make improvements to maximize property value.

- Personal Involvement: Many investors appreciate being directly involved in their investments rather than relying on third parties.

Risk of Tenant Issues and Vacancies

While rental income is a major benefit, it also comes with risks related to tenants.

- Tenant Problems: Issues such as late payments or damage to property can lead to financial strain for landlords.

- Vacancies: Extended vacancies can result in significant loss of income while still incurring costs like mortgage payments and maintenance fees.

Hedge Against Inflation

Real estate investments are often seen as a hedge against inflation due to the nature of property value appreciation over time.

- Increasing Rents: As inflation rises, so do rental prices, which can help maintain purchasing power for investors’ income streams.

- Asset Value Growth: Properties tend to increase in value alongside inflationary trends in the economy.

Potential for Negative Cash Flow During Downturns

Economic challenges may lead to situations where expenses exceed rental income.

- High Vacancy Rates: During economic downturns or local market issues, investors may struggle to find tenants or may have to lower rents significantly.

- Increased Costs: Rising maintenance costs or unexpected repairs during tough economic times can further erode cash flow margins.

Long-term Commitment Required for Returns

Real estate investing typically requires a long-term perspective for significant returns on investment (ROI).

- Patience Needed: Investors should be prepared for a long wait before seeing substantial gains from their properties as appreciation takes time.

- Market Timing Risks: Attempting to time the market for quick profits can lead to losses if conditions shift unexpectedly.

Legal and Regulatory Challenges

Investors must navigate various legal requirements when owning rental properties or engaging in real estate transactions.

- Compliance Obligations: Local laws regarding tenant rights, zoning regulations, and property taxes must be adhered to diligently.

- Potential Liabilities: Failing to comply with legal standards can result in costly lawsuits or fines that impact profitability.

In conclusion, investing in real estate offers numerous advantages such as steady cash flow, potential appreciation, tax benefits, diversification opportunities, control over investments, protection against inflation, leveraging capabilities; however it also presents challenges including high initial costs, illiquidity issues, management responsibilities, tenant-related risks, economic sensitivity leading to cash flow variability along with legal complexities.

Understanding these pros and cons is essential for anyone considering entering the real estate market. By weighing these factors carefully against personal financial goals and risk tolerance levels—investors can make informed decisions that align with their overall investment strategy.

Frequently Asked Questions About Real Estate Pros and Cons

- What are the main advantages of investing in real estate?

The main advantages include steady cash flow from rentals, potential appreciation of property values over time, tax benefits such as deductions on expenses related to ownership. - What are the primary risks associated with real estate investing?

The primary risks include high initial investments required for purchase; ongoing costs; market volatility affecting property values; tenant issues leading potentially vacant units. - How does real estate serve as a hedge against inflation?

Real estate tends to appreciate alongside inflation rates while rental prices often increase during inflationary periods ensuring consistent cash flow. - Is it easy to liquidate real estate assets?

No; selling properties usually takes considerable time compared with stocks or bonds due largely due complexity involved in transactions. - Can I manage my own rental properties?

Yes; many investors choose self-management but should be prepared for time-consuming responsibilities related tenant relations & maintenance. - What type of financing options are available for purchasing real estate?

You may consider traditional mortgages; private lenders; hard money loans; seller financing among others based on your financial situation. - How important is location when investing in real estate?

The location significantly impacts both current value & future appreciation potential making it crucial factor during investment analysis. - Are there tax advantages specific only available through owning rental properties?

Yes; owners benefit from various deductions including mortgage interest payments & depreciation which reduce taxable income significantly.