A mortgage recast is a financial strategy that allows homeowners to lower their monthly mortgage payments by making a substantial lump-sum payment towards the principal balance of their loan. This process, also known as reamortization, recalculates the loan based on the new, lower principal balance while keeping the original interest rate and loan term intact. Mortgage recasting can be an attractive option for homeowners who come into a large sum of money and want to reduce their monthly financial obligations without refinancing their entire mortgage.

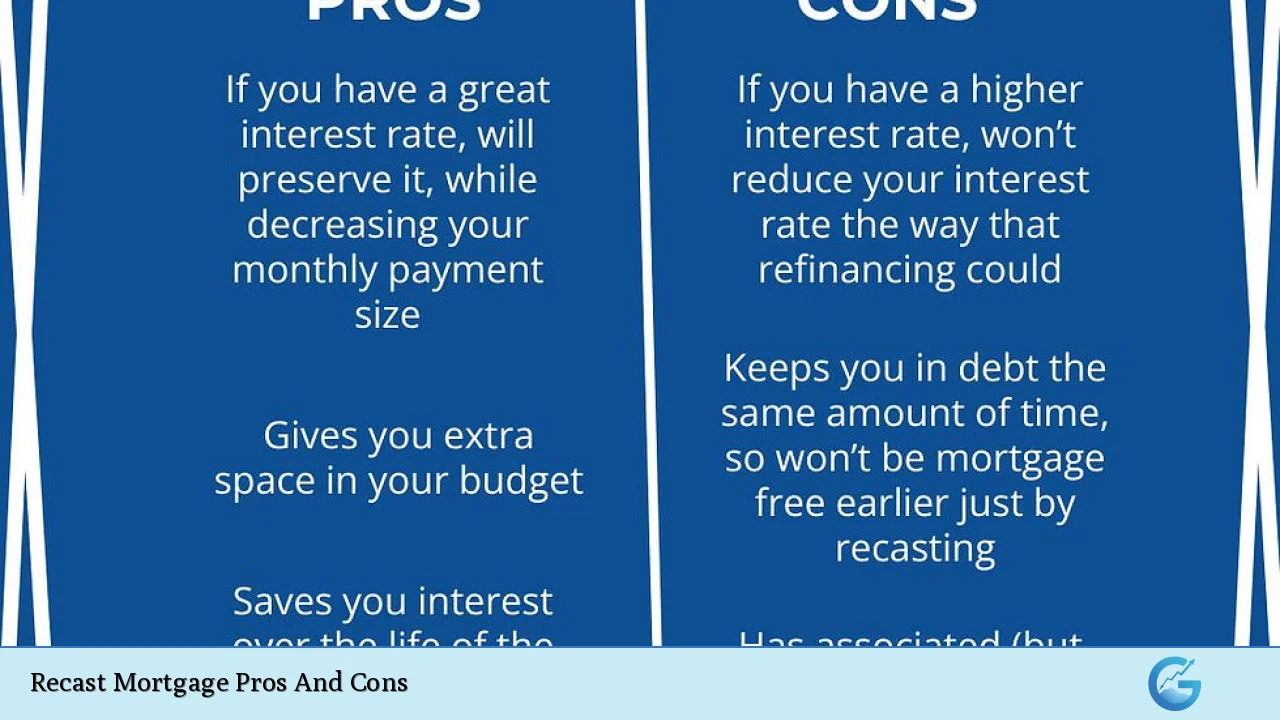

| Pros | Cons |

|---|---|

| Lower monthly payments | Requires a large lump-sum payment |

| Keeps original interest rate | Not available for all loan types |

| No credit check required | Doesn’t shorten loan term |

| Simpler process than refinancing | Reduces financial liquidity |

| Potential interest savings | May incur recasting fees |

| No appraisal needed | Doesn’t lower interest rate |

Advantages of Mortgage Recasting

Lower Monthly Payments

One of the primary benefits of recasting a mortgage is the reduction in monthly payments. By making a substantial lump-sum payment towards the principal, homeowners can significantly decrease their ongoing financial obligations. This can be particularly beneficial for those experiencing changes in their financial situation or looking to free up cash flow for other investments or expenses.

- Provides immediate relief on monthly budgets

- Allows for better cash management

- Can improve debt-to-income ratio, potentially helping with future loan applications

Retention of Original Interest Rate

In a rising interest rate environment, the ability to keep your original, potentially lower interest rate is a significant advantage. Unlike refinancing, which typically involves accepting current market rates, recasting allows homeowners to maintain their existing rate while still benefiting from lower monthly payments.

- Protects against interest rate increases

- Particularly valuable for those with historically low rates

- Can result in substantial long-term savings compared to refinancing at a higher rate

No Credit Check Required

Mortgage recasting does not involve a credit check, making it an attractive option for homeowners who may have experienced a decline in their credit score since originally obtaining their mortgage. This feature ensures that the recast process is accessible to a wider range of homeowners, regardless of changes in their credit profile.

- Eliminates stress associated with credit inquiries

- Accessible to those with fluctuating credit scores

- No impact on credit score from the recasting process

Simpler Process Than Refinancing

Compared to the often complex and time-consuming process of refinancing, mortgage recasting is relatively straightforward. It typically involves less paperwork, fewer steps, and a quicker turnaround time.

- Reduced documentation requirements

- Faster processing times

- Less administrative hassle for homeowners

Potential Interest Savings

While the primary goal of recasting is to lower monthly payments, it can also result in significant interest savings over the life of the loan. By reducing the principal balance early in the loan term, less interest accrues over time, potentially saving thousands of dollars.

- Long-term financial benefits from reduced interest payments

- More of each payment goes towards principal after recasting

- Can accelerate equity buildup in the property

No Appraisal Needed

Unlike refinancing, which often requires a new property appraisal, mortgage recasting typically does not involve this step. This can save both time and money in the process of adjusting your mortgage terms.

- Eliminates appraisal fees

- Protects against potential issues with property valuation

- Speeds up the overall process of loan adjustment

Disadvantages of Mortgage Recasting

Requires a Large Lump-Sum Payment

The most significant barrier to mortgage recasting is the requirement for a substantial lump-sum payment. This can be challenging for many homeowners, as it ties up a large amount of liquid assets in home equity.

- Typically requires a minimum of $5,000 to $10,000, often more

- May deplete savings or emergency funds

- Opportunity cost of not investing the money elsewhere

Not Available for All Loan Types

Mortgage recasting is not universally available across all loan types. Government-backed loans such as FHA, VA, and USDA loans are generally not eligible for recasting. This limitation can be frustrating for homeowners with these types of mortgages who are seeking to lower their monthly payments.

- Primarily available for conventional loans

- Some jumbo loans may also be ineligible

- Limits options for homeowners with government-backed mortgages

Doesn’t Shorten Loan Term

While recasting reduces monthly payments, it does not shorten the overall term of the loan. Homeowners will still be paying their mortgage for the same length of time as originally agreed upon, which may not align with long-term financial goals for some individuals.

- No acceleration of debt payoff timeline

- May not be ideal for those looking to be mortgage-free sooner

- Could result in paying more interest over the life of the loan compared to aggressive prepayment strategies

Reduces Financial Liquidity

By putting a large sum of money into home equity, homeowners reduce their overall financial liquidity. This can be problematic if unexpected expenses arise or if better investment opportunities present themselves in the future.

- Ties up cash in a relatively illiquid asset

- May limit ability to respond to financial emergencies

- Potential opportunity cost if other investments outperform real estate appreciation

May Incur Recasting Fees

While generally less expensive than refinancing, mortgage recasting is not free. Lenders typically charge a fee for this service, which can range from a few hundred to over a thousand dollars, depending on the institution.

- Additional cost to consider when evaluating the benefits of recasting

- Fees may offset short-term savings from lower monthly payments

- Varies by lender, requiring comparison shopping for best terms

Doesn’t Lower Interest Rate

Unlike refinancing, which offers the opportunity to secure a lower interest rate, recasting maintains the original rate of the loan. In a falling interest rate environment, this could mean missing out on potential savings from a lower rate.

- No benefit from market improvements in interest rates

- May be less advantageous in periods of declining rates

- Could result in higher long-term costs compared to refinancing at a lower rate

Mortgage recasting can be a powerful financial tool for homeowners looking to reduce their monthly payments without the complexity of refinancing. It offers a way to leverage a lump sum of money to improve cash flow while maintaining the original terms of the loan. However, it’s not without its drawbacks, including the need for significant upfront capital and the potential reduction in financial flexibility.

Before deciding to recast a mortgage, homeowners should carefully consider their overall financial situation, long-term goals, and alternative uses for their funds. Consulting with a financial advisor or mortgage professional can provide valuable insights into whether recasting aligns with your specific circumstances and objectives. Additionally, comparing the costs and benefits of recasting against other options like refinancing or making extra principal payments can help ensure you’re making the most informed decision for your financial future.

Frequently Asked Questions About Recast Mortgage Pros And Cons

- How does mortgage recasting affect my credit score?

Mortgage recasting typically does not impact your credit score as it doesn’t involve a new credit inquiry or change to your loan terms. The process is internal to your existing loan agreement. - Can I recast my mortgage multiple times?

Yes, many lenders allow multiple recasts, but there may be restrictions on frequency. Check with your specific lender for their policies on multiple recasts. - Is there a minimum amount required for recasting?

Most lenders require a minimum lump sum payment, often around $5,000 to $10,000 or a percentage of your loan balance. The exact amount varies by lender and loan size. - How long does the mortgage recasting process take?

The recasting process is generally quicker than refinancing, often taking 30-45 days from application to completion. Timelines can vary depending on the lender and your specific situation. - Will recasting help me pay off my mortgage faster?

Recasting alone doesn’t accelerate loan payoff as it maintains the original term. However, if you continue making your original higher payments after recasting, you can pay off the loan faster. - Can I recast an adjustable-rate mortgage (ARM)?

Some lenders allow recasting of ARMs, but it’s less common than for fixed-rate mortgages. Check with your lender for their specific policies on ARM recasting. - How does recasting compare to making extra principal payments?

Recasting reduces your monthly payment, while extra principal payments do not. However, extra payments can shorten your loan term, whereas recasting maintains the original term. - Are there tax implications to recasting a mortgage?

Recasting itself doesn’t typically have direct tax implications. However, the reduced mortgage interest resulting from a lower principal balance may affect your tax deductions. Consult a tax professional for advice on your specific situation.