Refinancing a home is a significant financial decision that can have far-reaching implications for homeowners. It involves replacing an existing mortgage with a new loan, often with different terms or interest rates. This process can offer numerous benefits, such as lower monthly payments or access to home equity, but it also comes with potential drawbacks that must be carefully considered. Understanding the intricacies of refinancing is crucial for anyone looking to optimize their mortgage situation or leverage their home’s value.

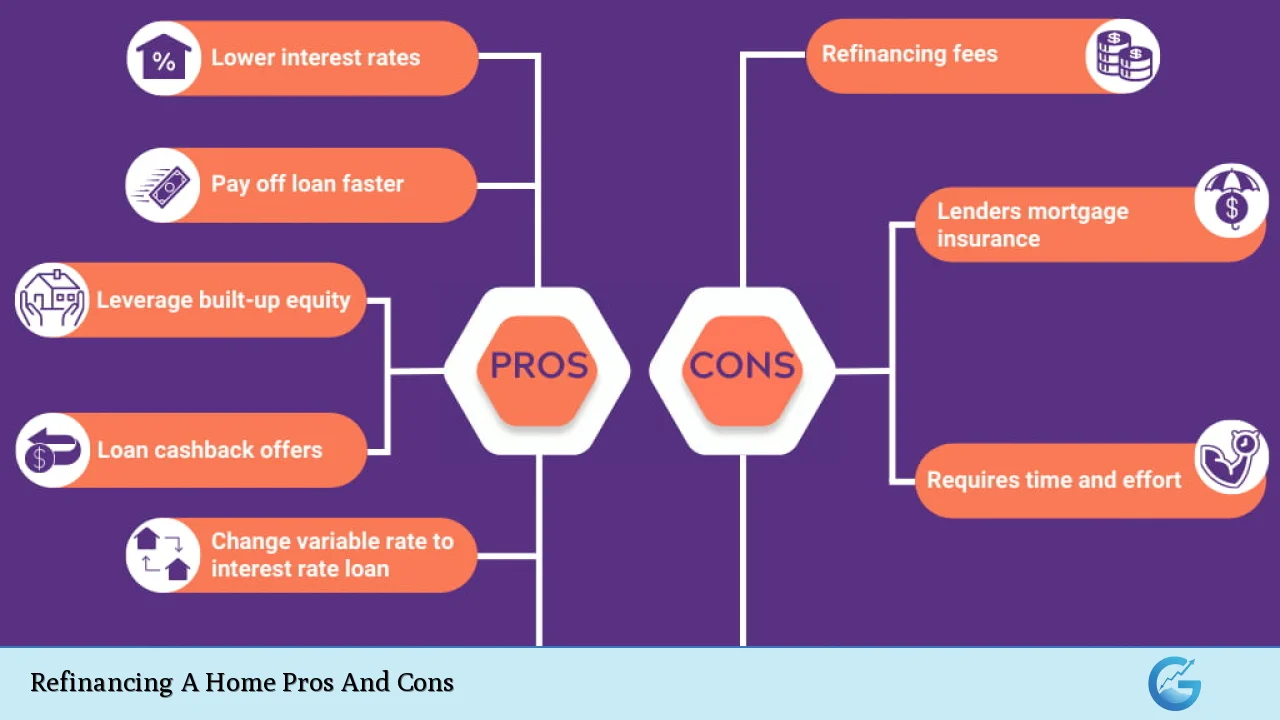

| Pros | Cons |

|---|---|

| Lower interest rates | Closing costs and fees |

| Reduced monthly payments | Potential for longer loan term |

| Access to home equity | Risk of underwater mortgage |

| Debt consolidation | Impact on credit score |

| Switch to fixed-rate mortgage | Prepayment penalties |

| Eliminate private mortgage insurance | Opportunity cost of refinancing |

Lower Interest Rates

One of the primary advantages of refinancing a home is the potential to secure a lower interest rate. This can lead to significant savings over the life of the loan.

- Reduced overall interest payments

- Opportunity to capitalize on market fluctuations

- Potential for substantial long-term savings

Homeowners should consider refinancing if they can reduce their interest rate by at least 0.75 to 1 percentage point. However, it’s crucial to factor in the closing costs and how long you plan to stay in the home to ensure the savings outweigh the expenses.

Closing Costs and Fees

While lower interest rates are attractive, the costs associated with refinancing can be substantial and may offset potential savings.

- Appraisal fees, typically ranging from $300 to $700

- Origination fees, often 1% of the loan amount

- Title search and insurance fees

- Attorney fees and document preparation costs

Homeowners should carefully calculate their break-even point—the time it takes for the savings from refinancing to exceed the costs. This calculation is crucial in determining whether refinancing is financially beneficial in the short and long term.

Reduced Monthly Payments

Refinancing can lead to lower monthly mortgage payments, freeing up cash flow for other financial goals or necessities.

- Improved household budgeting flexibility

- Opportunity to allocate funds to investments or savings

- Potential for improved debt-to-income ratio

However, it’s important to note that lower monthly payments often result from extending the loan term, which could mean paying more interest over the life of the loan. Homeowners should weigh the short-term benefits of reduced payments against the long-term cost of the mortgage.

Potential for Longer Loan Term

While a longer loan term can reduce monthly payments, it can also significantly increase the total amount paid over the life of the loan.

- Extended debt obligation

- Increased total interest paid

- Delayed full homeownership

Extending a loan term from 15 to 30 years could result in paying more than double the interest over the life of the loan, even with a lower interest rate. This is a critical consideration for homeowners approaching retirement or those looking to build equity quickly.

Access to Home Equity

Refinancing, particularly through a cash-out refinance, allows homeowners to tap into their home’s equity for various purposes.

- Fund home improvements or renovations

- Pay for education expenses

- Invest in other properties or financial instruments

- Start a business or fund other entrepreneurial ventures

This can be an attractive option for homeowners looking to leverage their property’s value. However, it’s crucial to remember that accessing home equity increases the loan balance and can put the home at risk if the borrower defaults on payments.

Risk of Underwater Mortgage

Cash-out refinancing or refinancing in a declining market can lead to an underwater mortgage, where the loan balance exceeds the home’s value.

- Difficulty selling the home without incurring a loss

- Challenges in obtaining future refinancing

- Potential for negative equity in case of market downturns

Homeowners should be cautious about refinancing more than 80% of their home’s value to avoid the risk of becoming underwater on their mortgage. This is particularly important in volatile real estate markets or areas prone to economic fluctuations.

Debt Consolidation

Refinancing can be an effective tool for consolidating high-interest debts into a single, lower-interest mortgage payment.

- Simplify multiple debt payments into one

- Potentially lower overall interest rates on debts

- Improve credit utilization ratio

This strategy can be particularly beneficial for those with significant credit card debt or other high-interest loans. However, it’s crucial to address the underlying spending habits that led to the debt accumulation to avoid falling back into the same financial pitfalls.

Impact on Credit Score

The refinancing process can have both positive and negative effects on a homeowner’s credit score.

- Initial credit score dip due to hard inquiry

- Potential improvement in credit utilization ratio

- Long-term positive impact if payments are made consistently

Multiple refinance applications within a short period can significantly impact credit scores, so it’s advisable to shop for rates within a focused timeframe, typically 14-45 days, depending on the credit scoring model.

Switch to Fixed-Rate Mortgage

Homeowners with adjustable-rate mortgages (ARMs) may benefit from refinancing to a fixed-rate mortgage, especially in a low-interest-rate environment.

- Predictable monthly payments

- Protection against future interest rate hikes

- Easier long-term financial planning

This can be particularly advantageous for those planning to stay in their homes for an extended period. However, fixed-rate mortgages typically start with higher interest rates than ARMs, so the initial payments may be higher.

Prepayment Penalties

Some mortgages include prepayment penalties, which can add significant costs to the refinancing process.

- Fees for paying off the original mortgage early

- Potential to negate the benefits of refinancing

- Varies by lender and loan terms

Homeowners should carefully review their current mortgage terms for prepayment penalties and factor these costs into their refinancing decision. In some cases, waiting until the prepayment penalty period expires can result in substantial savings.

Eliminate Private Mortgage Insurance

Refinancing can be an opportunity to eliminate private mortgage insurance (PMI) for homeowners who have built up sufficient equity.

- Reduce monthly mortgage costs

- Typically applies when equity reaches 20% or more

- Potential for significant long-term savings

Homeowners paying PMI should consider refinancing once their home’s value has appreciated enough to eliminate this additional cost, potentially saving hundreds of dollars per month.

Opportunity Cost of Refinancing

The time and effort involved in refinancing represent an opportunity cost that should be considered.

- Time spent researching and applying for refinancing

- Potential delays in pursuing other financial opportunities

- Stress and administrative burden of the refinancing process

Homeowners should weigh the potential benefits of refinancing against other financial opportunities or priorities that may require their attention and resources.

In conclusion, refinancing a home can offer significant advantages, including lower interest rates, reduced monthly payments, and access to home equity. However, it also comes with potential drawbacks such as closing costs, the risk of extending debt, and possible impacts on credit scores. Homeowners must carefully evaluate their financial situation, long-term goals, and market conditions before deciding to refinance. Consulting with financial advisors and mortgage professionals can provide valuable insights and help ensure that refinancing aligns with overall financial strategies.

Frequently Asked Questions About Refinancing A Home Pros And Cons

- How soon can I refinance after purchasing a home?

Most lenders require a waiting period of 6-12 months before refinancing. However, some government-backed loans, like FHA loans, may allow refinancing sooner. - Will refinancing affect my credit score?

Refinancing typically causes a temporary dip in your credit score due to the hard inquiry. However, if you make timely payments on the new loan, your score may improve over time. - Is it worth refinancing for a 1% lower interest rate?

Generally, a 1% reduction in interest rate can be worthwhile, especially for larger loan amounts. Calculate the break-even point to determine if the savings outweigh the costs. - Can I refinance if my home’s value has decreased?

It may be challenging, but options like the FHA Streamline Refinance or HARP (Home Affordable Refinance Program) may be available for underwater mortgages. Check with lenders for specific programs. - How does cash-out refinancing affect my taxes?

Cash-out refinancing may impact your mortgage interest deduction. Consult a tax professional to understand the implications based on your specific situation and current tax laws. - What documents are typically required for refinancing?

Common documents include recent pay stubs, W-2 forms, tax returns, bank statements, and proof of homeowners insurance. Lenders may require additional documentation based on your financial situation. - Can I refinance if I have a second mortgage or home equity loan?

Yes, but it may be more complex. You’ll need to either pay off the second mortgage, combine both loans into one new loan, or get the second mortgage lender to agree to remain in second position. - How does refinancing impact my long-term financial goals?

Refinancing can affect retirement planning, investment strategies, and overall wealth accumulation. Consider how the new loan terms align with your long-term financial objectives before proceeding.