Rent-to-own housing offers a unique pathway to homeownership, especially for individuals who may face challenges in qualifying for traditional mortgages. This arrangement allows potential buyers to rent a property with the option to purchase it later, typically after a set period. While this approach can provide significant advantages, it also comes with its own set of disadvantages. Understanding these pros and cons is crucial for anyone considering this option, particularly those interested in finance, investing, and real estate markets.

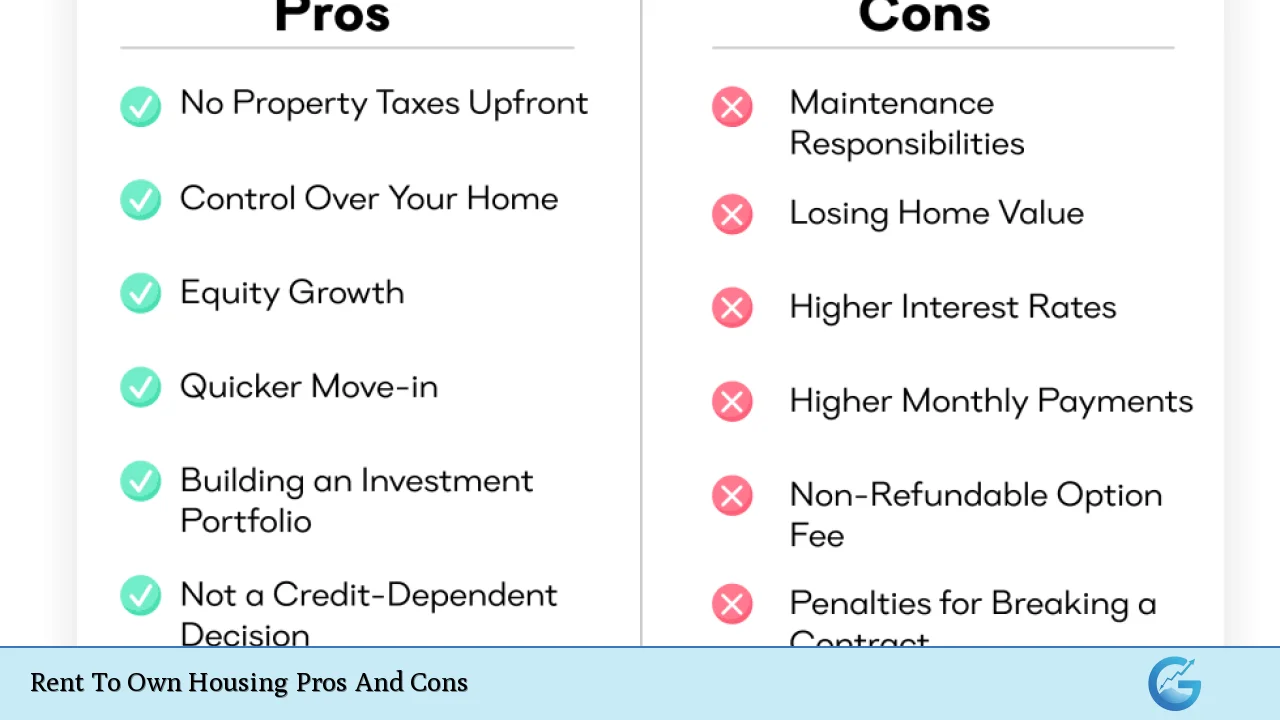

| Pros | Cons |

|---|---|

| Accessible homeownership for those with poor credit or insufficient funds. | Higher-than-average rent payments compared to market rates. |

| Opportunity to lock in a purchase price, protecting against market fluctuations. | Non-refundable option fees that could lead to financial loss. |

| Time to improve credit scores while living in the desired property. | Potential maintenance costs that may fall on the tenant. |

| Flexibility to test the neighborhood before committing to purchase. | Risk of losing accumulated rent credits if the purchase does not go through. |

| Avoidance of competitive bidding wars in hot real estate markets. | Financing is not guaranteed; mortgage approval is still required. |

Accessible Homeownership

One of the most significant advantages of rent-to-own agreements is their ability to make homeownership accessible to individuals who might struggle to qualify for a mortgage due to poor credit or lack of savings.

- Credit Improvement: Rent-to-own provides tenants with the opportunity to live in their future home while simultaneously working on improving their credit scores.

- Saving for a Down Payment: A portion of the rent paid can often be credited towards the eventual down payment, making it easier for tenants to save.

- Financial Stability: This arrangement allows individuals time to build financial stability and prepare for homeownership without the immediate pressure of a mortgage.

Locking In Purchase Price

Another key benefit is the ability to lock in a purchase price at the beginning of the rental period.

- Protection Against Market Increases: In a rising real estate market, locking in a price can protect buyers from potential increases in property values.

- Financial Planning: Knowing the future purchase price helps tenants budget effectively and plan their finances accordingly.

Time to Improve Finances

Rent-to-own agreements allow tenants time to strengthen their financial position before committing to a purchase.

- Debt Reduction: Tenants can focus on paying down existing debts, which can improve their debt-to-income ratio—a critical factor for mortgage lenders.

- Job Stability: This period also allows individuals time to establish job stability, making them more attractive candidates for mortgage approval when they are ready to buy.

Flexibility in Living Arrangements

Rent-to-own provides flexibility that traditional home buying methods do not.

- Testing Neighborhoods: Tenants can experience living in the neighborhood before making a long-term commitment, which is particularly beneficial for those unfamiliar with an area.

- Avoiding Moving Costs: By securing a rent-to-own agreement, individuals can avoid the costs and stresses associated with moving multiple times during their search for a permanent home.

Avoiding Bidding Wars

In competitive real estate markets, rent-to-own agreements can help buyers bypass intense bidding wars.

- Direct Negotiation: Tenants work directly with sellers rather than competing against multiple offers, which can lead to more favorable terms and less stress.

Higher-than-Average Rent Payments

Despite its advantages, rent-to-own agreements often come with higher costs compared to traditional rental arrangements.

- Premium Rent Rates: Rent payments are typically higher as they include an additional amount that goes toward the eventual purchase price.

- Financial Strain: This higher cost can strain budgets, particularly for those already facing financial challenges.

Non-refundable Option Fees

Rent-to-own agreements usually require an upfront option fee that gives tenants the right to purchase the property later.

- Financial Risk: If tenants choose not to buy or are unable to secure financing, they risk losing this non-refundable fee along with any accumulated rent credits.

Maintenance Responsibilities

In many rent-to-own arrangements, tenants may be responsible for maintenance and repairs during the rental period.

- Unexpected Costs: This responsibility can lead to unexpected expenses if significant repairs are needed, such as roof leaks or appliance failures.

- Financial Burden: Such costs can add financial strain on tenants who may already be managing higher-than-average rent payments.

Risk of Losing Rent Credits

If tenants do not proceed with purchasing the home by the end of the lease term, they often lose any credits accrued from their rent payments.

- Lost Investment: This situation can result in significant financial loss if substantial amounts have been paid toward future ownership without resulting in an actual purchase.

Financing Challenges

Even with a rent-to-own agreement in place, financing is not guaranteed at the end of the lease term.

- Mortgage Approval Required: Tenants must still qualify for a mortgage based on standard lending criteria, which may include credit score requirements and debt-to-income ratios.

- Potential Denial: If tenants cannot secure financing due to changes in their financial situation or market conditions, they risk losing their investment in the property entirely.

Closing Thoughts

Rent-to-own housing presents both opportunities and challenges. For many aspiring homeowners, it serves as a viable alternative path toward achieving homeownership while providing flexibility and time for financial improvement. However, potential buyers must carefully weigh these benefits against the risks involved, including higher costs and potential financial losses.

Before entering into a rent-to-own agreement, it is advisable to consult with real estate professionals or financial advisors who can provide guidance tailored to individual circumstances. Understanding all terms and conditions is crucial for making informed decisions that align with long-term financial goals and housing stability.

Frequently Asked Questions About Rent To Own Housing

- What is a rent-to-own agreement?

A rent-to-own agreement allows tenants to rent a property with an option to buy it later, typically after a specified period. - What are common benefits of rent-to-own?

Benefits include accessible homeownership opportunities, locked-in purchase prices, and time to improve credit scores. - Are there risks associated with rent-to-own?

Yes, risks include higher rental costs, non-refundable fees, responsibility for maintenance costs, and financing challenges at purchase time. - How does one build equity through rent-to-own?

A portion of monthly rent payments may be credited toward the down payment when purchasing the property. - Can I lose money in a rent-to-own agreement?

If you decide not to buy or cannot secure financing at the end of your lease term, you may lose any option fees and accumulated credits. - Is maintenance typically covered by landlords in rent-to-own?

Often, tenants are responsible for maintenance costs during the rental period unless otherwise specified in the agreement. - What happens if I can’t get approved for a mortgage?

If you cannot secure financing at the end of your lease term, you risk losing your investment in terms of option fees and accrued credits. - How do I find properties available for rent-to-own?

You can search online real estate listings or consult local real estate agents who specialize in rent-to-own agreements.