Renting a house is a significant decision that many individuals and families face, especially in today’s fluctuating real estate market. The choice between renting and buying can be influenced by various factors including financial stability, lifestyle preferences, and future goals. This article explores the advantages and disadvantages of renting a house, providing a comprehensive overview for those interested in finance, investments, and market dynamics.

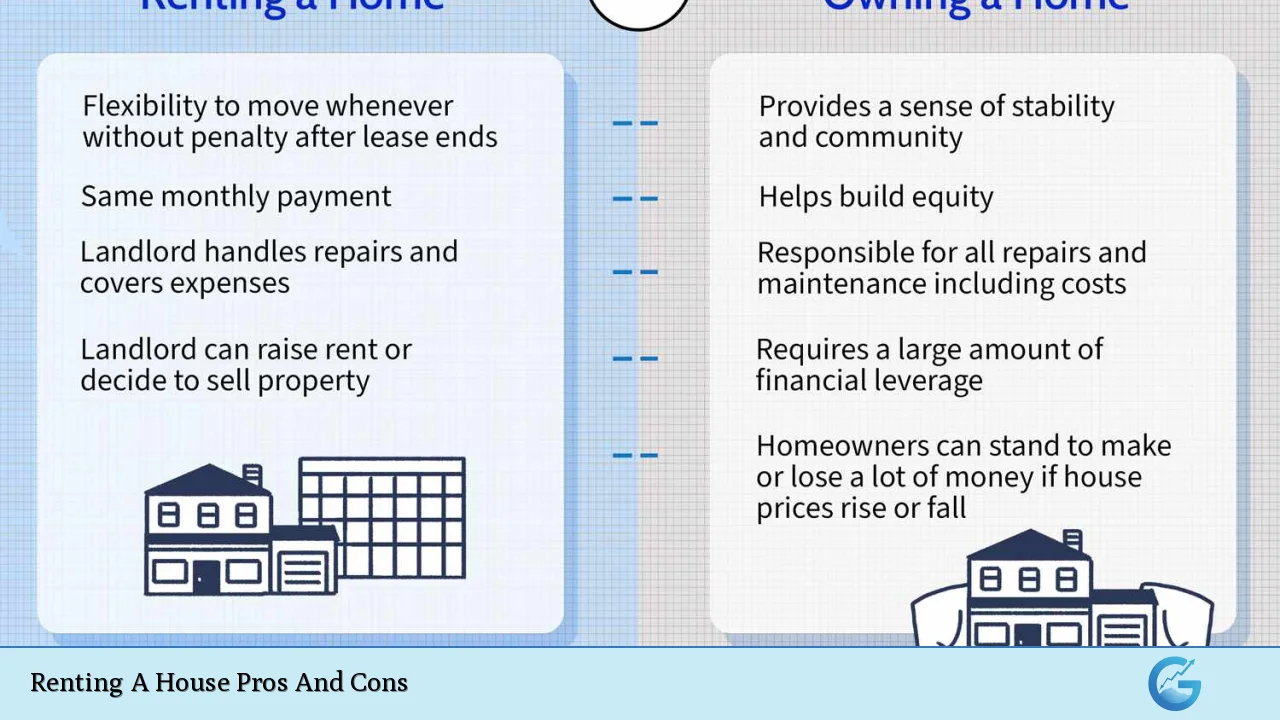

| Pros | Cons |

|---|---|

| Lower upfront costs | No equity building |

| Flexibility in moving | Potential for rent increases |

| No maintenance responsibilities | Restrictions on modifications |

| Access to amenities | Instability in housing situation |

| Financial liquidity | No tax benefits |

| Convenience of renting process | Possible eviction risks |

| Less financial risk during downturns | Lack of personalization options |

| Short-term commitment | Limited control over living environment |

Lower Upfront Costs

One of the most appealing aspects of renting a house is the significantly lower upfront costs compared to purchasing a home.

- Security Deposits: Typically, renters are required to pay a security deposit, which is often equivalent to one or two months’ rent. This is substantially less than the down payment required for buying a home.

- No Closing Costs: Renting eliminates the burden of closing costs associated with home purchases, which can amount to thousands of dollars.

- Budgeting Ease: Renters can plan their finances more effectively since they usually only need to cover monthly rent and utilities.

No Equity Building

While renting offers immediate financial relief, it comes with the downside of not building equity.

- Monthly Payments: Rent payments contribute to the landlord’s asset instead of building your own wealth.

- Long-Term Investment Loss: Over time, homeowners can accumulate wealth through property appreciation and mortgage payments. Renters miss out on this opportunity entirely.

- Retirement Planning Impact: Without equity in property, renters may find it challenging to secure financial stability in retirement compared to homeowners who can leverage their property value.

Flexibility in Moving

Renting provides unparalleled flexibility for those who may need or want to relocate frequently.

- Short Lease Terms: Many rental agreements are for six months to a year, allowing tenants to reassess their living situation regularly.

- Easy Relocation: Tenants can move without the complexities of selling a home, making it ideal for those with uncertain job prospects or lifestyle changes.

- Adaptability: Renters can choose different locations based on personal or professional needs without long-term commitments.

Potential for Rent Increases

A significant downside of renting is the potential for rent increases.

- Market Fluctuations: Landlords may raise rent prices based on market conditions, which can lead to unexpected financial strain on tenants.

- Lease Negotiations: Each time a lease expires, there is no guarantee that the rent will remain stable; tenants may face higher costs or be forced to move if they cannot afford the new rate.

No Maintenance Responsibilities

Renting alleviates the burden of maintenance and repairs associated with homeownership.

- Landlord Responsibilities: Landlords are typically responsible for all repairs and maintenance, allowing renters to focus on their lives without worrying about unexpected expenses.

- Cost Savings: Major repairs like plumbing issues or roof replacements are handled by landlords, saving renters from significant out-of-pocket expenses.

- Time Management: Tenants can dedicate their time to work or leisure instead of managing home upkeep.

Restrictions on Modifications

Renters often face limitations regarding how they can personalize their living space.

- Approval Required: Most rental agreements prohibit tenants from making significant changes without landlord approval, limiting personal expression in their homes.

- Decor Limitations: Tenants may not be able to paint walls or make other aesthetic changes that reflect their style preferences.

- Impact on Comfort: These restrictions can affect how comfortable and at-home renters feel in their space compared to homeowners who have complete control over their properties.

Access to Amenities

Many rental properties offer access to amenities that might be financially out of reach for individual homeowners.

- Shared Facilities: Rentals often include amenities such as swimming pools, gyms, and communal areas without additional costs beyond rent.

- Cost Efficiency: Accessing these facilities through renting can be more economical than owning a home with similar features that require maintenance and upkeep expenses.

Instability in Housing Situation

Renting can lead to instability due to various external factors beyond the tenant’s control.

- Eviction Risks: Landlords have the right to terminate leases under certain conditions, which could lead to sudden relocations for tenants.

- Market Vulnerability: Economic downturns may result in landlords selling properties or converting them into condominiums, displacing tenants unexpectedly.

- Emotional Stress: The potential for instability can create anxiety for renters who prefer security in their living arrangements.

Financial Liquidity

Renting enhances financial liquidity compared to owning property.

- Cash Flow Management: Renters typically have lower monthly expenses than homeowners with mortgages, allowing them more freedom to allocate funds toward savings or investments in other areas like stocks or cryptocurrencies.

- Investment Opportunities: Without the financial burden of homeownership, renters can invest in diverse assets that may yield higher returns than real estate appreciation alone.

No Tax Benefits

Unlike homeowners who benefit from various tax deductions related to mortgage interest and property taxes, renters do not enjoy similar perks.

- Tax Deductions Absence: Renters miss out on potential savings during tax season that could help offset housing costs significantly over time.

- Financial Disadvantage: This lack of tax benefits contributes further to the long-term financial gap between renters and homeowners regarding wealth accumulation strategies.

Convenience of Renting Process

The process of renting is often more straightforward than buying a home.

- Fewer Steps Required: Renting typically involves less paperwork than securing a mortgage, making it easier for individuals who need housing quickly.

- Speedy Move-In Times: Once a rental agreement is signed, tenants can often move in within days compared to the lengthy process of purchasing property which can take months or longer due to inspections and financing hurdles.

Possible Eviction Risks

Renters must navigate the risks associated with eviction from rental properties.

- Landlord Decisions: If landlords decide to sell or renovate properties extensively, tenants may face eviction notices regardless of their payment history.

- Legal Protections Vary by Region: The laws governing tenant rights differ significantly across states and municipalities; some areas offer more protection against eviction than others.

Lack of Personalization Options

Renters have limited ability to personalize their living spaces compared to homeowners.

- Design Restrictions: Many rental agreements restrict alterations that could make a space feel more like home.

- Temporary Nature of Rentals: The transient nature of renting means that even if modifications are allowed temporarily, they must be reverted before moving out.

Short-Term Commitment

Renting offers short-term commitments compared to long-term mortgages associated with buying homes.

- Flexibility in Living Arrangements: For individuals who anticipate changes in their work or personal lives (like job relocations), renting provides an adaptable option without long-term ties.

- Trial Living Situations: Renting allows individuals or families to experience different neighborhoods before committing long-term through purchase decisions.

In conclusion, renting a house comes with its unique set of advantages and disadvantages that must be carefully weighed against personal circumstances and financial goals. While it provides flexibility and reduced responsibility regarding maintenance and repairs, it also lacks equity building opportunities and comes with potential instability due to market fluctuations. Understanding these pros and cons is crucial for anyone considering renting as part of their housing strategy.

Frequently Asked Questions About Renting A House Pros And Cons

- What are the main benefits of renting?

The primary benefits include lower upfront costs, flexibility in relocation, no maintenance responsibilities, and access to amenities. - Why might someone choose not to rent?

The inability to build equity over time is a significant drawback; renters also miss out on potential tax benefits available only to homeowners. - How does renting affect financial liquidity?

Renting typically allows for better cash flow management since monthly expenses are generally lower than mortgage payments. - Can rent prices increase unexpectedly?

Yes, landlords may raise rents at lease renewal times based on market conditions or property improvements. - What happens if my landlord decides not to renew my lease?

If your landlord chooses not to renew your lease, you may need to find alternative housing quickly. - Aren’t there any tax benefits associated with renting?

No significant tax benefits exist for renters; only property owners enjoy deductions related to mortgage interest and property taxes. - How does renting affect my ability to personalize my living space?

Renters often face restrictions on making alterations or personalizing their homes without landlord approval. - Is renting suitable for everyone?

No; whether renting is suitable depends on individual circumstances such as job stability, lifestyle preferences, and financial goals.