Renting to own a house, often referred to as a rent-to-own agreement, is an increasingly popular option for individuals looking to transition from renting to homeownership. This arrangement allows tenants to rent a property with the option to purchase it after a specified period. While this approach can provide a pathway to ownership for those who may not qualify for traditional mortgages, it also comes with its own set of advantages and disadvantages. Understanding these pros and cons is essential for anyone considering this route, especially in the context of personal finance and investment strategies.

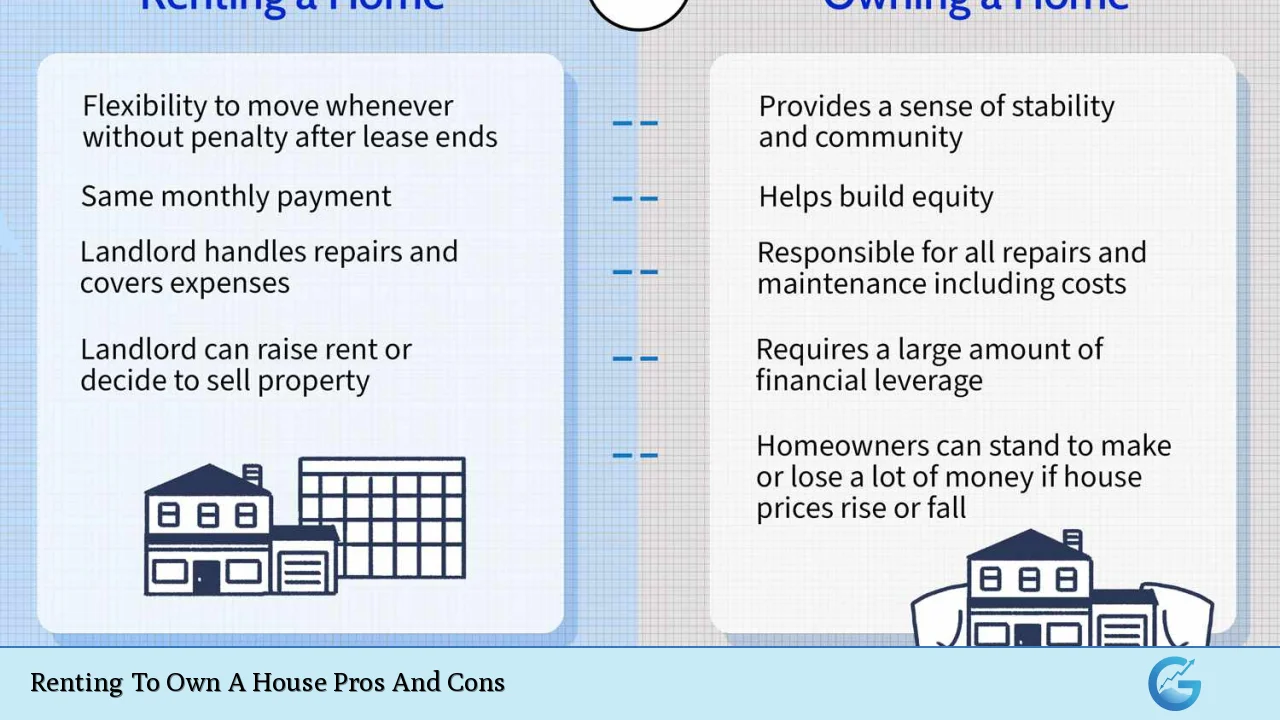

| Pros | Cons |

|---|---|

| Opportunity to build equity while renting. | Higher overall costs compared to standard renting. |

| Time to improve credit scores before purchase. | Risk of losing money if you decide not to buy. |

| Ability to lock in the purchase price. | Potential for higher-than-market rent payments. |

| Flexibility to test the home and neighborhood. | Maintenance responsibilities may fall on the tenant. |

| No immediate need for a large down payment. | Financing is not guaranteed at the end of the lease. |

Opportunity to Build Equity While Renting

One of the most significant advantages of a rent-to-own agreement is that it allows renters to build equity in the home while they are living in it. Unlike traditional renting, where monthly payments go directly to the landlord without any return on investment, a portion of the rent in a rent-to-own arrangement typically contributes towards the eventual purchase price. This means that renters can gradually accumulate equity, making their transition to homeownership smoother and more financially feasible.

- Equity Accumulation: Each month, part of your rent payment goes toward your future down payment.

- Financial Growth: This arrangement can be particularly beneficial for individuals who feel stuck in traditional renting scenarios where they do not see any financial return.

Time to Improve Credit Scores Before Purchase

For many potential homeowners, securing a mortgage can be challenging due to poor credit history or insufficient savings. Rent-to-own agreements provide an opportunity for individuals to improve their financial situation over time.

- Credit Improvement: Renters can use this period to pay down debts and improve their credit scores, making them more eligible for favorable mortgage rates when it comes time to buy.

- Financial Stability: This flexibility allows tenants to stabilize their finances without the immediate pressure of purchasing a home.

Ability to Lock in the Purchase Price

Another advantage of rent-to-own agreements is that they often allow tenants to lock in the purchase price at the beginning of the lease. This can be particularly advantageous in rising real estate markets.

- Market Protection: By locking in a price, renters protect themselves from potential increases in property values during their rental period.

- Financial Certainty: Knowing the purchase price upfront allows tenants to plan their finances more effectively.

Flexibility to Test the Home and Neighborhood

Renting to own offers prospective buyers a unique chance to “test drive” a property before committing fully. This is particularly beneficial for those who are unsure about their long-term housing needs or preferences.

- Neighborhood Assessment: Tenants can evaluate whether the location meets their lifestyle requirements, including commute times, school districts, and community amenities.

- Property Suitability: Living in the home allows potential buyers to assess its condition and suitability before making a significant financial commitment.

No Immediate Need for a Large Down Payment

Traditional home buying often requires substantial down payments, which can be a barrier for many potential homeowners. Rent-to-own agreements typically require lower initial costs.

- Reduced Upfront Costs: Instead of saving tens of thousands for a down payment, renters can focus on smaller monthly payments while gradually saving towards ownership.

- Financial Accessibility: This makes homeownership more accessible for individuals who may struggle with upfront costs but have steady incomes.

Higher Overall Costs Compared to Standard Renting

Despite its advantages, one significant drawback of renting to own is that it often comes with higher overall costs than traditional renting arrangements.

- Increased Rent Payments: Rent-to-own agreements typically involve higher-than-average rent payments because part of these payments is allocated toward building equity.

- Long-Term Financial Commitment: Over time, these increased costs can add up significantly compared to standard rental agreements.

Risk of Losing Money If You Decide Not to Buy

One of the most critical risks associated with rent-to-own agreements is that if you choose not to purchase the property at the end of your lease term, you may lose money invested during your rental period.

- Nonrefundable Fees: Many agreements require an upfront option fee that is nonrefundable if you decide not to buy.

- Lost Rent Credits: Any portion of your rent that was credited toward your future purchase may also be lost if you do not proceed with buying the home.

Potential for Higher-Than-Market Rent Payments

While building equity is an advantage, it often comes at the cost of higher monthly rent payments compared to market rates.

- Premium Payments: Renters may find themselves paying significantly more than they would under a standard lease agreement due to the added benefits included in rent-to-own contracts.

- Budget Strain: This can strain budgets and financial plans, especially if unexpected expenses arise during the rental period.

Maintenance Responsibilities May Fall on the Tenant

In many rent-to-own agreements, maintenance responsibilities are shared or entirely fall on the tenant.

- Unexpected Costs: Tenants may face unexpected repair costs that they would not typically incur under standard rental agreements where landlords handle maintenance.

- Financial Burden: This added responsibility can lead to financial strain if significant repairs are needed during the rental period.

Financing Is Not Guaranteed at The End Of The Lease

Even if you have been making timely payments and have built equity during your rental period, there is no guarantee that you will qualify for financing when it’s time to purchase.

- Mortgage Approval Risks: Changes in credit score or financial circumstances could jeopardize your ability to secure a mortgage when you are ready to buy.

- Potential Losses: If financing falls through after investing time and money into the property, you may end up losing both your option fee and any accumulated equity credits.

In conclusion, renting to own presents both unique opportunities and significant challenges. It provides a pathway toward homeownership while allowing renters time to improve their financial situations. However, it also carries risks such as higher costs and potential loss of investments if one decides not to proceed with purchasing.

Individuals considering this option should carefully evaluate their financial readiness and long-term goals before entering into a rent-to-own agreement. With thorough research and planning, renting to own can serve as an effective strategy for achieving homeownership while navigating personal finance challenges.

Frequently Asked Questions About Renting To Own A House

- What is renting to own?

A rent-to-own agreement allows tenants to live in a property while paying rent with an option or obligation to purchase it later. - What are typical terms in a rent-to-own agreement?

Terms usually include an option fee, monthly rent amount (often higher than market rates), and how much rent goes toward the purchase price. - Can I lose money with a rent-to-own agreement?

Yes, if you decide not to buy at the end of your lease term, you may lose any nonrefundable fees and accrued credits toward your down payment. - Is financing guaranteed after renting?

No, financing is not guaranteed; you must still qualify for a mortgage when you’re ready to buy. - What happens if I can’t afford repairs during my rental period?

If maintenance responsibilities fall on you as part of your agreement, you’ll need funds available for repairs or risk losing access or value in your investment. - How does renting affect my credit score?

Timely payments during your rental period can help improve your credit score over time. - Can I negotiate terms in my rent-to-own contract?

Yes, many aspects such as purchase price and maintenance responsibilities can often be negotiated before signing. - What should I consider before entering into a rent-to-own agreement?

You should evaluate your financial situation, understand all terms clearly, and assess whether you’re comfortable with potential risks involved.