Deciding whether to rent or buy a house is a significant financial decision that can impact your lifestyle, financial health, and long-term goals. Both options come with their unique advantages and disadvantages, making the choice highly personal and dependent on individual circumstances. This article delves into the pros and cons of renting versus buying a home, providing a comprehensive overview tailored for those interested in finance, investments, and market trends.

| Pros | Cons |

|---|---|

| Lower upfront costs | Building equity is not possible |

| Flexibility to move easily | Rent can increase over time |

| No maintenance responsibilities | Limited control over living space |

| Predictable monthly expenses | No tax benefits for renters |

| Access to amenities without added costs | Potential for eviction or lease termination |

| Financial risk is lower in volatile markets | No investment growth potential |

| Less commitment to a location | Long-term costs can add up without ownership benefits |

| Opportunity to invest in other areas (e.g., stocks) | Dependence on landlord’s decisions regarding property management |

Lower Upfront Costs

One of the most significant advantages of renting is the lower upfront costs associated with it.

- Security Deposits: Typically, renters only need to pay a security deposit (usually one or two months’ rent) and the first month’s rent.

- No Down Payment: Unlike buying a home, which often requires a down payment ranging from 5% to 20% of the purchase price, renting eliminates this financial hurdle.

This lower barrier to entry makes renting more accessible for individuals who may not have substantial savings.

Flexibility to Move Easily

Renting offers unparalleled flexibility compared to homeownership.

- Short-term Commitments: Lease agreements often range from six months to a year, allowing renters to relocate without the long-term commitment of a mortgage.

- Job Relocation: For those whose careers require frequent moves, renting provides an ideal solution without the burden of selling a property.

This flexibility can be particularly advantageous in today’s dynamic job market.

No Maintenance Responsibilities

When you rent, you are generally not responsible for maintenance and repairs.

- Landlord’s Responsibility: If something breaks—be it plumbing issues or appliance failures—the landlord is typically responsible for fixing it.

- Cost Savings: This arrangement can save renters significant amounts of money and stress compared to homeowners who must budget for unexpected repairs.

Predictable Monthly Expenses

Renting allows for more predictable monthly budgeting.

- Fixed Payments: Renters usually have fixed monthly payments outlined in their lease agreements, making it easier to plan finances.

- No Hidden Costs: While homeowners must account for fluctuating property taxes and maintenance costs, renters often have fewer variables affecting their monthly expenses.

This predictability can enhance financial stability.

Access to Amenities Without Added Costs

Many rental properties come with amenities that might be cost-prohibitive for homeowners.

- Shared Facilities: Renting often includes access to facilities such as pools, gyms, or community spaces without additional fees.

- Cost-effective Living: This access can enhance quality of life while keeping living expenses manageable.

Financial Risk is Lower in Volatile Markets

In uncertain economic climates, renting can be less risky than buying.

- Avoiding Depreciation: Renters are not tied to an asset that may lose value during economic downturns.

- Liquidity: Renting allows individuals to allocate their funds elsewhere—such as investments in stocks or bonds—rather than tying them up in real estate.

Less Commitment to a Location

Renting provides flexibility regarding where you live.

- Temporary Living Situations: Ideal for those who may not want to settle down permanently in one location.

- Easier Transitions: Renting allows individuals to explore different neighborhoods or cities without long-term commitments.

Opportunity to Invest in Other Areas

Renters can use the money saved from not having to maintain a home or pay property taxes to invest elsewhere.

- Diversification of Investments: Instead of tying up funds in real estate, renters can invest in stocks, crypto, or other financial markets.

- Potential Higher Returns: Depending on market conditions, these investments could yield higher returns than real estate appreciation alone.

Building Equity is Not Possible

While renting has its advantages, one significant downside is the inability to build equity.

- No Ownership Benefits: Rent payments do not contribute toward ownership; instead, they benefit the landlord.

- Long-Term Investment Loss: Over time, renters miss out on potential appreciation in property value that homeowners enjoy through equity buildup.

This lack of investment growth can be detrimental for those looking for long-term wealth accumulation.

Rent Can Increase Over Time

Another disadvantage of renting is the potential for rising costs.

- Landlord Discretion: Rent prices can increase at the end of lease terms based on market conditions or landlord decisions.

- Budget Constraints: These increases can strain budgets and force renters into less desirable living situations if they cannot afford higher rents.

Limited Control Over Living Space

Renters often face restrictions regarding how they can modify their living spaces.

- Customization Limitations: Many landlords do not allow significant alterations—such as painting walls or renovating kitchens.

- Personalization Restrictions: This limitation can affect renters’ sense of ownership and comfort within their homes.

No Tax Benefits for Renters

Homeownership often comes with tax benefits that are unavailable to renters.

- Mortgage Interest Deductions: Homeowners can deduct mortgage interest from their taxable income, reducing their overall tax burden.

- Property Tax Deductions: Homeowners may also deduct property taxes paid on their residences. Renters do not receive similar benefits, which may affect long-term financial planning strategies.

Potential for Eviction or Lease Termination

Renters face risks related to lease agreements that homeowners do not encounter.

- Eviction Risks: If landlords decide to sell the property or terminate leases for any reason—including non-payment—renters may find themselves needing to relocate unexpectedly.

- Instability Concerns: This potential instability can create anxiety and uncertainty regarding housing security.

No Investment Growth Potential

Unlike homeowners who benefit from property appreciation over time, renters miss out on this financial advantage.

- Market Fluctuations: Home values typically appreciate over time; renters do not gain from this increase.

- Long-Term Wealth Building: Without equity growth through homeownership, renters may find it challenging to build wealth over time compared to those who own property.

Long-Term Costs Can Add Up Without Ownership Benefits

While renting may seem cheaper initially, long-term costs without ownership benefits can accumulate significantly over time.

- Cumulative Payments: Over years of renting, individuals may spend large sums without any return on investment through equity.

- Opportunity Costs: Funds spent on rent could potentially yield better returns if invested wisely elsewhere but still lack the tangible asset ownership provides.

Dependence on Landlord’s Decisions Regarding Property Management

Renters rely heavily on landlords’ management decisions regarding property upkeep and policies.

- Quality Control Issues: If landlords neglect maintenance or fail to address tenant concerns promptly, renters may suffer from poor living conditions.

- Limited Agency in Housing Decisions: Renters have little control over significant decisions affecting their living environment compared to homeowners who manage their properties directly.

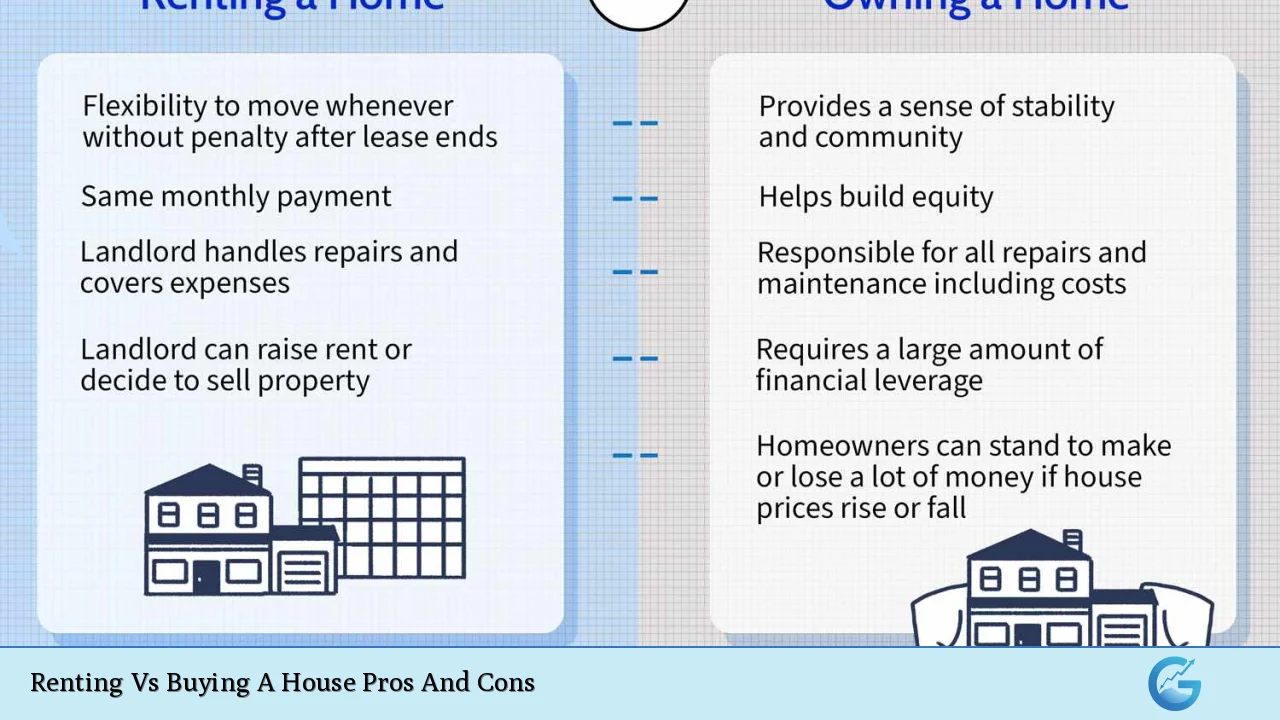

In conclusion, both renting and buying have distinct pros and cons that cater to different lifestyles and financial situations. Renting offers flexibility and lower initial costs but lacks equity-building opportunities. Conversely, buying provides stability and investment potential but comes with higher upfront expenses and ongoing responsibilities. Ultimately, individuals must weigh these factors against their personal circumstances and long-term goals when deciding between renting and buying a home.

Frequently Asked Questions About Renting Vs Buying A House Pros And Cons

- What are the main advantages of renting?

Renting offers lower upfront costs, flexibility in moving, no maintenance responsibilities, predictable monthly expenses, access to amenities without added costs, and reduced financial risk during market volatility. - What are the primary disadvantages of renting?

The main drawbacks include no opportunity to build equity, potential rent increases over time, limited control over living space modifications, lack of tax benefits compared to homeowners, risks of eviction or lease termination. - Is it cheaper to rent than buy?

It depends on various factors including local housing markets; in some areas renting may be more affordable while in others buying could offer better long-term investment returns. - How does renting affect my credit score?

Renting itself does not directly impact your credit score unless your landlord reports your payments; however consistently paying rent on time can help build credit history. - Can I negotiate my rent?

Yes, many landlords are open to negotiation especially if you have been a reliable tenant; discussing lease terms before signing can yield beneficial arrangements. - What should I consider before deciding whether to rent or buy?

Consider your financial situation including savings for down payments versus security deposits; evaluate your job stability and how long you plan on staying in one place. - Are there tax benefits associated with buying a home?

Yes, homeowners often benefit from tax deductions such as mortgage interest and property taxes which are unavailable to renters. - How does market volatility affect my decision?

In volatile markets renting might be safer as it avoids potential depreciation risks associated with owning property; however owning can provide long-term stability if planned correctly.