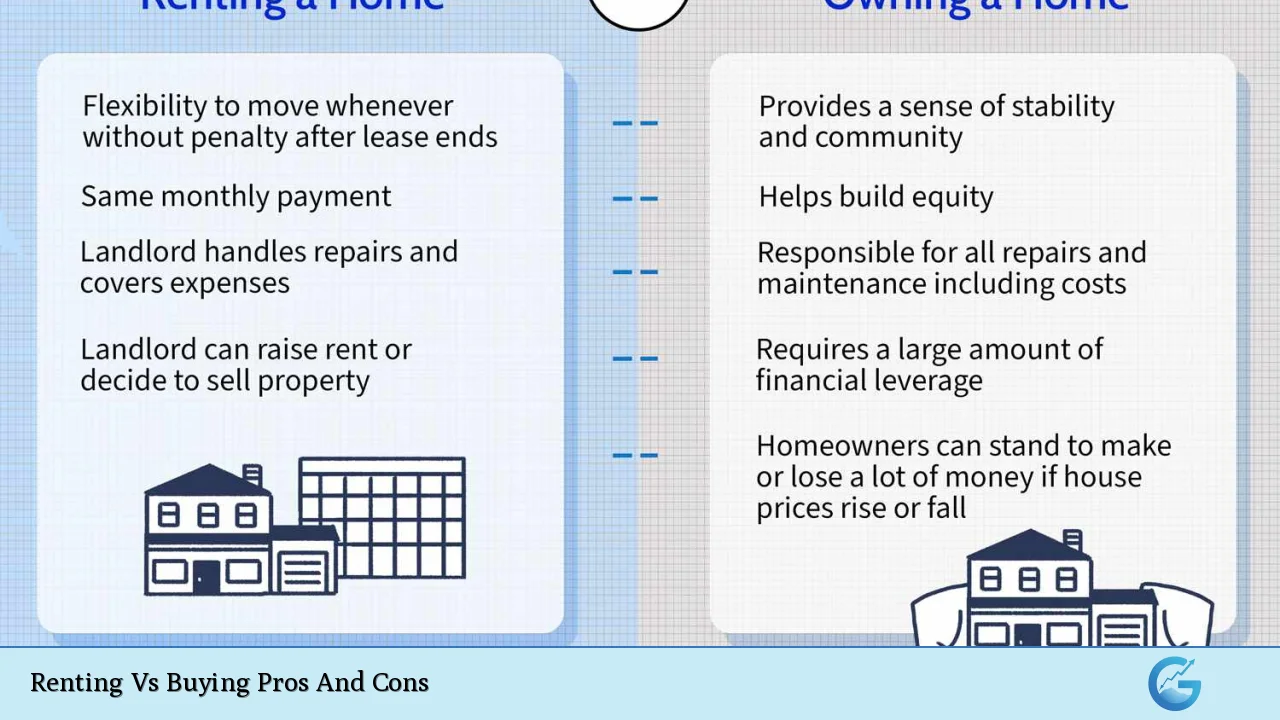

Deciding whether to rent or buy a property is a significant financial decision that can impact your lifestyle, financial health, and future goals. Each option comes with its own set of advantages and disadvantages, making it essential to weigh these carefully based on your personal circumstances. This article delves into the pros and cons of renting versus buying, providing a comprehensive overview to help you make an informed choice.

| Pros | Cons |

|---|---|

| Lower upfront costs | Building no equity |

| Flexibility and mobility | Rent increases over time |

| No maintenance responsibilities | No tax benefits |

| Access to amenities | Limited personalization options |

| Predictable monthly expenses | Potential for eviction |

| Less financial commitment | Dependency on landlord decisions |

| Opportunity to invest elsewhere | Limited long-term stability |

| Lower exposure to market fluctuations | Less sense of ownership |

Lower Upfront Costs

One of the primary advantages of renting is the significantly lower upfront costs compared to buying a home. When renting, you typically need to pay a security deposit and the first month’s rent, which is considerably less than the down payment required for purchasing a home.

- Security Deposits: Usually equivalent to one or two months’ rent.

- No Closing Costs: Renting eliminates additional costs such as closing fees, which can add thousands to the initial purchase price.

This financial flexibility allows renters to allocate funds toward other investments or savings.

Flexibility and Mobility

Renting provides unparalleled flexibility for those who may need to relocate frequently due to job changes or personal circumstances.

- Short-Term Leases: Many rental agreements are structured as month-to-month or yearly leases, allowing tenants to move without the burden of selling a property.

- Adaptability: Renters can easily adjust their living situation based on changing life circumstances without long-term commitments.

This is particularly beneficial for younger individuals or those in transitional phases of their careers.

No Maintenance Responsibilities

Another significant advantage of renting is that maintenance responsibilities typically fall on the landlord.

- Repairs and Upkeep: When issues arise, such as plumbing problems or appliance malfunctions, renters can contact their landlord for repairs rather than incurring out-of-pocket expenses.

- Time Savings: This arrangement frees up time and mental energy for renters, allowing them to focus on other priorities.

Access to Amenities

Many rental properties offer amenities that might be financially out of reach for homeowners.

- Shared Facilities: Renters often have access to gyms, pools, and community spaces that enhance their living experience without additional costs.

- Convenience: Such amenities can significantly improve quality of life, particularly in urban settings where space may be limited.

Predictable Monthly Expenses

Renting generally offers more predictable monthly expenses compared to homeownership.

- Fixed Rent Payments: While rents can increase, they usually remain stable for the duration of the lease.

- No Unexpected Costs: Renters do not have to worry about unexpected repairs or property taxes that can arise with homeownership.

This predictability aids in budgeting and financial planning.

Less Financial Commitment

Renting involves less financial commitment than buying a home.

- Lower Long-Term Risk: Without the burden of a mortgage, renters are less exposed to market fluctuations that could affect property values negatively.

- Investment Opportunities: The money saved from not purchasing a home can be invested elsewhere, potentially yielding higher returns.

Building No Equity

A significant disadvantage of renting is that it does not contribute to building equity.

- Monthly Payments Go Elsewhere: Rent payments go directly to the landlord’s mortgage or profit rather than contributing toward an asset you own.

- No Long-Term Investment: At the end of a rental period, there is no return on investment as there would be with homeownership.

This lack of equity can be a considerable drawback for those looking for long-term financial growth through real estate.

Rent Increases Over Time

Renters are often subject to rent increases at the end of their lease agreements.

- Unpredictable Costs: Landlords may raise rents based on market conditions or property value changes, leading to potential affordability issues for tenants.

- Budgeting Challenges: Sudden increases can disrupt financial planning and force renters to relocate unexpectedly if they cannot afford the new rate.

No Tax Benefits

Unlike homeowners who may benefit from mortgage interest deductions and property tax deductions, renters do not receive similar tax advantages.

- Missed Deductions: Homeownership provides opportunities for tax savings that can significantly impact overall financial health.

- Increased Tax Burden: Renters must pay taxes without receiving any offsetting benefits related to their housing costs.

This aspect can make renting less financially advantageous in the long run compared to owning a home.

Limited Personalization Options

Renting often comes with restrictions on how you can personalize your living space.

- Modification Restrictions: Changes such as painting walls or renovating kitchens typically require landlord approval, limiting creative expression in your home environment.

- Temporary Living Spaces: The inability to truly make a space your own can lead to dissatisfaction over time for some renters.

This limitation may deter individuals who value customization in their living arrangements.

Potential for Eviction

Renters face the risk of eviction if landlords decide to sell properties or change rental terms unfavorably.

- Lack of Control: Tenants have little control over their living situation compared to homeowners who have stability in ownership.

- Uncertainty: The possibility of needing to find new housing suddenly can create stress and instability in renters’ lives.

This unpredictability is a significant concern for many individuals considering renting as a long-term option.

Dependency on Landlord Decisions

Renters are at the mercy of their landlords regarding property management and decisions affecting their living conditions.

- Property Management Issues: If landlords fail to maintain properties properly or respond promptly to repair requests, tenants may suffer inconveniences without recourse.

- Market Vulnerability: Changes in ownership or management styles can lead renters into unfavorable situations unexpectedly.

This dependency highlights one of the key risks associated with renting versus owning a home outright.

Less Sense of Ownership

Finally, renting often lacks the sense of ownership that comes with buying a home.

- Emotional Investment: Homeownership tends to foster a deeper emotional connection and pride in one’s living space compared to renting.

- Community Stability: Owning typically encourages longer-term community engagement and investment in local neighborhoods compared to transient rental situations.

This intangible aspect may influence many individuals’ decisions when weighing their options between renting and buying.

In conclusion, both renting and buying have distinct advantages and disadvantages that cater to different lifestyles and financial situations. Renting offers flexibility, lower upfront costs, and reduced responsibilities but lacks equity building and stability. On the other hand, buying provides long-term investment potential and personal freedom but comes with higher initial costs and ongoing responsibilities. Ultimately, your decision should align with your financial goals, lifestyle preferences, and future plans.

Frequently Asked Questions About Renting Vs Buying Pros And Cons

- What are the main advantages of renting?

Renting offers lower upfront costs, flexibility in moving, no maintenance responsibilities, predictable monthly expenses, and access to amenities. - What are the main disadvantages of renting?

Renting does not build equity, may involve rent increases over time, lacks tax benefits, limits personalization options, and carries eviction risks. - Is buying always better than renting?

Not necessarily; it depends on individual circumstances such as financial stability, career mobility needs, and long-term goals. - How does renting affect my credit score?

Renting can help build credit if payments are reported by landlords; however, it generally has less impact than mortgage payments. - What factors should I consider when deciding between renting and buying?

Consider your financial situation, job stability, lifestyle preferences, future plans, and local real estate market conditions. - Can I negotiate rent prices?

Yes, especially if you have strong rental history or if rental demand is low; it’s worth discussing with your landlord. - Are there any hidden costs associated with renting?

Yes; potential hidden costs include utilities not covered by rent, security deposits that may not be returned fully, and renter’s insurance. - What happens if my landlord sells the property?

If your landlord sells the property during your lease term, you typically must honor your lease unless otherwise stated; however, new owners may change terms upon renewal.

Understanding these pros and cons will empower you as you navigate this critical decision-making process regarding where you live. Whether you choose renting or buying should reflect your unique needs and aspirations within today’s dynamic financial landscape.