Retirement accounts are essential financial tools designed to help individuals save for their future. They come in various forms, including Individual Retirement Accounts (IRAs), 401(k) plans, and pension plans, each offering unique benefits and drawbacks. Understanding the pros and cons of these accounts is crucial for making informed decisions about retirement savings. This article explores the advantages and disadvantages of retirement accounts, providing a comprehensive overview for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Tax advantages that can enhance savings growth. | Limited access to funds until retirement age. |

| Employer matching contributions in 401(k) plans. | Potential penalties for early withdrawals. |

| Diverse investment options available. | Fees associated with account management. |

| Tax-deferred or tax-free growth of investments. | Complex rules regarding withdrawals and contributions. |

| Encouragement of disciplined saving habits. | Potential for lower liquidity compared to other investments. |

Tax Advantages

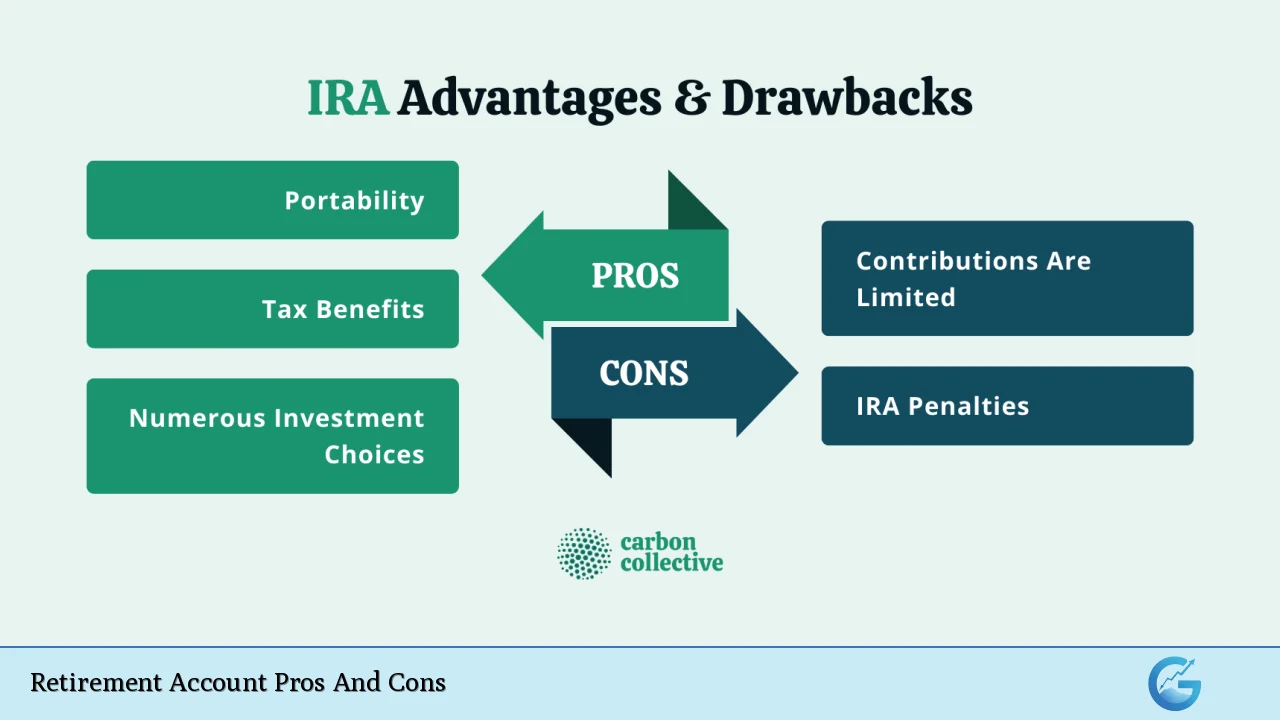

One of the most significant advantages of retirement accounts is the tax benefits they offer.

- Tax-Deferred Growth: Contributions to traditional IRAs and 401(k)s are often made pre-tax, allowing your investments to grow without immediate tax implications. This can lead to substantial growth over time due to compound interest.

- Tax-Free Withdrawals: Roth IRAs allow for tax-free withdrawals in retirement, provided certain conditions are met. This can be particularly advantageous for individuals who expect to be in a higher tax bracket upon retirement.

- Immediate Tax Deductions: Contributions to traditional IRAs may be tax-deductible, reducing your taxable income for the year you contribute. This can provide immediate financial relief.

Employer Matching Contributions

Many employer-sponsored retirement plans, such as 401(k)s, offer matching contributions.

- Free Money: Employer matches effectively increase your savings without additional cost to you. For example, if your employer matches 50% of your contributions up to a certain percentage of your salary, this can significantly boost your retirement fund.

- Incentive to Save: Knowing that your employer will match contributions incentivizes employees to save more aggressively for retirement.

Diverse Investment Options

Retirement accounts typically offer a range of investment options.

- Variety of Choices: Investors can choose from stocks, bonds, mutual funds, ETFs, and more within their retirement accounts. This diversity allows individuals to tailor their investment strategies according to their risk tolerance and financial goals.

- Self-Directed Accounts: Some IRAs allow for self-directed investments, enabling investors to explore alternative assets like real estate or cryptocurrencies.

Tax-Deferred or Tax-Free Growth

The growth potential of investments within retirement accounts is a significant advantage.

- Compounding Returns: By deferring taxes on earnings until withdrawal (in the case of traditional accounts), investors can benefit from compounding returns over time.

- Long-Term Growth: The longer you keep your money invested without taxation, the more it can grow. This is particularly beneficial for younger investors who have decades until retirement.

Encouragement of Disciplined Saving Habits

Retirement accounts inherently encourage disciplined saving behaviors.

- Automatic Contributions: Many employers offer automatic payroll deductions for 401(k) contributions, making saving effortless and habitual.

- Long-Term Focus: The structure of retirement accounts discourages impulsive withdrawals and encourages individuals to focus on long-term financial goals.

Limited Access to Funds Until Retirement Age

While there are numerous advantages, there are also significant drawbacks associated with retirement accounts.

- Withdrawal Restrictions: Most retirement accounts impose strict rules on when and how funds can be accessed. Generally, individuals cannot withdraw funds without penalties until they reach a certain age (typically 59½).

- Hardship Withdrawals: While some plans allow for hardship withdrawals, these are often limited and come with penalties or taxes.

Potential Penalties for Early Withdrawals

Early withdrawal penalties can deter individuals from accessing their funds when needed.

- 10% Penalty: For traditional IRAs and 401(k)s, withdrawing funds before age 59½ typically incurs a 10% penalty on top of regular income taxes owed on the withdrawal amount.

- Exceptions Exist: There are exceptions to this rule (such as first-time home purchases or certain medical expenses), but they are limited and often require documentation.

Fees Associated with Account Management

Retirement accounts can come with various fees that may impact overall returns.

- Management Fees: Many investment options within retirement accounts charge management fees that can erode returns over time. It’s essential to understand these fees when choosing an investment strategy.

- Administrative Fees: Some employer-sponsored plans may have administrative fees that further reduce the amount available for investment growth.

Complex Rules Regarding Withdrawals and Contributions

The rules governing retirement accounts can be intricate and confusing.

- Contribution Limits: There are annual contribution limits set by the IRS that vary depending on the type of account (e.g., $7,000 for IRAs in 2024). Understanding these limits is crucial for maximizing contributions.

- Required Minimum Distributions (RMDs): Traditional IRAs require account holders to begin taking distributions at age 73. Failing to take RMDs can result in significant penalties.

Potential for Lower Liquidity Compared to Other Investments

Retirement accounts often have lower liquidity than standard brokerage accounts or savings accounts.

- Difficulty Accessing Funds: Because funds are intended for long-term savings, accessing them before retirement may involve penalties or taxes that make it less appealing than other investment vehicles.

- Impact on Financial Flexibility: This lack of liquidity can limit financial flexibility during emergencies or unexpected expenses.

In conclusion, while retirement accounts offer numerous advantages such as tax benefits, employer matching contributions, diverse investment options, and encouragement of disciplined saving habits, they also present challenges including limited access to funds until retirement age, potential penalties for early withdrawals, associated fees, complex rules regarding contributions and withdrawals, and lower liquidity compared to other investments.

Understanding these pros and cons is essential for anyone looking to invest wisely in their financial future. Making informed decisions about which type of retirement account aligns best with individual financial goals will ultimately lead to a more secure retirement.

Frequently Asked Questions About Retirement Account Pros And Cons

- What is the primary benefit of a Roth IRA?

The primary benefit of a Roth IRA is tax-free withdrawals in retirement after meeting certain conditions. - Are there penalties for early withdrawal from retirement accounts?

Yes, most retirement accounts impose a 10% penalty on withdrawals made before age 59½. - Can I access my employer’s matching contributions immediately?

No, typically you must meet vesting requirements before accessing employer matching contributions. - What happens if I don’t take my required minimum distributions?

If you fail to take your RMDs from traditional IRAs after age 73, you may face a penalty equal to 50% of the amount that should have been withdrawn. - Do all retirement accounts offer tax benefits?

Most do; however, the type and extent of tax benefits vary between account types like traditional IRAs versus Roth IRAs. - What are some common fees associated with retirement accounts?

Common fees include management fees for investments and administrative fees charged by plan providers. - How do I choose between a traditional IRA and a Roth IRA?

Your choice should depend on your current tax bracket versus expected tax bracket during retirement; consult a financial advisor if uncertain. - Can I invest in cryptocurrencies through my IRA?

Yes, some self-directed IRAs allow investments in cryptocurrencies; however, it’s essential to understand the associated risks.