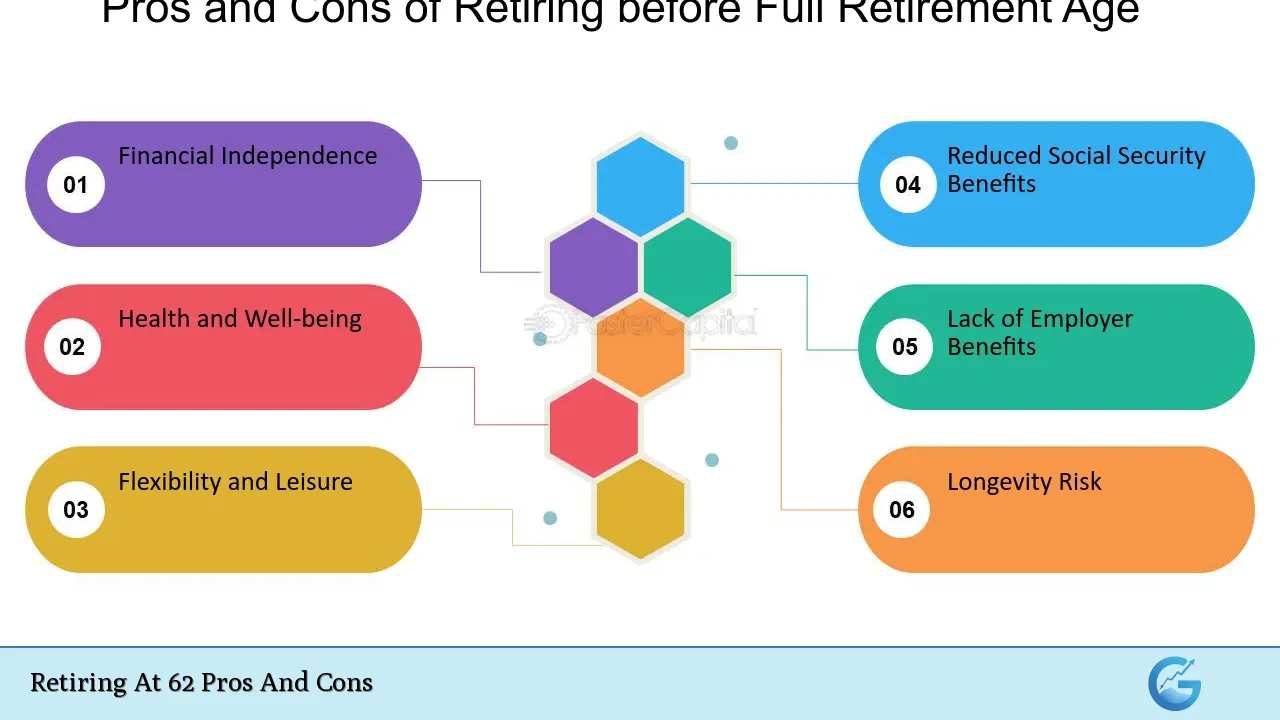

Deciding to retire at the age of 62 is a significant milestone that many individuals contemplate as they approach their golden years. This decision is influenced by various factors, including financial stability, health considerations, and personal aspirations. While retiring at 62 can provide a sense of freedom and the opportunity to pursue passions, it also presents challenges that require careful consideration. This article explores the pros and cons of retiring at this age, offering insights into the financial implications, health effects, and lifestyle changes associated with early retirement.

| Pros | Cons |

|---|---|

| Early Access to Social Security Benefits | Reduced Social Security Benefits |

| More Time for Personal Pursuits | Increased Healthcare Costs |

| Reduced Work-Related Stress | Financial Strain on Savings |

| Opportunity for Second Careers or Volunteer Work | Potential for Social Isolation |

| Enjoyment of Senior Living Amenities | Longer Retirement Periods and Risks of Outliving Savings |

| Flexible Work-Life Transition | Impact on Investment Growth Opportunities |

| Improved Quality of Life and Well-being | Adjustment to Lifestyle Changes and Routine Disruption |

Early Access to Social Security Benefits

One of the most appealing aspects of retiring at 62 is the ability to start collecting Social Security benefits earlier than the full retirement age, which typically ranges from 66 to 67 depending on your birth year.

- Financial Support: For those who may need financial assistance sooner rather than later, early access to these benefits can be a crucial lifeline.

- Supplementing Income: Early retirees can use these funds to supplement other retirement savings, allowing for a more comfortable lifestyle.

Reduced Social Security Benefits

While early access to Social Security benefits is advantageous, it comes with significant drawbacks.

- Permanent Reduction: Claiming benefits at 62 results in a permanent reduction of monthly payments—up to 30% less than if one waits until full retirement age.

- Long-term Financial Impact: This reduction can have serious implications for long-term financial security, especially for those relying heavily on Social Security as their primary income source.

More Time for Personal Pursuits

Retiring at 62 allows individuals to dedicate more time to activities they enjoy.

- Hobbies and Travel: With more free time, retirees can engage in hobbies, travel, or spend quality time with family and friends.

- Fulfillment and Satisfaction: This newfound freedom often leads to greater life satisfaction and fulfillment, as individuals pursue passions that may have been sidelined during their working years.

Increased Healthcare Costs

Healthcare is a significant concern for those retiring before Medicare eligibility at age 65.

- Insurance Coverage: Early retirees must secure private health insurance or face out-of-pocket expenses until they qualify for Medicare.

- Rising Medical Expenses: As individuals age, healthcare costs typically increase. This necessitates careful budgeting and planning for potential medical expenses that could strain finances.

Reduced Work-Related Stress

Leaving the workforce can lead to decreased stress levels associated with job responsibilities.

- Health Benefits: A less stressful lifestyle can improve both physical and mental health, potentially reducing risks associated with burnout and chronic stress-related conditions.

- Lifestyle Changes: Retirees often report improved well-being as they transition away from the demands of a full-time job.

Financial Strain on Savings

Retiring at 62 means relying on savings for a longer period without the benefit of continued income from employment.

- Longevity Risk: If an individual retires at 62 and lives into their 90s, their savings must last potentially three decades or more. This increases the risk of outliving one’s financial resources.

- Withdrawal Rates: It may be necessary to withdraw higher percentages from retirement accounts each year, which can deplete savings faster than anticipated.

Opportunity for Second Careers or Volunteer Work

Retirement does not have to mean complete withdrawal from work; it can also present opportunities for new ventures.

- Pursuing Passions: Many retirees choose to start second careers or engage in volunteer work that aligns with their interests and values.

- Social Engagement: These activities can provide social interaction and a sense of purpose, helping mitigate feelings of isolation that some retirees experience.

Potential for Social Isolation

Transitioning from a busy work environment to retirement can lead to feelings of loneliness for some individuals.

- Loss of Daily Interaction: The daily social interactions provided by a workplace are often missed in retirement, leading some retirees to seek new social connections actively.

- Combatting Loneliness: Engaging in community activities or groups can help counteract feelings of isolation but requires effort and initiative from the retiree.

Enjoyment of Senior Living Amenities

Retiring at 62 allows individuals to take advantage of senior living amenities sooner.

- Community Engagement: Many independent living communities offer activities tailored specifically for retirees looking for a vibrant social life.

- Health Programs: These amenities often include fitness programs and social events that promote an active lifestyle while fostering friendships among peers.

Longer Retirement Periods and Risks of Outliving Savings

While retiring early offers more leisure time, it also means potentially longer retirement periods that require careful financial planning.

- Extended Planning Horizon: With increasing life expectancies, retirees need to ensure their savings last throughout their lifetime, which may require adjustments in spending habits and investment strategies.

- Inflation Considerations: Inflation can erode purchasing power over time, making it crucial for retirees to invest wisely to maintain their standard of living throughout retirement.

Flexible Work-Life Transition

Retiring at 62 allows for a smoother transition from full-time work into retirement by providing flexibility in how one approaches this life change.

- Part-Time Opportunities: Many choose part-time work or consulting roles that allow them to remain engaged without the pressures of full-time employment.

- Gradual Adjustment: This flexibility helps ease the adjustment process into retirement life while still contributing financially if needed.

Impact on Investment Growth Opportunities

Retiring earlier may limit opportunities for investment growth compared to those who continue working longer.

- Less Time for Compounding Returns: The longer one stays in the workforce, the more time investments have to grow through compounding interest.

- Potentially Lower Retirement Funds: Early retirees might miss out on significant contributions to retirement accounts during their final working years when earnings are typically higher.

Improved Quality of Life and Well-being

For many individuals, retiring at 62 leads to an improved quality of life overall.

- Pursuing Interests Freely: Retirees often find joy in pursuing interests without the constraints imposed by work schedules.

- Mental Health Benefits: The reduction in work-related stress contributes positively to mental health, allowing individuals more time for relaxation and enjoyment in their daily lives.

Adjustment to Lifestyle Changes and Routine Disruption

Transitioning into retirement can disrupt established routines that may require adjustment over time.

- Creating New Routines: Retirees must find ways to fill their days meaningfully while establishing new routines that maintain engagement and purpose.

- Navigating Change: Adjusting from a structured work environment to an unstructured daily life can be challenging but also rewarding as new opportunities arise.

In conclusion, retiring at 62 presents both advantages and disadvantages that warrant careful consideration. While it offers early access to benefits, reduced stress levels, and opportunities for personal fulfillment, it also poses challenges such as reduced income security, increased healthcare costs, and potential social isolation. Individuals contemplating this decision should weigh these factors against their financial situation, health status, and personal goals. Ultimately, thorough planning is essential not only for financial stability but also for ensuring a fulfilling retirement experience aligned with one’s aspirations.

Frequently Asked Questions About Retiring At 62

- What are the main advantages of retiring at 62?

The main advantages include early access to Social Security benefits, more time for personal pursuits like hobbies or travel, reduced work-related stress, opportunities for second careers or volunteer work, and improved quality of life. - What are some significant disadvantages?

The disadvantages include reduced Social Security benefits due to early claiming, increased healthcare costs before Medicare eligibility at age 65, potential financial strain on savings due to longer retirement periods, and risks associated with social isolation. - How does retiring at 62 affect Social Security benefits?

Claiming Social Security benefits at age 62 results in a permanent reduction—up to 30% less than what would be received if benefits were claimed at full retirement age. - What should I consider regarding healthcare when retiring early?

You should consider securing private health insurance until you qualify for Medicare at age 65 since healthcare costs generally rise with age. - Can I still work part-time after retiring at 62?

Yes! Many retirees choose part-time work or consulting roles that allow them flexibility while providing additional income. - How long will my savings need to last if I retire at 62?

If you retire at 62 and live until your late 80s or beyond, your savings may need to last up to three decades or more. - What strategies can help manage finances after retiring?

Create a budget that accounts for all expenses including healthcare; consider diversifying investments; explore part-time work options; and regularly review your financial plan. - Is there a risk of social isolation after retiring?

Yes, transitioning from a busy work environment can lead some retirees to experience feelings of loneliness; engaging in community activities can help mitigate this risk.