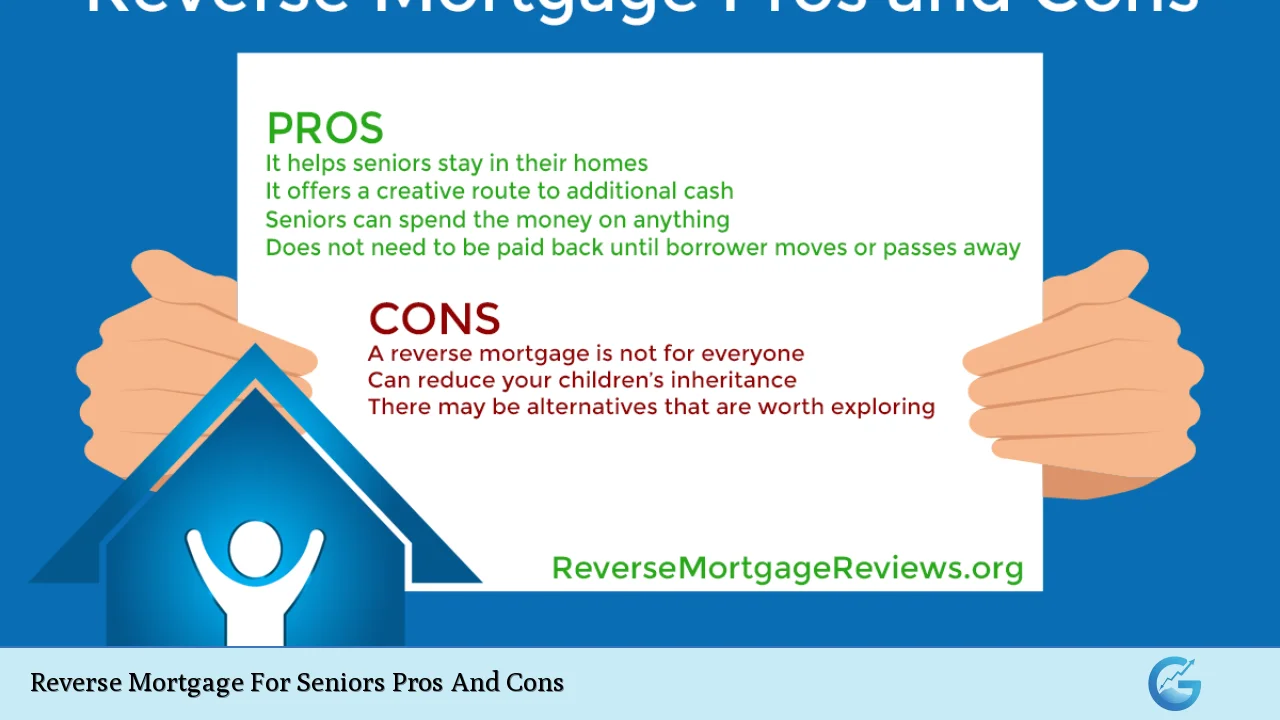

Reverse mortgages have become an increasingly popular financial tool for seniors looking to tap into their home equity during retirement. This unique type of loan allows homeowners aged 62 and older to borrow against the value of their property without the need for monthly mortgage payments. Instead, the loan is repaid when the homeowner sells the house, moves out, or passes away. While reverse mortgages can provide a valuable source of income for retirees, they also come with significant risks and considerations that must be carefully weighed.

| Pros | Cons |

|---|---|

| Supplemental income without monthly payments | High upfront costs and fees |

| Ability to stay in your home | Accumulating interest increases debt over time |

| No credit score requirements | Potential impact on government benefits |

| Funds can be used for any purpose | Reduced inheritance for heirs |

| Non-recourse loan protection | Strict occupancy requirements |

| Tax-free proceeds | Complexity and potential for misunderstanding |

Advantages of Reverse Mortgages for Seniors

Supplemental Income Without Monthly Payments

One of the most significant benefits of a reverse mortgage is the ability to access home equity without the burden of monthly mortgage payments.

This can be particularly advantageous for seniors living on fixed incomes who may struggle to meet regular financial obligations. The funds received from a reverse mortgage can be used to supplement retirement income, cover daily living expenses, or pay for unexpected costs such as medical bills or home repairs.

- Flexible payment options (lump sum, line of credit, or monthly payments)

- No obligation to make loan payments as long as the borrower lives in the home

- Potential to improve overall financial stability during retirement

Ability to Stay in Your Home

Reverse mortgages allow seniors to age in place, maintaining their independence and familiar surroundings. This can be emotionally and financially beneficial, as it eliminates the need to downsize or move to a different location.

- Retain ownership of the home

- Avoid the stress and costs associated with relocating

- Maintain community connections and support systems

No Credit Score Requirements

Unlike traditional loans, reverse mortgages do not have minimum credit score requirements. This can be a significant advantage for seniors who may have limited credit history or less-than-perfect credit scores.

- Easier qualification process compared to conventional loans

- Opportunity for financial assistance even with poor credit

- Focus on home equity rather than credit worthiness

Funds Can Be Used for Any Purpose

The proceeds from a reverse mortgage can be used at the borrower’s discretion, providing flexibility to address various financial needs or goals.

- Home improvements or modifications for aging in place

- Paying off existing debts or medical bills

- Funding travel or leisure activities

- Covering long-term care expenses

Non-Recourse Loan Protection

Reverse mortgages are non-recourse loans, meaning the borrower or their heirs will never owe more than the home’s value when the loan becomes due.

This protection safeguards against potential market declines or situations where the loan balance exceeds the property’s worth.

- Limited liability for borrowers and heirs

- Protection against negative equity scenarios

- Peace of mind in uncertain housing markets

Tax-Free Proceeds

The funds received from a reverse mortgage are generally not considered taxable income. This can be advantageous for seniors looking to minimize their tax burden during retirement.

- No impact on income tax obligations

- Potential to stay in lower tax brackets

- More effective use of borrowed funds

Disadvantages of Reverse Mortgages for Seniors

High Upfront Costs and Fees

One of the primary drawbacks of reverse mortgages is the substantial upfront costs associated with obtaining the loan. These expenses can significantly reduce the amount of equity available to the borrower.

- Origination fees (up to $6,000 for HECMs)

- Mortgage insurance premiums

- Closing costs and third-party fees

- Ongoing servicing fees

Accumulating Interest Increases Debt Over Time

Unlike traditional mortgages, interest on a reverse mortgage compounds over time, increasing the total loan balance.

This can result in a rapidly growing debt that erodes home equity more quickly than some borrowers may anticipate.

- Compound interest effect on loan balance

- Potential for the loan to consume most or all of the home’s equity

- Reduced financial flexibility in the future

Potential Impact on Government Benefits

Receiving funds from a reverse mortgage may affect eligibility for certain means-tested government benefits, such as Medicaid or Supplemental Security Income (SSI).

- Need for careful financial planning to maintain benefit eligibility

- Potential loss of crucial support services

- Complexity in managing reverse mortgage proceeds alongside government assistance

Reduced Inheritance for Heirs

As the reverse mortgage balance grows over time, it can significantly reduce or eliminate the equity that would otherwise be passed on to heirs.

- Potential for heirs to receive little or no inheritance from the home

- Complications in estate planning

- Possible need for heirs to repay the loan to keep the property

Strict Occupancy Requirements

Reverse mortgage borrowers must maintain the property as their primary residence and fulfill other obligations to avoid loan default.

- Requirement to live in the home for the majority of the year

- Responsibility for property taxes, insurance, and maintenance

- Risk of foreclosure if occupancy or other requirements are not met

Complexity and Potential for Misunderstanding

The terms and conditions of reverse mortgages can be complex, leading to potential misunderstandings or misuse of the loan.

- Risk of making uninformed decisions

- Importance of thorough counseling and education

- Potential for financial exploitation of vulnerable seniors

It is crucial for seniors considering a reverse mortgage to carefully weigh these pros and cons, consult with financial advisors, and thoroughly understand the terms and implications of the loan before making a decision.

While reverse mortgages can provide valuable financial flexibility for some retirees, they are not suitable for everyone and come with significant risks that must be carefully considered.

Frequently Asked Questions About Reverse Mortgage For Seniors Pros And Cons

- What is the minimum age requirement for a reverse mortgage?

The minimum age for a reverse mortgage is 62 years old. This applies to the youngest borrower on the loan application. - Can I lose my home with a reverse mortgage?

While you retain ownership of your home, you can lose it if you fail to meet the loan obligations, such as paying property taxes and insurance, or if you move out for more than 12 consecutive months. - How does a reverse mortgage affect my heirs?

Heirs have options when inheriting a home with a reverse mortgage: they can pay off the loan and keep the home, sell the home to repay the loan, or turn the home over to the lender. Any remaining equity after repaying the loan belongs to the heirs. - Are reverse mortgage proceeds taxable?

No, reverse mortgage proceeds are not considered taxable income. However, they may affect eligibility for certain means-tested government benefits. - Can I still get a reverse mortgage if I have an existing mortgage?

Yes, but the reverse mortgage must be used to pay off the existing mortgage first. Any remaining funds can then be used at your discretion. - What happens if my home value decreases after taking out a reverse mortgage?

Thanks to the non-recourse feature, you or your heirs will never owe more than the home’s value when the loan becomes due, even if the loan balance exceeds the home’s worth. - Can I make payments on a reverse mortgage?

Yes, you can make voluntary payments on a reverse mortgage at any time without penalty. This can help reduce the loan balance and preserve more equity in your home. - How does a reverse mortgage compare to a home equity loan?

Unlike a home equity loan, a reverse mortgage doesn’t require monthly payments and is repaid when you sell the home, move out, or pass away. However, reverse mortgages typically have higher fees and interest rates.