Reverse mortgages have become an increasingly popular financial tool for homeowners aged 62 and older, offering a way to tap into home equity without selling the property or making monthly mortgage payments. This unique loan product allows seniors to convert a portion of their home’s value into cash, providing financial flexibility during retirement. However, like any financial decision, reverse mortgages come with both advantages and disadvantages that must be carefully considered.

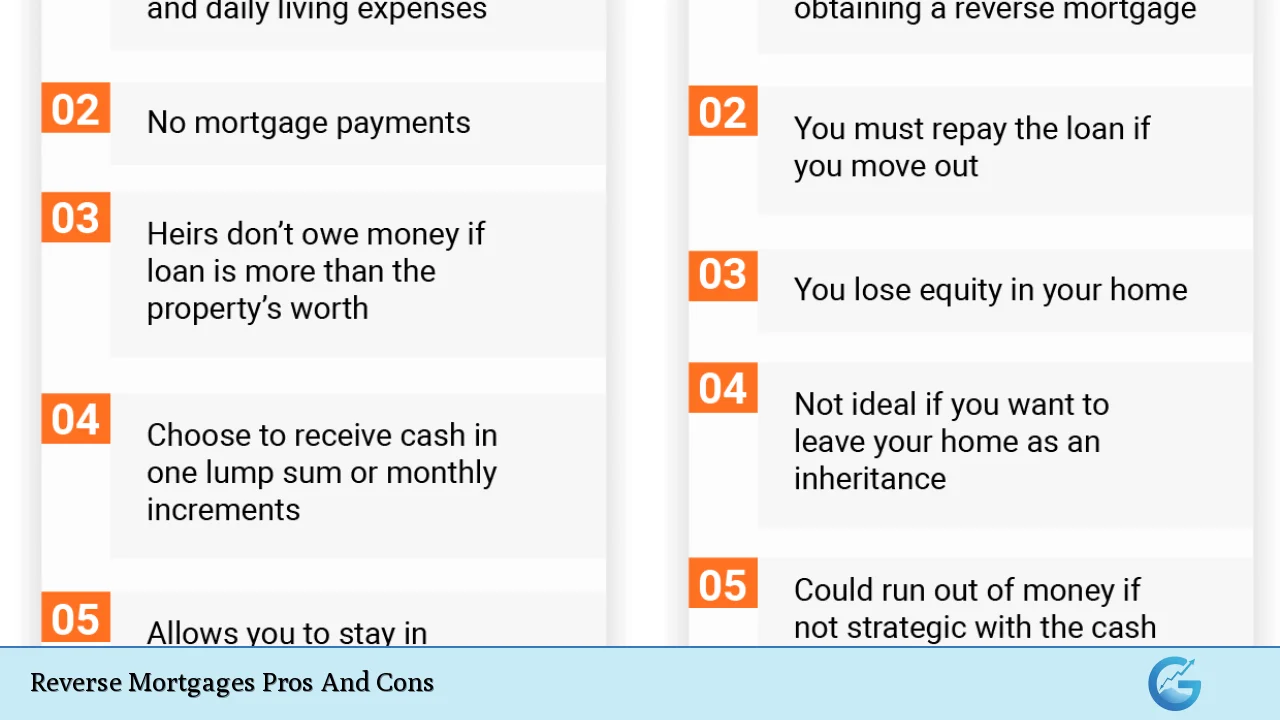

| Pros | Cons |

|---|---|

| No monthly mortgage payments | Accumulating interest and fees |

| Retain home ownership | Reduced inheritance for heirs |

| Tax-free cash access | Potential impact on government benefits |

| Non-recourse loan | High upfront costs |

| Flexible payout options | Complex terms and conditions |

| No income or credit score requirements | Risk of foreclosure |

Advantages of Reverse Mortgages

No Monthly Mortgage Payments

One of the most attractive features of a reverse mortgage is the absence of required monthly mortgage payments. This can significantly improve cash flow for retirees on fixed incomes, allowing them to allocate funds to other essential expenses or enjoy a more comfortable lifestyle. Unlike traditional mortgages or home equity loans, reverse mortgages do not require immediate repayment, as long as the borrower continues to live in the home and meets the loan obligations.

- Eliminates the burden of monthly mortgage payments

- Frees up cash for other expenses or investments

- Allows homeowners to age in place without financial strain

Retain Home Ownership

With a reverse mortgage, borrowers maintain ownership of their homes. This aspect is particularly appealing to seniors who have a strong emotional attachment to their property or wish to preserve it for future generations. The ability to access home equity without relinquishing ownership provides a sense of security and stability for many older homeowners.

- Borrowers remain on the title of the property

- Continued right to live in and use the home

- Option to sell or refinance remains available

Tax-Free Cash Access

The funds received from a reverse mortgage are considered loan proceeds, not income, making them tax-free. This tax treatment can be advantageous for retirees looking to supplement their income without increasing their tax burden. The tax-free nature of reverse mortgage proceeds can help seniors manage their overall tax liability and potentially qualify for certain income-based programs or benefits.

- No income tax on loan proceeds

- Potential for improved cash flow without tax consequences

- Flexibility in managing overall tax strategy

Non-Recourse Loan

Reverse mortgages are non-recourse loans, which means that the borrower or their heirs can never owe more than the home’s value when the loan becomes due. This protection, known as the No Negative Equity Guarantee, safeguards borrowers from owing more than their home is worth, even if property values decline or the loan balance exceeds the home’s market value.

- Borrower’s liability limited to the home’s value

- Protection against declining property values

- Peace of mind for borrowers and heirs

Flexible Payout Options

Reverse mortgages offer various payout options to suit different financial needs and goals. Borrowers can choose to receive funds as a lump sum, fixed monthly payments, a line of credit, or a combination of these options. This flexibility allows seniors to tailor the loan to their specific financial situation and long-term plans, whether they need immediate cash or want to establish a financial safety net for future expenses.

- Lump sum for large expenses or debt consolidation

- Monthly payments to supplement regular income

- Line of credit for ongoing or emergency expenses

- Combination of options for diverse financial needs

No Income or Credit Score Requirements

Unlike traditional mortgages, reverse mortgages do not have strict income or credit score requirements. This can be beneficial for seniors who may have limited income or less-than-perfect credit. While lenders will conduct a financial assessment to ensure borrowers can meet their loan obligations, the qualification process is generally more lenient than that of conventional loans.

- Accessible to seniors with limited income

- Option for those with lower credit scores

- Focus on home equity rather than traditional lending criteria

Disadvantages of Reverse Mortgages

Accumulating Interest and Fees

One of the primary drawbacks of reverse mortgages is the accumulation of interest and fees over time. Because no monthly payments are required, the loan balance grows as interest accrues, potentially consuming a significant portion of the home’s equity. This compounding effect can result in a substantial debt that must be repaid when the loan becomes due.

- Interest rates may be higher than traditional mortgages

- Compound interest increases the loan balance over time

- Ongoing mortgage insurance premiums add to the cost

Reduced Inheritance for Heirs

As the reverse mortgage balance grows, it reduces the amount of equity available to pass on to heirs. This can be a significant concern for homeowners who wish to leave a substantial inheritance or preserve the family home for future generations. While heirs have the option to repay the loan and keep the home, they may find it challenging to do so if the loan balance has grown substantially.

- Diminished home equity over time

- Potential need to sell the home to repay the loan

- Reduced financial legacy for beneficiaries

Potential Impact on Government Benefits

While reverse mortgage proceeds are not considered taxable income, they may affect eligibility for certain means-tested government benefits. Programs such as Medicaid and Supplemental Security Income (SSI) have asset limits that could be exceeded if reverse mortgage funds are not spent immediately. Careful planning and consultation with a financial advisor or benefits specialist is crucial to avoid unintended consequences.

- Possible reduction or loss of Medicaid benefits

- Potential impact on SSI eligibility

- Need for strategic spending of loan proceeds

High Upfront Costs

Reverse mortgages typically come with significant upfront costs, including origination fees, mortgage insurance premiums, and closing costs. These expenses can amount to several thousand dollars and are usually financed as part of the loan, further reducing the amount of equity available to the borrower. The high initial costs may make reverse mortgages less suitable for those planning to move or sell their home in the near future.

- Origination fees can be up to $6,000

- Upfront mortgage insurance premium of 2% of the home’s value

- Various closing costs and third-party fees

Complex Terms and Conditions

Reverse mortgages are complex financial products with numerous terms, conditions, and obligations. The intricacy of these loans can be overwhelming for some borrowers, potentially leading to misunderstandings or mismanagement of the loan. It’s crucial for borrowers to fully comprehend the loan terms, including ongoing obligations and potential triggers for loan repayment.

- Mandatory counseling session required before obtaining the loan

- Extensive documentation and disclosures

- Ongoing responsibilities for property taxes, insurance, and maintenance

Risk of Foreclosure

While reverse mortgages allow borrowers to remain in their homes without making monthly payments, there is still a risk of foreclosure if certain obligations are not met. Failure to pay property taxes, maintain adequate homeowners insurance, or keep the property in good repair can result in the loan becoming due and payable, potentially leading to foreclosure. This risk underscores the importance of careful financial planning and management.

- Obligation to pay property taxes and insurance

- Requirement to maintain the property

- Potential for loan default if obligations are not met

In conclusion, reverse mortgages offer unique financial opportunities for senior homeowners but come with significant considerations and potential drawbacks. The decision to pursue a reverse mortgage should be made after thorough research, consultation with financial advisors, and careful consideration of long-term financial goals and family circumstances. By weighing the pros and cons and understanding the complexities of these loans, seniors can make informed decisions about whether a reverse mortgage aligns with their financial needs and retirement plans.

Frequently Asked Questions About Reverse Mortgages Pros And Cons

- Who is eligible for a reverse mortgage?

Homeowners aged 62 or older who own their home outright or have significant equity are typically eligible. The property must be the borrower’s primary residence, and they must meet financial assessment criteria. - How much can I borrow with a reverse mortgage?

The amount depends on factors including age, home value, and current interest rates. Generally, older borrowers with higher-value homes can access more funds, up to the FHA lending limit for HECM loans. - Do I have to pay taxes on reverse mortgage proceeds?

No, reverse mortgage proceeds are not considered taxable income. However, they may affect eligibility for certain means-tested benefits, so consult with a tax advisor or benefits specialist. - Can my heirs keep the home after I pass away?

Yes, heirs can choose to keep the home by repaying the reverse mortgage balance, typically through refinancing or personal funds. Alternatively, they can sell the home to repay the loan. - What happens if my loan balance exceeds my home’s value?

Reverse mortgages are non-recourse loans, meaning you or your heirs will never owe more than the home’s value when the loan becomes due. This protection is known as the No Negative Equity Guarantee. - Can I lose my home with a reverse mortgage?

While you retain ownership, you can face foreclosure if you fail to meet loan obligations such as paying property taxes, maintaining insurance, or keeping the home in good repair. - Are there alternatives to reverse mortgages?

Alternatives include home equity loans, home equity lines of credit (HELOCs), downsizing, or selling the home. Each option has its own pros and cons to consider based on your financial situation. - How do reverse mortgage interest rates compare to traditional mortgages?

Reverse mortgage interest rates are typically higher than traditional mortgage rates. They can be fixed or adjustable, with adjustable rates potentially leading to faster growth of the loan balance over time.