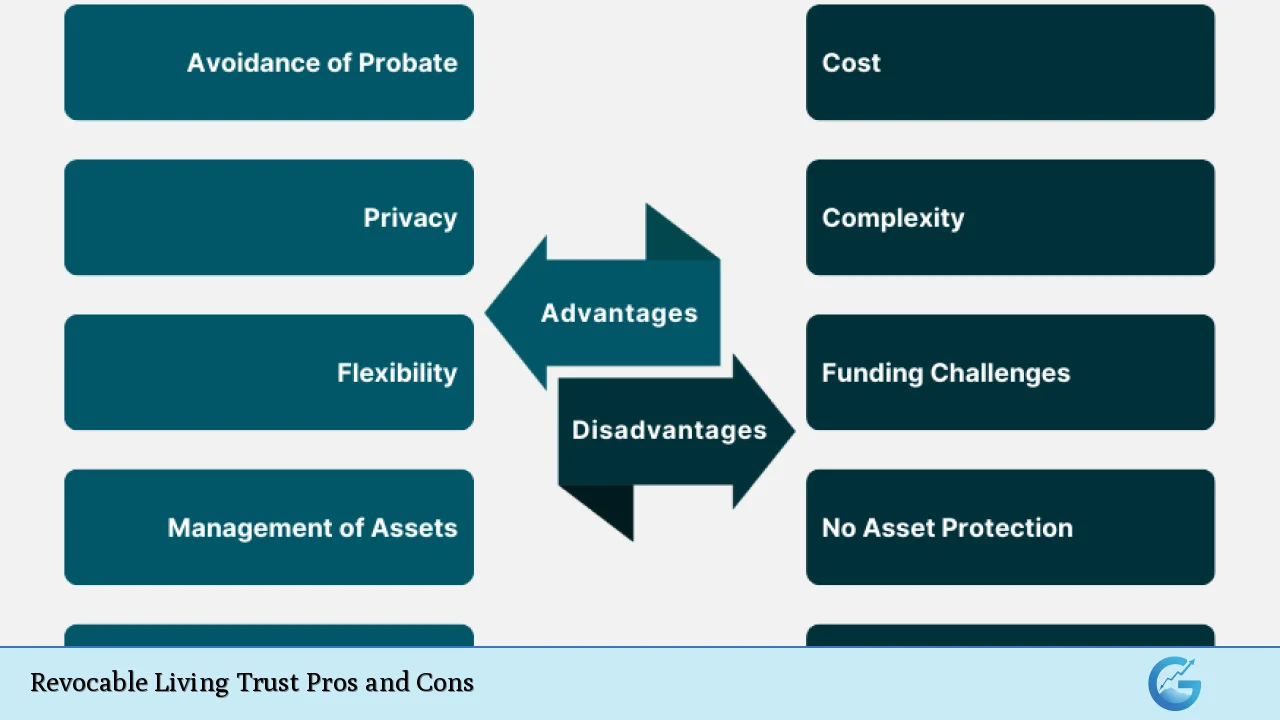

A revocable living trust (RLT) is a popular estate planning tool that allows individuals to manage their assets during their lifetime and dictate how those assets will be distributed after their death. Unlike a will, which goes through probate, a revocable living trust can help avoid the lengthy and often costly probate process, providing a smoother transition of assets to beneficiaries. However, while RLTs offer several advantages, they also come with notable disadvantages that potential users should consider. This article explores the comprehensive pros and cons of revocable living trusts, providing insights for individuals interested in finance, estate planning, and asset management.

| Pros | Cons |

|---|---|

| Avoids probate | Can be expensive to set up |

| Maintains privacy | No tax benefits |

| Flexibility and control over assets | Minimal asset protection from creditors |

| Continuity in asset management | Requires ongoing maintenance |

| Incapacitation protection | Complexity in re-titling assets |

| Potential for reduced estate taxes | Limited effectiveness for certain assets |

| Facilitates easier distribution of assets | Potential for misunderstandings among beneficiaries |

| Helps in long-term planning | Not suitable for all financial situations |

Avoids Probate

One of the most significant advantages of a revocable living trust is its ability to bypass the probate process upon the grantor’s death. This means that:

- Assets held in the trust can be transferred directly to beneficiaries without court intervention.

- This expedites the distribution process, allowing beneficiaries to access their inheritance more quickly than they would through a will.

Probate can be lengthy and costly, often involving court fees and legal expenses that can diminish the estate’s value. By avoiding probate, families can save both time and money during an already challenging period.

Maintains Privacy

Revocable living trusts provide a level of privacy that wills do not. Since wills become public documents once they enter probate:

- The details of your estate and its distribution can be accessed by anyone.

- In contrast, trusts are private agreements that do not need to be filed with the court, thus keeping financial matters confidential.

This aspect is particularly appealing for individuals who wish to maintain discretion regarding their financial affairs.

Flexibility and Control Over Assets

Revocable living trusts offer significant flexibility:

- The grantor retains control over the assets placed in the trust, allowing them to modify or revoke the trust at any time during their lifetime.

- This means that changes can be made as life circumstances evolve, such as marriage, divorce, or changes in financial status.

This adaptability makes RLTs an attractive option for many individuals looking to manage their estates proactively.

Continuity in Asset Management

In addition to facilitating asset distribution after death, revocable living trusts provide continuity in asset management:

- If the grantor becomes incapacitated, a successor trustee can step in seamlessly to manage the trust’s assets without court intervention.

- This ensures that financial matters are handled according to the grantor’s wishes even if they are unable to make decisions themselves.

This feature is particularly beneficial for those concerned about maintaining their financial affairs during periods of illness or incapacity.

Incapacitation Protection

A revocable living trust includes provisions that protect against incapacitation:

- The grantor can designate a successor trustee who will take over management of the trust if they become unable to do so.

- This arrangement helps avoid the need for guardianship proceedings, which can be invasive and time-consuming.

By having a plan in place for incapacitation, individuals can ensure their wishes are honored without unnecessary complications.

Potential for Reduced Estate Taxes

While revocable living trusts do not inherently provide tax benefits during the grantor’s lifetime:

- They may help minimize estate taxes upon death through strategic planning.

- For instance, specific provisions within the trust can be structured to take advantage of tax exemptions or deductions.

However, it is essential to consult with a tax professional or estate planner to maximize these potential benefits effectively.

Facilitates Easier Distribution of Assets

Revocable living trusts simplify the process of asset distribution:

- Trustees can distribute assets according to the terms outlined in the trust document without needing court approval.

- This streamlined process reduces delays and ensures that beneficiaries receive their inheritances as intended.

This efficiency is particularly valuable when dealing with complex estates or multiple beneficiaries.

Helps in Long-Term Planning

Establishing a revocable living trust allows individuals to engage in long-term financial planning:

- It provides a framework for managing assets over time, accommodating changes in family dynamics or financial situations.

- Individuals can set conditions on distributions, such as age milestones or educational achievements for beneficiaries.

This proactive approach helps ensure that wealth is preserved across generations while aligning with personal values regarding inheritance.

Can Be Expensive to Set Up

Despite their advantages, revocable living trusts come with costs associated with their creation:

- Legal fees for drafting a comprehensive trust document can be significant compared to standard wills.

- Depending on the complexity of the estate and local legal rates, these costs may vary widely.

For individuals with smaller estates or straightforward financial situations, these initial costs may outweigh the benefits of establishing a trust.

No Tax Benefits

A common misconception about revocable living trusts is that they offer tax advantages:

- Assets within an RLT remain part of the grantor’s taxable estate, meaning no immediate tax benefits are realized.

- Any income generated by trust assets is reported on the grantor’s personal tax return, similar to ownership outside of a trust.

This limitation makes RLTs less attractive for those primarily seeking tax mitigation strategies.

Minimal Asset Protection from Creditors

Revocable living trusts do not provide robust protection against creditors:

- Because the grantor retains control over the assets, they are still considered part of their personal estate.

- In cases where creditors seek repayment from an individual’s estate, assets within an RLT may still be vulnerable.

Individuals concerned about creditor claims may need to explore other options, such as irrevocable trusts or limited liability entities.

Requires Ongoing Maintenance

Once established, revocable living trusts require ongoing attention:

- Assets must be retitled into the name of the trust, which can be time-consuming and may incur additional fees.

- The grantor must also regularly review and update the trust document to reflect changes in circumstances, such as marriage or divorce.

This ongoing maintenance can be burdensome for some individuals who prefer a more straightforward estate planning approach.

Complexity in Re-Titling Assets

Transferring ownership of property into a revocable living trust involves specific legal procedures:

- Real estate and other titled assets must be re-titled under the name of the trust.

- This process may require additional documentation and potentially legal assistance, adding complexity to what might otherwise be straightforward asset management.

Failure to properly retitle assets could result in complications during asset distribution after death.

Limited Effectiveness for Certain Assets

While revocable living trusts work well for many types of property:

- Certain assets may not be suitable for inclusion within an RLT.

- For example, retirement accounts like IRAs typically cannot be transferred into a revocable trust without incurring penalties or triggering tax consequences.

Understanding which assets are appropriate for inclusion is crucial when establishing an RLT.

Potential for Misunderstandings Among Beneficiaries

Finally, misunderstandings regarding how a revocable living trust operates can arise among beneficiaries:

- If beneficiaries are not adequately informed about how the trust functions, it could lead to disputes or confusion upon the grantor’s death.

- Clear communication about intentions and provisions within the trust is essential to minimize potential conflicts among heirs.

Ensuring all parties understand their roles and expectations can help prevent unnecessary disputes during an emotional time.

In conclusion, while revocable living trusts offer numerous advantages such as avoiding probate, maintaining privacy, and providing flexibility in asset management, they also come with significant drawbacks like setup costs and minimal creditor protection. Individuals interested in establishing an RLT should carefully weigh these pros and cons against their specific financial situations and goals. Consulting with legal and financial professionals can provide valuable insights tailored to individual circumstances.

Frequently Asked Questions About Revocable Living Trust Pros and Cons

- What is a revocable living trust?

A revocable living trust is an estate planning tool that allows individuals to manage their assets during their lifetime and specify how those assets will be distributed after death. - How does a revocable living trust avoid probate?

Assets held within a revocable living trust bypass probate court upon death, allowing direct transfer to beneficiaries without court involvement. - What are some disadvantages of setting up a revocable living trust?

Disadvantages include setup costs, lack of immediate tax benefits, minimal protection from creditors, and ongoing maintenance requirements. - Can I change my revocable living trust?

Yes, one of the main features of a revocable living trust is that it allows you to make changes or revoke it entirely at any time during your lifetime. - Do I need an attorney to create a revocable living trust?

While it’s possible to create one using online templates, consulting with an attorney ensures that your trust meets legal requirements and accurately reflects your wishes. - Are there any tax benefits associated with revocable living trusts?

No immediate tax benefits exist; income generated by assets within the trust is taxed as part of your personal income. - What happens if I become incapacitated?

If you become incapacitated, your designated successor trustee can manage your assets according to your instructions outlined in the trust document. - Is a revocable living trust suitable for everyone?

No; while beneficial for many individuals with complex estates or privacy concerns, simpler estates may find traditional wills more appropriate.