A revocable trust, also known as a living trust, is a powerful estate planning tool that offers flexibility and control over your assets during your lifetime and after death. This legal arrangement allows you to transfer your assets into a trust, which you can manage and modify as long as you’re alive and mentally competent. Upon your death, the trust becomes irrevocable, and your designated successor trustee distributes the assets according to your wishes.

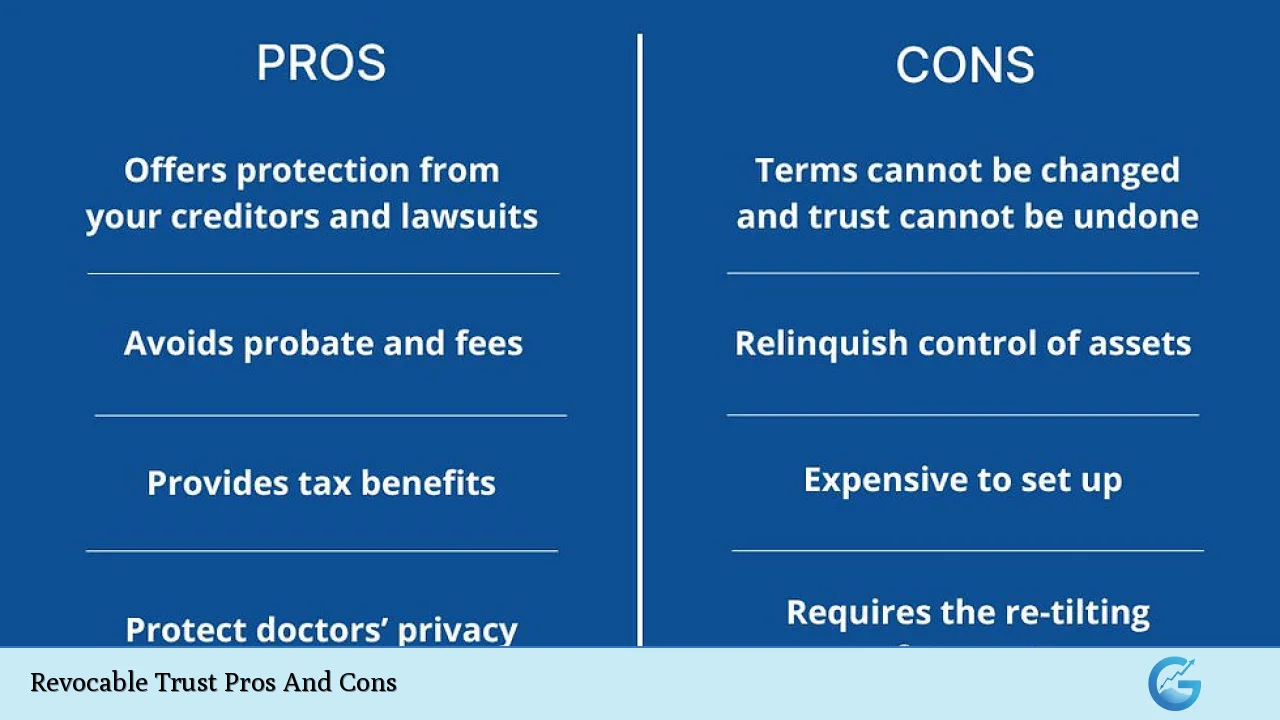

| Pros | Cons |

|---|---|

| Avoids probate | Initial setup costs |

| Maintains privacy | Ongoing management required |

| Provides flexibility | Limited asset protection |

| Enables smooth transition of assets | No immediate tax benefits |

| Allows for incapacity planning | Potential for errors in funding |

| Reduces potential for disputes | Complexity in administration |

| Facilitates management of out-of-state property | Possible overreliance on trust benefits |

| Offers potential for tax planning | Requires ongoing legal and financial advice |

Advantages of a Revocable Trust

Probate Avoidance

One of the primary benefits of a revocable trust is its ability to bypass the probate process.

Probate can be time-consuming, expensive, and public, often taking months or even years to complete. By placing your assets in a revocable trust, you ensure that they pass directly to your beneficiaries without court intervention.

- Faster distribution of assets to beneficiaries

- Reduction in legal fees and court costs

- Avoidance of multi-state probate for out-of-state property

Privacy Protection

Unlike wills, which become public records during probate, revocable trusts maintain privacy even after your death. This confidentiality can be particularly valuable for high-net-worth individuals or those concerned about potential challenges to their estate.

- Keeps family matters and asset distribution private

- Reduces the risk of unwanted publicity

- Protects beneficiaries from potential harassment

Flexibility and Control

A revocable trust offers unparalleled flexibility, allowing you to modify, amend, or even revoke the trust entirely during your lifetime.

This adaptability is crucial in responding to changing financial circumstances, family dynamics, or legal environments.

- Ability to add or remove assets from the trust

- Freedom to change beneficiaries or distribution terms

- Option to dissolve the trust if it no longer serves your purposes

Smooth Transition of Assets

In the event of your incapacity or death, a revocable trust facilitates a seamless transition of asset management. Your designated successor trustee can step in without court intervention, ensuring continuity in the management and distribution of your assets.

- Immediate access to trust assets for beneficiaries

- Avoidance of guardianship proceedings in case of incapacity

- Reduced potential for family conflicts over asset management

Incapacity Planning

Revocable trusts serve as effective tools for incapacity planning. By including provisions for your care and the management of your assets in case of mental incapacity, you can avoid the need for a court-appointed conservator.

- Designate a trusted individual to manage your affairs

- Provide detailed instructions for your care and financial management

- Maintain privacy in personal health and financial matters

Reduced Potential for Disputes

The clear instructions and private nature of a revocable trust can significantly reduce the likelihood of legal challenges to your estate.

This can help preserve family harmony and ensure your wishes are carried out as intended.

- Detailed instructions leave less room for interpretation

- Privacy reduces the chances of outside parties contesting the trust

- Flexibility allows for addressing potential conflicts during your lifetime

Management of Out-of-State Property

For individuals owning property in multiple states, a revocable trust can simplify estate administration by avoiding ancillary probate proceedings in each state where property is held.

- Consolidation of multi-state assets under one trust

- Elimination of separate probate processes for out-of-state real estate

- Potential cost savings in legal and administrative fees

Potential for Tax Planning

While revocable trusts don’t offer immediate tax benefits, they can be structured to provide tax advantages for married couples and facilitate more complex estate tax planning strategies.

- Opportunity for marital deduction planning

- Basis step-up for assets at death

- Foundation for more advanced tax planning techniques

Disadvantages of a Revocable Trust

Initial Setup Costs

Creating a revocable trust typically involves higher upfront costs compared to a simple will.

These expenses include legal fees for drafting the trust document and costs associated with transferring assets into the trust.

- Higher attorney fees for trust creation and funding

- Potential costs for retitling assets and updating beneficiary designations

- Ongoing expenses for trust maintenance and amendments

Ongoing Management Required

Maintaining a revocable trust requires active management and regular updates to ensure its effectiveness. This ongoing responsibility can be time-consuming and may necessitate professional assistance.

- Regular review and updating of trust provisions

- Continuous monitoring of asset titling and funding

- Potential need for professional trustee services

Limited Asset Protection

Contrary to common misconception, revocable trusts offer minimal protection against creditors or legal judgments.

Since you retain control over the assets, they remain vulnerable to claims against you personally.

- Assets remain accessible to personal creditors

- No protection in divorce proceedings

- Vulnerability to lawsuits and judgments against the grantor

No Immediate Tax Benefits

Revocable trusts do not provide immediate income tax or estate tax benefits. The trust’s income is still reportable on your personal tax return, and the assets remain part of your taxable estate.

- No income tax advantages during the grantor’s lifetime

- Assets still included in the grantor’s taxable estate

- Potential for increased complexity in tax reporting

Potential for Errors in Funding

The effectiveness of a revocable trust depends heavily on proper funding – transferring assets into the trust.

Failure to correctly title assets in the trust’s name can result in those assets still being subject to probate.

- Risk of assets inadvertently left out of the trust

- Complexity in transferring certain types of assets

- Ongoing vigilance required for newly acquired assets

Complexity in Administration

Managing a revocable trust can be more complex than administering a simple will, particularly for individuals with diverse or complicated asset portfolios.

- Increased record-keeping requirements

- Potential need for separate tax filings for the trust

- Complexity in managing trust assets alongside personal assets

Possible Overreliance on Trust Benefits

Some individuals may overestimate the benefits of a revocable trust, leading to a false sense of security in their estate planning.

- Misconception about asset protection capabilities

- Overestimation of tax benefits

- Neglect of other important estate planning documents

Ongoing Legal and Financial Advice

The complexity of trust administration often necessitates ongoing professional advice, which can increase the long-term costs associated with maintaining the trust.

- Regular consultations with attorneys for trust updates

- Potential need for financial advisors to manage trust investments

- Costs associated with professional trustee services, if required

In conclusion, revocable trusts offer significant advantages in terms of probate avoidance, privacy, and flexibility in estate planning. However, these benefits come with increased complexity and ongoing responsibilities.

The decision to establish a revocable trust should be made after careful consideration of your specific financial situation, family dynamics, and long-term estate planning goals.

Consulting with experienced estate planning professionals can help you determine whether a revocable trust is the right tool for your unique circumstances and how to maximize its benefits while mitigating potential drawbacks.

Frequently Asked Questions About Revocable Trust Pros And Cons

- How does a revocable trust differ from an irrevocable trust?

A revocable trust can be modified or revoked by the grantor during their lifetime, while an irrevocable trust generally cannot be changed once established. Irrevocable trusts offer greater asset protection and potential tax benefits but at the cost of flexibility. - Can a revocable trust help reduce estate taxes?

While a basic revocable trust doesn’t directly reduce estate taxes, it can be structured to include tax-saving provisions for married couples. More complex strategies, such as creating sub-trusts upon the grantor’s death, can be employed for potential tax benefits. - Is a revocable trust always better than a will?

Not necessarily. The choice between a revocable trust and a will depends on individual circumstances, including the complexity of your estate, privacy concerns, and probate laws in your state. For simpler estates, a will might be sufficient and more cost-effective. - How does a revocable trust impact my control over my assets?

As the grantor and typically the initial trustee, you maintain full control over the assets in a revocable trust during your lifetime. You can buy, sell, or transfer assets in and out of the trust as you see fit. - Are there any assets that shouldn’t be put into a revocable trust?

Certain assets, such as retirement accounts (IRAs, 401(k)s) and some types of annuities, typically shouldn’t be transferred to a revocable trust due to potential negative tax consequences. Consult with a financial advisor for specific recommendations. - How does a revocable trust affect my income taxes?

During your lifetime, a revocable trust is considered a “grantor trust” for tax purposes. This means you report all trust income on your personal tax return, and there are no separate income tax consequences for the trust itself. - Can creditors access assets in my revocable trust?

Yes, assets in a revocable trust are generally accessible to your creditors during your lifetime. The trust only provides asset protection for your beneficiaries after your death when it becomes irrevocable. - What happens to my revocable trust when I die?

Upon your death, the revocable trust becomes irrevocable. Your designated successor trustee takes over management of the trust and distributes assets to beneficiaries according to the trust’s terms, typically without the need for probate.