Revocable trusts, also known as revocable living trusts, are legal entities created to hold and manage assets during a person’s lifetime and distribute them after death. They offer flexibility and control over asset management while providing certain estate planning advantages. However, they also come with notable disadvantages that potential users should consider. This article explores the pros and cons of revocable trusts, providing a comprehensive overview for individuals interested in financial planning, including those involved in finance, crypto, forex, and money markets.

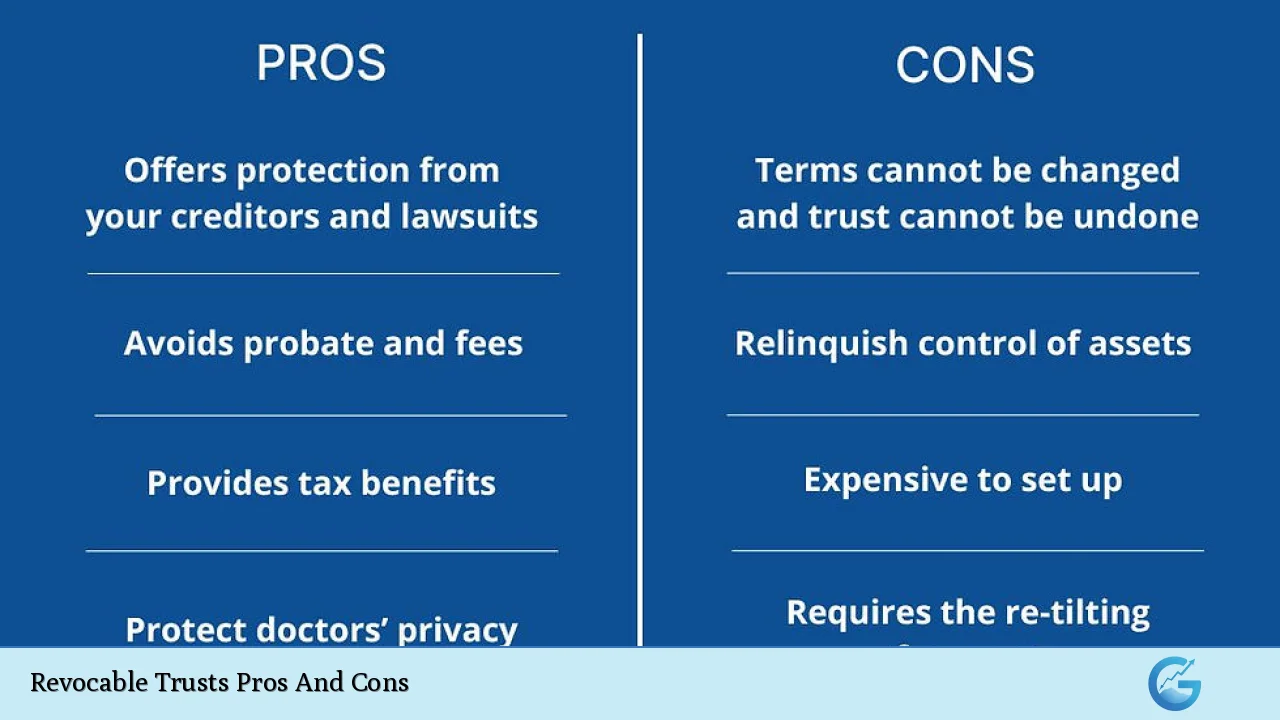

| Pros | Cons |

|---|---|

| Avoids probate | No immediate tax benefits |

| Maintains privacy | Minimal asset protection |

| Flexibility and control | Higher initial setup costs |

| Protection in case of incapacitation | Requires ongoing management |

| Long-term management of assets | Potential for disputes among beneficiaries |

| Separation of assets from communal property | Does not eliminate estate taxes |

| Streamlined distribution process | Complexity in funding the trust |

| Can be amended or revoked at any time | Not suitable for all asset types |

Avoids Probate

One of the most significant advantages of a revocable trust is its ability to bypass the probate process.

- Speedy Distribution: Assets held in a revocable trust can be distributed to beneficiaries without the delays associated with probate court.

- Cost Efficiency: Avoiding probate can save significant costs related to court fees and legal expenses.

- Immediate Access: Beneficiaries can access their inheritance more quickly, which can be crucial during difficult times.

Maintains Privacy

Revocable trusts provide a level of privacy that wills do not.

- Confidentiality: Unlike wills, which become public records upon death, revocable trusts are private documents.

- Discretion: This privacy can help prevent family disputes and protect sensitive financial information from public scrutiny.

Flexibility and Control

Revocable trusts offer a unique level of flexibility compared to other estate planning tools.

- Changeable Terms: The grantor can modify the terms of the trust or revoke it entirely at any time before their death.

- Asset Management: Grantors retain control over the assets in the trust during their lifetime, allowing them to adapt to changing circumstances.

Protection in Case of Incapacitation

A revocable trust provides mechanisms for managing assets if the grantor becomes incapacitated.

- Successor Trustee: The grantor can designate a successor trustee who will take over management of the trust assets without needing court intervention.

- Avoiding Guardianship: This arrangement can prevent the need for a court-appointed guardian, simplifying asset management during periods of incapacity.

Long-term Management of Assets

Revocable trusts allow for structured long-term management of assets.

- Guided Distribution: The grantor can set specific conditions for how and when beneficiaries receive their inheritance, ensuring their wishes are honored.

- Ongoing Oversight: A trustee can manage investments and distributions according to the grantor’s instructions, promoting better financial stewardship.

Separation of Assets from Communal Property

In community property states, revocable trusts can help separate personal assets from marital property.

- Protection from Claims: This separation can protect individual assets from claims made against communal property during divorce or creditor actions.

Streamlined Distribution Process

The distribution process after death is often more straightforward with a revocable trust than with a will.

- No Court Involvement: Since the trust avoids probate, there is no need for court oversight during asset distribution.

- Clear Instructions: The trust document provides clear guidelines on how assets should be distributed, reducing confusion among beneficiaries.

Can Be Amended or Revoked at Any Time

The revocability of these trusts allows for adaptability as life circumstances change.

- Responsive Planning: Grantors can adjust their estate plans as needed due to changes in family dynamics or financial situations.

Disadvantages of Revocable Trusts

While revocable trusts offer numerous advantages, they also have several drawbacks that should be carefully considered before establishment.

No Immediate Tax Benefits

One significant disadvantage is that revocable trusts do not provide immediate tax benefits.

- Tax Liability: Income generated by trust assets is taxed as part of the grantor’s income, meaning there are no tax advantages while the grantor is alive.

- Estate Tax Inclusion: Assets in a revocable trust are included in the grantor’s taxable estate upon death, potentially leading to higher estate taxes.

Minimal Asset Protection

Revocable trusts offer limited protection against creditors compared to irrevocable trusts.

- Creditor Access: Since the grantor retains control over the assets, creditors may still pursue these assets in case of legal judgments against the grantor.

- Not Ideal for Asset Protection Planning: For those primarily concerned with protecting assets from creditors, other structures may be more appropriate.

Higher Initial Setup Costs

Establishing a revocable trust typically involves higher upfront costs than creating a simple will.

- Legal Fees: Hiring an attorney to draft a comprehensive trust document can be expensive compared to drafting a will.

- Funding Costs: There may also be costs associated with transferring titles and retitling property into the trust’s name.

Requires Ongoing Management

Maintaining a revocable trust requires continuous oversight and management efforts by the grantor or trustee.

- Annual Reviews: Trusts should be reviewed regularly to ensure they reflect current wishes and circumstances; this can be time-consuming.

- Asset Re-titling: New assets must be properly titled in the name of the trust to ensure they are included in the estate plan, requiring diligence from the grantor or trustee.

Potential for Disputes Among Beneficiaries

The flexibility of revocable trusts can sometimes lead to conflicts among beneficiaries if not managed properly.

- Ambiguities in Terms: If the terms of the trust are not clearly defined or communicated, disagreements may arise among heirs regarding distributions or management decisions.

- Family Dynamics: Changes made by the grantor could lead to feelings of favoritism or resentment among family members if not handled transparently.

Does Not Eliminate Estate Taxes

Although revocable trusts help avoid probate, they do not eliminate estate taxes altogether.

- Tax Planning Required: Individuals still need to engage in tax planning strategies to minimize potential estate tax liabilities upon death.

Complexity in Funding the Trust

Properly funding a revocable trust involves more than just creating it; it requires careful planning and execution.

- Asset Transfer Process: The process of transferring ownership of various assets into the trust can be complicated and may require professional assistance.

- Potential Oversights: Failing to transfer all relevant assets into the trust could result in those assets going through probate instead, negating some benefits of establishing the trust initially.

Not Suitable for All Asset Types

Certain types of assets may not be appropriate for inclusion in a revocable trust.

- Retirement Accounts and Insurance Policies: These often have designated beneficiaries that supersede any instructions provided within a trust document.

- Real Estate Considerations: Real estate must be retitled properly; otherwise, it may remain subject to probate despite being intended for inclusion in the trust’s provisions.

In conclusion, while revocable trusts offer numerous advantages such as avoiding probate, maintaining privacy, and providing flexibility in asset management, they also come with significant disadvantages including no immediate tax benefits and minimal protection against creditors. Individuals interested in establishing a revocable trust should carefully weigh these pros and cons against their personal financial situation and estate planning goals. Consulting with an experienced estate planning attorney is advisable to ensure that this tool aligns with one’s overall financial strategy.

Frequently Asked Questions About Revocable Trusts Pros And Cons

- What is a revocable trust?

A revocable trust is an estate planning tool that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. - What are some key benefits of establishing a revocable trust?

The primary benefits include avoiding probate, maintaining privacy regarding asset distribution, flexibility to amend terms as needed, and providing protection if incapacitated. - Are there any tax advantages associated with revocable trusts?

No immediate tax benefits exist; income generated by assets within a revocable trust is taxed as part of the grantor’s income. - Can I change my revocable trust after it’s established?

Yes, one of the main features of a revocable trust is that it can be amended or revoked by the grantor at any time before death. - What happens if I become incapacitated?

If incapacitated, your designated successor trustee can manage your assets according to your wishes outlined in the trust without needing court intervention. - Do I need an attorney to create a revocable trust?

While it’s possible to create one without legal assistance using templates, consulting an attorney ensures that your specific needs are met effectively. - Is there any downside to using a revocable living trust?

Yes; downsides include higher initial setup costs compared to wills and minimal protection against creditors since you retain control over your assets. - What types of assets should not be placed in a revocable trust?

Certain assets like retirement accounts or life insurance policies should typically have designated beneficiaries instead of being included directly within a revocable living trust.