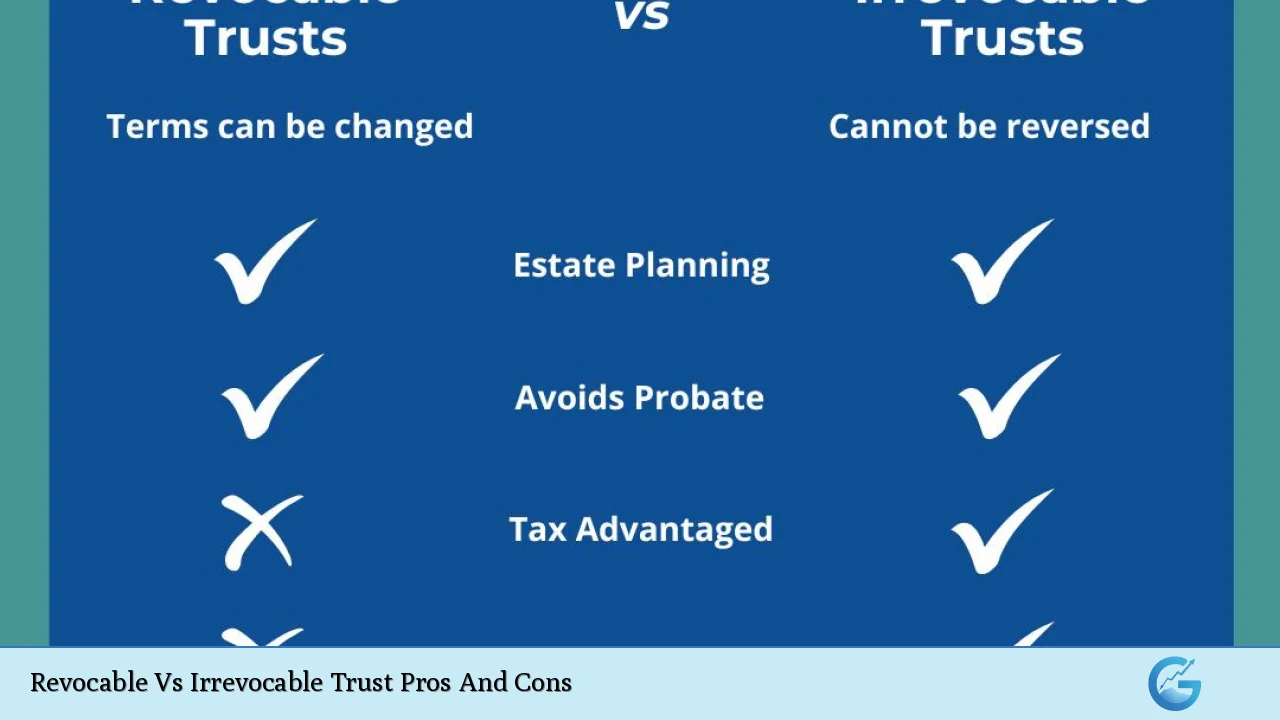

Trusts are essential tools in estate planning, offering unique advantages and disadvantages depending on whether they are revocable or irrevocable. Understanding these differences is crucial for individuals looking to protect their assets, minimize taxes, and ensure a smooth transition of wealth to beneficiaries. This article delves into the pros and cons of both types of trusts, providing a comprehensive overview to help you make informed decisions.

| Pros | Cons |

|---|---|

| Flexibility to modify or revoke at any time (Revocable) | No asset protection from creditors (Revocable) |

| Avoids probate, ensuring quicker distribution of assets (Both) | Potential estate tax implications (Revocable) |

| Control over trust assets during the grantor’s lifetime (Revocable) | Lack of flexibility once established (Irrevocable) |

| Asset protection from creditors (Irrevocable) | Complexity in setup and management (Irrevocable) |

| Estate tax benefits (Irrevocable) | Loss of control over trust assets (Irrevocable) |

| Can facilitate Medicaid planning (Irrevocable) | Limited ability to change beneficiaries or terms (Irrevocable) |

Flexibility to Modify or Revoke Trusts

One of the primary advantages of a revocable trust is its inherent flexibility. Grantors can modify the terms, add or remove assets, and even revoke the trust entirely if circumstances change. This adaptability allows individuals to respond to life events such as marriage, divorce, or changes in financial status.

- Easy amendments: Grantors can amend the trust documents as needed.

- Control: The grantor retains control over the assets during their lifetime.

However, this flexibility comes with significant drawbacks.

No Asset Protection from Creditors

A notable disadvantage of revocable trusts is that they do not provide protection against creditors. Since the grantor maintains control over the assets, these can be targeted in lawsuits or debt collections.

- Vulnerability: Assets can be seized to satisfy debts or legal judgments.

- Risk exposure: Individuals in high-risk professions may find this particularly concerning.

Avoiding Probate

Both revocable and irrevocable trusts allow for the avoidance of probate, which is the legal process through which a deceased person’s will is validated. This can save time and money for beneficiaries.

- Faster distribution: Assets held in trust can be distributed quickly without court intervention.

- Privacy: Trusts keep financial matters private, unlike probate proceedings.

Despite this advantage, there are potential estate tax implications associated with revocable trusts.

Potential Estate Tax Implications

Assets held in a revocable trust are still considered part of the grantor’s estate for tax purposes. This means that upon death, these assets may be subject to estate taxes.

- Tax liability: Beneficiaries may face significant tax burdens if the estate exceeds federal or state thresholds.

- No tax shelter: Unlike irrevocable trusts, revocable trusts do not offer tax benefits.

Control Over Trust Assets

Revocable trusts allow grantors to retain control over their assets throughout their lifetime. They can manage investments and make decisions regarding distributions.

- Active management: Grantors can adjust investments based on market conditions.

- Direct access: Individuals can use their assets as they see fit without restrictions.

In contrast, irrevocable trusts come with significant limitations regarding control.

Lack of Flexibility Once Established

Irrevocable trusts cannot be modified or revoked without the consent of all beneficiaries. This rigidity can be a disadvantage for those whose circumstances may change.

- Permanent decisions: Once established, changes are difficult and often require legal intervention.

- Limited adaptability: The inability to alter terms can lead to complications if family dynamics shift.

Asset Protection from Creditors

A significant advantage of irrevocable trusts is that they provide asset protection from creditors. Once assets are transferred into an irrevocable trust, they are no longer owned by the grantor.

- Creditor shield: Assets are generally protected from lawsuits and claims.

- Security for heirs: Beneficiaries may inherit without fear of losing assets to creditors.

However, this protection comes at a cost regarding control over those assets.

Complexity in Setup and Management

Setting up an irrevocable trust is often more complex than establishing a revocable trust. The legal documentation and requirements can be intricate.

- Legal assistance required: Professional guidance is typically necessary to navigate setup.

- Ongoing management: Trustees must manage the trust according to its terms, which may involve additional administrative burdens.

Estate Tax Benefits

Irrevocable trusts can provide significant estate tax benefits since assets placed within them are generally excluded from the grantor’s taxable estate.

- Tax reduction strategies: Beneficiaries may benefit from lower overall tax liabilities.

- Long-term planning: These trusts are often used as part of comprehensive estate planning strategies.

Nevertheless, transferring assets into an irrevocable trust can lead to loss of control over those assets.

Loss of Control Over Trust Assets

When assets are transferred into an irrevocable trust, the grantor relinquishes ownership and control. This means that decisions regarding those assets must be made by the trustee according to the terms set forth in the trust document.

- Trustee authority: The trustee manages distributions and investments without input from the grantor.

- Potential conflicts: Disagreements between trustees and beneficiaries can arise if expectations differ.

Can Facilitate Medicaid Planning

Irrevocable trusts can play a crucial role in Medicaid planning by allowing individuals to qualify for benefits while preserving their wealth for heirs. By placing assets into an irrevocable trust, individuals may reduce their countable resources for Medicaid eligibility purposes.

- Preservation of wealth: Helps ensure that heirs receive intended inheritances.

- Eligibility for benefits: Facilitates access to necessary care without depleting personal resources.

However, there are limitations on changing beneficiaries or terms once established.

Limited Ability to Change Beneficiaries or Terms

Once an irrevocable trust is created, changing beneficiaries or modifying terms is typically not allowed without significant legal hurdles. This limitation can pose challenges if family situations evolve over time.

- Static arrangements: Beneficiaries named at creation remain unchanged unless all parties agree otherwise.

- Potential dissatisfaction: If circumstances change (e.g., divorce), beneficiaries may feel unfairly treated under old arrangements.

In conclusion, both revocable and irrevocable trusts offer distinct advantages and disadvantages that cater to different needs in estate planning. Revocable trusts provide flexibility and control but lack asset protection and tax benefits. In contrast, irrevocable trusts offer stronger protections against creditors and potential tax savings but come with complexities and loss of control.

Ultimately, choosing between these options requires careful consideration of your financial situation, goals for asset distribution, and potential risks involved. Consulting with a qualified estate planning attorney can help navigate these choices effectively.

Frequently Asked Questions About Revocable Vs Irrevocable Trusts

- What is a revocable trust?

A revocable trust allows the grantor to modify or revoke it at any time during their lifetime. - What is an irrevocable trust?

An irrevocable trust cannot be changed or revoked once established without beneficiary consent. - What are the main advantages of a revocable trust?

The main advantages include flexibility in management and avoidance of probate. - What are the main disadvantages of a revocable trust?

The main disadvantages include lack of creditor protection and potential estate tax implications. - How does an irrevocable trust protect my assets?

An irrevocable trust protects assets from creditors since they are no longer owned by the grantor. - Can I change my beneficiaries in an irrevocable trust?

Changing beneficiaries in an irrevocable trust is typically not allowed without legal intervention. - Are there tax benefits associated with irrevocable trusts?

Yes, assets in an irrevocable trust may be excluded from your taxable estate, potentially reducing estate taxes. - Which type of trust should I choose?

Your choice should depend on your specific goals regarding asset management, protection needs, and family dynamics.