Registered Index-Linked Annuities (RILAs) have emerged as a popular financial product for individuals looking to balance risk and reward in their investment portfolios. These annuities offer a unique blend of potential market-linked growth while providing a degree of protection against losses. As with any financial instrument, RILAs come with their own set of advantages and disadvantages that investors should carefully consider before making a commitment. This article delves into the pros and cons of RILAs, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Potential for higher returns linked to market performance | Limited upside due to caps on gains |

| Downside protection through floors or buffers | Complexity of contracts can be challenging to understand |

| Tax-deferred growth until withdrawal | Fees may apply, impacting overall returns |

| Flexibility in payout options | No guaranteed minimum return on investment |

| Can supplement retirement income effectively | Surrender charges may apply for early withdrawals |

| Customization based on risk tolerance and investment goals | Market risk still exists; principal may not be fully protected |

| No direct investment in equities, reducing volatility exposure | Potential for loss if market conditions are unfavorable |

| Transparency in fee structures compared to traditional annuities | Performance is based on underlying index, which can fluctuate significantly |

Potential for Higher Returns Linked to Market Performance

One of the primary advantages of RILAs is their potential for higher returns. Unlike traditional fixed annuities that offer a guaranteed interest rate, RILAs allow investors to benefit from the performance of an underlying market index, such as the S&P 500. This means that when the market performs well, investors can enjoy significant growth in their annuity value.

- Market Participation: RILAs typically offer participation rates that determine how much of the index’s gains will be credited to the annuity. For example, if an investor has a participation rate of 100%, they will receive the full percentage increase of the index during the crediting period.

- Higher Caps: Compared to other indexed annuities, RILAs often feature higher caps on returns, allowing for greater earning potential during bullish market conditions.

Limited Upside Due to Caps on Gains

While RILAs present opportunities for substantial returns, they also impose limits on how much an investor can earn. These caps can significantly affect overall profitability.

- Cap Rates: Each RILA contract specifies a cap rate that limits the maximum return an investor can earn during a given period. For instance, if the cap is set at 10% and the index rises by 15%, the investor will only receive a 10% return.

- Opportunity Cost: In years when the market experiences exceptional growth, investors may miss out on potential earnings due to these caps, which can lead to frustration among those seeking maximum returns.

Downside Protection Through Floors or Buffers

RILAs provide built-in mechanisms for downside protection through floors or buffers that help mitigate losses during market downturns.

- Floor Option: This feature allows investors to set a maximum loss they are willing to accept. For example, if an investor sets a floor at -10%, any losses beyond this threshold would be absorbed by the issuing insurance company.

- Buffer Option: Alternatively, investors can choose a buffer that absorbs a certain percentage of losses. If an investor selects a buffer of 10%, they would only incur losses exceeding this amount.

Complexity of Contracts Can Be Challenging to Understand

The structure of RILAs can be intricate and may pose challenges for investors trying to navigate their terms.

- Varied Terms: Each issuer may have different terms regarding caps, buffers, floors, and participation rates. This variability can create confusion and make it difficult for investors to compare products effectively.

- Need for Expertise: Due to this complexity, it is often advisable for potential buyers to consult with financial advisors who can help clarify contract details and ensure alignment with personal financial goals.

Tax-Deferred Growth Until Withdrawal

Another significant advantage of RILAs is their tax treatment. Like other annuities, RILAs allow for tax-deferred growth.

- Tax Benefits: Investors do not pay taxes on earnings until they begin withdrawals. This feature enables capital to grow without being diminished by annual tax liabilities.

- Retirement Planning: This tax deferral is particularly beneficial for those looking to supplement retirement income while minimizing current tax burdens.

Fees May Apply, Impacting Overall Returns

While some RILAs may not have annual fees, there are often costs associated with these products that could affect overall returns.

- Surrender Charges: If an investor withdraws funds before the end of the surrender period specified in their contract, they may incur surrender charges that reduce their investment’s value.

- Rider Fees: Additional benefits such as guaranteed lifetime withdrawal benefits (GLWBs) often come with extra fees that can eat into overall returns if not carefully considered.

Flexibility in Payout Options

RILAs offer various payout options tailored to meet individual retirement needs and preferences.

- Multiple Structures: Investors can choose from fixed-period payouts or lifetime income options. This flexibility allows individuals to customize their annuity according to their financial situations and retirement plans.

- Survivor Benefits: Many RILAs also allow investors to designate beneficiaries who will continue receiving payments after their death, providing additional peace of mind for families.

No Guaranteed Minimum Return on Investment

Despite offering potential upside and downside protection features, many RILAs do not guarantee minimum returns or principal protection.

- Investment Risk: Investors must understand that while there are mechanisms in place to limit losses, there remains a risk that they could lose money depending on market performance and contract specifics.

- Market Dependency: The reliance on underlying indices means that adverse market conditions could lead to reduced account values or even losses if the chosen strategy does not perform as anticipated.

Surrender Charges May Apply for Early Withdrawals

Investors should be aware that withdrawing funds from a RILA before the specified surrender period could result in penalties.

- Withdrawal Restrictions: Most contracts impose penalties during initial years when withdrawals exceed specified limits. Understanding these restrictions is crucial before committing funds.

- Financial Planning Considerations: Individuals should factor these potential charges into their overall financial planning strategy to avoid unexpected costs later on.

Customization Based on Risk Tolerance and Investment Goals

RILAs provide opportunities for customization based on individual risk tolerance levels and investment objectives.

- Tailored Strategies: Investors can select specific floors or buffers according to how much risk they are willing to take. This level of customization allows individuals to align their investments with personal financial goals more effectively.

- Diverse Investment Profiles: By offering various indexing options and crediting strategies, RILAs cater to diverse investment profiles ranging from conservative savers seeking stability to more aggressive investors aiming for growth potential.

Market Risk Still Exists; Principal May Not Be Fully Protected

While RILAs provide some downside protection features, it is essential for investors to recognize that they still carry inherent risks associated with market fluctuations.

- Partial Protection: The protections offered by floors or buffers do not guarantee complete safety from losses; thus, understanding these limits is vital when assessing risk exposure within one’s portfolio.

- Investment Horizon Considerations: Long-term investors should consider how market volatility might impact their investments over time and whether they are comfortable with this level of risk as part of their overall strategy.

Closing Paragraph

In conclusion, Registered Index-Linked Annuities (RILAs) present both compelling advantages and notable disadvantages for investors seeking a balance between growth potential and protection against market volatility. With features such as tax-deferred growth, customizable payout options, and downside protection through floors or buffers, RILAs can serve as valuable tools in retirement planning. However, potential investors must also be mindful of limitations such as caps on gains, contract complexity, fees associated with early withdrawals or additional riders, and the absence of guaranteed minimum returns. As always, thorough research and consultation with financial advisors are recommended when considering incorporating RILAs into one’s investment strategy.

Frequently Asked Questions About Rila Annuity Pros And Cons

- What are registered index-linked annuities (RILAs)?

RILAs are insurance contracts designed for long-term investments where returns are linked to an underlying market index while providing some level of downside protection. - How do I benefit from investing in a RILA?

You can potentially achieve higher returns compared to traditional fixed-rate annuities while enjoying tax-deferred growth until withdrawal. - What risks are associated with RILAs?

The main risks include limited upside due to caps on gains and no guaranteed minimum return; therefore, principal may not be fully protected. - Can I customize my RILA?

You have options for customization based on your risk tolerance by selecting different floors or buffers. - Are there fees involved with RILAs?

While some may not have annual fees, surrender charges apply if you withdraw funds early or if you choose riders that come with additional costs. - What happens if I withdraw my money early from a RILA?

You may incur surrender charges which could reduce your investment’s value depending on your contract terms. - How does taxation work with RILAs?

You only pay taxes upon withdrawal from your RILA; earnings grow tax-deferred until then. - Are there any alternatives to RILAs?

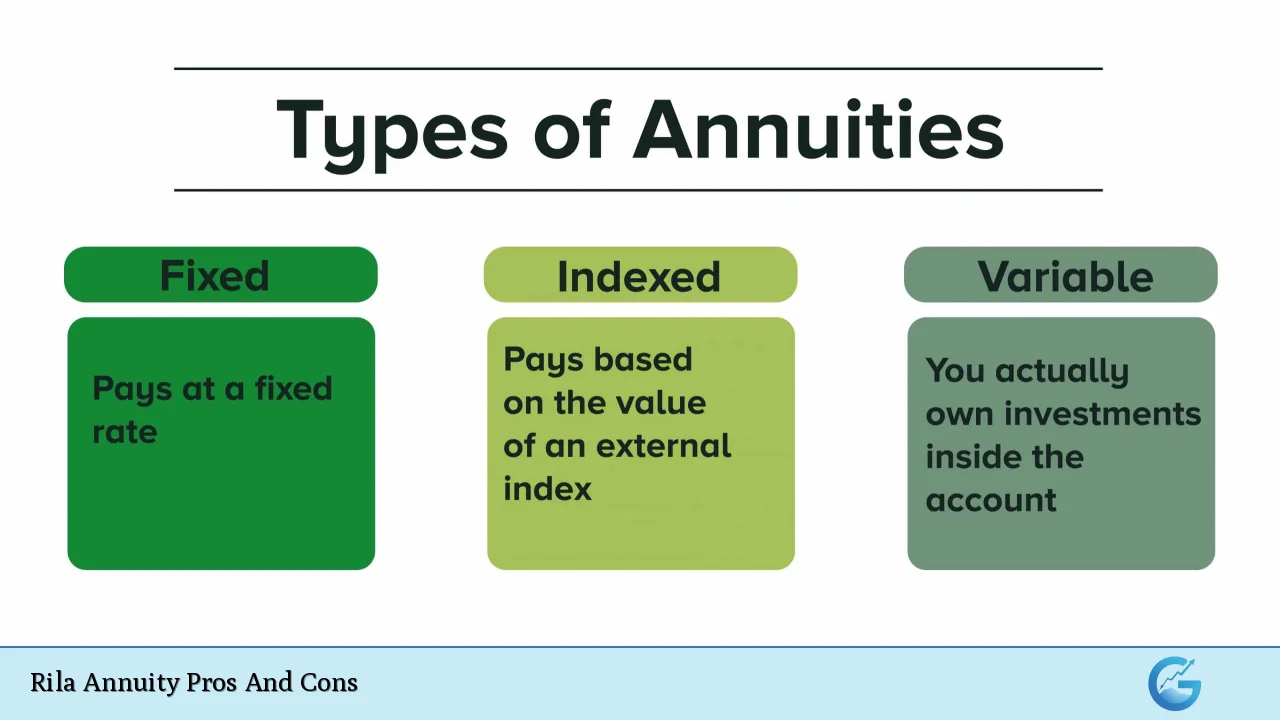

Yes, alternatives include fixed indexed annuities (FIAs), variable annuities (VAs), or traditional fixed-rate annuities depending on your financial goals.