Robo-advisors have emerged as a revolutionary force in the investment landscape, offering a blend of technology and finance that appeals to a broad spectrum of investors. These digital platforms provide automated investment management services, typically at lower costs than traditional financial advisors. By utilizing algorithms to assess an investor’s risk tolerance and financial goals, robo-advisors create and manage diversified portfolios with minimal human intervention. As more individuals seek accessible and efficient ways to invest, understanding the advantages and disadvantages of robo-advisors becomes crucial for making informed financial decisions.

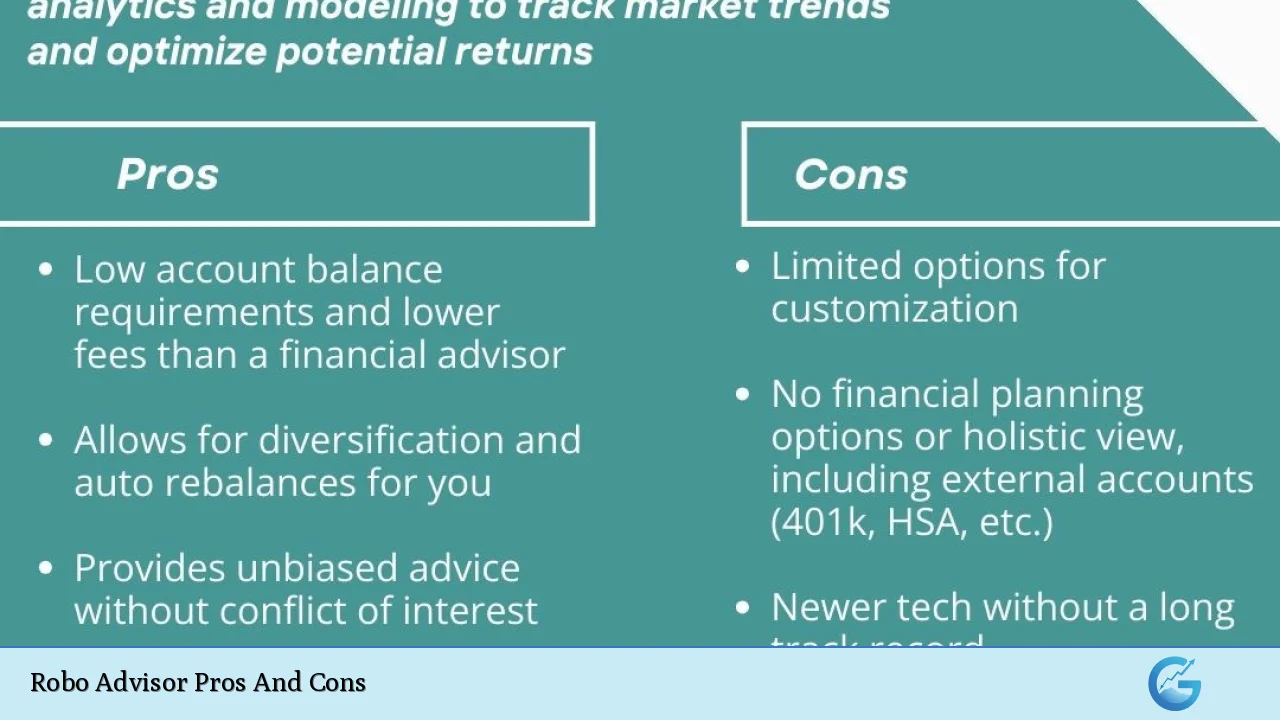

| Pros | Cons |

|---|---|

| Lower Costs | Lack of Personalization |

| Accessibility for All Investors | Limited Human Interaction |

| Emotion-Free Investing | Narrow Investment Choices |

| Efficient Portfolio Management | Inability to Address Complex Financial Situations |

| Transparency in Fees and Performance | Potential Over-Reliance on Algorithms |

| Convenience and Accessibility | Limited Tax Optimization Strategies |

| Regular Portfolio Rebalancing | Less Flexibility in Investment Options |

| Educational Resources Available | No Comprehensive Financial Planning Services |

Lower Costs

One of the most compelling advantages of robo-advisors is their lower cost structure compared to traditional financial advisors.

- Management Fees: Robo-advisors typically charge management fees ranging from 0.25% to 0.50% of assets under management, significantly lower than the 1% to 2% fees often charged by human advisors.

- No Hidden Fees: Many robo-advisors are transparent about their fee structures, ensuring that investors know exactly what they are paying for.

Accessibility for All Investors

Robo-advisors are designed to be accessible, making them suitable for a wide range of investors.

- Low Minimum Investment Requirements: Many platforms have low or no minimum investment thresholds, allowing even those with limited capital to start investing.

- User-Friendly Interfaces: The digital nature of robo-advisors means they can cater to tech-savvy millennials as well as older generations seeking straightforward investment solutions.

Emotion-Free Investing

Robo-advisors remove emotional biases from the investment process, which can lead to better long-term results.

- Algorithm-Driven Decisions: By relying on algorithms rather than human judgment, robo-advisors make decisions based purely on data and predefined strategies.

- Reduced Panic Selling: In volatile markets, robo-advisors maintain a disciplined approach, preventing impulsive decisions driven by fear or greed.

Efficient Portfolio Management

Robo-advisors excel in managing portfolios efficiently through automation.

- Automatic Rebalancing: They continuously monitor and rebalance portfolios to maintain the desired asset allocation based on market conditions.

- Cost-Effective Transactions: Automated trading reduces transaction costs and allows for more frequent adjustments without incurring significant fees.

Transparency in Fees and Performance

Investors benefit from the transparency offered by robo-advisors regarding fees and performance metrics.

- Clear Fee Structures: Most platforms provide straightforward information about their fees, making it easier for investors to understand their costs.

- Performance Tracking: Robo-advisors often offer tools that allow users to track their portfolio performance in real-time, enhancing accountability.

Convenience and Accessibility

The convenience of robo-advisors makes them an attractive option for busy individuals.

- 24/7 Access: Investors can access their accounts anytime via mobile apps or web platforms, making it easy to monitor investments on the go.

- Simplified Processes: The onboarding process is typically quick and straightforward, allowing users to set up accounts and start investing with minimal hassle.

Regular Portfolio Rebalancing

Robo-advisors provide regular portfolio rebalancing as part of their service.

- Maintaining Target Allocations: By automatically adjusting portfolios based on market performance, robo-advisors help investors stay aligned with their risk tolerance and investment goals.

- Tax-Loss Harvesting: Some platforms offer tax-loss harvesting features that can optimize tax efficiency by selling losing investments at strategic times.

Educational Resources Available

Many robo-advisor platforms include educational resources that can benefit investors.

- Investment Guides: Users often have access to articles, videos, and webinars that explain investment concepts and strategies.

- Risk Assessment Tools: Robo-advisors typically provide questionnaires that help users assess their risk tolerance and investment preferences before creating a portfolio.

Lack of Personalization

A significant drawback of robo-advisors is their lack of personalization compared to human advisors.

- Generic Investment Strategies: Robo-advisors often use standardized algorithms that may not fully account for an individual’s unique financial situation or goals.

- Limited Customization Options: While some platforms allow for minor adjustments, overall customization is generally restricted compared to working with a dedicated advisor.

Limited Human Interaction

The absence of personal interaction can be a disadvantage for some investors.

- No Face-to-Face Meetings: Robo-advisors do not offer in-person consultations, which can be a drawback for those who prefer personal relationships with their financial advisors.

- Difficulty in Addressing Emotional Concerns: In times of market volatility or personal financial crises, investors may find it challenging to get the emotional support they need from an automated system.

Narrow Investment Choices

Investing through robo-advisors often comes with limited options regarding asset classes and strategies.

- Preselected Funds: Many platforms restrict users to a predefined list of funds or ETFs, which may not align with every investor’s preferences or values (e.g., socially responsible investing).

- Inflexibility in Strategy Adjustments: Unlike traditional advisors who can tailor strategies based on ongoing discussions, robo-advisors may lack the flexibility needed for nuanced adjustments over time.

Inability to Address Complex Financial Situations

Robo-advisors may struggle with complex financial scenarios that require human insight and experience.

- Limited Financial Planning Services: They typically do not provide comprehensive financial planning services that consider factors like estate planning or tax strategies beyond basic optimization techniques.

- Not Suitable for High-Net-Worth Individuals: Investors with complex portfolios or unique financial situations may find that robo-advisors cannot adequately address their needs compared to personalized advisory services.

Potential Over-Reliance on Algorithms

Investing solely through algorithms can lead to potential risks if not managed properly.

- Market Volatility Risks: Automated systems may not react swiftly enough during extreme market conditions, potentially leading to suboptimal outcomes for investors who rely solely on these platforms.

- Algorithm Limitations: Algorithms are only as good as the data they are based upon; unexpected market events may not be adequately accounted for in automated strategies.

Limited Tax Optimization Strategies

While some robo-advisors offer basic tax-loss harvesting features, they often lack comprehensive tax planning capabilities.

- No Personalized Tax Advice: Investors may miss out on tailored tax strategies that could maximize their returns due to the generic nature of robo-advisor services.

- Complex Tax Situations Ignored: Those with complex tax situations may find that automated systems do not adequately address their specific needs regarding tax optimization across various income sources or investments.

In conclusion, while robo-advisors present numerous advantages such as lower costs, accessibility, and efficient portfolio management, they also come with significant drawbacks including lack of personalization, limited human interaction, and challenges in addressing complex financial situations. Investors must weigh these pros and cons carefully when considering whether a robo-advisor aligns with their individual financial goals and needs. As technology continues to evolve within the finance sector, understanding these dynamics will be crucial for anyone looking to navigate the modern investment landscape effectively.

Frequently Asked Questions About Robo Advisors

- What is a robo advisor?

A robo advisor is an automated platform that provides investment management services using algorithms based on user inputs regarding risk tolerance and financial goals. - Are robo advisors safe?

Generally yes; most are regulated by financial authorities like the SEC in the U.S., but it’s important to research specific platforms before investing. - How do I choose a robo advisor?

Consider factors such as fees, investment options, user interface, customer service availability, and whether they offer features like tax-loss harvesting. - Can I customize my portfolio with a robo advisor?

Customization options vary by platform; some allow limited adjustments while others provide preselected portfolios based on your profile. - Do robo advisors provide financial planning?

No; they typically focus on investment management rather than comprehensive financial planning services. - What are the fees associated with robo advisors?

Fees usually range from 0.25% to 0.50% of assets under management but can vary widely depending on the provider. - Can I access my investments anytime?

Yes; most robo advisors offer 24/7 access through mobile apps or web interfaces. - Are there any drawbacks to using a robo advisor?

Yes; drawbacks include lack of personalized advice, limited human interaction, and challenges in addressing complex financial situations.