Return of Premium (ROP) insurance is a unique form of life insurance that combines the features of traditional term life insurance with a money-back guarantee. This type of policy promises to return all premiums paid if the insured survives the policy term, making it an appealing option for those who want life insurance coverage without the fear of losing their investment. However, like any financial product, ROP insurance has its advantages and disadvantages that potential buyers should carefully consider.

ROP insurance is particularly relevant in today’s financial landscape, where individuals are increasingly looking for ways to secure their financial futures while also managing risks associated with investments and insurance. This article explores the various pros and cons of ROP insurance, helping readers make informed decisions about whether this type of policy aligns with their financial goals.

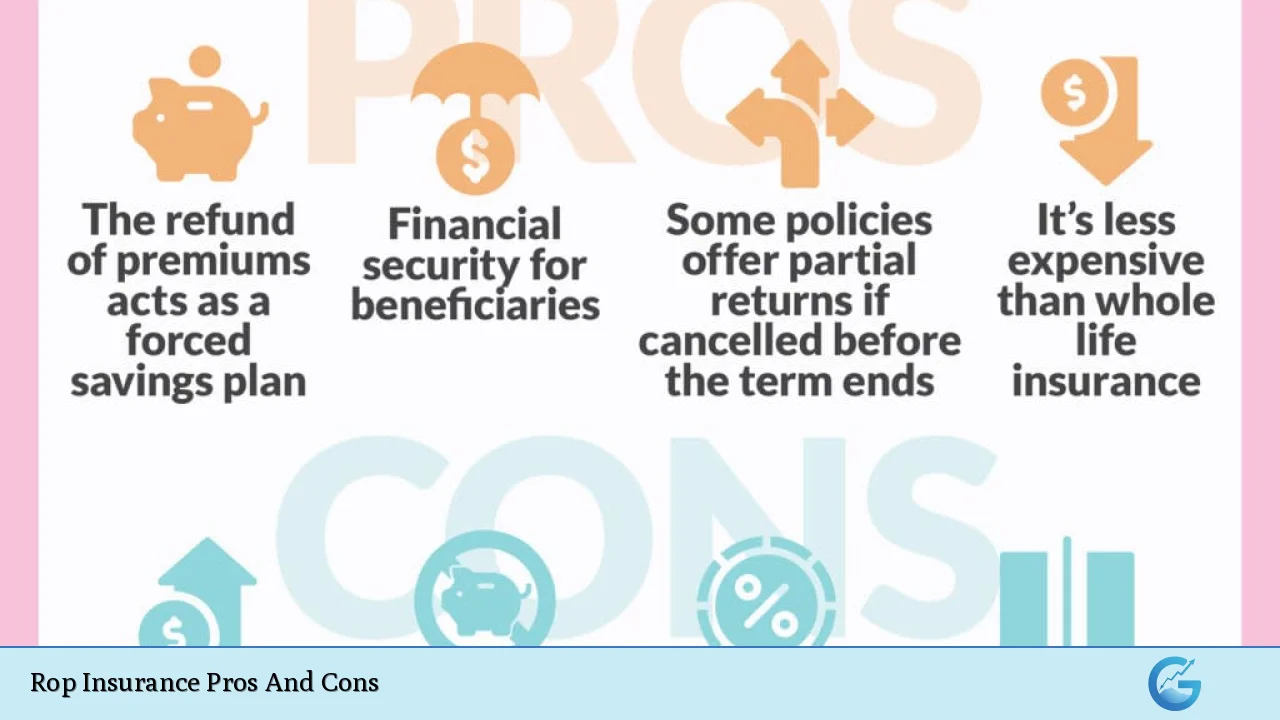

| Pros | Cons |

|---|---|

| Guaranteed return of premiums if you outlive the policy term. | Higher premiums compared to standard term life insurance. |

| Provides a sense of security for cautious savers. | No interest earned on returned premiums, leading to potential loss of value due to inflation. |

| Tax-free refund of premiums received upon maturity. | Opportunity cost of investing higher premiums elsewhere for potentially greater returns. |

| Can be converted to permanent coverage at the end of the term. | No refunds for additional riders or features added to the policy. |

| Attractive option for younger, healthy individuals seeking coverage. | Refunds are not given if the policy is canceled early or if payments are missed. |

Guaranteed Return of Premiums

One of the most significant advantages of ROP insurance is its promise to refund all premiums paid if the insured survives the policy term. This feature effectively transforms a life insurance policy into a savings vehicle, ensuring that if you outlive your coverage period, you will receive back what you invested.

- Security for Policyholders: This guarantee provides peace of mind for individuals who may be hesitant about traditional life insurance policies that do not offer any return on premiums.

- Encouragement to Maintain Coverage: Knowing that your money will be returned can incentivize policyholders to keep their coverage active throughout the entire term.

Higher Premiums

While ROP insurance offers a money-back guarantee, it comes at a cost. The premiums for ROP policies are typically significantly higher than those for standard term life insurance.

- Budget Considerations: For many individuals, these higher premiums can stretch budgets and may not be feasible in the long run.

- Potential Financial Strain: If a policyholder struggles to make payments, they risk losing both their coverage and any potential refunds.

No Interest Earned on Returned Premiums

Another critical downside of ROP insurance is that while you will receive your premiums back, they do not accrue interest during the policy term.

- Inflation Risk: The value of money decreases over time due to inflation. Therefore, when you receive your refunded premiums at the end of the term, they may have less purchasing power than when you initially paid them.

- Lost Opportunity for Growth: The funds used for higher premiums could potentially yield better returns if invested in other financial products such as stocks or mutual funds.

Tax-Free Refund

The refunded premiums from an ROP policy are generally tax-free, which can be an attractive feature for individuals in higher tax brackets.

- Financial Planning Advantage: This can provide significant tax savings compared to other investment vehicles where returns may be subject to taxation.

- Encourages Long-Term Thinking: Knowing that you will receive your money back tax-free can encourage individuals to think long-term about their financial planning.

Opportunity Cost

One major consideration when opting for ROP insurance is the opportunity cost associated with paying higher premiums rather than investing that money elsewhere.

- Potentially Higher Returns Elsewhere: By investing in traditional investment accounts or diversified portfolios, individuals may achieve greater returns than what they would receive from an ROP refund after years of premium payments.

- Financial Flexibility: Individuals who choose lower-cost term life insurance can allocate their savings towards other financial goals such as retirement savings or education funds.

Conversion Options

Many ROP policies offer conversion options that allow policyholders to convert their term coverage into permanent life insurance at the end of the term.

- Flexibility in Coverage: This feature can be particularly beneficial for individuals who may want ongoing coverage as they age without undergoing additional medical underwriting.

- Long-Term Security: It provides an avenue for continued protection even as individual circumstances change over time.

No Refunds for Additional Riders

While ROP policies provide a refund on base premiums, they typically do not include refunds on additional riders or features added to the policy.

- Understanding Policy Terms: It’s crucial for potential buyers to read and understand the fine print regarding what is and isn’t refundable under their specific policy terms.

- Potentially Misleading Value Proposition: Individuals may find themselves disappointed if they assumed all premium payments would be refunded without recognizing exclusions related to riders or extra features.

Attractive Option for Younger Individuals

ROP insurance can be particularly appealing for younger, healthier individuals who are looking for life insurance coverage while also wanting a safety net for their investment.

- Lower Relative Costs: Younger individuals often qualify for lower premiums based on their health status and age, making ROP policies more affordable early on.

- Longer Time Horizon for Refunds: The longer time frame before needing to claim benefits allows younger policyholders to maximize their potential refunds at maturity.

Risk of Policy Cancellation

A significant disadvantage is that if a policyholder decides to cancel their ROP policy before its maturity or misses premium payments, they typically lose both coverage and any chance at receiving refunds.

- Commitment Required: This aspect requires careful consideration and commitment from individuals who opt for this type of insurance.

- Financial Implications: Cancelling a policy can result in wasted premium payments that do not contribute towards any benefit or refund.

Closing Thoughts

In conclusion, Return of Premium (ROP) insurance presents both compelling advantages and notable disadvantages. Its unique structure appeals particularly to those who desire a safety net alongside life coverage. However, potential buyers must weigh these benefits against higher costs and opportunity costs associated with investing those funds elsewhere.

Ultimately, whether ROP insurance is suitable depends on individual financial goals, risk tolerance, and personal circumstances. Consulting with a financial advisor can provide valuable insights tailored to one’s specific situation, ensuring informed decisions in navigating this complex area of life insurance options.

Frequently Asked Questions About Rop Insurance

- What is Return of Premium (ROP) Insurance?

ROP Insurance is a type of life insurance that refunds all premiums paid if the insured survives the policy term. - Are ROP Insurance premiums tax-deductible?

No, while refunds are tax-free, premiums paid into an ROP policy are generally not tax-deductible. - How does inflation affect my ROP refund?

The value returned may decrease due to inflation over time since no interest is earned on those premium payments. - Can I cancel my ROP Insurance?

You can cancel your ROP Insurance; however, doing so typically results in losing all premium payments made thus far. - Is ROP Insurance suitable for older adults?

This type of insurance may become cost-prohibitive as one ages; thus, it’s generally more suited for younger individuals. - What happens if I die during the term?

If you pass away during the term, your beneficiaries receive the death benefit but no refund on your premium payments. - Can I convert my ROP Insurance into permanent coverage?

Many ROP policies offer conversion options allowing you to switch to permanent coverage at maturity. - What should I consider before purchasing ROP Insurance?

You should evaluate your financial situation, risk tolerance, and whether you would benefit more from traditional investments instead.